Small Business Insurance Policy

For small business owners, one of the most crucial yet often overlooked aspects of running a successful enterprise is securing the right insurance coverage. A comprehensive insurance policy can protect your business from financial ruin in the event of unforeseen circumstances, ranging from property damage to liability claims. In this in-depth guide, we will explore the world of small business insurance, helping you understand the nuances, benefits, and considerations to make an informed decision.

Understanding the Need for Small Business Insurance

The business landscape is inherently uncertain, and even the most meticulously planned ventures can face unforeseen challenges. Whether it’s a natural disaster, a customer injury on your premises, or a lawsuit arising from your operations, the potential risks are diverse and can have a significant impact on your business’s stability and growth.

Consider the case of Acme Widgets, a small manufacturing business. Despite their meticulous safety protocols, an unforeseen electrical fire damaged their warehouse, resulting in significant property loss and business interruption. Without adequate insurance, Acme Widgets might have struggled to recover, potentially facing bankruptcy. This scenario underscores the critical role of insurance in safeguarding small businesses.

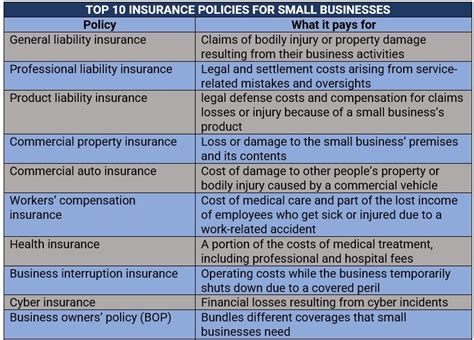

Types of Small Business Insurance Policies

The insurance landscape for small businesses is diverse, offering a range of policies tailored to different needs and industries. Here’s an overview of some of the most common types of small business insurance:

General Liability Insurance

This is often considered the foundation of any small business insurance portfolio. General liability insurance protects your business from a variety of claims, including bodily injury, property damage, and personal and advertising injury. For instance, if a customer slips and falls on your premises, this insurance would cover the resulting medical bills and legal fees.

Professional Liability Insurance (Errors & Omissions)

Also known as E&O insurance, this policy is essential for businesses providing professional services. It covers claims of negligence, errors, or omissions in the services provided. For instance, a software development firm might need E&O insurance to protect against claims of software malfunctions causing financial losses for their clients.

Product Liability Insurance

If your business manufactures, distributes, or sells products, product liability insurance is crucial. It protects you from claims arising from defective products, such as bodily injury or property damage caused by your products.

Business Owners Policy (BOP)

A BOP is a bundle of insurance policies tailored for small businesses. It typically includes property insurance, liability insurance, and business interruption insurance, offering a cost-effective solution for businesses with relatively simple insurance needs.

Workers’ Compensation Insurance

Workers’ comp insurance is mandated by law in most states and covers medical expenses and a portion of lost wages for employees injured on the job. It also protects your business from related lawsuits, ensuring your employees’ well-being and your business’s financial stability.

Factors to Consider When Choosing Insurance

Selecting the right insurance policy involves careful consideration of various factors, including your business’s specific needs, industry risks, and financial capacity. Here are some key aspects to keep in mind:

Risk Assessment

Every business is unique, and so are its risks. Conduct a thorough risk assessment to identify the potential hazards your business faces. This could include everything from natural disasters to cyber threats and employee injuries. Understanding these risks will help you choose the right insurance coverage.

Industry-Specific Needs

Different industries come with their own set of risks and insurance requirements. For instance, a construction company will require different coverage compared to a tech startup or a retail store. Tailor your insurance policy to your industry’s specific needs to ensure adequate protection.

Policy Limits and Deductibles

Insurance policies come with limits, which define the maximum amount the insurer will pay for a covered claim. Choose policy limits that reflect the potential risks and losses your business could face. Additionally, consider the deductibles, which are the amount you pay out of pocket before the insurance kicks in. Higher deductibles can lower your premium, but ensure you can afford the deductible in the event of a claim.

Comparative Analysis

Don’t settle for the first insurance policy that comes your way. Compare quotes and policies from multiple insurers to ensure you’re getting the best coverage at the most competitive price. Online tools and insurance brokers can help streamline this process.

Coverage Gaps and Endorsements

Standard insurance policies might not cover every possible risk. Identify any coverage gaps and consider endorsements (add-ons) to tailor your policy to your specific needs. For instance, you might want to add cyber liability coverage to protect against data breaches or identity theft.

The Process of Obtaining Insurance

Securing small business insurance typically involves the following steps:

Assess Your Insurance Needs

Start by evaluating your business’s unique risks and insurance requirements. Consider the different types of insurance and choose the ones that align with your needs.

Research Insurance Providers

Look for reputable insurance providers who specialize in small business insurance. Check their financial stability, customer reviews, and the range of policies they offer. Online resources and industry associations can be valuable sources of information.

Obtain Quotes and Compare

Request quotes from multiple insurers and compare them based on coverage, limits, deductibles, and premiums. Ensure you’re comparing apples to apples by reviewing the policy documents carefully.

Apply for Insurance

Once you’ve chosen an insurer, you’ll need to provide detailed information about your business, including its operations, revenue, and any past claims. Be prepared to answer questions and provide documentation to support your application.

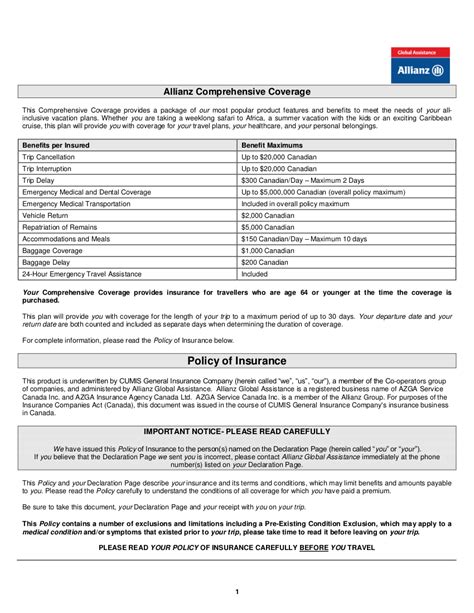

Review and Understand Your Policy

Before signing on the dotted line, carefully review your insurance policy. Ensure you understand the coverage, exclusions, and any special conditions. If you have any questions or concerns, don’t hesitate to reach out to your insurer for clarification.

Maximizing the Benefits of Your Insurance Policy

Having an insurance policy is just the first step. To truly leverage the benefits, consider the following strategies:

Regular Policy Reviews

Your business and its associated risks are likely to evolve over time. Regularly review your insurance policy to ensure it continues to meet your needs. Consider conducting an annual review, especially after significant business changes or growth.

Utilize Preventative Measures

While insurance provides a safety net, it’s always better to prevent losses in the first place. Implement safety measures, train your employees on best practices, and stay up-to-date with industry standards to minimize the likelihood of incidents that could trigger an insurance claim.

File Claims Promptly and Accurately

In the event of a claim, act promptly and provide accurate information to your insurer. Keep detailed records and documentation to support your claim. The faster and more accurately you file a claim, the quicker you can receive the benefits you’re entitled to.

Develop a Business Continuity Plan

Insurance is just one part of your overall business continuity strategy. Develop a comprehensive plan that outlines how your business will respond to various disruptions, including natural disasters, cyber attacks, or other emergencies. This plan should include steps to mitigate the impact and facilitate a swift recovery.

The Future of Small Business Insurance

The insurance industry is evolving, and small business insurance is no exception. With the rise of technology and changing business landscapes, insurers are offering more innovative solutions. Here are some trends to watch:

Digitalization of Insurance

From online quotes to digital claim submissions, the insurance industry is increasingly embracing technology. This trend is expected to continue, making insurance more accessible and efficient for small businesses.

Risk-Based Pricing

Insurers are moving towards more sophisticated risk assessment models, using advanced analytics and data to offer tailored pricing based on a business’s unique risks. This shift can provide more accurate pricing and coverage for small businesses.

Expanded Coverage Options

As businesses evolve and new risks emerge, insurers are expanding their coverage options. This includes offerings like cyber liability insurance, which has become increasingly important in today’s digital age.

Insurtech Innovations

Insurtech startups are disrupting the traditional insurance industry with innovative solutions. From AI-powered risk assessment tools to blockchain-based insurance contracts, these innovations are set to revolutionize the way small businesses interact with insurance.

Conclusion

Small business insurance is a vital component of any successful enterprise, offering protection against a wide range of risks. By understanding your insurance needs, researching providers, and choosing the right policy, you can safeguard your business and ensure its long-term viability. Stay informed, adapt to changing trends, and leverage your insurance policy to its fullest potential to protect your business’s future.

What is the average cost of small business insurance?

+The cost of small business insurance can vary widely depending on several factors, including the type of business, its location, revenue, and the specific insurance policies chosen. On average, small businesses can expect to pay anywhere from a few hundred to several thousand dollars per year for a basic insurance package. However, this is just a rough estimate, and the actual cost will depend on the unique circumstances of your business.

How can I reduce the cost of my small business insurance?

+There are several strategies you can employ to reduce the cost of your small business insurance. These include shopping around for the best rates, bundling multiple policies with the same insurer, increasing your deductibles, maintaining a good credit score, and implementing loss prevention measures to reduce the likelihood of claims. Additionally, some insurers offer discounts for businesses that meet certain criteria, such as having safety programs in place.

What happens if I don’t have small business insurance and a claim is made against my business?

+Operating a small business without insurance is a risky proposition. If a claim is made against your business and you don’t have the appropriate insurance coverage, you’ll be personally responsible for paying any damages or settlements. This could potentially bankrupt your business and leave you financially vulnerable. It’s always better to have insurance to protect your business and your personal assets.

How often should I review my small business insurance policy?

+It’s recommended to review your small business insurance policy at least once a year, or whenever significant changes occur in your business. This could include expanding your operations, moving to a new location, adding new products or services, or making significant staffing changes. Regular policy reviews ensure that your coverage remains adequate and up-to-date with your business’s evolving needs.