Best Life Insurance Agency

In the world of personal finance and protection, choosing the right life insurance agency is a crucial decision that can significantly impact your financial security and peace of mind. With numerous agencies offering a wide range of policies, it can be daunting to navigate the market and identify the best provider for your specific needs. In this comprehensive guide, we delve into the world of life insurance agencies, exploring their key characteristics, evaluating their offerings, and providing you with the tools to make an informed choice.

Understanding Life Insurance Agencies

Life insurance agencies are financial entities that specialize in offering a variety of life insurance policies to individuals and families. These agencies act as intermediaries between insurance companies and policyholders, providing expert guidance, personalized recommendations, and ongoing support throughout the insurance journey.

The primary role of a life insurance agency is to match clients with the most suitable insurance products based on their unique circumstances, goals, and budget. Agencies often represent multiple insurance carriers, allowing them to offer a diverse range of policies and ensure clients receive competitive rates and comprehensive coverage.

Key Characteristics of Top Life Insurance Agencies

When evaluating life insurance agencies, several key characteristics set the best agencies apart from the rest. These include:

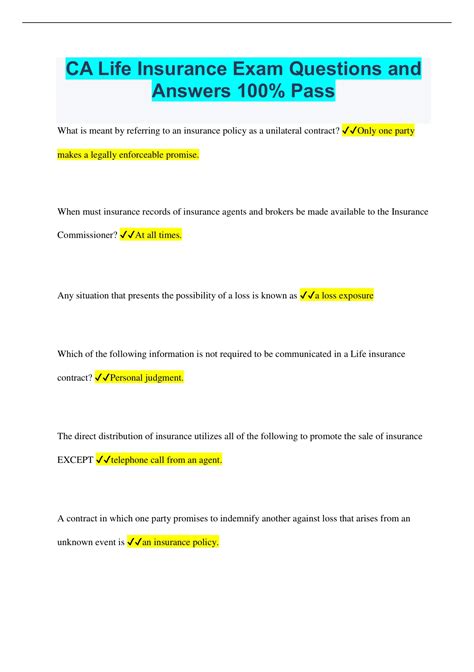

- Expertise and Knowledge: Top agencies employ experienced professionals who possess in-depth knowledge of the insurance industry, including policy types, features, and regulations. This expertise ensures that clients receive accurate information and tailored recommendations.

- Personalized Service: The best agencies understand that each client has unique needs and goals. They take the time to understand individual circumstances, providing personalized advice and creating customized insurance plans.

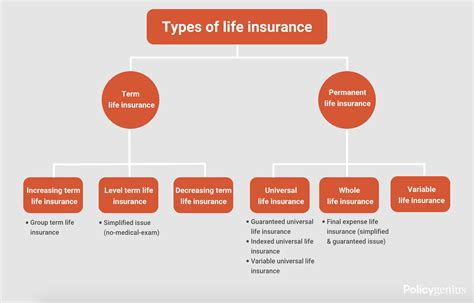

- Wide Range of Policies: A diverse portfolio of insurance policies is a hallmark of leading agencies. They offer various types of life insurance, including term, whole life, universal life, and more, ensuring clients can find the right coverage to meet their needs.

- Competitive Rates: Top agencies have access to multiple insurance carriers, allowing them to shop around and negotiate competitive rates for their clients. This ensures that policyholders receive the best value for their insurance premiums.

- Excellent Customer Support: Leading agencies prioritize customer satisfaction and provide exceptional support throughout the insurance process. This includes timely responses to queries, efficient claim processing, and ongoing policy management.

Evaluating Life Insurance Agencies: A Comprehensive Guide

Choosing the best life insurance agency involves a meticulous evaluation process. Here’s a step-by-step guide to help you make an informed decision:

Step 1: Define Your Needs and Goals

Before beginning your search, it’s essential to understand your specific insurance needs and goals. Consider the following factors:

- What type of life insurance are you seeking (term, whole life, etc.)?

- How much coverage do you require?

- Do you have any specific requirements, such as coverage for a particular medical condition or a need for flexible payment options?

- Are you looking for additional features like riders or investment opportunities within your policy?

Step 2: Research and Compare Agencies

Once you have a clear understanding of your needs, it’s time to research and compare different life insurance agencies. Here are some key steps:

- Search for reputable agencies online and read reviews from current and former clients.

- Check the agency's financial stability and rating. Look for agencies with strong financial ratings from reputable agencies like AM Best or Standard & Poor's.

- Compare the range of policies offered by different agencies. Ensure they provide the type of insurance you're seeking and have a diverse portfolio to meet various needs.

- Inquire about their customer service reputation and claim processing efficiency.

Step 3: Evaluate Agency Expertise and Personalization

Top life insurance agencies should demonstrate expertise and a commitment to personalized service. Here’s how to evaluate these aspects:

- Check the qualifications and experience of the agency's financial advisors or insurance brokers.

- Ask for references or testimonials from satisfied clients.

- Inquire about their approach to personalized insurance planning. Do they take the time to understand your unique circumstances and tailor their recommendations accordingly?

Step 4: Compare Rates and Coverage

One of the critical aspects of choosing a life insurance agency is ensuring you receive competitive rates and comprehensive coverage. Here’s how to assess these factors:

- Request quotes from multiple agencies for the specific type of insurance and coverage you need.

- Compare the quotes, ensuring you understand the coverage details, including any exclusions or limitations.

- Consider the long-term value of the policy. Some agencies may offer lower initial rates but have higher renewal costs, so evaluate the overall cost over the policy's term.

Step 5: Consider Additional Services and Support

Beyond the insurance policy itself, consider the additional services and support offered by the agency. These can include:

- Assistance with policy management and updates.

- Claim filing and processing support.

- Access to financial planning or investment advice.

- Customer service availability and response times.

Real-World Examples: Top Life Insurance Agencies in Action

To illustrate the impact of choosing the right life insurance agency, let’s explore a few real-world examples of how leading agencies have made a difference for their clients:

Example 1: Tailored Coverage for a Young Family

Sarah and John, a young couple with two small children, sought life insurance to protect their family’s financial future. They approached Agency A, which offered a comprehensive assessment of their needs. Based on their circumstances, Agency A recommended a term life insurance policy with a high coverage amount, ensuring their children’s financial security in the event of an untimely demise.

Example 2: Flexible Policy for a Self-Employed Business Owner

Emma, a self-employed business owner, required life insurance but wanted flexibility due to her variable income. Agency B, understanding her unique situation, proposed a universal life insurance policy with adjustable premiums. This allowed Emma to customize her coverage and premiums based on her business’s financial performance, providing her with the peace of mind she needed.

Example 3: Comprehensive Coverage for a Retiree

Mr. Smith, a retired individual, wanted to ensure his spouse’s financial security after his demise. Agency C, specializing in retirement planning, recommended a whole life insurance policy with a death benefit and an added long-term care rider. This comprehensive coverage provided Mr. Smith with peace of mind, knowing his spouse would have financial support and access to necessary care services.

Performance Analysis: Key Metrics to Consider

When evaluating life insurance agencies, several key performance metrics can provide valuable insights into their reliability and success. Here’s a breakdown of these metrics:

| Metric | Description |

|---|---|

| Customer Satisfaction Ratings | High customer satisfaction ratings indicate an agency's ability to provide excellent service and meet client expectations. Look for agencies with consistently positive reviews and testimonials. |

| Financial Stability | Financial stability is crucial for any insurance agency. Assess their financial health and rating to ensure they can honor their policy commitments over the long term. |

| Claim Settlement Ratio | The claim settlement ratio measures the percentage of claims an agency successfully processes and pays out. A high ratio indicates efficiency and a commitment to honoring policyholder obligations. |

| Policy Retention Rate | The policy retention rate reflects the percentage of clients who renew their policies with the agency. A high retention rate suggests client satisfaction and trust in the agency's services. |

| Average Response Time | Response time is crucial for customer service. Agencies with faster response times to inquiries and claims are often more efficient and responsive to client needs. |

Future Implications and Industry Trends

The life insurance industry is evolving, and staying abreast of emerging trends and innovations is essential for making informed choices. Here are some key trends to watch:

- Digital Transformation: The industry is increasingly adopting digital technologies, from online policy management to automated claim processing. This trend enhances efficiency and convenience for policyholders.

- Personalized Insurance: As agencies gather more data and utilize advanced analytics, they can offer even more personalized insurance plans tailored to individual needs and lifestyles.

- Wellness and Lifestyle Factors: Some agencies are exploring the integration of wellness and lifestyle factors into insurance policies, offering incentives for healthy behaviors and lifestyle improvements.

- AI and Machine Learning: Artificial intelligence is transforming the industry, from risk assessment to claim processing. Agencies leveraging AI can provide more accurate recommendations and efficient services.

Conclusion

Choosing the best life insurance agency is a decision that can have a profound impact on your financial well-being and the security of your loved ones. By understanding the key characteristics of top agencies, following a comprehensive evaluation process, and considering real-world examples and industry trends, you can make an informed choice. Remember, the right agency will not only provide you with the right insurance coverage but also offer expert guidance, personalized support, and peace of mind.

FAQ

What are the primary types of life insurance policies offered by agencies?

+Life insurance agencies typically offer a range of policies, including term life insurance, whole life insurance, universal life insurance, and variable life insurance. Each type has unique features and is suitable for different needs and financial goals.

How can I ensure I receive accurate and unbiased advice from a life insurance agency?

+To ensure unbiased advice, look for agencies that prioritize transparency and provide comprehensive information about different policy options. Choose an agency with a reputation for integrity and one that employs experienced advisors who put your interests first.

Are there any additional fees or charges associated with life insurance policies?

+Some life insurance policies may have additional fees, such as policy administration fees or rider charges. It’s essential to review the policy’s fine print and understand all associated costs to make an informed decision.

Can I switch life insurance agencies if I’m not satisfied with my current provider?

+Yes, you have the right to switch life insurance agencies if you’re dissatisfied with your current provider. However, it’s essential to carefully evaluate your options and choose a new agency that aligns with your needs and provides better service and coverage.

What should I do if I have a complaint or issue with my life insurance agency?

+If you encounter a problem or have a complaint, first reach out to your insurance agency’s customer service department. If the issue remains unresolved, you can file a complaint with your state’s insurance regulatory authority or seek legal advice if necessary.