Ncua Insured

The National Credit Union Administration (NCUA) is a United States federal agency tasked with regulating and supervising federal credit unions. It also insures deposits in these credit unions, providing a vital safety net for millions of Americans who choose to bank with credit unions. This article aims to delve into the world of NCUA-insured credit unions, exploring their history, benefits, and impact on the financial landscape.

The History and Evolution of NCUA Insured Credit Unions

The concept of credit unions has its roots in the cooperative movement, which gained momentum in the late 19th century as a response to the financial challenges faced by working-class communities. The idea was simple: people could pool their resources and provide financial services to each other, eliminating the need for traditional banks and their often-predatory practices.

In the United States, the first credit unions emerged in the early 1900s, primarily in rural areas. These early institutions were small, community-based operations, often run by volunteers. They provided much-needed financial services to farmers and rural residents who were often ignored by larger banks.

As credit unions grew in popularity, the need for a regulatory body became apparent. The NCUA was established in 1970 to oversee and insure federal credit unions, ensuring their stability and the protection of member deposits. The agency's creation was a significant milestone, as it provided a safety net for credit union members and helped establish credit unions as a viable alternative to traditional banking institutions.

Over the years, NCUA-insured credit unions have evolved to meet the changing needs of their members. They have expanded their services to include a wide range of financial products, from basic savings and checking accounts to mortgages, auto loans, and investment opportunities. This evolution has allowed credit unions to compete more effectively with traditional banks while maintaining their community-focused values.

Benefits of Banking with an NCUA-Insured Credit Union

Choosing to bank with an NCUA-insured credit union offers a range of benefits that set them apart from traditional banks.

Deposit Insurance and Security

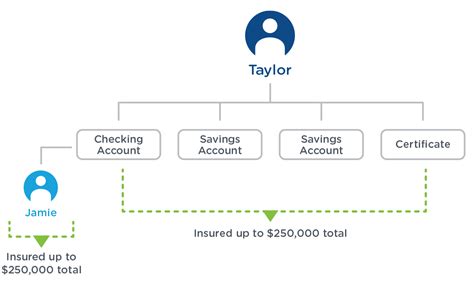

The most significant advantage is the insurance provided by the NCUA. All deposits in NCUA-insured credit unions are backed by the full faith and credit of the United States government, up to $250,000 per account owner. This insurance protects members’ savings, providing peace of mind and financial security.

Unlike some other deposit insurance programs, NCUA insurance covers all types of accounts, including checking, savings, money market, and certificates of deposit (CDs). It also covers joint accounts and certain retirement accounts, ensuring comprehensive protection for members' financial assets.

Community Focus and Personalized Service

Credit unions are known for their community-centric approach to banking. Unlike large, corporate banks, credit unions are member-owned and operated, which means they are focused on serving the financial needs of their members rather than maximizing profits for shareholders.

This community focus often translates into a more personalized banking experience. Credit union staff tend to be more accessible and knowledgeable about their members' financial situations, allowing for tailored advice and solutions. Many credit unions also offer educational programs and resources to help members improve their financial literacy and make informed decisions.

Competitive Rates and Lower Fees

NCUA-insured credit unions often provide more competitive rates on loans and credit products compared to traditional banks. This is because credit unions are not-for-profit institutions, meaning they can pass on the benefits of their lower operating costs to their members.

For example, credit unions frequently offer lower interest rates on mortgages, auto loans, and personal loans. They may also have more flexible terms and conditions, making it easier for members to access the funds they need. Additionally, credit unions often have lower or no fees for various services, such as account maintenance, overdraft protection, and ATM usage, further reducing the financial burden on members.

Member Benefits and Perks

Credit unions often provide additional benefits and perks to their members. These can include discounts on insurance policies, free or discounted financial services, and access to exclusive member events and programs. Some credit unions also offer scholarships and grants to members or their dependents, supporting education and community development.

Performance and Impact of NCUA-Insured Credit Unions

NCUA-insured credit unions have demonstrated resilience and financial stability over the years. Despite economic downturns and market fluctuations, these institutions have consistently provided safe and sound banking services to their members.

A look at the financial performance of NCUA-insured credit unions reveals some impressive statistics. As of [most recent data available], the NCUA reported that the national credit union system held over $1.8 trillion in assets, with more than 120 million members. This demonstrates the significant impact and reach of credit unions in the financial landscape.

| Metric | Value |

|---|---|

| Total Assets (as of [most recent data]) | $1.8 trillion |

| Number of Members | 120 million |

| Average Return on Assets | 1.05% |

| Average Delinquency Rate | 0.52% |

| Average Net Worth Ratio | 11.05% |

The above table provides a snapshot of the financial health of NCUA-insured credit unions. The average return on assets, delinquency rate, and net worth ratio indicate strong financial performance and stability. These metrics showcase the credit unions' ability to generate income, manage loans effectively, and maintain a healthy capital position.

Furthermore, NCUA-insured credit unions have consistently demonstrated their commitment to their members and communities. During economic downturns, credit unions often step in to provide much-needed financial support, offering loan modifications, payment deferrals, and other assistance programs. This community-centric approach has earned credit unions a reputation for reliability and trustworthiness.

Future Implications and Trends

As the financial landscape continues to evolve, NCUA-insured credit unions are well-positioned to adapt and thrive. Several trends and developments suggest a bright future for these institutions.

Digital Transformation and Convenience

Credit unions have embraced digital technology to enhance the member experience and improve operational efficiency. Many now offer robust online and mobile banking platforms, allowing members to manage their finances conveniently and securely from anywhere. This digital transformation has attracted younger generations who value convenience and ease of use.

Additionally, credit unions are leveraging technology to provide innovative financial products and services. From mobile check deposit to peer-to-peer payment systems, credit unions are staying ahead of the curve to meet the evolving needs of their members.

Community Engagement and Social Responsibility

Credit unions have always been community-focused, and this commitment is only strengthening. Many credit unions are actively involved in local initiatives, supporting education, healthcare, and other social causes. This engagement helps build trust and loyalty among members and demonstrates the credit unions’ dedication to the communities they serve.

Expanding Membership and Outreach

Credit unions are working to expand their reach and membership base. They are partnering with employers, community organizations, and even other credit unions to offer membership to a wider range of individuals. This strategy not only increases the credit unions’ customer base but also promotes financial inclusion and stability for more Americans.

Regulatory and Technological Challenges

While the future looks bright for NCUA-insured credit unions, they do face some challenges. Regulatory compliance and technological advancements require significant investments, and credit unions must stay vigilant to maintain their competitive edge.

Additionally, as the financial industry becomes more digitized, credit unions must ensure they have robust cybersecurity measures in place to protect their members' data and financial information. This requires continuous investment in technology and training to stay ahead of potential threats.

Conclusion

NCUA-insured credit unions have established themselves as a vital part of the financial landscape, offering a unique and member-centric approach to banking. With their strong financial performance, community focus, and commitment to member satisfaction, these institutions have earned the trust of millions of Americans.

As we look to the future, NCUA-insured credit unions are well-equipped to continue providing excellent service and financial security to their members. Their adaptability, community engagement, and digital transformation efforts position them as a reliable and innovative alternative to traditional banking.

For those seeking a more personalized and community-oriented banking experience, NCUA-insured credit unions offer a compelling choice. With their focus on member benefits, competitive rates, and strong financial performance, these institutions are a testament to the power of cooperative banking.

How can I find an NCUA-insured credit union near me?

+You can use the NCUA’s Credit Union Locator tool to find an NCUA-insured credit union in your area. This tool allows you to search by address, city, state, or ZIP code. Alternatively, you can ask friends, family, or colleagues if they are members of a credit union, as credit unions often have specific eligibility criteria based on employment, residence, or other affiliations.

What are the eligibility requirements to join an NCUA-insured credit union?

+Eligibility requirements vary from one credit union to another. Some credit unions may have open membership, meaning anyone can join, while others may have specific criteria, such as living or working in a certain area or being a member of a particular organization or association. It’s best to check with the credit union you’re interested in to understand their specific requirements.

Are there any differences in the products and services offered by NCUA-insured credit unions compared to traditional banks?

+Yes, there can be some differences. NCUA-insured credit unions are member-owned and not-for-profit, which often translates to more competitive rates on loans and lower fees for various services. They also tend to have a more personalized approach to banking and may offer unique benefits tailored to their members’ needs. However, the specific products and services offered can vary, so it’s best to compare credit unions and traditional banks based on your individual needs.