How Much Is Drivers Insurance

Understanding the cost of driver's insurance is essential for anyone seeking to protect their financial interests and comply with legal requirements. The price of insurance for drivers can vary significantly, influenced by a multitude of factors, each contributing to the final premium. This comprehensive guide aims to explore these factors, providing an in-depth analysis of the costs associated with driver's insurance.

Factors Influencing Driver’s Insurance Costs

Several critical factors play a role in determining the cost of insurance for drivers. These include:

1. Personal Information

Insurance providers assess various aspects of an individual’s personal life to calculate insurance premiums. Age, gender, and marital status are often considered, with younger, unmarried individuals typically facing higher premiums due to perceived risk. Occupation and educational background may also impact insurance costs, as certain professions or educational achievements can suggest a lower risk profile.

| Factor | Impact |

|---|---|

| Age | Higher premiums for younger drivers |

| Gender | Some providers offer gender-specific rates |

| Marital Status | Married individuals may receive discounts |

| Occupation | High-risk occupations may lead to higher premiums |

| Education | Advanced degrees can indicate a lower risk profile |

2. Driving History

A driver’s history behind the wheel is a critical factor in insurance cost determination. Claims history, traffic violations, and accidents all impact insurance premiums. A clean driving record typically leads to lower premiums, while multiple violations or accidents can significantly increase costs.

3. Vehicle Information

The type of vehicle an individual drives can also affect insurance costs. Vehicle make and model, age, and value are considered. High-performance cars or luxury vehicles often attract higher insurance premiums due to their cost and the potential for higher repair costs. Additionally, the purpose of the vehicle, such as personal use or business use, can impact insurance rates.

4. Coverage and Deductibles

The level of coverage an individual chooses, including liability, collision, and comprehensive coverage, directly affects insurance costs. Higher coverage limits generally result in higher premiums. The deductible chosen can also impact costs; a higher deductible often leads to lower premiums, as the policyholder assumes more financial responsibility in the event of a claim.

5. Location and Usage

The geographic location of the insured individual plays a role in insurance costs. Areas with higher accident rates or theft rates may experience higher premiums. Additionally, the frequency and purpose of vehicle usage can impact costs. Those who drive frequently or for business purposes may face higher premiums due to increased exposure to risk.

6. Insurance Company and Discounts

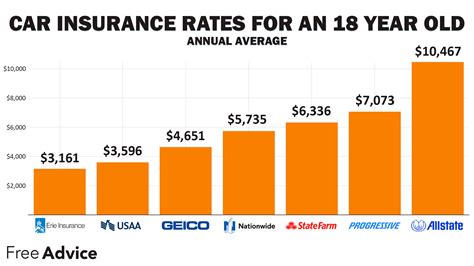

Different insurance companies offer varying rates and discounts. Shopping around and comparing quotes from multiple providers can help individuals find the best rates. Additionally, many insurance companies offer discounts for various reasons, such as safe driving records, loyalty, or bundle policies with other types of insurance.

Example Scenarios and Costs

To illustrate the variation in insurance costs, let’s explore a few hypothetical scenarios and the potential insurance costs associated with them:

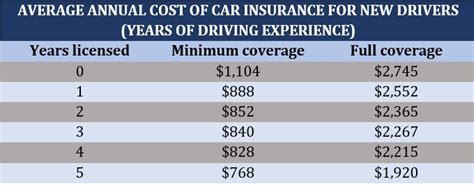

Scenario 1: New Driver

John, a 19-year-old male, has just received his driver’s license. He drives a 2018 Toyota Corolla, which he uses primarily for commuting to college. With a clean driving record and no prior insurance history, John’s insurance provider quotes him a premium of $2,500 annually for liability coverage.

Scenario 2: Experienced Driver

Sarah, a 35-year-old female, has been driving for over 20 years. She has a clean driving record and has been with the same insurance provider for the past 10 years. Sarah drives a 2020 Honda Civic for personal use. Her insurance provider offers her a premium of $1,200 annually for comprehensive coverage, including collision and liability.

Scenario 3: High-Risk Driver

Michael, a 28-year-old male, has a history of multiple traffic violations and accidents. He drives a 2015 Ford Mustang, which he uses for both personal and business purposes. Due to his high-risk profile, Michael’s insurance provider quotes him a premium of $4,000 annually for liability coverage, with a high deductible.

Future Implications and Tips

Understanding the factors that influence driver’s insurance costs is crucial for making informed decisions. Here are some key takeaways and tips to consider:

- Maintain a clean driving record to potentially reduce insurance costs.

- Shop around and compare quotes from multiple insurance providers to find the best rates.

- Consider increasing your deductible to lower premiums, but ensure you can afford the higher out-of-pocket expense in the event of a claim.

- Explore discounts offered by insurance providers, such as safe driving discounts or bundle discounts.

- Regularly review your insurance policy and coverage to ensure it aligns with your current needs and circumstances.

By staying informed and proactive, drivers can effectively manage the costs associated with their insurance policies.

Conclusion

The cost of driver’s insurance is a complex calculation influenced by numerous factors. From personal information and driving history to vehicle details and coverage choices, each aspect plays a role in determining insurance premiums. By understanding these factors and staying vigilant in reviewing insurance policies, drivers can make informed decisions to protect their financial interests.

What is the average cost of driver’s insurance in the United States?

+The average cost of driver’s insurance varies depending on numerous factors, including the state, the driver’s age and driving history, and the type of coverage. On average, drivers in the United States pay around 1,500 per year for car insurance, but this can range from 500 to $3,000 or more.

How can I reduce my insurance premiums?

+There are several ways to potentially reduce insurance premiums. Maintaining a clean driving record, shopping around for quotes from multiple providers, and considering higher deductibles are effective strategies. Additionally, exploring discounts, such as safe driving or loyalty discounts, can help lower costs.

Do insurance costs vary based on gender?

+Yes, insurance costs can vary based on gender. Historically, female drivers have often paid lower premiums due to statistical data suggesting they are involved in fewer accidents. However, with the introduction of gender-neutral pricing, this gap is narrowing, and insurance costs are becoming more uniform across genders.

What is the difference between liability, collision, and comprehensive coverage?

+Liability coverage protects you financially if you’re at fault in an accident, covering the costs of damages to the other party’s vehicle and any medical expenses. Collision coverage covers damages to your own vehicle in an accident, regardless of fault. Comprehensive coverage protects against non-accident-related damages, such as theft, vandalism, or natural disasters.