Ga Dept Of Insurance

Welcome to an in-depth exploration of the Georgia Department of Insurance (DOI), a critical regulatory body that safeguards the interests of consumers and ensures the stability of the insurance industry within the state of Georgia. This article will delve into the DOI's structure, functions, and its pivotal role in maintaining a robust insurance market.

The Georgia Department of Insurance: A Regulatory Force

The Georgia Department of Insurance is a state-level agency with a broad mandate to regulate the insurance industry, protect consumers, and promote a competitive and solvent insurance market. With a long history dating back to the early 20th century, the DOI has evolved into a sophisticated regulatory body, adapting to the dynamic nature of the insurance industry and the ever-changing needs of Georgians.

Structure and Leadership

The DOI is headed by the Commissioner of Insurance, an elected official who serves as the primary regulatory authority. The Commissioner is supported by a team of experienced professionals, including actuaries, lawyers, and insurance experts, who together form the leadership team. This team oversees various divisions within the DOI, each responsible for specific aspects of insurance regulation and consumer protection.

Key Divisions and Their Functions

- Consumer Services Division: This division is the frontline of consumer protection. It handles consumer complaints, provides education and outreach programs, and ensures that insurance companies treat consumers fairly and transparently.

- Legal and Regulatory Division: Responsible for the legal aspects of insurance regulation, this division drafts and enforces laws and regulations, conducts investigations, and takes enforcement actions when necessary.

- Actuarial Division: With a focus on mathematical and statistical analysis, this division assesses the financial health and stability of insurance companies, ensuring they can meet their obligations to policyholders.

- Market Regulation Division: This division oversees the insurance market, including the licensing and regulation of insurance agents, brokers, and companies. It ensures that only qualified professionals are serving the public and that insurance products are fair and understandable.

- Fraud Division: A crucial arm of the DOI, the Fraud Division investigates and prosecutes insurance fraud, protecting both consumers and the insurance industry from fraudulent activities.

| Division | Key Responsibilities |

|---|---|

| Consumer Services | Assists consumers, resolves disputes, and educates the public |

| Legal and Regulatory | Enforces laws, investigates violations, and drafts regulations |

| Actuarial | Evaluates financial stability of insurers, ensuring solvency |

| Market Regulation | Oversees the insurance market, licenses professionals, and ensures fair practices |

| Fraud | Investigates and combats insurance fraud to protect consumers and insurers |

Regulatory Processes and Consumer Protection

The DOI’s regulatory processes are comprehensive and designed to ensure the stability and integrity of the insurance market. Here’s an overview of some of the key processes and initiatives:

License and Compliance

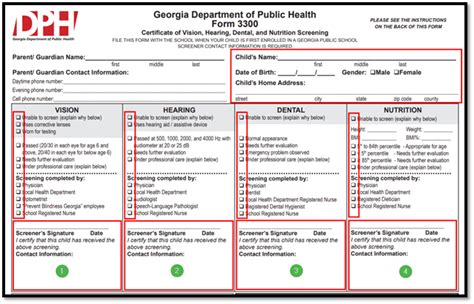

The DOI maintains a strict licensing process for insurance professionals, ensuring that only qualified individuals can sell insurance products. Regular compliance checks and audits are conducted to ensure that insurers and professionals adhere to state laws and regulations.

Market Conduct Examinations

Market conduct examinations are thorough reviews of insurance companies’ practices to ensure compliance with consumer protection laws. These examinations cover a range of areas, including sales practices, claim handling, and financial stability.

Consumer Education and Outreach

The DOI actively engages in consumer education initiatives, providing resources and information to help Georgians understand their insurance options and rights. This includes online resources, workshops, and community outreach programs.

Consumer Complaint Resolution

The DOI’s Consumer Services Division handles complaints from consumers about insurance companies, agents, or brokers. They investigate these complaints and take appropriate action to resolve issues, ensuring that consumers’ rights are protected.

Enforcement Actions

When insurers or professionals violate state laws or regulations, the DOI takes enforcement actions, which may include fines, license suspensions, or other measures to protect consumers and the integrity of the insurance market.

The Impact of DOI’s Work

The Georgia Department of Insurance’s efforts have a significant impact on the state’s insurance market and consumers. By regulating the industry, the DOI ensures that insurance products are available, affordable, and fair. Here are some key impacts:

Solvency and Financial Stability

The DOI’s actuarial division plays a crucial role in ensuring that insurance companies have the financial strength to meet their obligations. This stability benefits policyholders, as it reduces the risk of companies becoming insolvent and unable to pay claims.

Consumer Protection

Through its various divisions and initiatives, the DOI protects consumers from unfair or deceptive practices. This includes ensuring that insurance products are clearly explained, that claims are handled fairly, and that consumers have access to the support they need.

Market Efficiency and Competition

The DOI’s market regulation division fosters a competitive insurance market by ensuring that companies compete fairly. This competition drives innovation, keeps prices competitive, and ultimately benefits consumers.

Fraud Prevention

The DOI’s fraud division plays a vital role in preventing and combating insurance fraud. By investigating and prosecuting fraudulent activities, the DOI protects both consumers and insurance companies from financial loss and ensures the integrity of the insurance market.

The Future of Insurance Regulation in Georgia

As the insurance industry continues to evolve, the Georgia Department of Insurance is poised to adapt and respond to new challenges and opportunities. With advancements in technology and the increasing complexity of insurance products, the DOI is committed to staying at the forefront of regulatory practices.

Looking ahead, the DOI is focused on several key areas to enhance its regulatory framework. These include:

- Embracing Digital Innovation: The DOI is exploring ways to leverage technology to enhance its regulatory processes, improve efficiency, and provide better services to consumers.

- Data Analytics and Insights: By harnessing the power of data analytics, the DOI aims to gain deeper insights into the insurance market, identify trends, and make more informed regulatory decisions.

- Collaborative Efforts: The DOI is fostering stronger relationships with other regulatory bodies, industry stakeholders, and consumer groups to collaborate on best practices and share knowledge.

- Consumer Education and Empowerment: The DOI recognizes the importance of empowering consumers with knowledge. It plans to expand its educational initiatives and provide more resources to help Georgians make informed insurance decisions.

In conclusion, the Georgia Department of Insurance stands as a vital pillar of the state's insurance market, ensuring a fair, competitive, and solvent environment for both insurers and consumers. Through its dedicated team and comprehensive regulatory framework, the DOI plays a critical role in protecting the interests of Georgians and fostering a robust insurance industry.

What is the role of the Georgia Department of Insurance?

+The Georgia Department of Insurance regulates the insurance industry, protects consumers, and promotes a competitive and solvent insurance market in the state of Georgia.

How does the DOI ensure consumer protection?

+The DOI provides consumer education, handles complaints, and ensures fair practices by insurance companies through various regulatory processes.

What initiatives does the DOI have for the future of insurance regulation?

+The DOI is focusing on embracing digital innovation, data analytics, collaborative efforts, and consumer education to enhance its regulatory practices and better serve Georgians.