Best Trip Insurance Cancel For Any Reason

When planning a trip, one of the most important considerations is travel insurance, especially with the uncertainties and risks involved in traveling. The "Cancel For Any Reason" (CFAR) benefit is a valuable addition to trip insurance policies, offering travelers peace of mind and flexibility. This article explores the best trip insurance policies with CFAR coverage, providing a comprehensive guide for travelers seeking comprehensive protection.

Understanding the Importance of CFAR Coverage

CFAR coverage is a unique and valuable benefit that allows travelers to cancel their trip for any reason and receive a partial refund on their non-refundable trip costs. This differs from traditional trip cancellation coverage, which typically requires a specific covered reason for cancellation, such as illness or weather-related events.

With CFAR, travelers have the freedom to cancel their trip if unexpected circumstances arise, even if the reason for cancellation is not covered by the standard policy. This can include personal emergencies, job-related issues, or simply a change of heart. CFAR provides an added layer of security, ensuring that travelers can recoup a portion of their expenses in unforeseen situations.

The Benefits of CFAR

The primary advantage of CFAR coverage is the flexibility it offers. Life is unpredictable, and unexpected events can occur at any time. CFAR allows travelers to make last-minute changes to their travel plans without incurring significant financial losses. This benefit is particularly valuable for those who want to ensure they can travel without the stress of being locked into a non-refundable trip.

Additionally, CFAR coverage can provide a sense of security for travelers with pre-existing medical conditions or those who are concerned about potential health risks during their trip. It offers an added layer of protection, knowing that they can cancel their trip if their health situation changes unexpectedly.

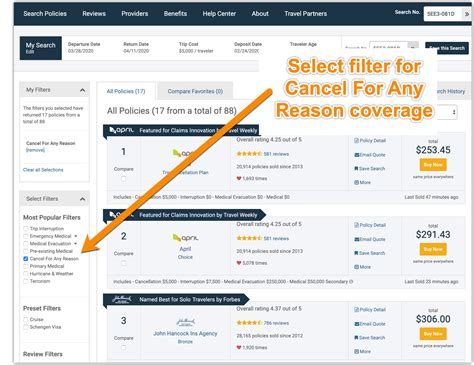

Identifying the Best Trip Insurance Policies with CFAR

When searching for the best trip insurance with CFAR coverage, it’s essential to consider various factors, including policy features, pricing, and reputation. Here are some of the top-rated trip insurance policies that offer comprehensive CFAR benefits:

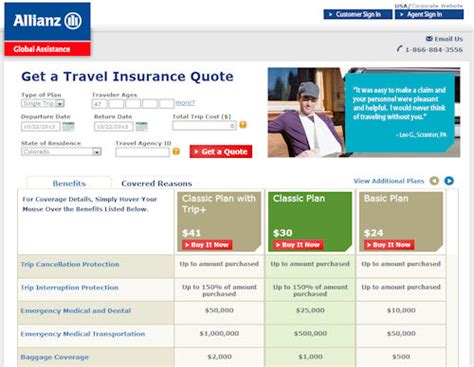

Allianz Travel Insurance

Allianz Travel Insurance is a renowned provider in the travel insurance industry, offering a range of comprehensive policies. Their CFAR benefit is an optional upgrade, providing travelers with the flexibility to cancel their trip for any reason and receive a 75% refund on their prepaid trip costs. This coverage is available for trips up to $10,000 and can be added to their standard travel insurance plans.

Allianz's CFAR coverage is ideal for travelers seeking peace of mind and flexibility. Their policies offer competitive pricing and comprehensive coverage, including trip cancellation, interruption, and delay benefits, as well as medical and emergency assistance. With Allianz, travelers can enjoy their trip with the assurance that they are protected in various situations.

Travelex Insurance Services

Travelex Insurance Services is another trusted provider offering trip insurance with CFAR coverage. Their TravelSelect plan includes an optional CFAR benefit, providing travelers with a 75% refund on their non-refundable trip costs if they decide to cancel for any reason. This coverage is available for trips up to $10,000 and can be added to their standard policy.

Travelex's CFAR benefit is particularly appealing for travelers who want comprehensive coverage without breaking the bank. Their policies offer a balance between affordability and extensive benefits, including trip cancellation, interruption, and medical emergency coverage. With Travelex, travelers can have the confidence to explore new destinations without worrying about unforeseen circumstances.

Travel Insured International

Travel Insured International is a leading provider of travel insurance, offering a wide range of policies tailored to different travel needs. Their CFAR benefit, available as an upgrade to their standard policies, provides travelers with a 75% refund on their non-refundable trip costs if they cancel for any reason. This coverage is applicable for trips up to $10,000.

Travel Insured International's CFAR coverage is designed to cater to a broad range of travelers, from adventure seekers to business professionals. Their policies offer flexible terms and customizable coverage options, allowing travelers to choose the level of protection that suits their specific needs. With their CFAR benefit, travelers can make informed decisions about their travel plans without financial worry.

| Insurance Provider | CFAR Coverage |

|---|---|

| Allianz Travel Insurance | 75% refund for trips up to $10,000 |

| Travelex Insurance Services | 75% refund for trips up to $10,000 |

| Travel Insured International | 75% refund for trips up to $10,000 |

Factors to Consider When Choosing Trip Insurance with CFAR

When selecting the best trip insurance policy with CFAR coverage, there are several key factors to keep in mind:

- Policy Features: Ensure the policy offers comprehensive coverage, including trip cancellation, interruption, and delay benefits, as well as medical and emergency assistance.

- Pricing: Compare prices and coverage limits to find a policy that fits your budget without compromising on essential benefits.

- Reputation: Choose a reputable insurance provider with a solid track record of claims handling and customer satisfaction.

- CFAR Details: Understand the specific terms of the CFAR coverage, including the required purchase date, percentage of coverage, and any exclusions.

- Customizable Options: Consider policies that allow you to tailor the coverage to your specific needs, such as choosing the level of CFAR coverage or adding additional benefits.

Personalizing Your Trip Insurance

Trip insurance policies with CFAR coverage often offer a range of customizable options to suit different travel needs. For instance, travelers can choose the level of CFAR coverage they desire, whether it’s a standard 75% refund or a higher percentage. Additionally, many policies allow travelers to add optional benefits, such as coverage for adventure sports or rental car damage.

Personalizing your trip insurance policy ensures that you have the protection you need for your specific travel plans. Whether you're an adventurous traveler seeking coverage for extreme sports or a business professional requiring higher CFAR limits, tailoring your policy can provide the peace of mind to enjoy your trip without worry.

Conclusion: Empowering Your Travel Experience

Trip insurance with CFAR coverage is an essential consideration for travelers seeking flexibility and peace of mind. By choosing a reputable insurance provider and carefully reviewing the policy details, travelers can ensure they have the protection they need for their unique travel circumstances. With the best trip insurance, travelers can focus on creating memorable experiences without the stress of unforeseen circumstances.

Remember, life is full of surprises, and travel insurance with CFAR coverage provides the assurance to make the most of your travels. So, whether you're exploring new destinations or embarking on a business trip, having the right trip insurance can make all the difference.

How much does CFAR coverage typically cost as an add-on to a trip insurance policy?

+The cost of adding CFAR coverage to a trip insurance policy can vary depending on the provider and the specific policy. On average, CFAR coverage can increase the premium by approximately 40% to 50% of the base policy cost. It’s essential to carefully review the policy terms and pricing to ensure it fits your budget and provides the coverage you require.

Are there any limitations or exclusions with CFAR coverage?

+Yes, CFAR coverage typically has certain limitations and exclusions. For instance, CFAR coverage may not apply if the reason for cancellation is already a covered reason under the standard policy. Additionally, there may be time limits for when you can purchase CFAR coverage, and it may not be available for certain high-risk activities or destinations. Always review the policy details carefully to understand the specific limitations and exclusions.

Can I purchase CFAR coverage for a trip that has already started?

+No, CFAR coverage is typically only available for purchase before the trip begins. It is designed to provide flexibility and peace of mind before the trip, allowing travelers to cancel without financial penalty if unexpected circumstances arise. Once the trip has commenced, CFAR coverage is generally not an option.