Car & Home Insurance

Welcome to an in-depth exploration of the world of car and home insurance, a crucial aspect of modern life that often goes unnoticed until it's needed. Insurance policies are like a safety net, providing financial protection and peace of mind for policyholders. In this comprehensive guide, we will delve into the intricacies of car and home insurance, uncovering the key factors, coverage options, and strategies to ensure you're adequately protected.

The Essentials of Car Insurance

Car insurance is a legal requirement in most regions and an essential safeguard against financial losses resulting from traffic accidents, theft, or other incidents. It provides coverage for a range of potential risks, ensuring you can drive with confidence.

Understanding Coverage Types

Car insurance policies typically offer a range of coverage types, each designed to address specific risks. Here’s a breakdown of the key coverage options:

- Liability Coverage: This is the most basic form of car insurance, covering bodily injury and property damage claims made against you if you’re at fault in an accident. It’s mandatory in most states and protects your assets.

- Collision Coverage: This optional coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of fault. It’s particularly valuable for newer or financed vehicles.

- Comprehensive Coverage: Comprehensive insurance covers damage to your car caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It’s an essential component for comprehensive protection.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers, regardless of fault, following an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have enough insurance to cover the damages.

Factors Influencing Car Insurance Premiums

The cost of car insurance, known as the premium, can vary significantly based on several factors. Understanding these factors can help you make informed decisions about your coverage and potentially save money.

- Vehicle Type and Usage: The make, model, and year of your vehicle play a role in determining your premium. Additionally, how you use your car (e.g., daily commute vs. occasional travel) can impact the risk profile and, consequently, the premium.

- Driving Record: Your driving history is a critical factor. A clean driving record with no accidents or violations can lead to lower premiums, while multiple violations or accidents may result in higher costs.

- Location and Mileage : Where you live and how many miles you drive annually can affect your premium. Urban areas with higher traffic density and theft rates often have higher insurance costs.

- Age and Gender: In some regions, insurance companies may consider age and gender when calculating premiums. Young drivers, particularly males, are often considered higher-risk and may face higher premiums.

- Marital Status: Being married can sometimes lead to lower premiums, as married individuals are statistically less likely to be involved in accidents.

- Credit Score: In many states, insurance companies use credit-based insurance scores to assess risk. A higher credit score may result in lower premiums.

Maximizing Savings on Car Insurance

Saving money on car insurance is possible without compromising on coverage. Here are some strategies to consider:

- Shop Around: Compare quotes from multiple insurance providers. Rates can vary significantly, so obtaining multiple quotes can help you find the best deal.

- Bundle Policies: Many insurance companies offer discounts when you bundle your car insurance with other policies, such as home or life insurance.

- Safe Driving Discounts: If you maintain a clean driving record, you may be eligible for safe driving discounts. These rewards can significantly reduce your premiums over time.

- Increase Deductibles: Opting for a higher deductible (the amount you pay out of pocket before insurance coverage kicks in) can lower your premium. However, ensure you can afford the increased deductible in case of an accident.

- Consider Usage-Based Insurance: Some insurers offer usage-based insurance programs that track your driving behavior. Safe drivers can benefit from lower premiums under these programs.

Securing Your Haven: Home Insurance

Home insurance is an indispensable safeguard for homeowners and renters alike. It provides financial protection against a wide range of risks, ensuring your home and its contents are covered in the event of damage, loss, or liability claims.

Coverage Options for Homeowners

Homeowners’ insurance policies typically offer a comprehensive range of coverage options, including:

- Dwelling Coverage: This coverage protects the structure of your home, including the walls, roof, and permanent fixtures. It covers damage caused by perils such as fire, wind, hail, and vandalism.

- Personal Property Coverage: This coverage protects your personal belongings, such as furniture, electronics, and clothing, against theft, damage, or loss. It’s essential to ensure you have adequate coverage limits to replace your belongings.

- Liability Coverage: Homeowners’ insurance includes liability coverage, which protects you if someone is injured on your property or if you’re legally responsible for injuries or property damage off your premises.

- Additional Living Expenses: In the event of a covered loss that makes your home uninhabitable, this coverage pays for temporary living expenses, such as hotel stays or rental costs, until your home is repaired or rebuilt.

- Medical Payments Coverage: Similar to car insurance, homeowners’ insurance often includes medical payments coverage, which pays for medical expenses for guests injured on your property, regardless of fault.

Factors Affecting Home Insurance Premiums

The cost of home insurance, like car insurance, is influenced by several factors. Here’s an overview of the key considerations:

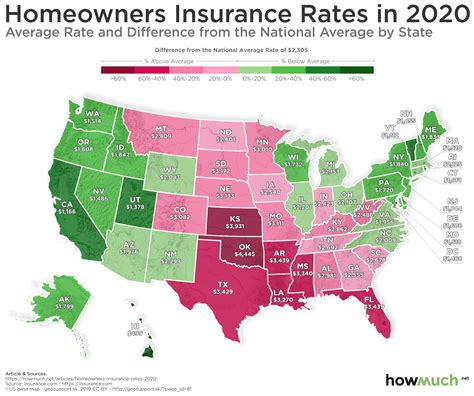

- Location: The location of your home plays a significant role in determining your premium. Areas prone to natural disasters, such as hurricanes or earthquakes, may have higher insurance costs.

- Home Value and Age: The value and age of your home are crucial factors. Older homes may require more maintenance and be at higher risk of damage, leading to higher premiums.

- Construction Materials: The materials used to construct your home can impact insurance costs. Homes built with fire-resistant materials or reinforced against natural disasters may qualify for lower premiums.

- Security Features: Installing security systems, smoke detectors, and fire sprinklers can lead to premium discounts, as these features reduce the risk of theft and fire-related incidents.

- Claims History: Your insurance claims history is a factor. Frequent claims can lead to higher premiums or even non-renewal of your policy.

- Deductibles: Similar to car insurance, opting for a higher deductible can lower your premium. However, ensure you can afford the deductible in the event of a claim.

Maximizing Savings on Home Insurance

Saving money on home insurance is possible while still maintaining adequate coverage. Consider these strategies:

- Shop and Compare: Obtain quotes from multiple insurers to find the best rates. Online comparison tools can make this process more efficient.

- Increase Deductibles: As with car insurance, opting for a higher deductible can reduce your premium. Ensure you have the financial means to cover the deductible in case of a claim.

- Bundle Policies: Similar to car insurance, bundling your home insurance with other policies, such as auto or life insurance, can lead to significant discounts.

- Maintain a Clean Claims History: Avoid filing small claims whenever possible. Each claim can increase your premiums or lead to non-renewal of your policy.

- Implement Home Safety Measures: Installing security systems, smoke detectors, and fire sprinklers can lead to premium discounts and provide added peace of mind.

The Future of Insurance: Emerging Trends

The insurance industry is evolving rapidly, driven by technological advancements and changing consumer expectations. Here’s a glimpse into the future of car and home insurance:

Digital Transformation

Insurance companies are embracing digital technologies to enhance the customer experience and streamline processes. Online quote comparisons, digital claim submissions, and mobile apps for policy management are becoming the norm.

Usage-Based Insurance

Usage-based insurance, or telematics, is gaining traction in the car insurance industry. This approach uses real-time data from devices installed in vehicles to assess driving behavior and calculate premiums. Safe drivers can benefit from lower rates under this model.

AI and Data Analytics

Artificial Intelligence (AI) and data analytics are transforming risk assessment and underwriting processes. Insurance companies are using advanced algorithms to analyze vast amounts of data, leading to more accurate risk profiling and personalized insurance offerings.

Smart Home Integration

The rise of smart home technology is influencing home insurance. Insurers are offering discounts and incentives for homeowners who integrate smart devices, such as smart locks and security cameras, into their homes, as these devices enhance security and reduce the risk of theft and damage.

Conclusion: Empowering Your Financial Security

Car and home insurance are essential tools for safeguarding your financial well-being. By understanding the coverage options, factors influencing premiums, and emerging trends, you can make informed decisions to protect your assets and ensure peace of mind. Remember, insurance is not a one-size-fits-all solution, so tailor your coverage to your unique needs and circumstances.

FAQ

How do I choose the right car insurance coverage for my needs?

+When selecting car insurance coverage, consider your specific needs and risk tolerance. If you have a newer or financed vehicle, collision and comprehensive coverage are essential. Additionally, evaluate your liability limits to ensure you have adequate protection against potential claims. Compare quotes from multiple insurers to find the best combination of coverage and cost.

What should I do if I’m involved in a car accident?

+If you’re involved in a car accident, prioritize your safety and that of others involved. Move to a safe location if possible, and call the police to file a report. Exchange contact and insurance information with the other party. Notify your insurance company as soon as possible to initiate the claims process. Take photos of the damage and gather any witness statements.

How can I reduce my home insurance premiums without compromising coverage?

+To reduce home insurance premiums, consider increasing your deductibles (within your financial means), bundling policies, and maintaining a clean claims history. Additionally, implementing home safety measures like security systems and fire prevention devices can lead to discounts. Regularly review your coverage limits to ensure they align with the current value of your home and belongings.

What is the difference between actual cash value and replacement cost coverage for my home?

+Actual cash value (ACV) coverage pays for the cost of replacing your belongings minus depreciation. Replacement cost coverage, on the other hand, provides full coverage for the cost of replacing your belongings without deducting depreciation. While ACV coverage is typically less expensive, replacement cost coverage ensures you can fully replace your belongings without financial strain.