Cheap Car Insurance#

Securing affordable car insurance is a top priority for many vehicle owners, and the quest for cheap car insurance often leads to a careful evaluation of various factors. In this comprehensive guide, we will delve into the intricacies of obtaining affordable car insurance, exploring the key considerations, strategies, and insights that can help you make informed decisions. By understanding the factors that influence insurance rates and implementing effective cost-saving measures, you can navigate the world of car insurance with confidence and achieve significant savings.

Understanding the Fundamentals of Cheap Car Insurance

Cheap car insurance is a relative term, as the cost of coverage can vary significantly based on individual circumstances and the specific insurance provider. However, by comprehending the fundamental principles that influence insurance rates, you can position yourself to negotiate better deals and secure more affordable coverage.

Key Factors Influencing Car Insurance Rates

The cost of car insurance is determined by a myriad of factors, including but not limited to the following:

- Vehicle Type and Usage: The make, model, and age of your vehicle play a crucial role in determining insurance rates. Additionally, the primary purpose of your vehicle, such as personal or business use, can impact the cost of coverage.

- Driver Profile: Your driving history, age, gender, and marital status are key considerations for insurance providers. A clean driving record with no accidents or traffic violations can lead to more favorable insurance rates.

- Location and Mileage: The area where you reside and the annual mileage you accumulate significantly influence insurance costs. Urban areas with higher traffic volumes and accident rates often result in higher premiums.

- Coverage Requirements: The level of coverage you choose, including liability, comprehensive, and collision insurance, directly impacts your insurance premiums. Understanding your specific needs and selecting appropriate coverage levels is essential for cost optimization.

- Claims History: A history of frequent claims can lead to higher insurance rates, as it indicates a higher risk profile. Maintaining a clean claims record can help you secure more affordable coverage over time.

Strategies for Obtaining Cheap Car Insurance

Now that we have established the key factors that influence car insurance rates, let’s explore some effective strategies to secure cheap car insurance:

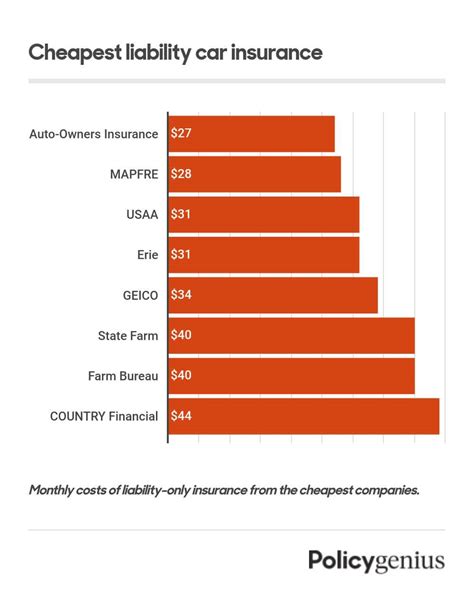

- Compare Multiple Quotes: Obtaining quotes from multiple insurance providers is essential to finding the best deal. Online comparison tools and direct interactions with insurance companies can provide valuable insights into competitive pricing.

- Bundling Policies: If you own multiple vehicles or have other insurance needs, such as home or life insurance, consider bundling your policies with the same provider. Many insurers offer significant discounts for multi-policy holders.

- Safe Driving Habits: Maintaining a safe driving record is crucial for securing cheap car insurance. Avoid traffic violations, practice defensive driving, and consider enrolling in safe driving courses to enhance your driving skills and reduce the risk of accidents.

- Increase Deductibles: Opting for higher deductibles can lead to reduced insurance premiums. However, it’s essential to ensure that you can afford the increased out-of-pocket expenses in the event of a claim.

- Explore Discounts: Many insurance providers offer discounts for a variety of reasons, such as good student discounts, safe driver discounts, and loyalty discounts. Take advantage of these opportunities to reduce your insurance costs.

- Review Coverage Levels: Regularly review your insurance policy to ensure that your coverage levels are appropriate for your needs. Over time, your circumstances may change, and you may be able to reduce certain coverage levels to save on premiums.

- Shop Around Regularly: Insurance rates can fluctuate, and it’s beneficial to shop around periodically to ensure you’re still getting the best deal. Regularly reviewing your options can help you identify new opportunities for cost savings.

Analyzing Real-World Examples of Cheap Car Insurance

To illustrate the effectiveness of the strategies outlined above, let’s examine a few real-world examples of individuals who successfully obtained cheap car insurance:

Case Study 1: John’s Journey to Affordable Coverage

John, a 30-year-old professional, recently moved to a new city and was in the market for car insurance. By comparing quotes from various providers, he discovered that his current insurance company was offering significantly higher premiums than its competitors. He decided to switch providers, opting for a company that offered a more competitive rate. Additionally, John took advantage of a loyalty discount by bundling his car insurance with his existing home insurance policy, resulting in substantial savings.

| Insurance Provider | Annual Premium |

|---|---|

| Previous Provider | $1,800 |

| New Provider | $1,400 |

Case Study 2: Sarah’s Safe Driving Rewards

Sarah, a 25-year-old student, has maintained a clean driving record throughout her driving career. As a result, she has consistently received safe driver discounts on her car insurance. By prioritizing safe driving habits and enrolling in defensive driving courses, Sarah has been able to secure affordable insurance rates year after year. Additionally, Sarah opted for a higher deductible, further reducing her insurance premiums.

| Insurance Provider | Annual Premium |

|---|---|

| Provider A | $1,200 |

| Provider B | $1,100 |

Case Study 3: Michael’s Comprehensive Approach

Michael, a 40-year-old business owner, recently purchased a new vehicle and was in the market for car insurance. He took a comprehensive approach to finding affordable coverage by comparing quotes, exploring discounts, and optimizing his coverage levels. By carefully reviewing his insurance needs, Michael was able to tailor his policy to his specific requirements, resulting in significant cost savings.

| Insurance Provider | Annual Premium |

|---|---|

| Provider X | $1,600 |

| Provider Y | $1,350 |

Future Implications and Ongoing Strategies

Securing cheap car insurance is an ongoing process that requires regular evaluation and adaptation. As your circumstances change, it’s essential to reassess your insurance needs and explore new opportunities for cost savings. Here are some key considerations for the future:

- Stay Informed: Keep abreast of changes in the insurance market, including new providers, innovative coverage options, and evolving discount programs. Staying informed can help you identify new opportunities for savings.

- Maintain a Clean Record: Continue to prioritize safe driving habits and maintain a clean driving record. A spotless record not only reduces your insurance costs but also provides peace of mind and enhances your overall driving experience.

- Explore Telematics: Telematics-based insurance, also known as usage-based insurance, is an emerging trend that offers personalized premiums based on your driving behavior. Consider exploring these options, as they can provide significant savings for responsible drivers.

- Review Coverage Periodically: Regularly review your insurance policy to ensure that your coverage levels remain appropriate for your needs. As your circumstances change, you may find opportunities to adjust your coverage and save on premiums.

- Shop Around: Don’t settle for the status quo. Continuously shop around for the best deals and explore new insurance providers. The insurance market is highly competitive, and providers are constantly striving to offer attractive rates to new customers.

Conclusion: Navigating the World of Affordable Car Insurance

Securing cheap car insurance is a journey that requires a combination of knowledge, strategy, and proactive decision-making. By understanding the factors that influence insurance rates and implementing the strategies outlined in this guide, you can navigate the world of car insurance with confidence and achieve significant savings. Remember, the key to affordable coverage lies in staying informed, comparing options, and optimizing your insurance policy to suit your specific needs.

How often should I review my car insurance policy for potential savings opportunities?

+

It is recommended to review your car insurance policy annually or whenever your circumstances change significantly. This allows you to stay updated with the latest market trends, discounts, and coverage options, ensuring you’re getting the best value for your insurance needs.

Are there any specific discounts I should look out for when shopping for car insurance?

+

Yes, there are several discounts commonly offered by insurance providers. These include safe driver discounts, good student discounts, loyalty discounts, multi-policy discounts (bundling car insurance with other policies), and even discounts for certain occupations or membership affiliations. It’s worth exploring these options to see if you qualify for any additional savings.

Can I negotiate with my insurance provider to lower my premiums?

+

While negotiating with insurance providers may not always be possible, it’s worth inquiring about potential discounts or premium adjustments. Some providers may be willing to work with you, especially if you have a long-standing relationship or a clean claims history. Don’t hesitate to ask about any available options or promotions that could benefit you.