California Auto Insurance Co

California Auto Insurance Co. is a well-established insurance provider in the state of California, offering a comprehensive range of auto insurance policies tailored to meet the diverse needs of drivers across the region. With a rich history spanning over five decades, the company has built a solid reputation for its customer-centric approach and commitment to delivering quality coverage at competitive rates. In this comprehensive article, we delve into the various aspects of California Auto Insurance Co., exploring its offerings, customer satisfaction, and the key factors that have contributed to its success in the competitive insurance market.

A Legacy of Trust and Service Excellence

California Auto Insurance Co. traces its roots back to the early 1970s, when it was founded with a vision to revolutionize the auto insurance industry by putting the interests of policyholders first. Over the years, the company has grown exponentially, expanding its network of branches and developing innovative insurance products to cater to the evolving needs of Californian drivers. Today, it stands as a leading provider, known for its exceptional service, personalized approach, and a wide array of coverage options.

One of the company's core strengths lies in its ability to adapt and innovate. As the insurance landscape evolved, California Auto Insurance Co. stayed ahead of the curve by continuously updating its policies and introducing new features. This commitment to staying current has allowed the company to provide its customers with the most relevant and beneficial coverage options, ensuring they are protected against the unique risks associated with modern driving conditions.

Comprehensive Auto Insurance Solutions

California Auto Insurance Co. offers a comprehensive suite of auto insurance policies designed to provide drivers with the protection they need, whether they are navigating the busy streets of Los Angeles or cruising along the scenic Pacific Coast Highway. Here’s an overview of the key coverage options available:

Liability Coverage

Liability insurance is a fundamental component of any auto insurance policy. California Auto Insurance Co. offers both bodily injury and property damage liability coverage, ensuring policyholders are financially protected in the event they cause an accident resulting in injuries or property damage to others.

| Bodily Injury Liability | Property Damage Liability |

|---|---|

| Covers medical expenses and lost wages for injured parties. | Repairs or replaces damaged property caused by the policyholder. |

Collision and Comprehensive Coverage

To protect against damages to the policyholder’s own vehicle, California Auto Insurance Co. provides collision and comprehensive coverage. Collision coverage pays for repairs or replacements when the insured vehicle is involved in an accident, while comprehensive coverage covers non-accident-related damages such as theft, vandalism, or natural disasters.

| Collision Coverage | Comprehensive Coverage |

|---|---|

| Repairs or replaces the insured vehicle after an accident. | Covers damages not caused by accidents, including theft and natural disasters. |

Uninsured/Underinsured Motorist Coverage

In the event of an accident with an uninsured or underinsured driver, California Auto Insurance Co.’s uninsured/underinsured motorist coverage steps in to provide financial protection to its policyholders. This coverage helps cover medical expenses and property damage costs, ensuring the insured is not left financially burdened by the actions of an irresponsible driver.

Personal Injury Protection (PIP)

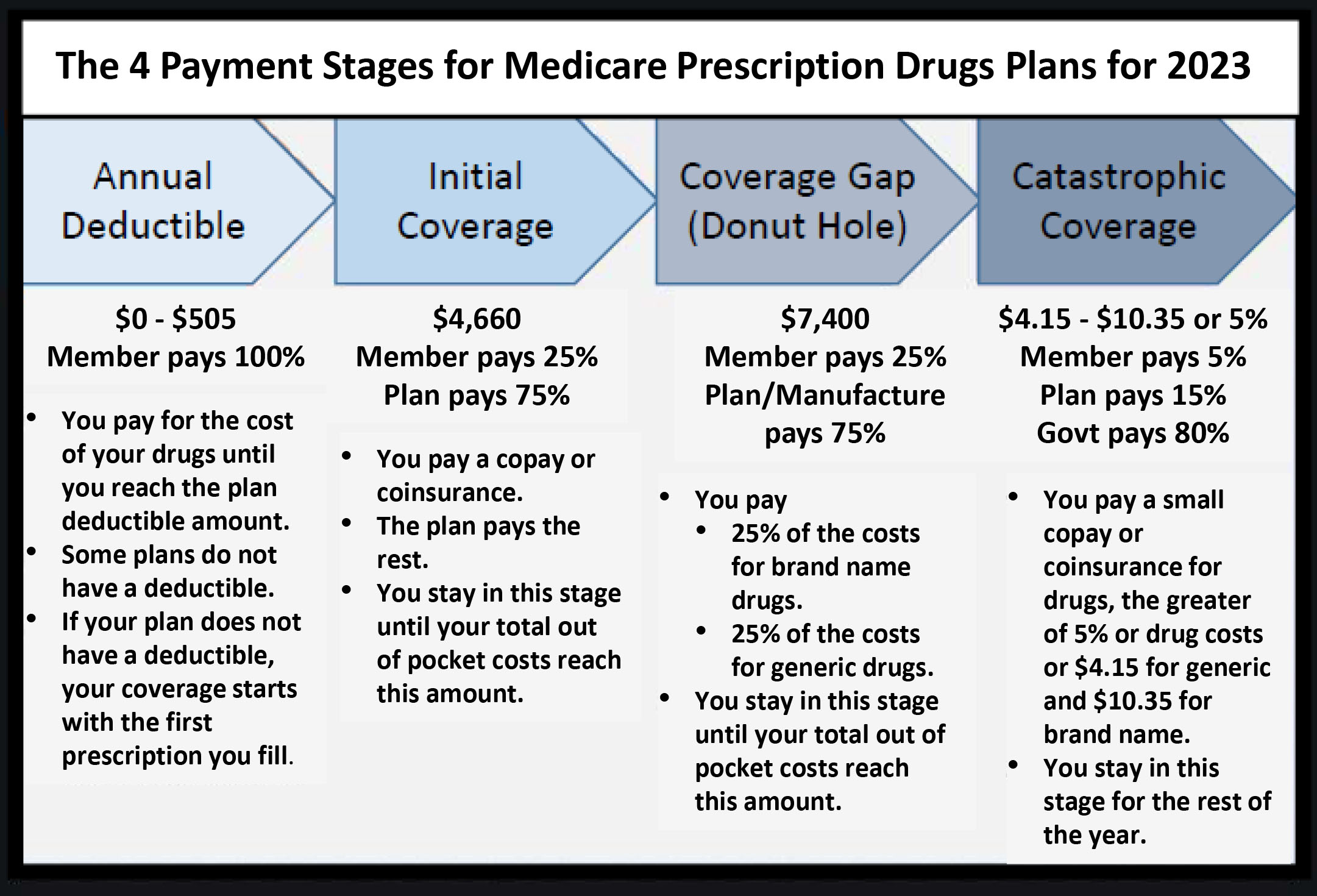

Personal Injury Protection, or PIP, is a crucial component of auto insurance policies, especially in states with no-fault insurance laws. California Auto Insurance Co. offers PIP coverage, which provides medical and rehabilitation benefits to policyholders injured in an accident, regardless of fault. This coverage ensures prompt access to necessary medical care and helps policyholders manage their recovery expenses.

Additional Coverage Options

California Auto Insurance Co. understands that every driver has unique needs, which is why it offers a range of additional coverage options to customize policies. These include:

- Rental car reimbursement: Covers the cost of renting a vehicle while the insured's car is being repaired.

- Roadside assistance: Provides emergency services such as towing, flat tire repair, and battery jump-starts.

- Gap coverage: Helps cover the difference between the insured vehicle's actual cash value and the remaining loan or lease balance in the event of a total loss.

- Custom parts and equipment coverage: Protects custom modifications and upgrades made to the insured vehicle.

Customer Satisfaction and Industry Recognition

California Auto Insurance Co.’s commitment to delivering exceptional service and competitive coverage has earned it widespread recognition and acclaim within the industry. Here are some key highlights:

- The company consistently maintains an A+ rating from the Better Business Bureau (BBB), reflecting its commitment to customer satisfaction and ethical business practices.

- It has been named one of the "Best Places to Work" by industry publications, recognizing its employee-centric culture and supportive work environment.

- California Auto Insurance Co. has received numerous awards for its innovative products and outstanding customer service, including the "Customer Service Excellence Award" and the "Insurance Innovation Award."

- The company's focus on digital transformation has resulted in a seamless online experience, allowing customers to manage their policies, file claims, and access support resources conveniently through its user-friendly website and mobile app.

Tailored Policies for Diverse Needs

One of California Auto Insurance Co.’s key strengths is its ability to cater to the diverse needs of its customer base. Whether you’re a young driver just starting out, a seasoned professional, or a family seeking comprehensive protection, the company offers tailored policies to suit your specific requirements. Here’s a closer look at how it accommodates different demographics:

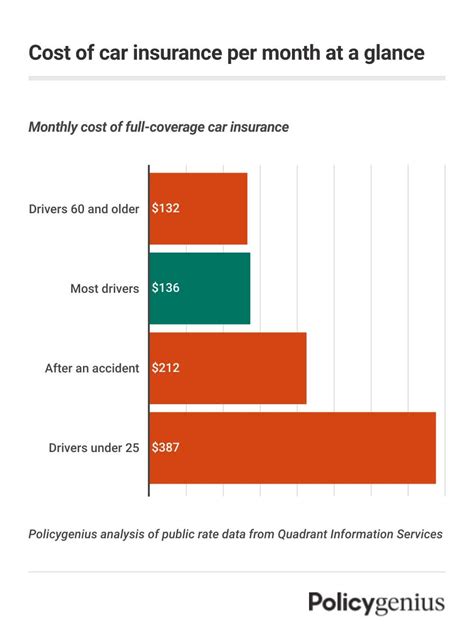

Young Drivers

California Auto Insurance Co. understands the unique challenges faced by young drivers, such as higher insurance premiums due to their lack of driving experience. To address this, the company offers specialized policies designed to help young drivers build a solid insurance foundation. These policies often include discounts for good grades, driver training courses, and safe driving incentives.

Professionals and Business Owners

For professionals and business owners, California Auto Insurance Co. provides comprehensive coverage options that go beyond standard auto insurance. These policies can include coverage for business-related activities, such as transporting equipment or making business-related trips. The company also offers tailored endorsements and higher liability limits to accommodate the unique risks associated with professional driving.

Families

Families have distinct insurance needs, often requiring coverage for multiple vehicles and additional liability protection. California Auto Insurance Co. recognizes this and offers family-friendly policies with multi-car discounts and comprehensive coverage options. These policies can include features such as accident forgiveness, which helps protect the family’s insurance record and keeps premiums stable even after an at-fault accident.

Digital Innovation and Convenience

In today’s fast-paced world, convenience and accessibility are key considerations for insurance consumers. California Auto Insurance Co. has embraced digital innovation to provide its customers with a seamless and efficient experience. Here’s how the company leverages technology to enhance its services:

Online Policy Management

Policyholders can access their accounts online through the company’s secure website, allowing them to view policy details, make payments, and update their coverage preferences anytime, anywhere. This level of convenience ensures customers can stay on top of their insurance needs without the hassle of physical paperwork or long phone calls.

Mobile App

California Auto Insurance Co.’s mobile app takes convenience to the next level. Available on both iOS and Android platforms, the app provides customers with instant access to their policy information, allows them to file claims directly from their smartphones, and offers a range of additional features such as digital ID cards and emergency roadside assistance.

Digital Claims Process

In the event of an accident, policyholders can initiate the claims process online or through the mobile app. The company’s streamlined digital claims system allows for quick and efficient claim submissions, with real-time updates and notifications keeping policyholders informed throughout the process. This digital approach not only saves time but also reduces the administrative burden associated with traditional paper-based claims.

Community Involvement and Social Responsibility

Beyond its commitment to providing quality insurance coverage, California Auto Insurance Co. actively engages in community initiatives and social responsibility programs. The company believes in giving back to the communities it serves, fostering a culture of support and empowerment.

One of its notable initiatives is the "Drive Safe, Stay Safe" program, which aims to promote road safety and reduce accidents. The program includes educational workshops, community outreach events, and partnerships with local law enforcement agencies to raise awareness about safe driving practices and the importance of responsible vehicle maintenance.

California Auto Insurance Co. also supports various charitable causes, focusing on education, healthcare, and environmental sustainability. The company regularly sponsors local events and organizations, demonstrating its commitment to making a positive impact in the communities where its customers live and work.

Conclusion: A Trusted Partner for Californian Drivers

California Auto Insurance Co. has established itself as a trusted partner for drivers across the Golden State. With its rich history, commitment to innovation, and focus on customer satisfaction, the company has built a strong reputation as a leading provider of comprehensive auto insurance solutions. By offering tailored policies, embracing digital convenience, and engaging in community initiatives, California Auto Insurance Co. continues to set the standard for excellence in the insurance industry.

How can I get a quote from California Auto Insurance Co.?

+To get a quote from California Auto Insurance Co., you can visit their official website and use the online quoting tool. Alternatively, you can call their customer service hotline or visit one of their local branches to speak with an agent and obtain a personalized quote based on your specific needs.

What discounts are available with California Auto Insurance Co. policies?

+California Auto Insurance Co. offers a range of discounts to its policyholders, including multi-policy discounts, good student discounts, safe driver discounts, and loyalty discounts. The specific discounts available may vary based on your location and other factors, so it’s best to inquire with an agent or check their website for more details.

Does California Auto Insurance Co. provide rental car coverage?

+Yes, California Auto Insurance Co. offers rental car reimbursement coverage as an optional add-on to their standard policies. This coverage helps cover the cost of renting a vehicle while your insured car is being repaired due to a covered loss.

How does California Auto Insurance Co. handle claims?

+California Auto Insurance Co. has a dedicated claims team that works efficiently to process and resolve claims promptly. Policyholders can initiate claims online, through the mobile app, or by calling the 24⁄7 claims hotline. The company aims to provide timely updates and assistance throughout the claims process, ensuring a smooth and stress-free experience.

What makes California Auto Insurance Co. stand out from other providers?

+California Auto Insurance Co. stands out for its customer-centric approach, innovative products, and commitment to community involvement. The company’s focus on providing personalized coverage, digital convenience, and exceptional service sets it apart, ensuring that policyholders receive the protection and support they need throughout their insurance journey.