Best Insurance Companies 2024

The insurance industry is a vast and diverse landscape, offering a wide range of products and services to cater to individuals' and businesses' varying needs. When it comes to selecting the best insurance companies, there are several factors to consider, including financial stability, customer satisfaction, product offerings, and innovative solutions. In this comprehensive guide, we will explore the top insurance companies for 2024, delving into their unique features, strengths, and areas of expertise.

The Evolution of Insurance: A Historical Perspective

To truly appreciate the excellence of today’s top insurance providers, we must first understand the industry’s evolution. Insurance, in its earliest forms, can be traced back to ancient civilizations such as Babylon and China, where early concepts of risk-sharing and protection were developed. These early practices laid the foundation for modern insurance, which emerged as a vital tool for managing financial risks in the 17th century.

The 20th century saw a rapid expansion of the insurance industry, with the introduction of new technologies and regulations. The post-World War II era brought about significant growth, as insurance became an essential component of economic stability and personal financial planning. Today, the industry continues to innovate, adapting to changing market dynamics and customer expectations.

Key Considerations for Choosing an Insurance Company

When evaluating insurance companies, several critical factors come into play. Financial strength and stability are paramount, as they ensure the company’s ability to fulfill its obligations and pay claims. Customer satisfaction is another vital aspect, as it reflects the insurer’s ability to provide efficient and responsive service. Additionally, the range and quality of products offered, as well as the company’s innovation in developing new solutions, are essential considerations.

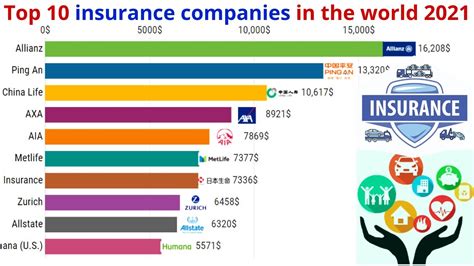

Top Insurance Companies for 2024: An In-Depth Analysis

As we navigate the insurance landscape, several companies stand out for their excellence and innovation. Let’s delve into the specifics of these top performers.

State Farm: A Trusted Leader

State Farm, a household name in the insurance industry, has consistently ranked among the top insurers for decades. With a focus on auto, home, and life insurance, State Farm offers a comprehensive range of products tailored to individual needs. Their strength lies in their extensive agent network, providing personalized service and expertise.

Key Features:

- A+ financial strength rating from AM Best

- Comprehensive coverage options for auto, home, and life insurance

- Personalized service through a network of local agents

- Innovative digital tools for policy management and claims tracking

Allstate: Empowering Customers

Allstate is renowned for its commitment to empowering customers and providing innovative solutions. Their Your Choice Auto program offers customizable coverage options, allowing customers to tailor their policies to their specific needs. Allstate also excels in digital innovation, providing easy-to-use mobile apps and online tools for policy management.

Key Features:

- A+ financial strength rating from AM Best

- Customizable auto insurance coverage with Your Choice Auto

- Comprehensive home and renters insurance options

- Award-winning digital tools for policy management and claims reporting

Progressive: Leading Innovation

Progressive Insurance is a pioneer in the industry, known for its innovative approach and cutting-edge technology. They offer a wide range of insurance products, including auto, home, and business insurance, with a focus on providing personalized quotes and coverage options.

Key Features:

- A+ financial strength rating from AM Best

- Personalized auto insurance quotes with Name Your Price®

- Comprehensive home insurance options, including discounts for safety features

- Innovative digital tools for policy comparison and management

Liberty Mutual: Focus on Customer Service

Liberty Mutual is dedicated to providing exceptional customer service and tailored insurance solutions. They offer a comprehensive range of products, including auto, home, life, and business insurance, with a focus on meeting the unique needs of their policyholders.

Key Features:

- A+ financial strength rating from AM Best

- Customized auto insurance coverage with RightTrack®

- Home insurance with flexible coverage options and discounts

- Excellent customer service and claims handling

USAA: Military and Veteran Focus

USAA is a unique insurance provider, catering specifically to military personnel, veterans, and their families. They offer a full suite of insurance products, including auto, home, and life insurance, with a strong focus on providing competitive rates and exceptional service to those who have served our country.

Key Features:

- A++ financial strength rating from AM Best

- Comprehensive auto insurance coverage with discounts for military personnel

- Home insurance tailored to military housing needs

- Highly rated customer service and claims handling

Industry Insights and Future Trends

The insurance industry is constantly evolving, driven by technological advancements and changing customer expectations. As we look ahead to 2024 and beyond, several key trends are shaping the future of insurance.

Digital Transformation

Insurance companies are increasingly embracing digital technologies to enhance the customer experience. From online policy management to innovative claims processing, digital transformation is revolutionizing the industry. Insurers are investing in AI, machine learning, and data analytics to streamline processes and provide more personalized services.

Personalized Coverage

The shift towards personalized insurance is gaining momentum. Insurers are developing innovative products and services that cater to individual needs and preferences. This includes customizable coverage options, usage-based insurance, and tailored risk assessment tools.

Sustainable Practices

Environmental sustainability is becoming a priority for many insurance companies. Insurers are adopting green initiatives, investing in renewable energy, and developing products that promote sustainable practices. This trend is not only beneficial for the environment but also aligns with the growing demand for eco-friendly solutions.

Enhanced Customer Engagement

Insurance companies are recognizing the importance of building strong relationships with their customers. They are investing in customer engagement strategies, such as personalized communication, educational resources, and loyalty programs. By fostering a sense of community and trust, insurers aim to provide a more holistic experience beyond traditional insurance products.

Conclusion: Navigating the Insurance Landscape

Choosing the right insurance company is a critical decision that requires careful consideration. By evaluating financial stability, customer satisfaction, product offerings, and innovation, individuals and businesses can make informed choices to protect their assets and secure their financial future. As the insurance industry continues to evolve, staying informed about the latest trends and top performers is essential for making the best insurance decisions.

How do I choose the right insurance company for my needs?

+When selecting an insurance company, consider your specific needs and priorities. Research the financial stability, customer satisfaction ratings, and product offerings of different insurers. Compare quotes and coverage options to find the best fit for your requirements.

What are the key benefits of choosing a top-rated insurance company?

+Top-rated insurance companies offer financial stability, ensuring they can meet their obligations. They also provide excellent customer service, innovative products, and a strong track record of claims handling. These factors contribute to a more secure and reliable insurance experience.

How do insurance companies stay competitive in a rapidly changing industry?

+Insurance companies adapt to changing market dynamics by embracing digital transformation, offering personalized coverage options, and focusing on customer engagement. They invest in technology, data analytics, and sustainable practices to stay ahead of the curve and meet evolving customer expectations.