Auto Policy Insurance

Auto Policy Insurance: Understanding Your Coverage and Maximizing Protection

Auto policy insurance is a crucial aspect of responsible vehicle ownership. It provides financial security and peace of mind, ensuring that you and your vehicle are protected in the event of an accident, theft, or other unforeseen circumstances. With a myriad of coverage options and varying state regulations, understanding your auto insurance policy is essential to make informed decisions and ensure you have the right coverage for your needs.

In this comprehensive guide, we will delve into the world of auto policy insurance, exploring the key components, coverage options, and factors that influence your insurance premiums. By the end of this article, you will have a deeper understanding of auto insurance, enabling you to make informed choices and potentially save money on your policy.

The Fundamentals of Auto Policy Insurance

Auto policy insurance is a contract between you, the policyholder, and your insurance provider. It outlines the terms and conditions of your coverage, including the types of incidents covered, the limits of your policy, and any exclusions or deductibles that may apply. This contract is designed to protect you and your vehicle from financial losses arising from accidents, theft, natural disasters, and other covered events.

Key Components of an Auto Policy

- Liability Coverage: This is the most fundamental aspect of auto insurance. It covers the costs of bodily injury and property damage that you may cause to others in an accident. Liability coverage is typically divided into two parts: bodily injury liability and property damage liability.

- Comprehensive Coverage: Also known as "other than collision" coverage, comprehensive insurance protects your vehicle against damage or loss caused by events other than collisions. This includes theft, vandalism, natural disasters, and animal collisions. It provides financial protection for your vehicle even when you are not at fault.

- Collision Coverage: As the name suggests, collision coverage comes into play when your vehicle is involved in a collision with another vehicle or object. It covers the cost of repairing or replacing your vehicle, regardless of who is at fault. Collision coverage is essential for ensuring your vehicle's integrity and functionality after an accident.

- Medical Payments or Personal Injury Protection (PIP): This coverage pays for the medical expenses of you and your passengers after an accident, regardless of fault. It provides quick access to medical treatment and can cover a range of expenses, including doctor visits, hospital stays, and even funeral costs.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in the event of an accident with a driver who has no insurance or insufficient insurance to cover the damages. It ensures that you are not left financially burdened due to the actions of an uninsured or underinsured driver.

These are the primary components of an auto policy, but there are additional coverages and endorsements available to tailor your policy to your specific needs. These may include rental car reimbursement, gap insurance, custom parts coverage, and more.

Factors Influencing Auto Insurance Premiums

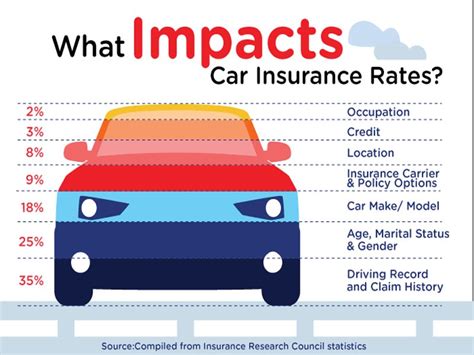

The cost of your auto insurance policy, or your premium, is determined by a variety of factors. Understanding these factors can help you make informed decisions to potentially lower your insurance costs. Here are some key influences on auto insurance premiums:

Driver Profile

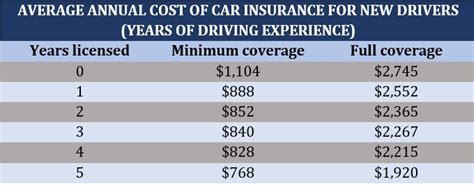

- Age and Gender: Younger drivers, especially those under 25, often face higher insurance premiums due to their lack of driving experience. Additionally, gender can play a role in insurance rates, with some insurers charging different rates for male and female drivers.

- Driving Record: Your driving history is a significant factor in determining your insurance rates. A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents or traffic violations may result in higher rates or even policy cancellations.

- Credit Score: In many states, insurers are allowed to use your credit score as a factor in determining your insurance rates. A higher credit score may lead to lower premiums, as it is seen as an indicator of financial responsibility.

Vehicle Profile

- Vehicle Type and Age: The type and age of your vehicle can impact your insurance rates. Newer, more expensive vehicles generally have higher premiums due to their higher replacement costs. Additionally, vehicles with a history of frequent claims or those considered "high-risk" by insurers may attract higher premiums.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and collision avoidance systems, may be eligible for insurance discounts. These features reduce the risk of accidents and injuries, leading to lower insurance costs.

Geographic Location

Where you live and drive can significantly impact your insurance rates. Insurers consider factors such as population density, crime rates, and the frequency of natural disasters when determining premiums. Urban areas with higher populations and traffic congestion often result in higher insurance rates.

Usage and Mileage

The purpose and frequency of your vehicle's use can affect your insurance rates. Insurers may offer lower rates for vehicles used primarily for pleasure driving or those with low annual mileage. Conversely, vehicles used for business purposes or those with high mileage may be considered higher risk and attract higher premiums.

Insurance Provider and Coverage Selection

Different insurance providers offer varying coverage options and price points. It's essential to shop around and compare quotes from multiple insurers to find the best coverage and rates for your needs. Additionally, the coverage options you choose, such as higher liability limits or additional endorsements, can impact your overall premium.

| Coverage Type | Average Premium Impact |

|---|---|

| Liability Coverage | Moderate to High |

| Comprehensive Coverage | Moderate |

| Collision Coverage | High |

| Medical Payments/PIP | Moderate |

| Uninsured/Underinsured Motorist Coverage | Moderate |

Maximizing Your Auto Policy's Value

While auto insurance is a necessary expense, there are strategies you can employ to maximize the value of your policy and potentially reduce your premiums. Here are some tips to consider:

Shop Around and Compare Quotes

Don't settle for the first insurance quote you receive. Take the time to compare quotes from multiple insurers. Online comparison tools can be especially useful for this purpose. By comparing quotes, you can identify the best coverage and rates for your needs.

Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies with them. For example, you may be able to save money by combining your auto insurance with your home or renters' insurance. This not only simplifies your insurance management but also often results in significant savings.

Choose Higher Deductibles

Increasing your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can lower your insurance premiums. However, it's essential to choose a deductible that you can comfortably afford in the event of a claim. This strategy can be particularly effective if you have a clean driving record and are confident in your ability to avoid accidents.

Take Advantage of Discounts

Insurance providers often offer a range of discounts to policyholders. These may include discounts for safe driving, accident-free periods, good student status, senior citizen status, and more. Ask your insurer about the discounts they offer and ensure you are taking advantage of all applicable discounts.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep your insurance premiums low. Avoid accidents and traffic violations, as these can significantly impact your insurance rates. Additionally, consider taking defensive driving courses, which may qualify you for insurance discounts and help improve your driving skills.

Regularly Review and Adjust Your Policy

Your insurance needs may change over time. Regularly review your auto insurance policy to ensure it still aligns with your current situation and requirements. As your life circumstances change, such as getting married, having children, or purchasing a new vehicle, you may need to adjust your coverage limits or add additional endorsements to your policy.

Conclusion: Empowering Your Auto Insurance Journey

Understanding your auto policy insurance is the first step towards making informed decisions and ensuring you have the right coverage for your needs. By familiarizing yourself with the key components of an auto policy, the factors influencing premiums, and strategies to maximize value, you can take control of your insurance journey. Remember, auto insurance is a vital aspect of responsible vehicle ownership, providing financial protection and peace of mind in the face of unexpected events.

FAQ

What is the difference between liability coverage and comprehensive coverage in auto insurance?

+

Liability coverage is designed to protect you financially in the event that you cause an accident resulting in bodily injury or property damage to others. It covers the costs of medical treatment, property repairs, and legal fees associated with the accident. Comprehensive coverage, on the other hand, provides protection for your vehicle against damage or loss caused by events other than collisions, such as theft, vandalism, natural disasters, and animal collisions.

How can I lower my auto insurance premiums if I have a clean driving record?

+

If you have a clean driving record, you may be eligible for insurance discounts. Many insurers offer safe driver discounts, which reward drivers who have not had accidents or traffic violations for a certain period. Additionally, you can explore options such as increasing your deductible, bundling your policies with the same insurer, and taking advantage of other available discounts, such as those for advanced safety features or defensive driving courses.

What should I do if I’m involved in an accident and need to make an insurance claim?

+

If you’re involved in an accident, it’s important to remain calm and follow these steps: (1) Ensure the safety of yourself and others involved. (2) Call the police to report the accident and obtain a police report. (3) Exchange contact and insurance information with the other driver(s). (4) Take photos of the accident scene, including any visible damage to vehicles and the surrounding area. (5) Notify your insurance company as soon as possible and provide them with all relevant details. They will guide you through the claims process and assist you in obtaining the necessary repairs or compensation.

Are there any alternatives to traditional auto insurance policies?

+

Yes, there are alternative insurance options available, such as usage-based insurance (UBI) and pay-as-you-drive (PAYD) policies. These policies are based on your actual driving behavior and mileage, rather than traditional rating factors. UBI and PAYD policies may offer lower premiums for low-risk drivers or those who drive infrequently. However, it’s important to carefully review the terms and conditions of these policies to ensure they align with your needs and provide adequate coverage.

What is the role of deductibles in auto insurance claims?

+

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. For example, if you have a 500 deductible and file a claim for a covered loss, you will pay the first 500, and your insurance provider will cover the remaining costs up to your policy limits. Choosing a higher deductible can lower your insurance premiums, but it’s important to select a deductible that you can afford in the event of a claim.