Broker Insurance

In the dynamic world of business and finance, understanding the intricacies of insurance brokerage is paramount. This comprehensive guide aims to delve into the world of broker insurance, shedding light on its critical role, the processes involved, and its impact on risk management strategies.

Broker insurance is a specialized service that provides businesses and individuals with tailored insurance solutions. It involves an intricate process of assessment, recommendation, and management of insurance policies to mitigate potential risks. As we navigate the complexities of modern business landscapes, the role of broker insurance becomes increasingly crucial.

Understanding the Role of Insurance Brokers

Insurance brokers serve as trusted intermediaries between clients and insurance companies. They possess extensive knowledge of the insurance market, offering personalized advice and tailored solutions to meet their clients' unique needs. Here's a deeper look into their vital functions:

Risk Assessment and Analysis

Brokers conduct thorough risk assessments to identify potential hazards and vulnerabilities specific to their clients’ operations. This involves analyzing various factors such as industry trends, location, assets, and legal obligations. By understanding these risks, brokers can recommend appropriate insurance coverage.

Policy Recommendation and Selection

Based on the risk assessment, brokers propose a range of insurance policies tailored to the client’s needs. They consider factors like coverage limits, deductibles, and premium costs to ensure an optimal balance between protection and affordability. Brokers often have access to multiple insurance carriers, allowing them to shop around for the best options.

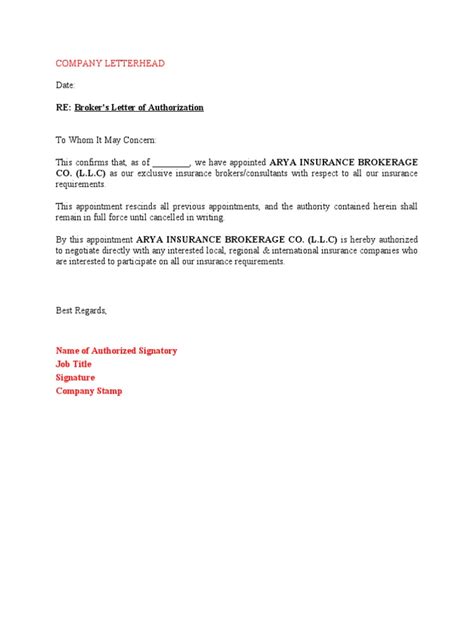

Negotiation and Advocacy

Insurance brokers act as advocates for their clients during the negotiation process. They negotiate with insurance companies to secure the best terms, often leveraging their industry relationships and expertise. This advocacy ensures that clients receive fair and favorable policies.

Policy Management and Support

Broker insurance extends beyond policy procurement. Brokers provide ongoing support, including policy reviews, updates, and renewals. They ensure that the insurance coverage remains relevant and aligned with the client’s changing needs. Additionally, brokers assist with claims management, guiding clients through the process and advocating for fair settlements.

The Benefits of Broker Insurance

Engaging the services of an insurance broker offers a multitude of advantages. Here's a glimpse into the key benefits:

Tailored Solutions

Brokers understand that every business is unique. They tailor insurance policies to address specific risks, ensuring comprehensive coverage without unnecessary expenses. This customization ensures a precise fit for the client’s needs.

Expertise and Knowledge

Insurance brokers are industry experts, possessing extensive knowledge of insurance products and regulations. They stay updated on market trends, allowing them to offer the latest and most relevant solutions. This expertise ensures clients receive accurate and up-to-date advice.

Time and Cost Savings

The process of researching and securing insurance policies can be time-consuming and complex. Brokers streamline this process, saving clients valuable time and effort. Additionally, brokers negotiate on behalf of their clients, often securing better rates and terms, resulting in cost savings.

Claims Assistance

When a claim arises, brokers provide invaluable support. They guide clients through the claims process, ensuring all necessary steps are taken. Brokers advocate for their clients, helping to expedite claims and secure fair settlements. This assistance can be critical during challenging times.

Case Study: A Broker’s Impact on Risk Management

To illustrate the practical application of broker insurance, let's explore a case study. Imagine a small business owner, Ms. Johnson, who operates a retail store in a high-risk area. Without insurance expertise, she might underestimate the potential risks and choose inadequate coverage.

However, with the guidance of an insurance broker, Ms. Johnson undergoes a comprehensive risk assessment. The broker identifies vulnerabilities, such as the risk of theft and damage to her inventory. They recommend a tailored insurance policy that covers these specific risks, providing peace of mind and financial protection.

| Risk Category | Recommended Coverage |

|---|---|

| Theft | Property Insurance with enhanced theft coverage |

| Damage to Inventory | Business Interruption Insurance |

The broker's expertise ensures Ms. Johnson's business is adequately protected. In the event of a theft or damage incident, the tailored insurance policy covers the costs, allowing her business to recover quickly and continue operations without financial strain.

The Future of Broker Insurance

As the business landscape evolves, so does the role of insurance brokers. Here's a glimpse into the future implications and potential innovations:

Digital Transformation

The insurance industry is embracing digital technologies, and brokers are adapting to this shift. Online platforms and digital tools enhance the efficiency of risk assessment and policy management. Brokers can now offer real-time insights and seamless client interactions, further streamlining the insurance process.

Specialized Services

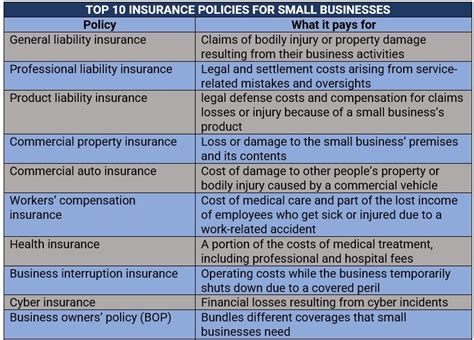

With an increasing demand for specialized insurance coverage, brokers are diversifying their services. From cybersecurity insurance to environmental liability coverage, brokers are expanding their expertise to meet the unique needs of various industries. This specialization ensures clients receive the most relevant and comprehensive solutions.

Data-Driven Insights

The utilization of advanced analytics and data science is transforming risk assessment. Brokers can now leverage big data and predictive modeling to identify emerging risks and tailor insurance solutions accordingly. This data-driven approach enhances the accuracy and effectiveness of risk management strategies.

Conclusion

In a world filled with uncertainties, broker insurance serves as a vital tool for businesses and individuals to navigate the complexities of risk management. By understanding the role and benefits of insurance brokers, individuals can make informed decisions to protect their assets and future. As the insurance industry evolves, brokers remain at the forefront, ensuring clients are equipped with the best possible protection.

How do insurance brokers determine the right coverage for their clients?

+Insurance brokers employ a comprehensive risk assessment process. They analyze various factors such as the client’s industry, location, assets, and legal obligations. Based on this assessment, they recommend tailored insurance policies that address specific risks while considering factors like coverage limits and deductibles.

What are the key benefits of using an insurance broker?

+Key benefits include tailored insurance solutions, expert knowledge and guidance, time and cost savings, and invaluable claims assistance. Brokers ensure clients receive the right coverage, negotiate favorable terms, and provide ongoing support throughout the policy lifecycle.

How do brokers stay updated on market trends and regulations?

+Insurance brokers invest in continuous education and professional development. They attend industry conferences, engage in networking, and utilize digital resources to stay informed about market trends, product innovations, and regulatory changes. This ensures they provide the most up-to-date advice to their clients.