Auto Insurance Cheapest Rates

Finding the cheapest auto insurance rates is a priority for many drivers, as it can significantly impact their monthly expenses and overall financial planning. With a plethora of insurance providers offering various coverage options, it's crucial to understand the factors that influence rates and the strategies to secure the most affordable coverage. This comprehensive guide will delve into the world of auto insurance, offering expert insights and practical tips to help you secure the best deals available.

Understanding Auto Insurance Rates

Auto insurance rates are determined by a combination of personal and environmental factors. Insurance companies assess the risk associated with each driver and vehicle to calculate premiums. These rates can vary significantly based on individual circumstances and the chosen coverage options.

Key Factors Affecting Rates

- Driving History: Your driving record is a crucial factor. Insurance providers examine your history for accidents, traffic violations, and claims made. A clean driving record can lead to lower rates, while a history of accidents or violations may result in higher premiums.

- Vehicle Type and Usage: The make, model, and year of your vehicle play a role in determining rates. Additionally, the purpose of your vehicle's usage, such as commuting, business, or pleasure, can impact the cost of insurance.

- Location: Where you live and drive can influence your rates. Urban areas often have higher rates due to increased traffic congestion and accident risks. Insurance providers also consider local crime rates and weather conditions.

- Coverage Options: The type and extent of coverage you choose impact your premiums. Comprehensive and collision coverage, for instance, can be more expensive than liability-only coverage.

- Demographics: Age, gender, and marital status are factors considered by some insurance providers. Younger drivers and males, in general, tend to pay higher rates due to statistically higher accident risks.

| Factor | Impact on Rates |

|---|---|

| Driving History | A clean record can lead to lower rates, while violations and accidents may increase premiums. |

| Vehicle Type and Usage | Sports cars and vehicles used for business may have higher rates. Commute distance and purpose also influence rates. |

| Location | Urban areas and regions with high accident rates often have higher insurance costs. |

| Coverage Options | Comprehensive coverage is more expensive than liability-only options. |

| Demographics | Younger drivers and males may pay higher rates due to statistical risk factors. |

Strategies to Secure the Cheapest Rates

To find the cheapest auto insurance rates, consider the following expert strategies:

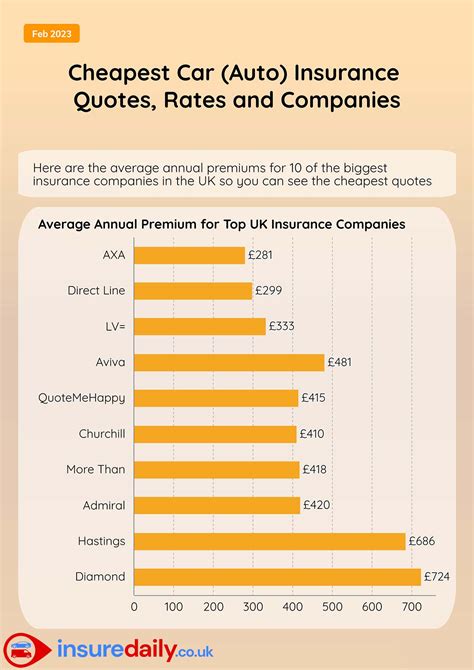

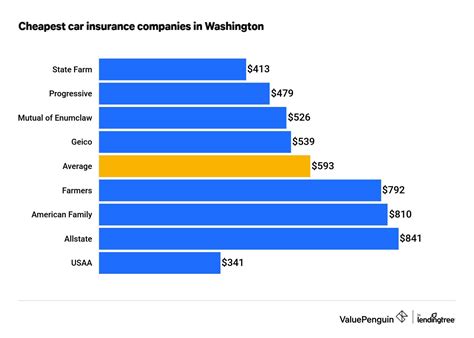

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers. Shopping around and comparing quotes is essential to finding the best deal. Use online comparison tools or contact multiple insurance companies to gather quotes based on your specific circumstances.

Consider Bundle Discounts

Many insurance providers offer bundle discounts when you combine multiple policies, such as auto and home insurance. Bundling can result in substantial savings, so it's worth exploring this option.

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach where premiums are calculated based on your actual driving behavior. This can be beneficial for safe drivers who don't log many miles annually.

Improve Your Driving Record

A clean driving record is essential for securing the cheapest rates. If you have violations or accidents on your record, focus on safe driving practices to improve your record over time. Most violations and accidents remain on your record for a specified period, typically three to five years.

Adjust Your Coverage

Review your coverage needs regularly. If your circumstances change, such as purchasing a new vehicle or moving to a different location, reassess your coverage requirements. You may be able to reduce your premiums by adjusting your coverage limits or deductibles.

Take Advantage of Discounts

Insurance providers offer various discounts, including safe driver discounts, good student discounts, and loyalty discounts. Ensure you're taking advantage of all applicable discounts to lower your premiums.

Consider Higher Deductibles

Opting for higher deductibles can reduce your premiums. However, it's essential to ensure you can afford the higher deductible in the event of a claim. This strategy is best suited for those with a robust emergency fund.

Maintain a Good Credit Score

In many states, insurance providers consider your credit score when calculating premiums. Maintaining a good credit score can lead to lower rates. Focus on responsible financial practices to improve and maintain a healthy credit profile.

Ask About Loyalty and Other Programs

Some insurance companies offer loyalty programs or discounts for long-term customers. Additionally, inquire about other programs, such as safe driver or accident-free incentives, that could lower your premiums over time.

Understanding Coverage Options

Understanding the different coverage options available is crucial to securing the right insurance at the best price. Here's a breakdown of the primary types of auto insurance coverage:

Liability Coverage

Liability coverage is the most basic and typically the least expensive type of auto insurance. It covers bodily injury and property damage caused to others in an accident for which you are at fault. This coverage is mandatory in most states and is essential for protecting your financial well-being in the event of an accident.

Collision Coverage

Collision coverage protects your vehicle in the event of a collision with another vehicle or object. This coverage is optional but highly recommended, especially if you have a loan or lease on your vehicle. It covers repairs or the replacement cost of your vehicle, up to its actual cash value, minus your deductible.

Comprehensive Coverage

Comprehensive coverage provides protection for damages caused by events other than collisions, such as theft, vandalism, weather-related incidents, or collisions with animals. Like collision coverage, it's optional but highly recommended. Comprehensive coverage typically has a deductible, and the insurance company will pay for the repairs or the vehicle's actual cash value, minus the deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage provides protection in the event you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages. This coverage is essential, as it protects you from financial loss in the event of an accident caused by an uninsured/underinsured driver.

Personal Injury Protection (PIP) or Medical Payments Coverage

PIP or medical payments coverage provides coverage for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault in an accident. This coverage is mandatory in some states and highly recommended in others.

Future Trends in Auto Insurance

The auto insurance industry is constantly evolving, and several trends are shaping the future of insurance. Here's a glimpse into what the future may hold:

Increased Use of Telematics

Usage-based insurance, or telematics, is expected to become more prevalent. This technology allows insurance companies to track driving behavior and offer more personalized and accurate rates. As more drivers embrace this technology, insurance providers will likely use it to reward safe driving practices.

Enhanced Data Analytics

Insurance companies are increasingly using advanced data analytics to assess risk and set premiums. This includes analyzing vast amounts of data from various sources, such as vehicle sensors, social media, and weather patterns. Improved data analytics will likely lead to more accurate risk assessments and potentially lower premiums for safe drivers.

Growth of Autonomous Vehicles

The rise of autonomous vehicles will significantly impact the auto insurance industry. As self-driving cars become more common, insurance providers will need to adapt their coverage and pricing models. Liability may shift from individual drivers to vehicle manufacturers, and new coverage options may emerge to address the unique risks associated with autonomous vehicles.

Focus on Customer Experience

Insurance providers are increasingly focusing on enhancing the customer experience. This includes improving digital tools and platforms, offering more personalized service, and providing faster claims processing. A better customer experience can lead to increased customer satisfaction and loyalty, potentially impacting insurance rates over time.

Environmental Factors and Sustainability

Environmental considerations are becoming more important in the insurance industry. As climate change and extreme weather events impact driving conditions and vehicle usage, insurance providers may adjust their risk assessments and pricing models accordingly. Additionally, the rise of electric and hybrid vehicles may lead to new coverage options and pricing structures.

Frequently Asked Questions

How often should I review my auto insurance policy and rates?

+It's recommended to review your auto insurance policy and rates at least once a year, or whenever your circumstances change significantly. This ensures you're getting the best coverage and rates for your specific needs.

Can I switch insurance providers to get a better rate?

+Absolutely! Shopping around for auto insurance is a great way to find the best rates. Many insurance providers offer discounts for new customers, so it's worth comparing quotes from multiple companies.

What factors can I control to lower my auto insurance rates?

+You can control several factors to lower your rates, including maintaining a clean driving record, choosing higher deductibles, taking advantage of discounts, and regularly reviewing your coverage needs.

Are there any hidden costs or fees associated with auto insurance?

+Some insurance providers may charge additional fees, such as policy fees, cancellation fees, or administrative fees. It's essential to review the policy documents and understand any potential fees before purchasing auto insurance.

How can I get personalized advice on choosing the right auto insurance coverage and rates?

+Consider consulting an independent insurance agent or broker who can provide personalized advice based on your specific needs and circumstances. They can help you understand your options and guide you towards the best coverage and rates.

Finding the cheapest auto insurance rates requires a combination of understanding the factors that influence premiums, shopping around for the best deals, and making informed decisions about coverage. By implementing the strategies outlined in this guide and staying aware of the evolving trends in the auto insurance industry, you can secure the most affordable coverage that suits your needs.