Insurance Policy For Business

In today's dynamic business landscape, ensuring the longevity and resilience of your enterprise is paramount. One of the most crucial steps in this endeavor is obtaining a comprehensive insurance policy tailored to your specific business needs. This article aims to delve into the intricacies of business insurance, offering a detailed guide to help you navigate this essential aspect of risk management.

Understanding the Scope of Business Insurance

Business insurance, a vital component of any commercial operation, serves as a safeguard against an array of risks that businesses face daily. From unforeseen accidents to financial losses, these policies provide a safety net, ensuring that your business can weather the storm and emerge intact.

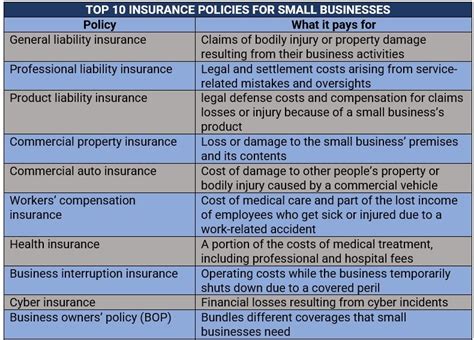

The scope of business insurance is vast and multifaceted, covering a range of potential liabilities and risks. Here's an overview of some key aspects:

- Property Insurance: Protects your business premises, equipment, and inventory from damages caused by events like fires, storms, or vandalism.

- Liability Insurance: Safeguards your business from legal liabilities arising from injuries or damages caused to third parties or their properties.

- Business Interruption Insurance: Provides financial support to cover losses incurred when your business operations are interrupted due to covered events, such as natural disasters or equipment failures.

- Product Liability Insurance: Essential for businesses involved in manufacturing or selling products, it protects against claims of injury or damage caused by a defective product.

- Professional Liability Insurance: Also known as errors and omissions insurance, it covers claims of negligence or failure to perform professional duties, often vital for businesses offering professional services.

- Workers' Compensation Insurance: A statutory requirement in many jurisdictions, this insurance covers medical care and replaces wages for employees injured or become ill due to work-related causes.

- Cyber Insurance: With the rise in cyber threats, this type of insurance is crucial, offering protection against financial losses due to data breaches, cyberattacks, or system failures.

Each of these policies plays a critical role in mitigating the financial impact of unforeseen events, ensuring your business can continue to operate smoothly and maintain its financial stability.

Customizing Your Business Insurance Portfolio

Every business is unique, and as such, its insurance needs are distinct. The process of customizing your insurance portfolio involves a meticulous assessment of your specific risks and vulnerabilities.

Identifying Your Business Risks

The first step in crafting an effective insurance strategy is to conduct a thorough risk assessment. This involves identifying the potential hazards and risks that your business might face. These could include natural disasters (like floods or earthquakes), theft or vandalism, cyberattacks, product failures, or errors in professional services.

For instance, if your business operates in an area prone to floods, flood insurance becomes a critical component of your portfolio. Similarly, if your business involves handling sensitive customer data, cyber insurance is a non-negotiable necessity.

Choosing the Right Insurance Coverage

Once you’ve identified your business’s unique risks, the next step is to select the appropriate insurance coverage. This involves evaluating the potential financial impact of each risk and choosing policies that provide adequate protection.

For instance, a business that owns valuable equipment might opt for a higher level of property insurance to ensure full coverage in the event of a loss. Similarly, a business with a large customer base and significant data storage needs might require a more comprehensive cyber insurance policy.

| Risk Type | Recommended Insurance |

|---|---|

| Property Damage | Property Insurance |

| Third-Party Injuries | Liability Insurance |

| Business Interruption | Business Interruption Insurance |

| Product-Related Injuries | Product Liability Insurance |

| Professional Negligence | Professional Liability Insurance |

| Employee Injuries | Workers' Compensation Insurance |

| Cyber Attacks | Cyber Insurance |

This table provides a basic overview of common business risks and the corresponding insurance types. However, it's essential to note that the specific needs of your business may require a more tailored approach.

The Benefits of Comprehensive Business Insurance

A well-designed business insurance portfolio offers a multitude of advantages, ensuring the long-term viability and success of your enterprise.

Financial Protection

One of the primary benefits of business insurance is the financial security it provides. In the event of a covered loss, insurance policies offer financial compensation, helping your business recover and continue operations. This financial safety net is crucial for maintaining stability, especially in the face of unexpected events.

For instance, if a fire breaks out in your office, property insurance can help cover the cost of repairs and replacements, ensuring your business can quickly resume operations.

Risk Management

Business insurance also plays a pivotal role in effective risk management. By identifying and addressing potential risks, insurance policies help businesses proactively mitigate the impact of adverse events. This proactive approach can lead to improved operational efficiency and a more resilient business model.

Consider a business that implements robust cyber insurance and data protection measures. In the event of a cyberattack, this business is not only financially protected but also better equipped to handle the situation, minimize damage, and quickly restore operations.

Legal Protection

Certain insurance policies, such as liability insurance, offer crucial legal protection. In the event of a lawsuit or claim, these policies can provide the necessary financial support to cover legal fees and potential damages, safeguarding your business’s financial health and reputation.

For instance, if a customer suffers an injury on your business premises and decides to sue, liability insurance can cover the legal costs and potential settlement, protecting your business from significant financial loss.

The Future of Business Insurance

As the business landscape continues to evolve, so too does the world of insurance. The future of business insurance is likely to be shaped by several key trends and developments.

Emerging Risks and Insurance Solutions

With advancements in technology and changes in business practices, new risks are emerging. This includes increased cyber threats, supply chain vulnerabilities, and climate-related risks. The insurance industry is adapting to these challenges, developing innovative products to address these emerging risks.

For instance, with the rise of remote work, businesses are now more vulnerable to cyberattacks. As a result, cyber insurance policies are becoming increasingly comprehensive, offering a wider range of coverage to protect businesses operating in the digital realm.

Data-Driven Insurance

The insurance industry is increasingly leveraging data analytics and artificial intelligence to enhance risk assessment and pricing. This data-driven approach allows insurers to offer more tailored and accurate policies, ensuring businesses receive the coverage they need at a fair price.

By analyzing vast amounts of data, insurers can identify specific risk factors for different industries and businesses, leading to more precise insurance offerings.

Collaboration and Partnerships

The future of business insurance also lies in collaboration and partnerships. Insurers are increasingly working closely with businesses to understand their unique needs and challenges. This collaborative approach allows for the development of customized insurance solutions, ensuring businesses are adequately protected.

For instance, an insurer might partner with a technology company to develop a specialized insurance product for businesses operating in the tech sector, addressing their specific risks and challenges.

Conclusion

In conclusion, business insurance is an indispensable tool for any enterprise, providing a vital layer of protection against an array of risks. By understanding the scope of business insurance, customizing your insurance portfolio, and staying abreast of emerging trends, you can ensure your business is well-prepared for whatever challenges lie ahead.

Remember, a robust insurance strategy is not just about financial protection but also about effective risk management and business continuity. With the right insurance coverage, your business can thrive with confidence, knowing it's protected against the unexpected.

What are the most common types of business insurance?

+Common types of business insurance include property insurance, liability insurance, business interruption insurance, product liability insurance, professional liability insurance, workers’ compensation insurance, and cyber insurance. Each serves a unique purpose in protecting businesses from various risks.

How do I determine the right amount of insurance coverage for my business?

+Determining the right amount of coverage involves a comprehensive risk assessment. Evaluate the potential financial impact of various risks and choose policies that provide adequate protection. It’s beneficial to consult with an insurance professional who can guide you through this process.

What are some emerging risks that businesses should be aware of in terms of insurance?

+Emerging risks include increased cyber threats, supply chain vulnerabilities, and climate-related risks. The insurance industry is developing innovative products to address these challenges, so it’s essential for businesses to stay informed and adapt their insurance strategies accordingly.