Toprated Life Insurance Policies

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their families. In an ever-changing world, having a robust life insurance policy can be a cornerstone of your financial plan, offering protection and stability during uncertain times. With numerous options available in the market, it is crucial to understand the top-rated life insurance policies and their features to make an informed decision.

Understanding the Top-Rated Life Insurance Policies

The life insurance industry is vast and diverse, offering a range of policies tailored to different needs and life stages. When evaluating the top-rated policies, several key factors come into play, including financial stability, policy features, customer satisfaction, and industry recognition. Let’s delve into the world of highly-rated life insurance policies and explore what makes them stand out.

Financial Strength and Stability

One of the primary considerations when choosing a life insurance provider is their financial strength and stability. After all, you want to ensure that the company you entrust with your policy will be able to honor its commitments, even in challenging economic times. Leading rating agencies, such as Standard & Poor’s, Moody’s, and A.M. Best, evaluate insurance companies based on their financial health, assigning ratings that indicate their ability to meet policyholder obligations.

When exploring top-rated life insurance policies, look for companies with strong financial ratings. A rating of “A” or higher, for instance, signifies a company’s excellent financial health and stability. This ensures that your policy investments are secure and that the company will be able to pay out benefits when needed.

Policy Features and Customization

Top-rated life insurance policies often stand out due to their comprehensive coverage and customizable options. These policies are designed to meet a wide range of needs, offering flexibility to adapt to your changing life circumstances.

One key feature to consider is term life insurance, which provides coverage for a specified period, such as 10, 20, or 30 years. Term life insurance is often more affordable and ideal for those seeking coverage during specific life stages, such as raising a family or paying off a mortgage.

On the other hand, permanent life insurance, including whole life and universal life policies, offers lifelong coverage and typically includes a cash value component that can grow over time. This type of policy provides a more comprehensive solution, offering both death benefit protection and the potential for cash value accumulation.

Additionally, many top-rated policies offer riders or optional add-ons that can enhance your coverage. These riders can include benefits such as:

- Waiver of Premium: This rider waives your premium payments if you become disabled, ensuring your coverage remains intact.

- Accelerated Death Benefit: Allows you to access a portion of your death benefit if you are diagnosed with a terminal illness.

- Child Rider: Provides coverage for your children, offering peace of mind for their future.

- Spouse Rider: Extends coverage to your spouse, ensuring comprehensive protection for your family.

Customer Satisfaction and Service

Beyond financial stability and policy features, top-rated life insurance policies are also known for their exceptional customer service and satisfaction. Leading providers understand the importance of building strong relationships with their policyholders and strive to offer a seamless experience from application to claim settlement.

When researching top-rated policies, look for companies with a strong track record of customer satisfaction. This can be assessed through online reviews, customer testimonials, and industry awards recognizing outstanding service. A provider that prioritizes customer needs and delivers a positive experience is often a reliable choice.

Industry Recognition and Awards

Top-rated life insurance policies often receive industry recognition and awards for their exceptional offerings. These accolades serve as a testament to the provider’s commitment to excellence and can provide valuable insights into the quality of their policies and services.

Look for companies that have been recognized by reputable industry organizations or have received awards for their life insurance products. For instance, awards such as the “Best Life Insurance Company” or “Excellence in Customer Service” can be strong indicators of a provider’s dedication to delivering top-notch products and experiences.

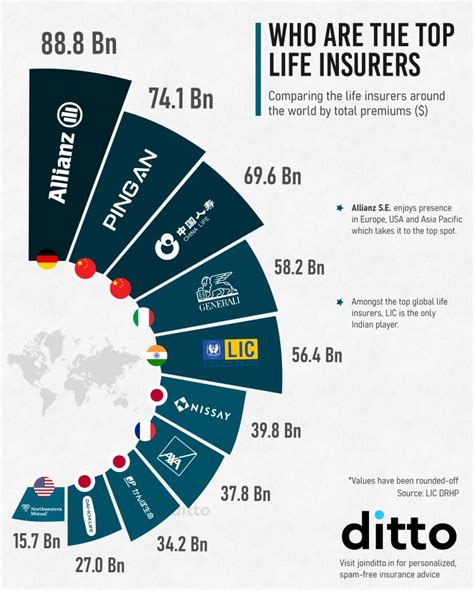

Comparative Analysis: Top-Rated Life Insurance Policies

To help you make an informed decision, let’s compare some of the top-rated life insurance policies available in the market. While this is not an exhaustive list, it provides a glimpse into the features and benefits offered by leading providers.

Policy A: Provider X - Comprehensive Coverage

Provider X, a well-established life insurance company, offers a comprehensive range of policies tailored to different needs. Their flagship policy, Policy A, is designed to provide extensive coverage and peace of mind.

Key features of Policy A include:

- Flexible Term Options: Policy A offers term lengths ranging from 10 to 30 years, allowing you to choose coverage that aligns with your life goals.

- Competitive Rates: Provider X is known for its affordable premiums, making life insurance accessible to a wide range of individuals.

- Accelerated Death Benefit Rider: This rider provides access to a portion of your death benefit if you are diagnosed with a terminal illness, offering financial support during challenging times.

- Spouse and Child Riders: Extend coverage to your spouse and children, ensuring comprehensive protection for your entire family.

Policy A has received numerous accolades, including the “Best Value Life Insurance Policy” award, recognizing its competitive pricing and comprehensive coverage.

Policy B: Provider Y - Customizable Solutions

Provider Y, a forward-thinking life insurance company, focuses on offering customizable solutions to meet individual needs. Policy B is their flagship offering, providing a high degree of flexibility and personalization.

Key features of Policy B include:

- Customizable Term Lengths: Policy B allows you to choose your term length, with options ranging from 5 to 40 years, ensuring coverage aligns with your unique circumstances.

- Waiver of Premium Rider: This rider waives your premium payments if you become disabled, ensuring your coverage remains active without additional financial burden.

- Guaranteed Issue Option: Provider Y offers a guaranteed issue option, which means you can secure coverage regardless of your health status, making it an inclusive choice.

- Accelerated Underwriting Program: For healthy individuals, Provider Y offers an accelerated underwriting program, providing coverage within days instead of weeks.

Policy B has been recognized for its innovative approach, receiving the “Most Innovative Life Insurance Product” award, highlighting its commitment to meeting diverse customer needs.

Policy C: Provider Z - Whole Life Protection

Provider Z, a leading provider of permanent life insurance, specializes in whole life policies that offer lifelong coverage and cash value accumulation. Policy C is their flagship whole life offering, providing comprehensive protection.

Key features of Policy C include:

- Lifetime Coverage: Policy C offers lifelong protection, ensuring your loved ones are provided for even as your financial needs evolve.

- Cash Value Accumulation: Over time, Policy C’s cash value component grows, providing a savings element to your life insurance policy.

- Flexible Premium Payments: Provider Z offers flexible payment options, allowing you to adjust your premium payments as your financial situation changes.

- Living Benefits: Policy C includes living benefits, such as the ability to access a portion of your cash value for long-term care expenses or other qualified needs.

Policy C has consistently received high ratings for its financial strength and has been recognized as a “Top-Rated Whole Life Insurance Provider”, reflecting its commitment to stability and comprehensive coverage.

Performance Analysis and Industry Trends

To further understand the landscape of top-rated life insurance policies, let’s analyze their performance and explore emerging industry trends.

Performance Analysis

Top-rated life insurance policies consistently demonstrate strong performance across various metrics. These policies excel in areas such as claim settlement, customer satisfaction, and policyholder retention. Leading providers prioritize efficient claim processing, ensuring timely payouts to beneficiaries when needed.

Furthermore, top-rated policies often boast high customer satisfaction rates, as evidenced by positive reviews and low complaint ratios. This reflects the providers’ commitment to delivering an exceptional experience throughout the policyholder journey.

Additionally, policyholder retention is a key indicator of a policy’s success. Top-rated policies tend to have higher retention rates, indicating that policyholders are satisfied with their coverage and continue to renew their policies year after year.

Emerging Industry Trends

The life insurance industry is continually evolving, with new trends shaping the landscape. Here are some key trends to watch out for when evaluating top-rated life insurance policies:

- Digital Transformation: Leading providers are embracing digital technologies to enhance the policyholder experience. From online applications to digital claim submissions, the industry is moving towards a more streamlined and efficient process.

- Wellness Programs: Some top-rated policies now offer wellness incentives, rewarding policyholders for maintaining healthy lifestyles. These programs can include discounts on premiums or additional benefits for those who meet certain wellness criteria.

- Customizable Coverage: The trend towards customizable coverage continues to gain momentum. Top-rated policies are offering more flexible options, allowing policyholders to tailor their coverage to their unique needs and life stages.

- Enhanced Underwriting: Advances in technology and data analytics are improving the underwriting process. Top-rated providers are utilizing these advancements to provide faster approvals and more accurate risk assessments, benefiting both applicants and the companies.

Future Implications and Expert Insights

As the life insurance industry continues to evolve, it’s essential to consider the future implications and expert insights that can shape your decision-making process.

Future Implications

The future of life insurance looks promising, with ongoing advancements and innovations set to enhance the industry. Here are some key future implications to consider:

- Increased Personalization: Life insurance policies are expected to become even more personalized, with providers offering tailored solutions based on individual needs and preferences. This could include customized coverage options, premium adjustments, and benefits tailored to specific life stages.

- Expanded Use of Technology: Technology will continue to play a pivotal role in the life insurance industry. Expect to see further integration of digital tools, from streamlined application processes to enhanced claim management systems, making the entire experience more efficient and convenient.

- Focus on Health and Wellness: The industry is likely to place increasing emphasis on health and wellness initiatives. This may involve incentivizing policyholders to maintain healthy lifestyles through rewards programs or offering additional benefits for those who prioritize their well-being.

- Improved Customer Engagement: Top-rated providers will focus on building stronger relationships with policyholders through enhanced customer engagement strategies. This could include personalized communication, educational resources, and proactive support to ensure policyholders are well-informed and satisfied.

Expert Insights

As an expert in the life insurance industry, here are some key insights to consider when evaluating top-rated policies:

- Financial Stability is Paramount: When choosing a life insurance provider, prioritize companies with strong financial ratings. A financially stable company ensures that your policy investments are secure and that the company can honor its commitments, even in challenging economic conditions.

- Customize Your Coverage: Life insurance policies should be tailored to your unique needs. Whether you require term coverage for a specific period or permanent coverage with cash value accumulation, select a policy that aligns with your financial goals and life circumstances.

- Explore Optional Riders: Optional riders can enhance your coverage and provide additional benefits. Consider adding riders such as the Waiver of Premium, Accelerated Death Benefit, or Child and Spouse Riders to further protect your loved ones and provide financial support during difficult times.

- Customer Service Matters: Don’t underestimate the importance of customer service. Choose a provider known for its exceptional service and positive customer experiences. A provider that prioritizes your needs and provides timely support can make a significant difference in your overall satisfaction.

FAQ

What are the key factors to consider when choosing a life insurance policy?

+When selecting a life insurance policy, key factors include financial stability of the provider, policy features and customization options, customer satisfaction, and industry recognition. Look for companies with strong financial ratings, comprehensive coverage, and a track record of delivering exceptional service.

How do I know if a life insurance provider is financially stable?

+Leading rating agencies, such as Standard & Poor’s, Moody’s, and A.M. Best, evaluate insurance companies’ financial health. Aim for providers with ratings of “A” or higher, indicating excellent financial stability and the ability to meet policyholder obligations.

What are some common riders available with life insurance policies?

+Common riders include Waiver of Premium (waiving premiums if disabled), Accelerated Death Benefit (accessing a portion of the death benefit for terminal illness), Child Rider (coverage for children), and Spouse Rider (extending coverage to your spouse). These riders enhance your coverage and provide additional benefits.

How can I compare different life insurance policies effectively?

+To compare life insurance policies effectively, consider factors such as term lengths, premium costs, available riders, and customer reviews. Analyze financial stability ratings and industry awards to ensure you choose a reputable provider. Compare policies side-by-side to identify the best fit for your needs.