Uninsured Motorist Insurance

In today's world, where road accidents are an unfortunate reality, having adequate insurance coverage is essential to protect yourself and your finances. One often-overlooked aspect of auto insurance is uninsured motorist insurance. This coverage safeguards policyholders against financial losses and potential legal battles arising from accidents caused by drivers who lack insurance. In this comprehensive guide, we will delve into the world of uninsured motorist insurance, exploring its significance, benefits, and real-world implications.

Understanding Uninsured Motorist Insurance

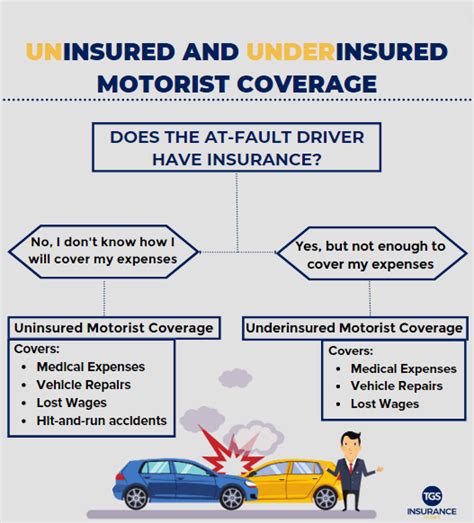

Uninsured motorist insurance, often abbreviated as UM or UIM coverage, is a vital component of any comprehensive auto insurance policy. It provides financial protection to policyholders in the event of an accident caused by an uninsured or underinsured driver. This coverage ensures that you are not left vulnerable and financially burdened due to the negligence of others on the road.

The Prevalence of Uninsured Drivers

Before we delve deeper, it’s crucial to understand the prevalence of uninsured drivers on the roads. Despite mandatory insurance laws in many regions, a significant number of drivers choose to operate their vehicles without valid insurance. According to recent statistics, approximately 12.6% of drivers in the United States are uninsured, which translates to millions of vehicles on the road without adequate coverage. This statistic highlights the importance of uninsured motorist insurance, as it provides a safety net for responsible drivers who encounter such individuals.

Furthermore, the financial implications of an accident involving an uninsured driver can be devastating. Medical bills, vehicle repairs, and potential legal fees can quickly accumulate, leaving victims in a precarious financial situation. Uninsured motorist insurance aims to mitigate these risks and provide peace of mind to policyholders.

Coverage Options

Uninsured motorist insurance typically offers two main types of coverage:

- Uninsured Motorist Bodily Injury (UMBI): This coverage provides financial protection for policyholders and their passengers in the event of bodily injuries sustained in an accident caused by an uninsured or hit-and-run driver. It covers medical expenses, lost wages, and other related costs.

- Uninsured Motorist Property Damage (UMPD): UMPD coverage steps in when an uninsured driver damages your vehicle. It covers the cost of repairs or, in severe cases, the replacement of your vehicle. This coverage ensures that you are not left bearing the financial burden of repairing or replacing your vehicle.

Real-World Scenarios and Benefits

Let’s explore some real-life scenarios where uninsured motorist insurance proves to be invaluable:

Scenario 1: Hit-and-Run Accident

Imagine you’re driving home from work when suddenly, a speeding vehicle collides with your car and flees the scene. You’re left with a damaged vehicle and potential injuries. In such a situation, uninsured motorist insurance can cover the cost of repairing your car and provide compensation for any medical treatment you may require. Without this coverage, you would be left to navigate the complexities of tracking down the driver and potentially dealing with legal battles.

Scenario 2: Accident with an Underinsured Driver

You’re involved in a collision with another driver who carries minimal insurance coverage. Their policy limits are insufficient to cover the full extent of your injuries and property damage. In this case, uninsured motorist insurance steps in to bridge the gap, ensuring that you receive the necessary compensation to cover your medical bills and vehicle repairs.

Benefits of Uninsured Motorist Insurance

The benefits of uninsured motorist insurance are numerous and extend beyond financial protection:

- Financial Security: Uninsured motorist insurance provides a financial safety net, ensuring that you are not left with unexpected and overwhelming expenses after an accident caused by an uninsured driver.

- Peace of Mind: Knowing that you have this coverage can give you peace of mind while driving. It eliminates the worry of encountering uninsured drivers and allows you to focus on the road ahead.

- Legal Protection: In cases where an uninsured driver is at fault, uninsured motorist insurance can provide legal assistance and representation, ensuring that your rights are protected and that you receive the compensation you deserve.

- Reduced Stress: Dealing with an accident is already a stressful situation. Uninsured motorist insurance simplifies the process by handling the financial aspects, allowing you to concentrate on your recovery and getting your life back on track.

Claim Process and Considerations

When it comes to filing a claim under your uninsured motorist insurance policy, it’s essential to understand the process and certain considerations:

Reporting the Accident

If you’re involved in an accident with an uninsured or hit-and-run driver, it’s crucial to report the incident to the police immediately. Obtain a copy of the police report, as it serves as vital evidence for your insurance claim. Additionally, gather as much information as possible about the other driver, including their vehicle details and any witness statements.

Contacting Your Insurance Provider

Reach out to your insurance provider as soon as possible after the accident. Provide them with all the relevant details and documentation, including the police report and any photographs of the accident scene and vehicle damage. Your insurance company will guide you through the claim process and assess your coverage.

Understanding Policy Limits

It’s important to familiarize yourself with the policy limits of your uninsured motorist insurance coverage. These limits dictate the maximum amount your insurance provider will pay out for claims. Ensure that your policy limits align with your financial needs and the potential risks you face on the road.

Comparative Analysis: Uninsured vs. Insured Motorist Coverage

To further emphasize the significance of uninsured motorist insurance, let’s compare it to the coverage provided by insured motorists:

| Coverage Aspect | Uninsured Motorist Insurance | Insured Motorist Insurance |

|---|---|---|

| Financial Protection | Covers policyholders in accidents with uninsured or underinsured drivers | Provides coverage for accidents involving insured drivers |

| Legal Representation | May offer legal assistance for claims against uninsured drivers | Typically provides legal support for disputes with insured drivers |

| Claim Process | Varies based on state laws and insurance provider guidelines | Follows standard claim procedures for insured drivers |

| Cost | Typically affordable; often included in comprehensive policies | Varies based on policy limits and coverage options |

Expert Insights and Recommendations

As an industry expert, I strongly advocate for the inclusion of uninsured motorist insurance in your auto insurance policy. Here are some key recommendations:

- Review Your Policy Regularly: Ensure that your uninsured motorist insurance coverage is up-to-date and aligns with your current needs. Consider increasing your policy limits if your financial situation or risk factors have changed.

- Educate Yourself: Understand the terms and conditions of your uninsured motorist insurance coverage. Familiarize yourself with the claim process and any specific requirements set by your insurance provider.

- Choose a Reputable Insurer: Select an insurance provider with a solid reputation for prompt claim settlements and excellent customer service. This can make a significant difference in the event of an accident.

- Consider Bundling: Explore the option of bundling your auto insurance with other policies, such as homeowners or renters insurance. Bundling can often lead to cost savings and streamlined claim processes.

Conclusion

In a world where road safety is paramount, uninsured motorist insurance plays a crucial role in safeguarding policyholders from the financial and legal repercussions of accidents caused by uninsured or underinsured drivers. By understanding the coverage options, real-world scenarios, and benefits, you can make informed decisions to protect yourself and your finances. Remember, being proactive about your insurance coverage is a step towards a safer and more secure driving experience.

Frequently Asked Questions

How much does uninsured motorist insurance typically cost?

+The cost of uninsured motorist insurance can vary based on several factors, including your location, driving history, and the insurance provider. On average, it typically adds around 20 to 40 to your monthly premium. However, it’s essential to note that the financial protection it provides far outweighs the cost.

Can I file a claim if the uninsured driver is never found after a hit-and-run accident?

+Yes, you can still file a claim under your uninsured motorist insurance coverage even if the hit-and-run driver remains unidentified. Your insurance provider will assess the circumstances and determine the validity of your claim based on the available evidence.

Does uninsured motorist insurance cover passengers in my vehicle who are injured in an accident with an uninsured driver?

+Absolutely! Uninsured motorist bodily injury coverage extends to passengers in your vehicle who sustain injuries in an accident caused by an uninsured or hit-and-run driver. This coverage ensures that your passengers receive the necessary medical treatment and compensation.

What if the uninsured driver is at fault, but I also bear some responsibility for the accident?

+In such cases, the determination of fault can be complex. Your insurance provider will assess the circumstances and apply comparative negligence principles to determine the extent of your coverage. It’s essential to cooperate with your insurer and provide accurate information.

Is uninsured motorist insurance mandatory in all states?

+No, uninsured motorist insurance is not mandatory in all states. However, it is highly recommended to include this coverage in your auto insurance policy, as it provides valuable financial protection and peace of mind.