Get A Quote For Car Insurance

Are you looking to secure a comprehensive car insurance policy but unsure where to start? Getting a quote for car insurance is a straightforward process, and with the right approach, you can ensure you're getting the best coverage for your needs. In this article, we'll guide you through the essential steps to obtaining a competitive quote and provide valuable insights to help you make informed decisions.

Understanding Car Insurance Coverage

Car insurance is a vital aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. It’s essential to grasp the different types of coverage available to make an informed decision when seeking a quote.

Liability Coverage

Liability coverage is a fundamental aspect of car insurance, safeguarding you against claims arising from bodily injury or property damage caused to others in an accident for which you are at fault. This coverage is typically split into bodily injury liability and property damage liability.

Bodily injury liability covers medical expenses and potential legal fees if someone is injured in an accident caused by you. Property damage liability, on the other hand, covers the cost of repairing or replacing the other party’s vehicle or property.

It’s crucial to note that liability coverage only applies to damages you cause to others and does not cover your own vehicle’s repairs or injuries sustained by you or your passengers.

Comprehensive and Collision Coverage

Comprehensive and collision coverage are optional but highly recommended additions to your car insurance policy. Comprehensive coverage protects against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or damage caused by animals.

Collision coverage, as the name suggests, covers damages to your vehicle resulting from a collision with another vehicle, an object, or a rollover. Both comprehensive and collision coverage come with a deductible, which is the amount you pay out of pocket before your insurance kicks in.

While these coverages may come at an additional cost, they provide valuable protection for your vehicle and can save you from significant out-of-pocket expenses in the event of an accident or other covered incidents.

Other Types of Coverage

In addition to the aforementioned coverages, there are several other types of coverage you may consider adding to your car insurance policy, depending on your specific needs and circumstances.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, provides medical benefits for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has little or no insurance.

- Rental Car Reimbursement: If your vehicle is in the shop for repairs after an insured incident, this coverage can help cover the cost of renting a temporary vehicle.

- Gap Insurance: Gap insurance covers the difference between the actual cash value of your vehicle and the balance you owe on your loan or lease if your car is declared a total loss.

The specific coverage options available to you may vary depending on your state’s insurance laws and the insurance provider you choose.

Factors Affecting Car Insurance Quotes

When requesting quotes for car insurance, it’s important to be aware of the various factors that can influence the cost of your policy. Understanding these factors can help you make informed decisions and potentially save money on your insurance premiums.

Vehicle Make and Model

The make and model of your vehicle play a significant role in determining your insurance rates. Certain vehicles may be more expensive to insure due to factors such as their repair costs, safety ratings, and likelihood of theft.

Sports cars, luxury vehicles, and SUVs, for example, often come with higher insurance premiums due to their higher repair costs and increased risk of accidents or theft.

Driving History

Your driving record is a crucial factor in car insurance quotes. A clean driving history with no at-fault accidents or moving violations can lead to lower insurance rates. Conversely, a history of accidents or traffic violations may result in higher premiums.

Insurance companies assess your driving history to evaluate your risk level and determine the likelihood of future claims. A single at-fault accident or multiple violations can significantly impact your insurance rates, so it’s essential to maintain a safe driving record.

Age and Gender

Your age and gender can also influence your car insurance quotes. Statistically, younger drivers, particularly those under the age of 25, tend to have higher insurance rates due to their relative inexperience behind the wheel and higher risk of accidents.

Gender may also be a factor in some cases, as insurance companies may consider historical data showing that men or women are more likely to be involved in accidents or file claims. However, gender-based pricing is becoming less common as insurance companies adopt more sophisticated risk assessment methods.

Location

The area where you live and drive your vehicle can significantly impact your insurance rates. Factors such as population density, crime rates, and the frequency of accidents in your area can all influence the cost of your insurance.

Urban areas, for instance, may have higher insurance rates due to increased traffic congestion, higher accident rates, and a greater risk of vehicle theft. Conversely, rural areas may offer lower insurance rates due to less dense traffic and lower crime rates.

Coverage and Deductible

The level of coverage you choose and the deductible you select can greatly affect your insurance premiums. Comprehensive and collision coverage, as mentioned earlier, provide valuable protection for your vehicle but come at an additional cost.

The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your insurance premiums, as it reduces the insurer’s potential liability. However, it’s essential to choose a deductible amount that you can comfortably afford in the event of a claim.

Comparing Quotes and Choosing the Right Policy

Now that you understand the factors influencing car insurance quotes, it’s time to delve into the process of comparing quotes and selecting the right policy for your needs.

Obtaining Multiple Quotes

To ensure you’re getting the best deal, it’s advisable to obtain quotes from multiple insurance providers. You can do this by visiting insurance company websites, using online quote comparison tools, or reaching out to insurance brokers who can provide quotes from various insurers.

When requesting quotes, be sure to provide accurate and detailed information about your vehicle, driving history, and desired coverage levels. Inaccurate information can lead to quotes that don’t accurately reflect your actual insurance needs.

Assessing Coverage and Costs

Once you have a selection of quotes, carefully evaluate each one to determine the coverage and costs associated with each policy. Consider not only the premium amount but also the specific coverage limits and deductibles.

Look for policies that offer the coverage you need at a competitive price. Don’t automatically choose the cheapest option without considering the quality of coverage. It’s essential to strike a balance between affordability and adequate protection.

Understanding Policy Terms and Conditions

Before finalizing your decision, take the time to read and understand the terms and conditions of the policy you’re considering. Pay close attention to the fine print, as this can reveal important details that may impact your coverage or claims process.

Look for any exclusions or limitations that could affect your coverage in certain situations. Understand the process for filing claims and the timelines involved. It’s also worth checking the insurer’s reputation and financial stability to ensure they’re a reliable choice for your insurance needs.

Negotiating and Customizing Your Policy

In some cases, you may have the opportunity to negotiate certain aspects of your car insurance policy. If you’re a loyal customer with a clean driving record, you may be able to secure a better rate or additional discounts.

Additionally, consider customizing your policy to meet your specific needs. For example, if you have a low-mileage vehicle, you may be eligible for a usage-based insurance program that rewards you for driving fewer miles. Or, if you have multiple vehicles, you may be able to bundle your policies and save money.

Additional Tips for Saving on Car Insurance

Beyond comparing quotes and customizing your policy, there are several other strategies you can employ to save money on your car insurance premiums.

Safe Driving Practices

Maintaining a safe driving record is crucial for keeping your insurance premiums low. Avoid traffic violations and at-fault accidents, as these can significantly increase your insurance costs.

Consider enrolling in a defensive driving course, which can not only improve your driving skills but may also qualify you for insurance discounts. Some insurers offer safe driver discounts or accident forgiveness programs, so be sure to inquire about these options.

Bundling Policies

If you have multiple insurance needs, such as home, renters, or life insurance, consider bundling your policies with the same insurer. Many insurance companies offer multi-policy discounts, which can result in significant savings.

By combining your insurance needs under one provider, you may also benefit from streamlined billing and claims processes, making it more convenient to manage your insurance portfolio.

Utilizing Telematics

Telematics, also known as usage-based insurance, is a relatively new concept that allows insurers to track your driving behavior and reward safe driving habits with lower premiums.

With telematics, your insurer installs a device in your vehicle or uses an app on your smartphone to monitor your driving habits, such as acceleration, braking, and mileage. If you consistently exhibit safe driving behavior, you may be eligible for discounted rates.

Raising Your Deductible

As mentioned earlier, opting for a higher deductible can reduce your insurance premiums. While this means you’ll pay more out of pocket in the event of a claim, it can be a cost-effective strategy if you’re a safe driver with a low risk of accidents.

Be sure to choose a deductible amount that you’re comfortable paying, as it should reflect your financial situation and ability to cover unexpected expenses.

Future Implications and Industry Trends

The car insurance industry is constantly evolving, with new technologies and innovations shaping the way policies are priced and delivered. Staying informed about these trends can help you make more informed decisions and potentially benefit from new opportunities.

Technology and Data Analytics

Advancements in technology and data analytics are transforming the car insurance landscape. Insurers are increasingly leveraging big data and artificial intelligence to assess risk and price policies more accurately.

For example, telematics data can provide insurers with a wealth of information about your driving behavior, allowing them to offer more personalized and competitive rates. Additionally, insurers are using advanced analytics to identify fraud and improve claims handling processes.

Usage-Based Insurance

Usage-based insurance, as mentioned earlier, is gaining popularity as a way to reward safe drivers with lower premiums. This trend is expected to continue as insurers seek more innovative ways to assess risk and offer personalized pricing.

With usage-based insurance, drivers who exhibit safe driving habits and drive fewer miles may see significant savings on their insurance premiums. This shift towards a pay-as-you-drive model aligns with the increasing focus on sustainability and reducing carbon emissions.

Autonomous Vehicles and Insurance

The emergence of autonomous vehicles is set to have a significant impact on the car insurance industry. As self-driving cars become more prevalent, the nature of accidents and liability will shift, potentially leading to new insurance products and pricing models.

While fully autonomous vehicles may reduce the frequency of accidents, there will still be a need for insurance coverage to protect against potential malfunctions or cyber attacks. Insurers will need to adapt their policies and underwriting processes to accommodate this evolving technology.

Insurance Tech Startups

The insurance industry is witnessing a surge in tech startups offering innovative insurance products and services. These startups are leveraging technology to disrupt traditional insurance models, providing consumers with more convenient and personalized options.

From on-demand insurance apps to peer-to-peer insurance platforms, these startups are challenging the status quo and forcing established insurers to adapt and innovate to remain competitive.

Conclusion

Obtaining a quote for car insurance is a crucial step in securing adequate protection for your vehicle and your financial well-being. By understanding the factors that influence insurance quotes and taking a proactive approach to comparing policies, you can make informed decisions and potentially save money on your premiums.

As the car insurance industry continues to evolve, staying abreast of technological advancements and industry trends can help you navigate the changing landscape and make the most of emerging opportunities. Whether it’s embracing usage-based insurance, considering autonomous vehicle coverage, or exploring innovative insurance tech startups, there are countless ways to customize your insurance portfolio and optimize your coverage.

Remember, car insurance is a vital aspect of responsible vehicle ownership, and by staying informed and proactive, you can ensure you have the protection you need at a price that fits your budget.

What documents do I need to provide when requesting a car insurance quote?

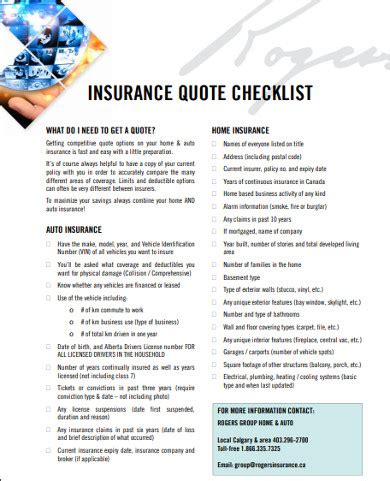

+When requesting a car insurance quote, you’ll typically need to provide your driver’s license number, vehicle identification number (VIN), and information about your vehicle’s make, model, and year. Additionally, you may be asked for your driving record and any previous insurance claims you’ve made. Having this information ready can expedite the quoting process.

How long does it take to get a car insurance quote?

+The time it takes to receive a car insurance quote can vary depending on the insurer and the complexity of your request. In many cases, you can obtain a quote within a matter of minutes by using online quote comparison tools or directly on insurance company websites. However, if you’re seeking a more customized quote or have specific coverage requirements, the process may take a bit longer.

Can I switch car insurance providers and keep my existing coverage?

+Yes, you can switch car insurance providers and maintain your existing coverage. When you obtain a new policy, simply provide your new insurer with the details of your current coverage, including your policy number and the date you wish to have the new policy take effect. Your new insurer will work with your previous provider to ensure a smooth transition and avoid any lapses in coverage.