Liability Only Insurance

Liability-only insurance is a crucial aspect of financial protection and risk management, offering a cost-effective solution for individuals and businesses alike. This type of insurance provides coverage solely for legal liabilities arising from accidents, injuries, or property damage caused by the policyholder. While it may not offer the comprehensive protection of full-coverage insurance, liability-only policies are designed to safeguard policyholders from potentially devastating financial consequences in the event of a claim.

In today's fast-paced and unpredictable world, accidents can happen anytime, anywhere. From fender benders on the road to unforeseen workplace injuries, the potential for legal liabilities is ever-present. This is where liability-only insurance steps in, offering a tailored solution to protect policyholders from the financial fallout of such incidents. By understanding the intricacies of liability-only insurance and its applications, individuals and businesses can make informed decisions to ensure their financial security and peace of mind.

Understanding Liability-Only Insurance

Liability-only insurance, often referred to as third-party insurance, is a specific type of coverage that focuses on protecting policyholders from claims made against them by third parties. These third parties could be individuals, businesses, or even government entities, who have suffered harm or incurred losses as a result of the policyholder’s actions or negligence.

The primary purpose of liability-only insurance is to provide financial coverage for legal defense costs, settlements, and judgments resulting from such claims. It acts as a safety net, ensuring that policyholders do not face crippling financial burdens when faced with unexpected liabilities.

Key Features of Liability-Only Insurance

- Coverage for Legal Liabilities: Liability-only insurance primarily covers legal liabilities arising from bodily injury, property damage, and personal injury claims. It offers financial protection against lawsuits and helps policyholders manage the associated legal costs.

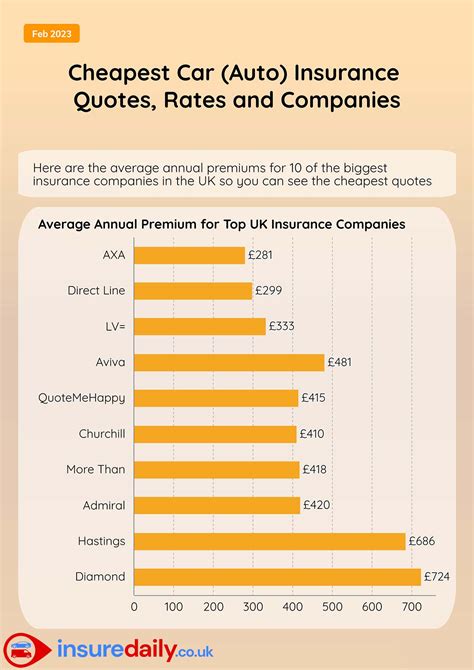

- Cost-Effectiveness: One of the significant advantages of liability-only insurance is its affordability. Compared to full-coverage insurance policies, liability-only options are generally more budget-friendly, making them an attractive choice for those seeking essential protection without the added expense of comprehensive coverage.

- Tailored to Individual Needs: Liability-only insurance policies can be customized to meet the unique needs of different individuals and businesses. Policyholders can select coverage limits and specific types of liability protection based on their risk assessment and financial capabilities.

It's important to note that liability-only insurance does not provide coverage for damage to the policyholder's own property or possessions. It is designed to protect against the financial impact of harming others or their property, rather than self-inflicted losses.

Applications of Liability-Only Insurance

Liability-only insurance finds applications in various scenarios, offering tailored protection for different situations.

Automotive Insurance

In the context of automotive insurance, liability-only coverage is commonly known as liability car insurance. This type of insurance provides protection for vehicle owners against legal liabilities arising from accidents caused by their vehicles. It covers the costs associated with bodily injury, property damage, and legal defense if the policyholder is found at fault in an accident.

For drivers who primarily use their vehicles for personal use and have older or less valuable cars, liability-only car insurance can be a cost-effective solution. It ensures that they are financially protected in the event of an accident without the added expense of comprehensive coverage for their vehicle.

Business Insurance

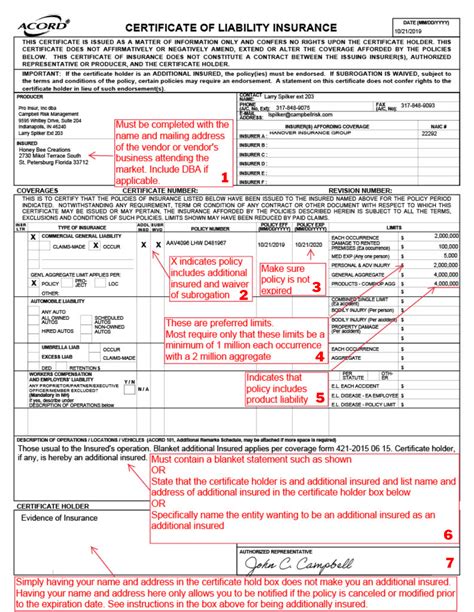

Businesses, regardless of size, face unique risks and potential liabilities. Liability-only insurance for businesses, often referred to as commercial liability insurance, provides coverage for legal liabilities arising from business operations. This includes claims related to bodily injury, property damage, and personal injury caused by the business’s products, services, or premises.

Commercial liability insurance is particularly crucial for small businesses and startups, as it protects them from financial ruin in the event of a successful claim against their operations. It allows businesses to focus on growth and innovation without the constant worry of potential legal liabilities.

Homeowners and Renters Insurance

Liability-only insurance is also available for homeowners and renters. This type of coverage, known as homeowners liability insurance or renters liability insurance, provides protection against legal liabilities arising from accidents or injuries that occur on the insured property.

For homeowners, liability insurance is often a requirement of their mortgage agreement. It protects them from financial losses if someone is injured on their property and decides to take legal action. Similarly, renters liability insurance provides protection for tenants, ensuring they are not financially responsible for accidents that occur within their rental unit.

Professional Liability Insurance

Professionals in various fields, such as lawyers, doctors, consultants, and accountants, face unique risks associated with their expertise and services. Professional liability insurance, also known as errors and omissions (E&O) insurance, provides coverage for legal liabilities arising from mistakes, negligence, or failures in providing professional services.

Professional liability insurance is essential for protecting professionals' financial well-being and reputation. It covers the costs associated with legal defense and potential settlements or judgments resulting from claims made against their professional practice.

Performance Analysis: Advantages and Considerations

Liability-only insurance offers several advantages that make it an appealing choice for many individuals and businesses.

Cost Savings

The most significant advantage of liability-only insurance is its cost-effectiveness. By focusing solely on legal liabilities, policyholders can save on insurance premiums compared to full-coverage policies. This is particularly beneficial for those with limited financial resources or those who prioritize cost savings without compromising essential protection.

Flexibility and Customization

Liability-only insurance policies can be tailored to meet the specific needs and risk profiles of policyholders. This flexibility allows individuals and businesses to select coverage limits and types of liability protection that align with their unique circumstances. Whether it’s adjusting coverage limits or adding endorsements for specific risks, liability-only insurance provides the freedom to create a customized protection plan.

Simplified Claims Process

Liability-only insurance policies generally have a streamlined claims process. Since these policies focus on specific types of coverage, the claims process is often more straightforward and efficient. Policyholders can expect a quicker response and resolution to their claims, ensuring they receive the necessary financial support without unnecessary delays.

Considerations for Policyholders

While liability-only insurance offers numerous benefits, there are also considerations that policyholders should keep in mind.

- Limited Coverage: As the name suggests, liability-only insurance provides coverage only for legal liabilities. It does not offer protection for damage to the policyholder's own property or possessions. Policyholders must assess their unique risks and determine if additional coverage is necessary to fully protect their assets.

- Potential for Higher Deductibles: Liability-only insurance policies may come with higher deductibles compared to full-coverage policies. This means that policyholders may have to pay a larger portion of the claim out of pocket before their insurance coverage kicks in. It's essential to carefully consider deductible amounts and their financial implications.

- Risk Assessment: Choosing liability-only insurance requires a thorough risk assessment. Policyholders must evaluate their exposure to potential liabilities and determine if the selected coverage limits are sufficient to protect their financial interests. Regular reviews of coverage limits and policy terms are necessary to adapt to changing circumstances.

Evidence-Based Future Implications

The landscape of liability-only insurance is evolving, driven by technological advancements, changing consumer behaviors, and evolving regulatory frameworks.

Digitalization and Insurance Tech

The insurance industry is experiencing a digital transformation, with the rise of insurance tech (InsurTech) startups and the integration of digital tools. Liability-only insurance is likely to benefit from this trend, as digital platforms and online insurance marketplaces offer policyholders greater convenience and accessibility. Digital tools can also streamline the claims process, making it more efficient and customer-centric.

Consumer Awareness and Education

As consumers become more aware of their insurance needs and options, there is a growing demand for customized and affordable insurance solutions. Liability-only insurance, with its cost-effectiveness and flexibility, is well-positioned to cater to this evolving consumer landscape. Education and awareness campaigns can further emphasize the benefits of liability-only insurance, empowering individuals and businesses to make informed choices.

Regulatory and Legal Changes

Regulatory and legal frameworks play a crucial role in shaping the insurance industry. Changes in liability laws and regulations can directly impact the scope and applicability of liability-only insurance. Policyholders and insurance providers must stay updated on these changes to ensure compliance and maintain adequate coverage.

Additionally, emerging trends such as the gig economy and remote work arrangements introduce new liability risks. Insurance providers will need to adapt their liability-only insurance offerings to address these evolving risks and provide comprehensive protection for policyholders in the digital age.

Conclusion

Liability-only insurance is a vital component of financial protection, offering a tailored and cost-effective solution for individuals and businesses. By understanding the key features and applications of liability-only insurance, policyholders can make informed decisions to safeguard their financial well-being. As the insurance industry continues to evolve, liability-only insurance will play a crucial role in empowering individuals and businesses to navigate risks and protect their assets.

What is the difference between liability-only insurance and full-coverage insurance?

+Liability-only insurance provides coverage solely for legal liabilities arising from accidents or injuries caused by the policyholder. In contrast, full-coverage insurance offers a comprehensive range of protections, including coverage for the policyholder’s own property and possessions. Full-coverage insurance typically includes liability coverage as well as coverage for damages to the policyholder’s assets.

Who should consider liability-only insurance?

+Liability-only insurance is suitable for individuals and businesses that prioritize cost savings and seek essential protection against legal liabilities. It is particularly beneficial for those with older or less valuable assets, as it provides coverage for potential liabilities without the added expense of comprehensive asset protection.

How do I choose the right liability-only insurance coverage limits?

+Choosing the right coverage limits for liability-only insurance involves a careful risk assessment. Consider your potential exposure to liabilities and select coverage limits that provide adequate protection without being excessive. Regularly review and adjust your coverage limits to reflect changes in your financial situation and risk profile.