Hra Insurance Meaning

In the world of finance and risk management, the term HRA often arises, leaving many wondering about its meaning and implications. HRA, which stands for Health Reimbursement Account, is a tax-advantaged workplace benefit that offers a unique approach to healthcare financing. This article delves into the intricacies of HRA insurance, exploring its definition, benefits, and the impact it can have on individuals and businesses alike.

Understanding HRA Insurance: A Comprehensive Overview

HRA insurance is a specific type of healthcare coverage that operates under a distinct set of rules and regulations. Unlike traditional health insurance plans, HRAs are designed to provide reimbursement for qualified medical expenses, offering a flexible and personalized approach to healthcare management.

At its core, an HRA is a dedicated account funded by an employer to help cover employees' healthcare costs. These accounts can be used to reimburse a wide range of medical expenses, including copayments, deductibles, and even some over-the-counter medications. The key advantage of HRAs is their flexibility, as they allow employees to decide how and when to use their benefits, providing a sense of control over their healthcare choices.

The Benefits of HRA Insurance

HRA insurance offers a multitude of advantages for both employers and employees. For employers, HRAs can be a cost-effective way to provide healthcare benefits, as they often result in lower overall healthcare expenses. Additionally, HRAs can help attract and retain talented employees, as they offer a valuable and flexible benefit package.

From an employee's perspective, HRAs provide a sense of financial security and control. Employees can use their HRA funds to cover a variety of healthcare needs, from routine check-ups to more significant medical procedures. This flexibility can be especially beneficial for individuals with unique healthcare requirements or those who prefer a more tailored approach to their medical care.

| Key Benefits of HRA Insurance | Description |

|---|---|

| Tax Advantages | HRA contributions and reimbursements are generally tax-free, offering significant savings for both employers and employees. |

| Customizable Coverage | HRAs allow employers to tailor healthcare benefits to their specific workforce, accommodating diverse needs and preferences. |

| Cost Control | Employees can make more informed healthcare decisions, potentially reducing overall healthcare costs. |

| Enhanced Benefits | HRAs can be used in conjunction with other healthcare plans, providing an additional layer of coverage and support. |

The Impact on Healthcare Management

The introduction of HRA insurance has had a notable impact on the healthcare industry and the way individuals approach their healthcare decisions. With HRAs, there is a shift towards more proactive and informed healthcare management. Employees are encouraged to take a more active role in their healthcare, making choices that align with their specific needs and financial situations.

Furthermore, HRAs can promote a culture of preventative care, as employees may be more inclined to seek regular check-ups and screenings when they have the means to cover these expenses. This focus on preventative measures can lead to better overall health outcomes and potentially reduce the burden of chronic illnesses.

Implementing HRA Insurance: A Strategic Approach

Implementing HRA insurance requires careful planning and consideration. Employers must navigate various regulations and guidelines to ensure compliance and maximize the benefits of HRAs. Here are some key considerations for businesses looking to adopt HRA insurance:

Regulatory Compliance

HRAs are subject to specific rules and regulations, particularly under the Affordable Care Act (ACA). Employers must ensure their HRA plans align with these regulations to avoid penalties and ensure the effectiveness of the benefit.

Plan Design

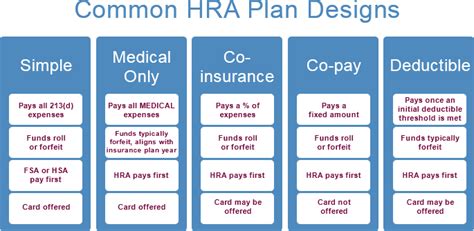

The design of an HRA plan should be tailored to the needs of the workforce. Employers should consider factors such as the age and health status of their employees, as well as the types of healthcare services commonly utilized by their staff. A well-designed HRA plan can provide comprehensive coverage while remaining cost-effective.

Employee Education

To ensure the success of HRA insurance, employers should invest in educating their employees about the benefits and features of HRAs. Clear communication about eligible expenses, reimbursement processes, and the overall value of HRAs can help employees make the most of this benefit.

Integration with Existing Plans

In many cases, HRAs can be integrated with existing healthcare plans, such as High Deductible Health Plans (HDHPs). This integration can provide a seamless and comprehensive healthcare experience for employees, ensuring they have access to a wide range of benefits.

The Future of HRA Insurance: Trends and Innovations

The landscape of HRA insurance is continually evolving, with new trends and innovations shaping the way HRAs are utilized. As employers and employees become more familiar with the benefits of HRAs, we can expect to see further refinement and expansion of this healthcare financing model.

Enhanced Technology Integration

Technology is playing an increasingly vital role in healthcare, and HRAs are no exception. Employers are exploring ways to integrate digital platforms and mobile apps into HRA management, making it easier for employees to track expenses, submit claims, and access their HRA funds.

Focus on Preventative Care

As mentioned earlier, HRAs have the potential to promote preventative care. In the future, we may see HRAs incentivizing employees to engage in healthy behaviors and regular check-ups through reward programs or discounted rates for preventative services.

Expanded Eligibility

Currently, HRAs are primarily associated with employer-sponsored plans. However, there is growing interest in expanding the eligibility criteria for HRAs, potentially allowing individuals to set up their own HRAs for personal healthcare management.

Can HRA insurance be used for all medical expenses?

+While HRAs provide flexibility, there are certain limitations. HRA funds are typically used for qualified medical expenses, which include a wide range of healthcare costs but may exclude specific services or treatments. It’s essential to review the specific guidelines of an HRA plan to understand what expenses are eligible for reimbursement.

Are there any tax implications for HRA insurance contributions and reimbursements?

+Generally, HRA contributions and reimbursements are tax-free for both employers and employees. However, there are specific rules and limitations, particularly under the Affordable Care Act. It’s advisable to consult with a tax professional to fully understand the tax implications of HRAs.

How can employers maximize the benefits of HRA insurance for their workforce?

+Employers can maximize the benefits of HRA insurance by designing plans that align with the unique needs of their workforce. This may involve conducting surveys or focus groups to understand employee healthcare preferences and concerns. Additionally, employers should ensure clear communication about HRA benefits and provide resources to help employees navigate the reimbursement process.