Auto Insurance Liability Limits

Understanding auto insurance liability limits is crucial for every vehicle owner. These limits define the maximum amount an insurance company will pay out in the event of a covered claim. In this comprehensive guide, we will delve into the world of auto insurance liability limits, exploring their significance, how they work, and why they matter for your financial protection.

The Importance of Auto Insurance Liability Limits

Auto insurance liability coverage is designed to protect you from financial loss if you’re found legally responsible for an accident that causes injuries or property damage to others. Liability limits represent the maximum amount your insurance provider will cover for these types of claims. Here’s why they are essential:

- Financial Protection: High liability limits provide a safety net, ensuring you can cover the costs of another person's injuries or property damage without facing significant financial strain.

- Legal Compliance: Most states mandate that drivers carry a minimum level of liability insurance. Adhering to these requirements is crucial to avoid legal penalties and maintain compliance with the law.

- Peace of Mind: By selecting appropriate liability limits, you can drive with confidence, knowing you're adequately protected against potential liabilities.

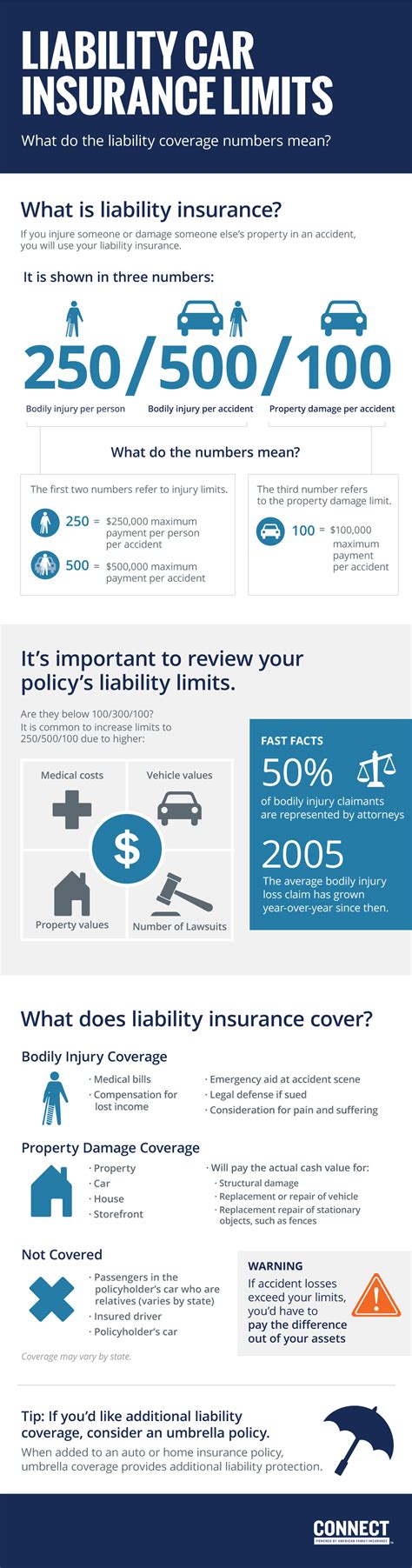

How Auto Insurance Liability Limits Work

Auto insurance liability limits are typically expressed as three numbers, such as 100/300/100. These numbers represent the maximum amounts your insurance policy will pay for:

- Bodily Injury Per Person: This limit covers the medical expenses and related costs for each person injured in an accident for which you are responsible. In our example, it would be $100,000.

- Bodily Injury Per Accident: This limit is the maximum your insurance will pay for all bodily injury claims arising from a single accident. For our example, it would be $300,000.

- Property Damage Liability: This limit covers the cost of repairing or replacing another person's property, such as their vehicle, in an accident you caused. The example limit is $100,000.

It's important to note that these limits are per occurrence, meaning they reset for each new accident. Once the limits are reached, you become personally responsible for any additional costs.

Choosing the Right Liability Limits

Selecting appropriate liability limits is a critical decision. Here are some factors to consider:

Your State’s Minimum Requirements

Each state has its own minimum liability insurance requirements. These limits often fall short of covering the potential costs of an accident. For instance, consider the following state minimums:

| State | Minimum Bodily Injury Per Person | Minimum Bodily Injury Per Accident | Minimum Property Damage |

|---|---|---|---|

| California | $15,000 | $30,000 | $5,000 |

| Texas | $30,000 | $60,000 | $25,000 |

| New York | $25,000 | $50,000 | $10,000 |

While these limits meet the legal requirements, they may not provide sufficient coverage in the event of a severe accident. It's advisable to choose higher limits to ensure better protection.

Your Personal Assets

Consider your financial situation and the assets you own. If you have significant assets, such as a home or investments, higher liability limits can help protect these assets in the event of a lawsuit. A liability judgment exceeding your insurance coverage could result in the liquidation of your assets to satisfy the claim.

The Cost of Living in Your Area

Medical expenses and vehicle repair costs can vary significantly across different regions. In areas with higher costs of living, accidents can result in more expensive claims. Adjusting your liability limits accordingly can provide better protection.

Your Risk Profile

Your driving history and personal circumstances can influence the choice of liability limits. If you have a history of accidents or live in an area with a high accident rate, opting for higher limits is advisable. Additionally, consider your daily commute and the types of roads you frequently drive on.

The Impact of Liability Limits on Your Premium

Increasing your liability limits will typically result in a higher insurance premium. However, the additional cost may be minimal compared to the increased protection it provides. Here’s an example to illustrate the potential difference in premiums:

| Liability Limits | Annual Premium |

|---|---|

| 100/300/100 | $1,200 |

| 250/500/250 | $1,250 |

| 500/1000/500 | $1,300 |

As you can see, the difference in premiums is relatively small, while the increased protection offered by higher limits is significant.

Additional Liability Coverage Options

Beyond the standard liability limits, there are additional coverage options to consider:

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have sufficient coverage. It provides financial protection for your injuries and property damage.

Medical Payments Coverage

Also known as MedPay, this coverage helps cover the medical expenses of you and your passengers, regardless of fault. It can be a valuable addition to your policy, providing quick access to funds for medical treatment after an accident.

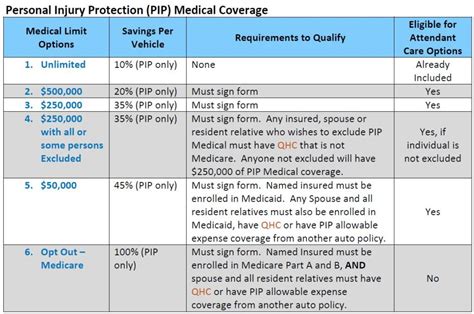

Personal Injury Protection (PIP)

PIP coverage is similar to MedPay but often offers more comprehensive benefits, including coverage for lost wages and funeral expenses. It’s an important consideration for ensuring you and your passengers are adequately protected.

Conclusion

Understanding and selecting the right auto insurance liability limits is a critical step in protecting yourself and your assets. By considering your state’s requirements, personal assets, cost of living, and risk profile, you can make an informed decision. Remember, while liability limits are essential, they are just one aspect of a comprehensive insurance policy. Explore additional coverage options to ensure you have the protection you need on the road.

What happens if I exceed my liability limits in an accident?

+

If the damages and expenses incurred in an accident exceed your liability limits, you become personally responsible for the remaining amount. This can result in significant financial strain and, in some cases, lead to legal action against you.

Are there any penalties for not having enough liability insurance?

+

Yes, most states impose penalties for driving without the required minimum liability insurance. These penalties can include fines, license suspension, and even jail time in severe cases. It’s crucial to maintain adequate liability coverage to avoid legal consequences.

How often should I review my liability limits?

+

It’s a good practice to review your liability limits annually or whenever your circumstances change significantly. Factors like purchasing a new vehicle, acquiring additional assets, or moving to a different state can impact your insurance needs. Regular reviews ensure your coverage remains appropriate.