Insurance Car Cheaper

Finding affordable car insurance is a priority for many vehicle owners, as it can significantly impact their financial planning and overall expenses. The cost of car insurance can vary greatly depending on various factors, and understanding how to make it more affordable is essential. In this comprehensive guide, we will delve into the world of car insurance, exploring strategies and insights to help you secure the best rates and make informed decisions. From understanding the key factors that influence premiums to exploring cost-saving options, we aim to provide you with expert advice to navigate the complex landscape of insurance.

Unraveling the Factors That Affect Insurance Costs

Several elements play a pivotal role in determining the cost of your car insurance. By understanding these factors, you can better comprehend why insurance rates vary and take steps to potentially reduce your premiums.

Vehicle Type and Age

The type and age of your vehicle are fundamental considerations for insurance providers. Generally, newer and more expensive cars tend to attract higher insurance premiums. This is primarily due to the higher replacement and repair costs associated with newer models. Additionally, certain makes and models may have a reputation for higher accident rates or be more susceptible to theft, further influencing insurance costs.

Conversely, older vehicles, especially those with lower market values, often enjoy more affordable insurance rates. This is because the potential financial loss in the event of an accident or theft is comparatively lower. However, it's important to note that older vehicles may require specialized insurance coverage to ensure adequate protection, which could result in slightly higher premiums.

Driving History and Record

Your driving history is a significant factor in determining insurance costs. Insurance companies carefully analyze your driving record to assess your risk profile. A clean driving record, free from accidents and traffic violations, is generally rewarded with lower insurance premiums. On the other hand, if you have a history of accidents or moving violations, your insurance rates are likely to be higher.

Furthermore, the number of years you've been driving can also impact your insurance costs. Newer drivers, especially those under the age of 25, are often considered high-risk and may face higher premiums. This is because younger drivers tend to have less experience on the road, leading to a higher likelihood of accidents.

Location and Usage

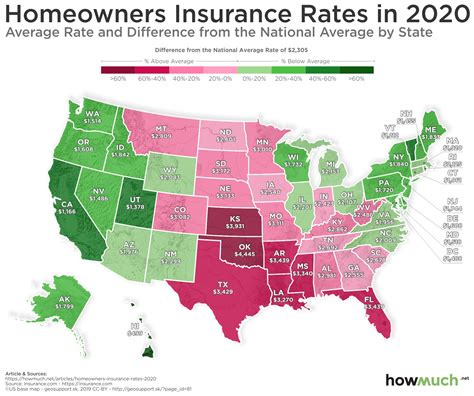

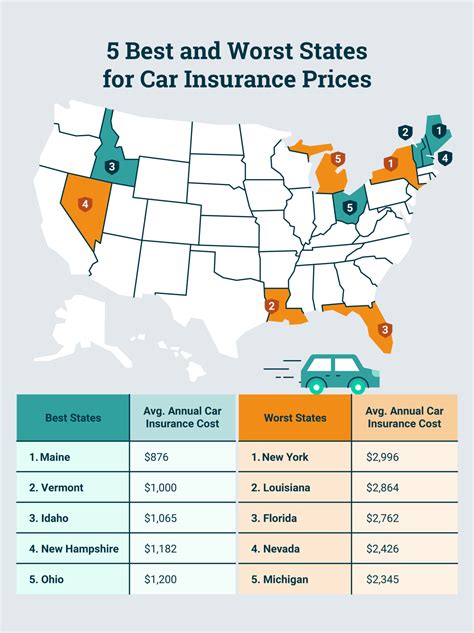

The location where your vehicle is primarily used and the purpose of its usage are also critical factors in determining insurance costs. Insurance providers consider the geographic location of your vehicle, taking into account factors like crime rates, traffic density, and the likelihood of natural disasters. Areas with higher risks of theft, accidents, or natural disasters often result in higher insurance premiums.

Additionally, the purpose for which you use your vehicle can influence insurance costs. For instance, if you primarily use your car for business purposes, such as delivering goods or providing services, your insurance rates may be higher compared to those who use their vehicles solely for personal travel. Business-related usage often entails more miles driven and potentially higher exposure to risk.

Insurance Coverage and Deductibles

The type and level of insurance coverage you choose directly impact your insurance costs. Comprehensive coverage, which includes protection for a wide range of potential incidents like theft, fire, and natural disasters, tends to be more expensive than basic liability coverage, which only covers damage you cause to others. It’s essential to strike a balance between the coverage you need and the premiums you can afford.

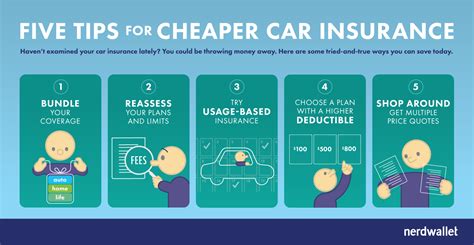

Furthermore, the deductible you choose plays a significant role in determining your insurance costs. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible typically results in lower premiums, as you're accepting more financial responsibility in the event of a claim. However, it's important to ensure that you can afford the deductible in the event of an accident or incident.

Strategies to Make Car Insurance More Affordable

Now that we’ve explored the key factors influencing car insurance costs, let’s delve into some practical strategies to potentially reduce your insurance premiums and make car insurance more affordable.

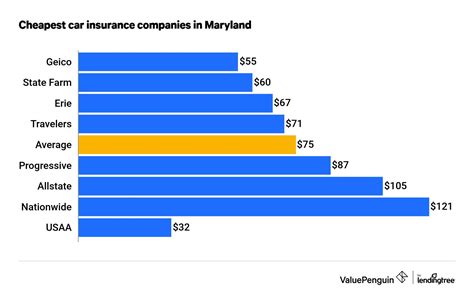

Shop Around and Compare Quotes

One of the simplest yet most effective ways to save on car insurance is to shop around and compare quotes from different insurance providers. Insurance rates can vary significantly between companies, even for the same level of coverage. By obtaining multiple quotes, you can identify the most competitive rates and potentially save a considerable amount on your premiums.

When comparing quotes, ensure that you're comparing like-for-like coverage. Different insurance providers may offer slightly different coverage options, so it's essential to understand the specifics of each quote to ensure you're getting the best value for your money.

Bundle Your Insurance Policies

Many insurance providers offer discounts when you bundle multiple insurance policies with them. For instance, if you have home insurance and car insurance, consider combining them with the same provider. By doing so, you may be eligible for a multi-policy discount, which can result in significant savings on your car insurance premiums.

Additionally, some insurance companies offer discounts for bundling different types of insurance, such as life insurance, health insurance, and car insurance. Exploring these bundling options can be a smart strategy to reduce your overall insurance costs.

Improve Your Driving Record

As mentioned earlier, your driving record is a crucial factor in determining your insurance costs. Maintaining a clean driving record, free from accidents and traffic violations, is essential to keeping your insurance premiums low. If you have a history of accidents or violations, taking steps to improve your driving habits and reduce the likelihood of future incidents can positively impact your insurance costs over time.

Consider investing in defensive driving courses, which can not only enhance your driving skills but also often result in insurance discounts. Many insurance companies offer incentives for completing these courses, recognizing the reduced risk associated with safer driving habits.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is an innovative approach to car insurance that takes into account how and when you use your vehicle. This type of insurance uses telematics technology to track your driving behavior, such as miles driven, driving speed, and braking habits.

By opting for usage-based insurance, you may be able to save on your premiums, especially if you drive less than average or have a history of safe driving. This type of insurance rewards safe driving habits and can be a cost-effective option for those who are confident in their driving skills and road safety awareness.

Explore Discounts and Special Programs

Insurance providers often offer a variety of discounts and special programs to attract and retain customers. These discounts can significantly reduce your insurance premiums, so it’s worth exploring all available options.

Some common discounts include:

- Good Student Discount: Many insurance companies offer discounts to students who maintain a certain grade point average. This encourages academic achievement and can result in savings on car insurance.

- Safe Driver Discount: As mentioned earlier, safe driving habits can lead to insurance discounts. Insurance companies often reward drivers with clean records and a history of safe driving.

- Multi-Car Discount: If you have multiple vehicles in your household, insuring them all with the same provider can result in a multi-car discount, reducing your overall insurance costs.

- Loyalty Discount: Staying with the same insurance provider for an extended period can lead to loyalty discounts. Insurance companies often reward long-term customers with lower premiums.

- Membership and Affiliation Discounts: Belonging to certain organizations, such as alumni associations, professional groups, or even specific credit unions, can sometimes qualify you for insurance discounts.

It's important to note that the availability of discounts can vary depending on your location and the insurance provider. Be sure to inquire about all potential discounts when obtaining quotes to ensure you're taking advantage of all applicable savings.

Understand Your Coverage Needs

Assessing your coverage needs is crucial to ensuring you have adequate protection without overpaying for insurance. While it’s important to have sufficient coverage to protect yourself and your assets, overinsuring can lead to unnecessary expenses.

Evaluate your financial situation and determine the level of coverage you truly need. For instance, if you have significant savings or other assets, you may be able to opt for a higher deductible, which can result in lower premiums. Conversely, if you're financially vulnerable, a lower deductible may be more suitable to ensure you can afford out-of-pocket expenses in the event of an incident.

Additionally, consider the age and value of your vehicle. For older vehicles with low market values, comprehensive and collision coverage may not be necessary, as the cost of repairs or replacement may not justify the insurance premiums. In such cases, opting for liability-only coverage can be a cost-effective solution.

The Impact of Credit Score on Insurance Costs

Your credit score, a measure of your financial reliability and creditworthiness, can have a significant impact on your car insurance costs. Many insurance providers use credit-based insurance scoring to assess the risk of insuring a particular individual. This practice, while controversial, is legal in most states and is a common factor in determining insurance premiums.

In general, individuals with higher credit scores are considered lower-risk and may enjoy more affordable insurance rates. Conversely, those with lower credit scores may face higher insurance premiums. This is because insurance companies view individuals with lower credit scores as potentially more likely to file claims, which can result in increased costs for the insurer.

While the exact impact of your credit score on insurance costs can vary depending on the insurance provider and your specific circumstances, it's generally advisable to maintain a good credit score to potentially save on insurance premiums. Improving your credit score can have benefits beyond insurance, such as better interest rates on loans and credit cards, so it's a worthwhile long-term financial goal.

Future Trends and Innovations in Car Insurance

The car insurance industry is constantly evolving, with new technologies and innovations shaping the way insurance is offered and delivered. Staying informed about these trends can help you make more informed decisions and potentially benefit from cost-saving opportunities.

Telematics and Connected Cars

The use of telematics and connected car technology is transforming the way insurance is priced and delivered. As mentioned earlier, usage-based insurance relies on telematics to track driving behavior and offer personalized insurance rates. This technology is becoming increasingly sophisticated, allowing for more accurate assessment of risk and potentially resulting in more affordable insurance for safe drivers.

Additionally, connected car technology can provide real-time data on vehicle diagnostics and performance, which can be used to enhance safety features and potentially reduce the likelihood of accidents. This, in turn, can lead to lower insurance premiums for drivers who embrace these advanced technologies.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are increasingly being utilized by insurance providers to streamline processes and enhance risk assessment. These technologies can analyze vast amounts of data, including driving behavior, weather patterns, and traffic conditions, to more accurately predict the likelihood of accidents and claims.

By leveraging AI and ML, insurance companies can offer more personalized and competitive insurance rates. For instance, these technologies can identify patterns and trends that traditional methods may miss, allowing for more precise pricing and potentially lower premiums for certain drivers.

Blockchain Technology

Blockchain technology, often associated with cryptocurrencies, has the potential to revolutionize the insurance industry by enhancing transparency, security, and efficiency. Blockchain can be used to create a secure and immutable record of insurance policies, claims, and payments, reducing the risk of fraud and improving the overall integrity of the insurance process.

Additionally, blockchain can facilitate more efficient and secure peer-to-peer insurance models, where individuals can directly insure each other without the need for traditional insurance providers. While this concept is still in its early stages, it has the potential to disrupt the traditional insurance model and offer more affordable options for certain individuals.

InsureTech Startups and Innovations

The rise of InsureTech startups and innovative insurance models is reshaping the insurance landscape. These startups are leveraging technology to offer more personalized, flexible, and cost-effective insurance solutions. From on-demand insurance coverage to insurance-as-a-service models, these innovative approaches are challenging traditional insurance providers and driving down costs for consumers.

By embracing these new insurance models, consumers can potentially access more affordable insurance options tailored to their specific needs and circumstances. It's important to stay informed about these emerging trends to make the most of the evolving insurance market.

Conclusion

Making car insurance more affordable is a multifaceted process that involves understanding the factors that influence insurance costs, exploring cost-saving strategies, and staying informed about the latest industry trends. By adopting a proactive approach and making informed decisions, you can potentially reduce your insurance premiums and ensure you have adequate coverage without breaking the bank.

Remember, the key to affordable car insurance is a combination of smart shopping, understanding your coverage needs, and embracing the innovations that the insurance industry has to offer. With the right approach, you can navigate the complex world of insurance with confidence and secure the best rates for your circumstances.

How often should I review my car insurance policy and premiums?

+It’s a good practice to review your car insurance policy and premiums annually or whenever your circumstances change significantly. This allows you to stay up-to-date with the latest market rates and ensure you’re getting the best value for your money. Additionally, if you’ve made improvements to your driving record or have installed safety features in your vehicle, reviewing your policy can help you take advantage of potential discounts.

Can I switch insurance providers to save money on car insurance?

+Absolutely! Switching insurance providers is a common strategy to save money on car insurance. As mentioned earlier, insurance rates can vary significantly between providers, so shopping around and obtaining multiple quotes can help you identify the most competitive rates. When switching providers, ensure that your new policy provides the same level of coverage as your previous one to avoid any gaps in protection.

What are some common mistakes to avoid when shopping for car insurance?

+When shopping for car insurance, it’s important to avoid common pitfalls that can lead to overpaying or inadequate coverage. Some mistakes to avoid include:

- Not comparing enough quotes: Obtaining multiple quotes is essential to finding the best rates. Comparing at least three to five quotes can help you identify the most competitive options.

- Overlooking discounts: Insurance providers offer various discounts, so it’s important to inquire about all available discounts to ensure you’re taking advantage of all potential savings.

- Underestimating your coverage needs: Assessing your coverage needs accurately is crucial. Insuring your vehicle adequately is essential to protect your assets and ensure you’re not underinsured in the event of an accident.

- Assuming rates are fixed: Car insurance rates can fluctuate over time, so it’s important to stay informed and review your policy regularly to ensure you’re getting the best rates available.

How can I improve my chances of getting lower car insurance rates in the future?

+To improve your chances of getting lower car insurance rates in the future, focus on the following strategies:

- Maintain a clean driving record: A clean driving record, free from accidents and traffic violations, is a key factor in keeping insurance rates low. Focus on safe driving habits and avoid risky behaviors.

- Improve your credit score: As mentioned earlier, your credit score can impact your insurance rates. Work on improving your credit score by paying bills on time, reducing debt, and managing your credit responsibly.

- Stay informed about industry trends: The car insurance industry is constantly evolving, so staying informed about new technologies and innovations can help you make the most of cost-saving opportunities. Keep an eye on emerging trends and consider embracing new insurance models that align with your needs.