Farmers Insurance Claim Status

For homeowners and vehicle owners, understanding the Farmers Insurance claim process is essential, especially when unexpected events like accidents or property damage occur. The Farmers Insurance claim status system provides policyholders with real-time updates, ensuring transparency and ease of access throughout the claims journey. This article aims to provide an in-depth analysis of the Farmers Insurance claim status process, offering insights into how policyholders can navigate and track their claims efficiently.

Understanding the Farmers Insurance Claim Status System

Farmers Insurance, a leading insurance provider, has implemented an innovative and user-friendly claim status system, enabling policyholders to stay informed about the progress of their claims. This system is designed to streamline the claims process, offering a convenient way to track the status of repairs, replacements, and reimbursements.

The claim status system is accessible through the Farmers Insurance website and their mobile app. Policyholders can log in to their accounts using their unique credentials, ensuring secure access to their claim information. This digital platform provides a centralized hub where individuals can monitor their claims, making it easier to manage and stay updated.

Key Features of the Farmers Insurance Claim Status System

- Real-Time Updates: Policyholders can expect frequent and timely updates on their claim status. From the moment a claim is filed, the system provides regular notifications, keeping individuals informed about the next steps and expected timelines.

- Detailed Information: The claim status platform offers a comprehensive overview of the claim. Policyholders can access information such as the date of the incident, the claim number, the type of claim (e.g., auto, home, or liability), and the current stage of the claims process.

- Document Upload and Management: A dedicated section allows policyholders to upload and manage important documents related to their claim. This includes photos, receipts, police reports, and any other relevant information, ensuring a well-organized digital record.

- Communication Portal: The system provides a direct line of communication between policyholders and their claims adjusters. Individuals can send messages, ask questions, and receive responses, fostering a collaborative and efficient claims process.

- Progress Tracking: A visual timeline or progress bar often accompanies the claim status, providing a clear illustration of the various stages of the process. This feature helps policyholders understand where their claim is in the overall journey, from initial filing to final resolution.

| Claim Status | Description |

|---|---|

| Pending | The claim has been submitted and is awaiting review by the insurance company. |

| In Progress | The claim is actively being processed, with investigations, assessments, or repairs underway. |

| Approved | The claim has been approved, and the policyholder can expect reimbursement or repairs to begin. |

| Paid | The claim has been fully processed, and the policyholder has received their reimbursement or repairs. |

| Closed | The claim process is complete, and no further action is required from the policyholder. |

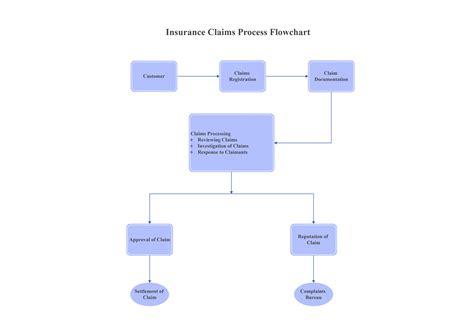

The Claims Process: From Filing to Resolution

Understanding the various stages of the Farmers Insurance claim process is crucial for policyholders to effectively navigate their claims. From the initial filing to the final resolution, each step plays a vital role in ensuring a smooth and successful claims journey.

Step 1: Filing a Claim

The first step in the process is filing a claim. Policyholders can initiate a claim through various channels, including the Farmers Insurance website, their mobile app, or by contacting their local agent. When filing a claim, individuals will need to provide specific details about the incident, such as the date, location, and nature of the damage or loss.

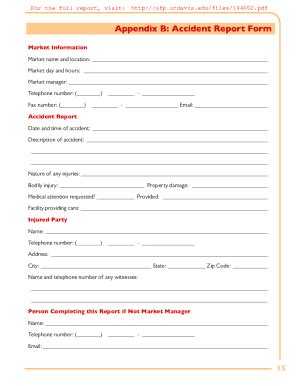

During this stage, it is essential to gather and organize all relevant documentation. This may include photographs of the damage, estimates for repairs, and any supporting evidence that can help substantiate the claim. Farmers Insurance provides clear guidelines on the documentation required for different types of claims, ensuring a comprehensive and efficient filing process.

Step 2: Initial Assessment

Once a claim is filed, Farmers Insurance conducts an initial assessment to understand the extent of the damage and the potential liability. This step often involves a thorough review of the policyholder’s coverage and the specific circumstances of the incident. Based on this assessment, the insurance company will determine the next steps, which may include further investigations or the initiation of the claims resolution process.

During the initial assessment, policyholders can expect to receive regular updates on the progress of their claim. The claim status system provides real-time notifications, keeping individuals informed about the status and any required actions on their part.

Step 3: Investigation and Adjustment

In cases where further investigation is necessary, Farmers Insurance deploys a team of experienced adjusters to assess the damage and determine the appropriate course of action. This stage may involve inspections, interviews, and the collection of additional evidence to ensure a fair and accurate resolution.

Policyholders are encouraged to actively participate in this process by providing any relevant information and cooperating with the adjusters. The claim status system keeps individuals informed about the investigation's progress, including any scheduled appointments or required follow-ups.

Step 4: Resolution and Reimbursement

Once the investigation is complete and the claim is approved, Farmers Insurance moves forward with the resolution process. This stage may involve various outcomes, depending on the nature of the claim.

For property damage claims, Farmers Insurance may authorize repairs or replacements, working closely with the policyholder to ensure a satisfactory outcome. In cases of total loss, the insurance company will provide reimbursement based on the policy's coverage and the assessed value of the damaged property.

For liability claims, Farmers Insurance will handle the settlement process, ensuring that the policyholder's interests are protected. This may involve negotiating with the affected party or their insurance company to reach a fair and timely resolution.

Step 5: Post-Resolution Support

Even after the claim is resolved, Farmers Insurance continues to provide support to policyholders. This includes assistance with any additional steps required, such as filing supplemental claims or providing further documentation. The claim status system remains active, allowing individuals to track any ongoing activities related to their claim.

Farmers Insurance also offers resources and guidance on preventing future incidents, helping policyholders enhance their safety and reduce the likelihood of future claims.

Tips for a Smooth Claims Experience

Navigating the Farmers Insurance claim process can be smoother and more efficient with a few key strategies. Here are some tips to ensure a positive claims experience:

- Understand Your Coverage: Familiarize yourself with your insurance policy and the specific coverages it provides. This knowledge will help you navigate the claims process with confidence and ensure you receive the benefits you are entitled to.

- Gather Evidence: Collect and organize all relevant evidence related to your claim, including photographs, videos, receipts, and witness statements. Having a well-documented case can expedite the claims process and provide a stronger basis for a successful resolution.

- Communicate Regularly: Maintain open and frequent communication with your claims adjuster. Provide prompt responses to their inquiries and be transparent about any relevant information. Regular communication ensures a collaborative approach and helps avoid delays.

- Utilize Digital Tools: Take advantage of the digital resources provided by Farmers Insurance, such as their mobile app and online claim status platform. These tools offer convenience, accessibility, and real-time updates, making it easier to track and manage your claim.

- Stay Organized: Keep all claim-related documents and communications organized in a dedicated folder or digital file. This ensures easy access to important information and helps you stay on top of any required actions or deadlines.

- Ask for Clarification: If you have any doubts or questions about the claims process or your specific claim, don't hesitate to reach out to your claims adjuster or Farmers Insurance customer support. They are there to provide guidance and ensure you understand the steps and expectations.

The Future of Claims: Digital Innovation and Customer Experience

The insurance industry is undergoing a digital transformation, and Farmers Insurance is at the forefront of this evolution. The claim status system and the overall claims process are evolving to meet the expectations of modern policyholders, who seek convenience, transparency, and efficiency.

Digital Enhancements

Farmers Insurance continues to invest in digital innovations to enhance the claims experience. This includes the development of advanced claim status platforms with interactive features, real-time claim tracking, and seamless integration with other digital tools and services.

The company is also exploring the use of artificial intelligence and machine learning to streamline claim assessments and provide more accurate and timely resolutions. These technologies can automate certain processes, reducing the time and effort required for policyholders to navigate the claims journey.

Customer-Centric Approach

Farmers Insurance recognizes the importance of a customer-centric approach in the claims process. The company is committed to delivering a personalized and tailored experience, ensuring that policyholders feel supported and understood throughout their claims journey.

This approach involves proactive communication, regular updates, and a focus on empathy and understanding. Farmers Insurance aims to provide a human touch in a digital landscape, ensuring that policyholders feel valued and respected during a potentially challenging time.

Future Implications

As Farmers Insurance continues to innovate and improve its claims process, the future looks promising for policyholders. The integration of digital technologies and a customer-centric mindset will likely lead to faster, more efficient, and more satisfying claims experiences.

Policyholders can expect further enhancements to the claim status system, including more intuitive interfaces, enhanced data security, and additional features that simplify the claims process. The company's focus on customer satisfaction and industry-leading practices will continue to set the standard for the insurance industry.

Conclusion

The Farmers Insurance claim status system and overall claims process offer a comprehensive and user-friendly experience for policyholders. By providing real-time updates, accessible digital tools, and a collaborative approach, Farmers Insurance ensures a smooth and efficient journey for individuals navigating the claims landscape.

As the insurance industry evolves, Farmers Insurance remains at the forefront, embracing digital innovation and a customer-centric mindset. With a focus on transparency, efficiency, and a commitment to delivering exceptional customer experiences, Farmers Insurance sets a high bar for the industry.

How do I check the status of my Farmers Insurance claim online?

+To check the status of your Farmers Insurance claim online, you can visit the Farmers Insurance website or use their mobile app. Log in to your account using your credentials, and you will be able to access your claim information. The claim status system provides real-time updates and a comprehensive overview of your claim’s progress.

What documents do I need to provide when filing a claim with Farmers Insurance?

+When filing a claim with Farmers Insurance, it is important to gather and provide relevant documentation. This may include photographs of the damage, estimates for repairs, police reports, and any other supporting evidence. Farmers Insurance will guide you on the specific documents required based on the nature of your claim.

How long does it typically take for Farmers Insurance to process a claim?

+The processing time for a Farmers Insurance claim can vary depending on the complexity of the claim and the specific circumstances. Simple claims with minimal damage and clear liability may be resolved within a few days to a week. More complex claims involving extensive damage or liability disputes may take several weeks or even months to resolve.

Can I track my claim’s progress if I don’t have access to the online platform?

+Yes, even if you don’t have access to the online platform, you can still track the progress of your Farmers Insurance claim. Contact your local Farmers Insurance agent or the customer support team, and they will provide updates on the status of your claim. They can also assist you in accessing the online platform if needed.

What should I do if I disagree with the outcome of my Farmers Insurance claim?

+If you disagree with the outcome of your Farmers Insurance claim, it is important to communicate your concerns promptly. Reach out to your claims adjuster or the customer support team, and explain the reasons for your disagreement. They will guide you through the appeals process and help resolve any discrepancies.