Cheap Business Insurance

Finding affordable and comprehensive business insurance is a top priority for entrepreneurs and small business owners. In today's competitive market, protecting your business with adequate insurance coverage is essential to mitigate risks and ensure long-term success. This comprehensive guide will delve into the world of cheap business insurance, offering insights and strategies to secure the best coverage at the most competitive prices.

Understanding the Basics of Business Insurance

Business insurance, often referred to as commercial insurance, is a broad term encompassing various types of coverage designed to protect businesses against a wide range of risks. These risks can include property damage, liability claims, theft, employee injuries, and more. By understanding the fundamentals of business insurance, you can make informed decisions to safeguard your venture effectively.

Key Components of Business Insurance

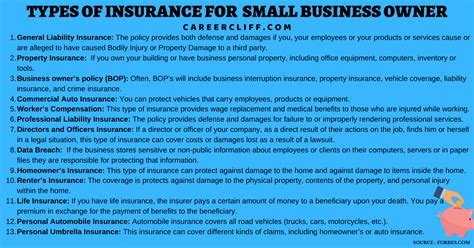

Business insurance typically comprises several essential components tailored to the specific needs of your industry and operations. Here’s a breakdown of the key elements:

- General Liability Insurance: This coverage is a cornerstone of most business insurance policies. It protects your business against third-party claims arising from bodily injury, property damage, and personal and advertising injury.

- Commercial Property Insurance: This type of insurance safeguards your business's physical assets, including buildings, inventory, equipment, and furniture. It's crucial for protecting your business's tangible investments.

- Professional Liability Insurance (Errors & Omissions): Also known as E&O insurance, this coverage is vital for businesses offering professional services. It protects against claims of negligence, errors, or omissions in the services provided.

- Workers' Compensation Insurance: Mandated by most states, workers' comp insurance provides coverage for employees who suffer work-related injuries or illnesses. It ensures medical care and wage replacement, protecting both the employee and the business.

- Business Interruption Insurance: This coverage steps in when your business operations are disrupted due to covered perils, such as fires or natural disasters. It helps cover ongoing expenses and lost income during the recovery period.

- Cyber Liability Insurance: With the rise of cyber threats, this insurance has become crucial. It protects your business against cyber attacks, data breaches, and the resulting legal and customer notification costs.

Each business is unique, and the specific insurance needs can vary widely. A comprehensive understanding of these components allows business owners to tailor their insurance coverage to their unique circumstances.

Strategies for Securing Cheap Business Insurance

Finding affordable business insurance requires a strategic approach. Here are some expert tips and tactics to help you secure the best coverage at the most competitive rates:

Compare Multiple Quotes

Obtaining multiple quotes is essential to finding the best deal. Reach out to various insurance providers or utilize online comparison tools to gather quotes tailored to your business needs. By comparing rates and coverage, you can make an informed decision and potentially save a significant amount.

Understand Your Risks

Assessing the unique risks associated with your business is crucial. Identify the specific hazards your business faces, whether it’s property damage, liability claims, or industry-specific risks. By understanding these risks, you can tailor your insurance coverage to address them effectively, potentially reducing premiums.

Bundle Your Policies

Bundling your insurance policies with a single provider can often lead to significant savings. Many insurance companies offer multi-policy discounts, rewarding you for consolidating your coverage. Consider bundling your business insurance with other policies, such as commercial auto insurance or personal insurance, to maximize your savings.

Opt for Higher Deductibles

Choosing a higher deductible can reduce your insurance premiums. While this strategy requires you to pay more out-of-pocket in the event of a claim, it can lead to substantial savings on your overall insurance costs. Assess your financial situation and comfort level with this approach to determine if it’s the right fit for your business.

Review Coverage Regularly

Your business’s insurance needs can evolve over time. Regularly reviewing your coverage ensures that you’re not overinsured or underinsured. As your business grows and changes, adjust your insurance policies accordingly to maintain the right balance of protection and affordability.

Implement Risk Management Strategies

Taking proactive measures to mitigate risks can not only reduce the likelihood of claims but also lead to lower insurance premiums. Implement safety protocols, invest in security measures, and train your employees on risk prevention. By demonstrating a commitment to risk management, you may be rewarded with lower insurance rates.

Utilize Technology

Leverage technology to streamline your insurance process and potentially save money. Many insurance providers offer digital tools and platforms that allow for quick and easy policy management, claim submissions, and payments. These digital solutions can often lead to more efficient and cost-effective insurance experiences.

Real-World Examples of Affordable Business Insurance

To illustrate the strategies discussed, let’s explore a few real-world examples of businesses that have successfully secured affordable insurance coverage:

Example 1: Small Retail Store

A small retail store owner, Sarah, sought to reduce her insurance costs while maintaining comprehensive coverage. She started by comparing quotes from multiple providers, ultimately bundling her general liability, commercial property, and workers’ compensation insurance with a single insurer, resulting in a 15% discount. Additionally, Sarah implemented robust security measures, including a state-of-the-art alarm system, which led to a further 10% reduction in her premiums.

Example 2: Online E-commerce Business

John, the owner of an online e-commerce business, faced the challenge of securing affordable cyber liability insurance. He researched extensively and found a provider specializing in cyber insurance for small businesses. By demonstrating a strong commitment to data security and implementing recommended measures, John was able to secure a competitive rate, saving him over 20% on his annual premiums.

Example 3: Construction Company

A construction company, owned by Mike, faced high insurance costs due to the inherent risks of the industry. To reduce expenses, Mike focused on risk management. He invested in comprehensive safety training for his employees, ensuring they were well-equipped to handle potential hazards. This proactive approach not only reduced the likelihood of accidents but also led to a 10% discount on his general liability and workers’ compensation insurance.

The Impact of Industry and Location on Insurance Costs

The cost of business insurance can vary significantly based on your industry and location. High-risk industries, such as construction or manufacturing, often face higher insurance premiums due to the increased likelihood of accidents and claims. Similarly, businesses located in areas prone to natural disasters or with high crime rates may also experience higher insurance costs.

| Industry | Average Annual Premium |

|---|---|

| Construction | $15,000 |

| Retail | $8,000 |

| Professional Services | $6,500 |

| Manufacturing | $18,000 |

| E-commerce | $4,500 |

The table above provides a snapshot of average annual premiums for various industries. However, it's important to note that these figures can vary significantly based on individual circumstances and the specific coverage needs of each business.

Future Trends in Business Insurance

The business insurance landscape is evolving, driven by technological advancements and changing risk profiles. Here are some key trends to watch:

- Rise of Insurtech: Insurtech startups are disrupting the traditional insurance industry, offering innovative solutions and digital platforms. These platforms often provide more efficient and cost-effective insurance experiences, benefiting small businesses.

- Focus on Data Analytics: Insurance providers are increasingly leveraging data analytics to assess risks and set premiums. This trend allows for more accurate risk assessment, potentially leading to fairer and more affordable insurance rates.

- Increased Cyber Risk Awareness: With cyber threats on the rise, businesses are becoming more aware of the need for comprehensive cyber liability insurance. This awareness is driving the development of specialized insurance products to address these risks.

- Growing Importance of Risk Management: Insurance providers are recognizing the value of proactive risk management. Businesses that demonstrate a strong commitment to risk mitigation are likely to be rewarded with more favorable insurance rates and coverage.

Conclusion

Finding cheap business insurance is a crucial aspect of managing your business’s finances and protecting your venture. By understanding the basics of business insurance, implementing strategic approaches, and staying informed about industry trends, you can navigate the complex world of insurance with confidence. Remember, affordable coverage is within reach, and with the right approach, you can secure the protection your business deserves without breaking the bank.

How can I get a quote for business insurance?

+To obtain a quote for business insurance, you can contact insurance providers directly or utilize online comparison tools. Provide details about your business, including industry, size, and specific coverage needs. Multiple quotes will allow you to compare rates and coverage options effectively.

What are the most common types of business insurance?

+The most common types of business insurance include general liability, commercial property, professional liability (E&O), workers’ compensation, and business interruption insurance. Each type of coverage addresses specific risks faced by businesses.

How often should I review my business insurance coverage?

+It’s recommended to review your business insurance coverage annually or whenever significant changes occur in your business. This ensures that your coverage remains aligned with your evolving needs and that you’re not overpaying for unnecessary coverage.

Can I negotiate my business insurance premiums?

+While insurance premiums are primarily based on risk assessment, there’s room for negotiation. You can discuss your specific circumstances, risk management strategies, and potential discounts with your insurance provider. Building a strong relationship with your insurer can also lead to more favorable rates over time.