Motorcycle Insurance Price

Motorcycle insurance is an essential aspect of motorcycle ownership, offering financial protection and peace of mind to riders. However, the cost of motorcycle insurance can vary significantly depending on numerous factors. Understanding these factors and how they influence the premium rates is crucial for riders seeking affordable coverage. This comprehensive guide will delve into the key elements that impact motorcycle insurance prices, providing riders with the knowledge to make informed decisions about their coverage.

The Influence of Rider Experience

One of the primary factors that insurance companies consider when determining insurance rates is the rider’s experience. New riders, especially those with little to no prior experience on a motorcycle, often face higher insurance premiums. Insurance providers view novice riders as a higher risk due to the increased likelihood of accidents and claims during the initial learning phase. As a rider gains experience and demonstrates safe riding habits, insurance rates tend to decrease over time.

Consider the case of John, a 25-year-old who recently obtained his motorcycle license. Despite having a clean driving record with his car, John's motorcycle insurance premium is significantly higher compared to that of his friend, Sarah, who has been riding for over a decade. Sarah's extensive experience and proven track record of safe riding have resulted in lower insurance rates, highlighting the importance of experience in insurance pricing.

Tips for New Riders to Reduce Insurance Costs

- Complete a Motorcycle Safety Foundation (MSF) riding course to demonstrate your commitment to safe riding practices.

- Opt for a smaller, less powerful motorcycle as insurance rates are often lower for less powerful bikes.

- Maintain a clean driving record to show insurers your reliability and responsibility.

- Consider adding an experienced rider to your policy as a named insured, which can potentially lower your rates.

The Impact of Location and Riding Environment

Where you ride your motorcycle and the environment in which you ride can significantly influence your insurance rates. Insurance companies carefully analyze the statistical data of accidents and claims in different regions to assess the risk associated with riding in those areas.

For instance, let's compare the insurance rates of two riders, Mike and Emma. Mike resides in a densely populated urban area with a high volume of traffic and a higher incidence of motorcycle accidents. On the other hand, Emma lives in a rural area with less traffic and a lower accident rate. Insurance companies will typically charge Mike a higher premium due to the increased risk associated with his riding environment.

| Rider | Location | Insurance Premium |

|---|---|---|

| Mike | Urban Area | $1,200 annually |

| Emma | Rural Area | $800 annually |

How Weather Conditions Affect Insurance Rates

The weather in your riding area can also influence insurance rates. Regions with harsh winters, for example, may see a higher number of motorcycle accidents during the spring and summer months as riders adjust to changing road conditions. Similarly, areas prone to severe weather events like hurricanes or floods may also experience higher insurance rates due to the increased risk of accidents and damage.

Motorcycle Type and Value: A Major Factor

The type and value of your motorcycle play a significant role in determining your insurance rates. Insurance companies consider various factors, including the make, model, and year of your bike, as well as its performance capabilities and potential for theft.

Take, for example, the difference in insurance rates for two riders, Alex and Lisa. Alex owns a powerful sports bike, known for its high performance and speed, while Lisa rides a classic, vintage motorcycle. Insurance companies typically charge higher premiums for high-performance bikes like Alex's, as they are often associated with higher speeds and a greater risk of accidents. In contrast, Lisa's vintage motorcycle, which is less powerful and has a lower likelihood of theft, may result in lower insurance rates.

| Rider | Motorcycle Type | Insurance Premium |

|---|---|---|

| Alex | Sports Bike | $1,500 annually |

| Lisa | Vintage Motorcycle | $900 annually |

The Role of Customizations and Modifications

Customizations and modifications to your motorcycle can also impact your insurance rates. Insurance companies often view significant modifications as a potential indicator of increased risk. For example, adding a powerful engine or enhancing the suspension system of your bike may lead to higher insurance rates, as these modifications can increase the bike’s performance and speed.

Comprehensive vs. Liability-Only Coverage

The level of coverage you choose for your motorcycle insurance policy is another crucial factor in determining your insurance premium. Riders can opt for comprehensive coverage, which provides protection for a wide range of incidents, including accidents, theft, and damage caused by natural disasters. Alternatively, riders can choose liability-only coverage, which primarily covers damage caused to others in an accident for which you are at fault.

Comprehensive coverage, while offering more extensive protection, typically comes with a higher premium. For riders who own high-value motorcycles or those who frequently ride in areas with a higher risk of theft or damage, comprehensive coverage may be the more cost-effective option in the long run. On the other hand, liability-only coverage is often more affordable, making it a suitable choice for riders who are looking to keep their insurance costs down.

| Coverage Type | Description | Premium Range |

|---|---|---|

| Comprehensive | Covers a wide range of incidents, including accidents, theft, and natural disasters. | $1,000 - $2,500 annually |

| Liability-Only | Covers damage caused to others in an accident for which you are at fault. | $500 - $1,200 annually |

Factors Influencing Coverage Choice

When deciding between comprehensive and liability-only coverage, several factors come into play. These include the value of your motorcycle, the risk associated with your riding environment, and your personal financial situation. Riders with high-value motorcycles or those who ride in high-risk areas may find comprehensive coverage more beneficial, as it provides broader protection. Conversely, riders who prioritize cost-effectiveness may opt for liability-only coverage, especially if they have a lower-value motorcycle or live in a relatively safe riding area.

The Role of Deductibles in Insurance Pricing

Deductibles are an essential component of insurance policies and can significantly impact your insurance premium. A deductible is the amount of money you agree to pay out of pocket before your insurance coverage kicks in. Typically, higher deductibles result in lower insurance premiums, while lower deductibles lead to higher premiums.

For instance, consider two riders, David and Rachel. David opts for a higher deductible of $1,000, which results in a lower insurance premium. On the other hand, Rachel chooses a lower deductible of $500, which translates to a higher insurance premium. The decision to choose a higher or lower deductible depends on individual preferences and financial capabilities. While a higher deductible may save on insurance costs, it also means that the rider will have to pay a larger portion of any claim out of pocket.

| Rider | Deductible | Insurance Premium |

|---|---|---|

| David | $1,000 | $850 annually |

| Rachel | $500 | $1,100 annually |

Understanding the Impact of Deductibles on Claims

When you make a claim on your motorcycle insurance policy, the deductible amount is subtracted from the total cost of the claim. For example, if you have a 500 deductible and your repair costs amount to 2,000, your insurance company will cover 1,500, and you will be responsible for the remaining 500. It’s important to carefully consider the deductible amount when choosing your insurance policy, as it can significantly impact your out-of-pocket expenses in the event of a claim.

Discounts and Savings: Lowering Your Insurance Costs

Insurance companies often offer a range of discounts and savings opportunities to policyholders. These discounts can significantly reduce your insurance premium and make motorcycle insurance more affordable. Here are some common discounts that riders can take advantage of:

- Multi-Policy Discounts: Bundling your motorcycle insurance with other policies, such as auto or home insurance, can lead to substantial savings.

- Safe Rider Discounts: Many insurance companies reward riders who have a clean driving record and no history of accidents or traffic violations.

- Loyalty Discounts: Staying with the same insurance company for an extended period can result in loyalty discounts, especially if you maintain a good claims history.

- Membership Discounts: Belonging to certain organizations or associations, such as motorcycle clubs or alumni groups, may qualify you for insurance discounts.

- Defensive Riding Course Discounts: Completing a defensive riding course can demonstrate your commitment to safe riding practices and potentially earn you a discount.

By exploring these discount opportunities and negotiating with insurance providers, riders can often find ways to lower their insurance costs without compromising on coverage.

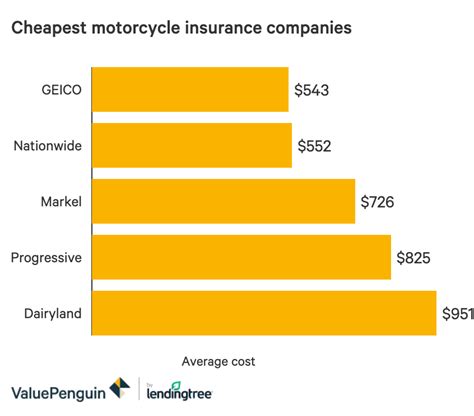

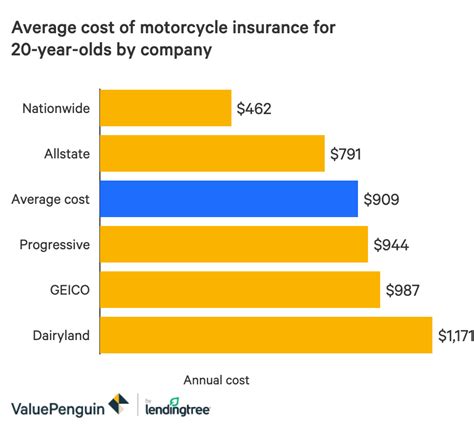

The Power of Comparison Shopping

Comparison shopping is a powerful tool for finding the best insurance rates. Riders should obtain quotes from multiple insurance companies to compare coverage options and premiums. This process allows riders to identify the most cost-effective insurance provider for their specific needs and circumstances. Online quote comparison tools and insurance broker services can simplify this process, making it easier for riders to find the right insurance coverage at the best price.

How often should I review my motorcycle insurance policy and premiums?

+

It’s recommended to review your motorcycle insurance policy and premiums at least once a year, especially if your riding habits, location, or personal circumstances have changed. Regular reviews ensure you’re getting the best value for your insurance and that your coverage remains adequate for your needs.

Can I lower my insurance premium by increasing my coverage limits?

+

Increasing your coverage limits can provide more financial protection, but it may also result in a higher insurance premium. It’s important to strike a balance between adequate coverage and cost-effectiveness. Consider your personal financial situation and the potential risks you face while riding to determine the appropriate coverage limits for your needs.

Are there any specific insurance companies that offer the best rates for motorcycle insurance?

+

The best insurance company for motorcycle insurance will vary depending on individual circumstances and the specific needs of the rider. It’s essential to compare quotes from multiple insurers to find the most cost-effective option. Factors such as the type of motorcycle, riding experience, and location can significantly influence the rates offered by different insurance companies.