Auto Insurance Quotes State Farm

Welcome to a comprehensive guide on navigating the world of auto insurance quotes, with a focus on one of the industry's leading providers, State Farm. In this article, we will delve into the intricacies of obtaining accurate and competitive quotes for your vehicle insurance, exploring the key factors that influence rates and the unique offerings of State Farm. By the end of this journey, you'll possess the knowledge and tools to make informed decisions about your auto insurance coverage.

Understanding Auto Insurance Quotes

Auto insurance quotes serve as the foundation for your vehicle coverage, providing an estimate of the cost to insure your specific vehicle and driving profile. These quotes are highly personalized, taking into account various factors such as your age, driving history, location, and the make and model of your car. Understanding how these quotes are calculated is crucial to making smart choices when selecting an insurance provider.

At its core, the quote-generation process involves a meticulous analysis of your risk profile. Insurance companies assess the likelihood of you filing a claim based on historical data and statistical models. This assessment determines the premium you'll pay for your coverage. While the quote is an estimate, it provides a solid starting point for comparison shopping and understanding the costs associated with insuring your vehicle.

Factors Influencing Auto Insurance Quotes

Numerous factors come into play when insurance companies calculate quotes. These include:

- Driving Record: Your history of accidents, violations, and claims significantly impacts your quote. A clean driving record generally results in lower premiums, while multiple infractions or accidents can lead to higher costs.

- Vehicle Type and Usage: The make, model, and age of your vehicle, along with how you use it (commuting, pleasure driving, business purposes), influence the quote. Certain vehicles may have higher repair costs or be more prone to theft, affecting your insurance rates.

- Location and Demographics: Where you live and work plays a role in determining your quote. Areas with higher accident rates or instances of fraud may result in increased premiums. Additionally, demographic factors like age and gender can impact rates, although these considerations are subject to regulatory oversight.

- Coverage and Deductibles: The level of coverage you choose, including liability, collision, comprehensive, and additional endorsements, directly affects your quote. Higher coverage limits and lower deductibles typically lead to increased premiums.

It's important to note that while these factors provide a general overview, the specific weight assigned to each can vary across insurance companies. This variability is why it's beneficial to obtain quotes from multiple providers to find the best fit for your needs and budget.

Exploring State Farm: A Leader in Auto Insurance

State Farm stands as one of the most prominent players in the auto insurance landscape, known for its comprehensive coverage options and competitive rates. With a rich history spanning over 90 years, State Farm has built a reputation for reliability and customer satisfaction.

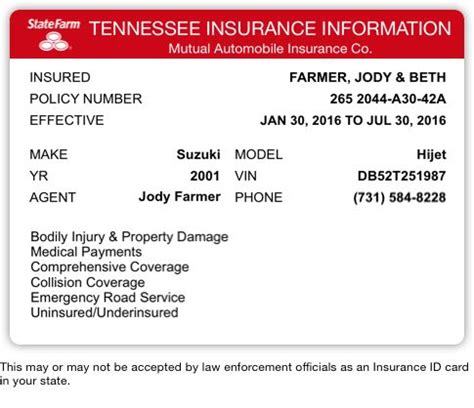

State Farm’s Comprehensive Coverage

State Farm offers a range of coverage options to meet the diverse needs of its customers. These include:

- Liability Coverage: Provides financial protection in the event you cause an accident, covering bodily injury and property damage costs.

- Collision Coverage: Pays for repairs or replacement of your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers non-accident-related damages, such as theft, vandalism, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who lacks sufficient insurance coverage.

- Medical Payments Coverage: Helps cover medical expenses for you and your passengers after an accident, regardless of fault.

In addition to these standard coverages, State Farm provides a suite of optional endorsements and specialized coverage options to cater to unique needs. These include rental car coverage, gap insurance, and coverage for custom parts and equipment.

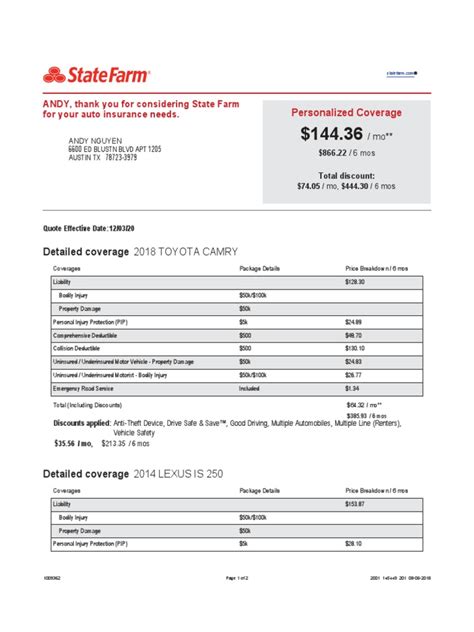

State Farm’s Competitive Rates and Discounts

One of the key strengths of State Farm is its ability to offer competitive rates while maintaining a strong financial foundation. The company’s extensive experience and data-driven approach to risk assessment allow it to provide accurate and fair quotes to its customers.

State Farm also offers a variety of discounts to help reduce insurance costs. These include:

- Multi-Policy Discount: Save by bundling your auto insurance with other policies, such as homeowners or renters insurance.

- Safe Driver Discount: Recognizes drivers with a clean driving record, offering reduced premiums.

- Student Discount: Provides savings for students who maintain good grades and attend school full-time.

- Defensive Driving Course Discount: Encourages safer driving habits by offering discounts to those who complete approved defensive driving courses.

- Loyalty Discount: Rewards long-term customers with reduced rates over time.

These discounts, combined with State Farm's commitment to personalized service and a strong network of local agents, make it a top choice for many drivers seeking comprehensive and affordable auto insurance coverage.

Navigating the Quote Process with State Farm

Obtaining an auto insurance quote from State Farm is a straightforward process, designed to be user-friendly and efficient. Whether you prefer to interact with a local agent or utilize online tools, State Farm provides multiple avenues to gather the information you need to make an informed decision.

Online Quote Tool

State Farm’s website features an intuitive online quote tool that allows you to quickly generate personalized quotes. By providing basic information about yourself, your vehicle, and your driving history, you can receive instant estimates for various coverage options. This tool is especially convenient for those who prefer a self-service approach or want to compare rates from the comfort of their homes.

Working with a Local Agent

State Farm’s network of local agents is a hallmark of its service. These professionals are deeply familiar with the unique needs and risks of their communities, offering personalized guidance and support throughout the quote and coverage process. By meeting with an agent, you can receive tailored advice, explore coverage options, and discuss any concerns or questions you may have.

The agent-client relationship is a key strength of State Farm, providing a level of personalized service that many customers find invaluable. Agents can offer insights into local regulations, recommend coverage levels based on your specific needs, and provide ongoing support should you ever need to file a claim.

Comparing Quotes and Making Informed Decisions

While State Farm’s quotes are highly competitive, it’s always beneficial to compare rates from multiple providers. By obtaining quotes from a variety of insurance companies, you can ensure you’re getting the best value for your money. Consider factors beyond just the premium, such as the breadth of coverage, customer service reputation, and financial stability of the insurer.

State Farm's commitment to transparency and customer satisfaction makes it an excellent choice for those seeking comprehensive auto insurance coverage. By understanding the quote process and exploring the range of coverage options available, you can make an informed decision that aligns with your unique needs and budget.

FAQ

How often should I review my auto insurance quotes and coverage?

+It’s recommended to review your auto insurance quotes and coverage annually, or whenever significant life changes occur. These changes could include moving to a new location, purchasing a new vehicle, getting married or divorced, or adding a young driver to your policy. Regular reviews ensure your coverage remains adequate and cost-effective.

What happens if I have an accident or file a claim after receiving a quote but before purchasing a policy?

+Accidents or claims filed after receiving a quote but before purchasing a policy can impact your insurance rates. Insurance companies consider these incidents when assessing your risk profile, which may lead to an increase in premiums. It’s important to be upfront about any incidents during the quote process to ensure accurate pricing.

Can I bundle my auto insurance with other types of insurance, such as homeowners or renters insurance, to save money?

+Yes, bundling your auto insurance with other policies, such as homeowners or renters insurance, is a great way to save money. Many insurance companies, including State Farm, offer multi-policy discounts. By bundling your coverage, you can often receive a significant discount on your overall insurance premiums.