Health Insurance Market Place

Welcome to the comprehensive guide to understanding and navigating the complex world of the Health Insurance Marketplace. In today's ever-evolving healthcare landscape, making informed decisions about health insurance is crucial. This article aims to demystify the Health Insurance Marketplace, offering an in-depth analysis and practical insights to help individuals and families secure the coverage they need.

The Health Insurance Marketplace: A Brief Overview

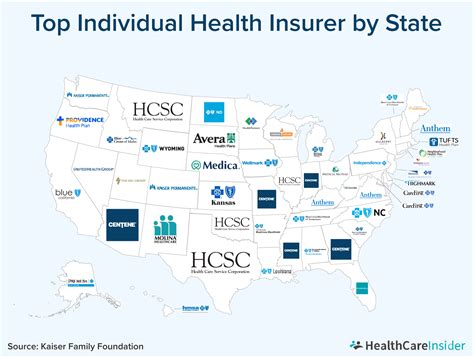

The Health Insurance Marketplace, often referred to as the Health Insurance Exchange, is a crucial platform established as part of the Affordable Care Act (ACA) in the United States. It serves as a one-stop shop for individuals and small businesses to compare and purchase health insurance plans. The Marketplace plays a vital role in ensuring that Americans have access to affordable, quality healthcare coverage, particularly those who may not have access to employer-sponsored plans.

Since its inception, the Health Insurance Marketplace has provided a transparent and competitive environment for insurance providers to offer their plans. It has revolutionized the way Americans shop for health insurance, empowering individuals with the tools and information needed to make informed choices.

Key Features of the Health Insurance Marketplace

The Health Insurance Marketplace offers a range of features designed to simplify the insurance-shopping experience and ensure equitable access to coverage. These features include:

- Plan Comparison Tools: Users can easily compare various health insurance plans based on factors like cost, coverage, and provider networks. This feature ensures that individuals can find a plan that best suits their healthcare needs and budget.

- Income-Based Premium Subsidies: One of the key advantages of the Marketplace is the availability of premium tax credits for eligible individuals and families. These subsidies reduce the cost of monthly premiums, making health insurance more affordable.

- Open Enrollment Period: The Marketplace operates on a set schedule with an annual Open Enrollment Period. During this time, individuals can enroll in a new plan or make changes to their existing coverage. It's important to note that outside of this period, changes can only be made under specific qualifying life events.

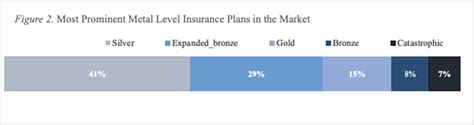

- Metallic Plan Categories: Health insurance plans on the Marketplace are categorized into four metallic tiers: Bronze, Silver, Gold, and Platinum. Each tier represents a different level of cost-sharing between the insurer and the policyholder. Bronze plans typically have lower premiums but higher out-of-pocket costs, while Platinum plans offer the opposite.

- Essential Health Benefits: All plans offered on the Health Insurance Marketplace must cover a set of essential health benefits, including hospitalization, prescription drugs, and mental health services. This ensures that individuals receive comprehensive coverage, regardless of their chosen plan.

Navigating the Health Insurance Marketplace

Understanding how to navigate the Health Insurance Marketplace is essential for anyone seeking to enroll in a health insurance plan. Here’s a step-by-step guide to help you through the process:

Step 1: Determine Your Eligibility

The first step is to assess your eligibility for the Health Insurance Marketplace. Generally, individuals who are not covered by an employer-sponsored plan, Medicaid, or Medicare are eligible to shop for plans on the Marketplace. However, it’s important to note that specific eligibility criteria may vary by state.

Step 2: Explore Plan Options

Once you’ve determined your eligibility, it’s time to explore the available plan options. The Marketplace provides a user-friendly interface where you can compare plans based on your specific needs and preferences. Consider factors such as:

- Premium Costs: Review the monthly premiums for each plan. Keep in mind that lower premiums may result in higher out-of-pocket costs when utilizing healthcare services.

- Deductibles and Copays: Understand the deductible amounts and copay structures for each plan. This will help you estimate your potential out-of-pocket expenses.

- Provider Networks: Ensure that your preferred healthcare providers are in-network for the plan you're considering. Out-of-network care can result in higher costs.

- Coverage Limits: Review the plan's coverage limits for essential health benefits, prescription drugs, and specialized services to ensure they align with your healthcare needs.

Step 3: Apply for Premium Subsidies (if eligible)

If your income falls within the specified range, you may be eligible for premium tax credits to reduce the cost of your health insurance premiums. The Marketplace will guide you through the application process, and these subsidies can significantly lower your monthly costs.

Step 4: Enroll in Your Chosen Plan

Once you’ve selected the plan that best meets your needs, it’s time to enroll. The enrollment process typically involves providing personal and household information, selecting a coverage start date, and making your first premium payment. It’s important to ensure that all information is accurate to avoid any delays or issues with your coverage.

Understanding Health Insurance Plans

The Health Insurance Marketplace offers a range of plan options, each designed to cater to different healthcare needs and budgets. Here’s a closer look at the metallic plan categories and what they entail:

| Plan Category | Description |

|---|---|

| Bronze | Bronze plans typically have the lowest monthly premiums but higher deductibles and out-of-pocket costs. They are suitable for individuals who prioritize lower monthly expenses and anticipate minimal healthcare utilization. |

| Silver | Silver plans offer a balance between premiums and out-of-pocket costs. They are often chosen by individuals who anticipate moderate healthcare utilization and want a plan that covers a significant portion of their costs. |

| Gold | Gold plans provide more generous coverage with higher premiums and lower out-of-pocket costs. They are ideal for individuals who require frequent healthcare services or have ongoing medical conditions. |

| Platinum | Platinum plans offer the most comprehensive coverage with the highest premiums and lowest out-of-pocket expenses. These plans are designed for individuals who require extensive medical care and want minimal financial burden when accessing healthcare services. |

Note: The specific details and availability of plans may vary depending on your state and the insurance providers offering coverage in your area.

Special Enrollment Periods

In addition to the annual Open Enrollment Period, the Health Insurance Marketplace offers Special Enrollment Periods (SEPs) for individuals who experience qualifying life events. These events may include losing employer-sponsored coverage, getting married, having a baby, or moving to a new state. SEPs allow individuals to enroll in a health insurance plan outside of the standard Open Enrollment Period, ensuring that coverage needs are met during significant life changes.

The Future of the Health Insurance Marketplace

The Health Insurance Marketplace continues to evolve, with ongoing efforts to improve accessibility and affordability. Here are some key developments and future implications to consider:

- Expanded Access: Efforts are being made to reach and enroll more individuals in the Marketplace, particularly those who may be unaware of their eligibility or face barriers to enrollment. This includes targeted outreach programs and simplified enrollment processes.

- Enhanced Consumer Protection: The ACA and the Marketplace have implemented various consumer protections, such as prohibiting insurers from denying coverage based on pre-existing conditions and limiting cost-sharing for essential health benefits. These protections are expected to remain in place, ensuring that individuals have access to necessary healthcare services.

- Innovative Plan Designs: Insurance providers are continuously developing new plan designs and features to meet the diverse needs of consumers. This includes the introduction of telehealth services, flexible coverage options, and tailored plans for specific populations, such as those with chronic conditions.

- Data-Driven Improvements: The Marketplace collects and analyzes data to identify areas for improvement and enhance the overall user experience. This data-driven approach ensures that the Marketplace remains efficient, transparent, and responsive to the needs of its users.

FAQ

How often does the Open Enrollment Period occur, and when is it for the current year?

+The Open Enrollment Period typically occurs once a year, allowing individuals to enroll in or make changes to their health insurance plans. For the current year, the Open Enrollment Period is scheduled from November 1, 2023, to January 15, 2024. It’s important to note that this period may vary slightly by state, so it’s advisable to check the official Health Insurance Marketplace website for accurate and up-to-date information.

Are there any income requirements to qualify for premium subsidies on the Health Insurance Marketplace?

+Yes, income requirements play a crucial role in determining eligibility for premium subsidies on the Health Insurance Marketplace. Generally, individuals and families with household incomes between 100% and 400% of the federal poverty level may qualify for these subsidies. The exact income thresholds may vary by state, so it’s recommended to use the Marketplace’s eligibility calculator or consult with a healthcare navigator to determine your specific eligibility.

Can I enroll in a health insurance plan outside of the Open Enrollment Period?

+While the Open Enrollment Period is the standard time to enroll in a health insurance plan, there are exceptions. The Health Insurance Marketplace offers Special Enrollment Periods (SEPs) for individuals who experience qualifying life events, such as losing their job, getting married, or having a baby. These SEPs allow for enrollment outside of the Open Enrollment Period, ensuring coverage during significant life changes. It’s important to note that the qualifying event must be reported within a certain timeframe to be eligible for an SEP.