Homeowners Warranty Insurance

When it comes to protecting one of the most significant investments of your life, your home, a homeowners warranty insurance policy is an essential consideration. These policies are designed to provide homeowners with financial security and peace of mind by covering various aspects of home ownership and potential issues that may arise.

In this comprehensive guide, we will delve into the world of homeowners warranty insurance, exploring its benefits, coverage options, and how it can safeguard your home and wallet. We will uncover the key features, compare different policies, and offer expert insights to help you make an informed decision. So, whether you're a first-time homeowner or looking to enhance your existing coverage, join us on this journey as we navigate the complexities of homeowners warranty insurance.

Understanding Homeowners Warranty Insurance

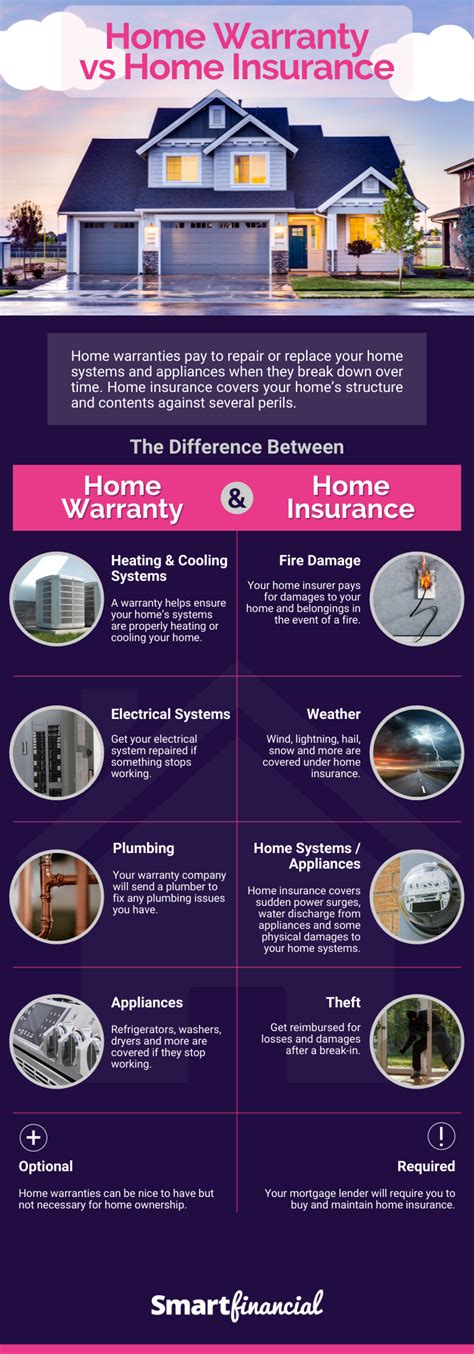

Homeowners warranty insurance, often referred to as a home warranty plan, is a type of insurance policy that covers the repair or replacement of specific home systems and appliances. It serves as a safety net for homeowners, providing coverage for unexpected breakdowns or malfunctions that may occur during the policy period.

Unlike traditional homeowners insurance, which primarily covers damage to the structure of the home and its contents due to perils like fire, theft, or natural disasters, homeowners warranty insurance focuses on the functional aspects of your home. It offers protection for essential components such as heating and cooling systems, plumbing, electrical systems, and major appliances like refrigerators, ovens, and washing machines.

Key Benefits of Homeowners Warranty Insurance

The benefits of investing in homeowners warranty insurance are multifaceted and can provide significant value to homeowners. Here are some of the key advantages:

- Cost Savings: One of the primary benefits is the potential for substantial cost savings. Repairing or replacing major home systems and appliances can be incredibly expensive. A warranty plan can help mitigate these costs, offering pre-negotiated service fees and covering the majority of the repair or replacement expenses.

- Peace of Mind: Knowing that your home's essential systems and appliances are covered provides immense peace of mind. You won't have to worry about unexpected breakdowns or the financial burden they may bring. Homeowners warranty insurance ensures that you can enjoy your home without constant concern over potential maintenance issues.

- Expert Service: When you have a warranty plan, you gain access to a network of pre-screened, qualified service providers. These professionals are experts in their fields and can provide timely and efficient service, ensuring that your home remains in optimal condition.

- Convenience: Dealing with home repairs can be a hassle, from finding reliable contractors to coordinating schedules. With a warranty plan, the process is streamlined. You simply make a service request, and the warranty company takes care of the rest, arranging for a qualified technician to come to your home.

- Resale Value: Having a homeowners warranty insurance policy can be an attractive feature for potential buyers if you ever decide to sell your home. It demonstrates to buyers that you've taken good care of the property and provides them with additional protection, potentially increasing your home's resale value.

Coverage Options and Considerations

Homeowners warranty insurance offers a range of coverage options, allowing you to tailor the policy to your specific needs and budget. Here are some important factors to consider when choosing a warranty plan:

Coverage Plans

Warranty companies typically offer different coverage plans to suit various homeowner needs. These plans can include:

- Basic Plans: These plans usually cover essential home systems like plumbing, electrical, and heating/cooling. They provide a good foundation of protection but may not include appliances.

- Appliance Plans: As the name suggests, these plans focus on covering major appliances such as refrigerators, ovens, dishwashers, and washing machines. They are ideal for homeowners who want comprehensive coverage for their appliances.

- Combination Plans: Combination plans offer the best of both worlds, providing coverage for both home systems and appliances. This is a popular choice for homeowners who want a comprehensive warranty solution.

Coverage Limits and Deductibles

When selecting a warranty plan, it’s important to consider the coverage limits and deductibles. Coverage limits refer to the maximum amount the warranty company will pay for a covered repair or replacement. Deductibles, on the other hand, are the amount you, as the homeowner, are responsible for paying out of pocket before the warranty coverage kicks in.

It's crucial to review these limits and deductibles carefully. While higher deductibles may result in lower monthly premiums, they also mean you'll be responsible for a larger portion of the repair costs. Conversely, lower deductibles can provide more financial protection but may result in higher premiums.

Additional Coverage Options

Some warranty companies offer additional coverage options that can further enhance your protection. These may include:

- Roof Leak Coverage: This add-on provides coverage for roof leaks, which can be costly to repair.

- Swimming Pool/Spa Coverage: If you have a pool or spa, this coverage ensures that any repairs or maintenance are covered.

- Septic System Coverage: Septic systems can be expensive to repair or replace, so this add-on provides peace of mind.

- Extended Appliance Coverage: Certain warranty plans offer the option to extend the coverage period for specific appliances beyond the standard term.

Choosing the Right Homeowners Warranty Insurance

Selecting the right homeowners warranty insurance policy involves careful consideration of your unique needs and circumstances. Here are some steps to guide you through the process:

Assess Your Home’s Needs

Start by evaluating the age and condition of your home. Older homes may require more extensive coverage due to potential wear and tear on systems and appliances. Consider any specific issues or concerns you have, such as a problematic roof or an aging HVAC system.

Research Warranty Companies

Take the time to research different warranty companies and their offerings. Look for reputable companies with a solid track record of providing quality service and customer satisfaction. Read reviews and testimonials to gain insights into their performance and reliability.

Compare Coverage and Pricing

Compare the coverage options and pricing of various warranty plans. Consider not only the initial cost but also the long-term value and potential savings. Some companies may offer discounts for bundling with other insurance policies or for purchasing long-term plans.

Review Fine Print and Exclusions

Pay close attention to the fine print and exclusions of each warranty plan. Understand what is covered and what is not. Some common exclusions may include pre-existing conditions, normal wear and tear, and certain types of damage caused by negligence or lack of maintenance.

Consider Customization Options

Look for warranty companies that offer customization options. This allows you to tailor the coverage to your specific needs, ensuring you’re not paying for unnecessary protections while still maintaining comprehensive coverage.

The Claims Process

Understanding the claims process is essential to ensure a smooth and stress-free experience when utilizing your homeowners warranty insurance. Here’s an overview of what you can expect:

Step 1: Identifying the Issue

The first step is to identify the problem with your home system or appliance. Take note of any unusual noises, strange odors, or lack of functionality. It’s important to act promptly to prevent further damage or potential safety hazards.

Step 2: Contacting the Warranty Company

Once you’ve identified the issue, contact your warranty company as soon as possible. Most companies have dedicated customer service lines or online portals for reporting claims. Provide detailed information about the problem and any relevant documentation, such as photos or videos.

Step 3: Scheduling a Service Visit

After reporting the claim, the warranty company will schedule a service visit with one of their qualified contractors or technicians. They will assess the issue and provide a diagnosis. In some cases, they may need to order parts or schedule a follow-up visit for repairs.

Step 4: Paying the Service Fee

Before the service visit, you will typically be required to pay a service fee, which is a predetermined amount set by the warranty company. This fee is usually covered by your warranty plan and is often significantly lower than what you would pay for regular service calls.

Step 5: Repair or Replacement

During the service visit, the technician will determine whether the issue can be repaired or if a replacement is necessary. If a repair is possible, they will fix the problem and ensure that your system or appliance is functioning properly. In the case of a replacement, the technician will coordinate the process and install the new component.

Step 6: Final Inspection and Resolution

After the repair or replacement, the technician will conduct a final inspection to ensure that the issue has been resolved and that your home system or appliance is in good working condition. At this point, the claim is considered resolved, and you can enjoy the peace of mind that comes with a properly functioning home.

Tips for Maximizing Your Warranty Coverage

To make the most of your homeowners warranty insurance, consider the following tips:

- Regular Maintenance: Maintain your home systems and appliances regularly. This not only helps prevent breakdowns but also ensures that any issues are covered by your warranty plan. Many warranty companies require proof of regular maintenance to honor claims.

- Document Everything: Keep a record of all maintenance and service visits, including dates, issues addressed, and any repairs made. This documentation can be invaluable when filing a claim.

- Understand Exclusions: Familiarize yourself with the exclusions listed in your warranty plan. This will help you understand what is not covered and potentially save you from unnecessary expenses.

- Upgrade When Needed: If you have an older home or appliances, consider upgrading to a more comprehensive warranty plan. This can provide better coverage and peace of mind.

- Read the Fine Print: Take the time to read and understand your warranty contract thoroughly. This ensures that you're aware of any limitations or conditions that may impact your coverage.

Future Outlook and Trends

The homeowners warranty insurance industry is evolving to meet the changing needs of homeowners. Here are some trends and developments to watch for in the future:

Digitalization of Services

Warranty companies are increasingly embracing digital technologies to enhance the customer experience. Expect to see more online portals, mobile apps, and streamlined claim processes, making it easier and more convenient to manage your warranty coverage.

Personalized Coverage Plans

The industry is moving towards offering more personalized coverage plans. This means that homeowners will have the flexibility to choose specific coverages based on their unique needs, allowing for a more tailored and cost-effective warranty solution.

Integration with Smart Home Technology

As smart home technology continues to advance, warranty companies may start integrating their services with these systems. This could enable remote monitoring and diagnostics, potentially reducing the need for physical service visits and providing more efficient resolution of issues.

Expanded Coverage Options

Warranty companies may expand their coverage options to include new and emerging home systems and technologies. This could include coverage for renewable energy systems, smart home devices, and even coverage for issues related to cybersecurity.

Conclusion

Homeowners warranty insurance is a valuable tool for protecting your home and your finances. By understanding the benefits, coverage options, and the claims process, you can make an informed decision about whether a warranty plan is right for you. Remember to assess your specific needs, compare different policies, and stay up-to-date with industry trends to ensure you have the best protection for your home.

How much does homeowners warranty insurance typically cost?

+

The cost of homeowners warranty insurance can vary depending on factors such as the coverage plan, the age and condition of your home, and your location. On average, basic plans start around 300 to 500 per year, while more comprehensive plans can range from 500 to 1,000 or more annually. It’s important to compare quotes from different providers to find the best value for your specific needs.

What happens if I need to file a claim outside of regular business hours?

+

Most warranty companies offer 24⁄7 emergency service hotlines. If you experience a sudden breakdown or malfunction outside of regular business hours, you can contact their emergency line, and they will assist you in scheduling a service visit as soon as possible.

Can I cancel my homeowners warranty insurance if I’m not satisfied with the service?

+

Yes, you have the right to cancel your homeowners warranty insurance at any time. However, it’s important to review the terms and conditions of your policy, as some providers may have cancellation fees or require notice within a specific timeframe. Ensure you understand the cancellation process before proceeding.

Are there any limitations on the number of claims I can make in a year?

+

Yes, most warranty plans have a limit on the number of claims you can make in a given year. This limit is typically outlined in the policy contract. Exceeding the claim limit may result in additional fees or the suspension of your coverage. It’s important to review these limits to ensure you’re not overusing your warranty plan.

Can I transfer my homeowners warranty insurance to a new homeowner if I sell my property?

+

In many cases, yes. Transferring your homeowners warranty insurance to the new homeowner can be an attractive selling point and provide added value to your property. Check with your warranty provider to understand the process and any associated fees for transferring the policy.