Progressive Insurance Claims Number

Progressive Insurance, a leading name in the world of automotive insurance, has established itself as a trusted provider, offering a range of comprehensive policies to protect drivers and their vehicles. However, for policyholders, one of the most crucial aspects of their service is the claims process. Understanding how to navigate this process efficiently and effectively is key to a positive experience with Progressive.

The Progressive Claims Process: A Step-by-Step Guide

Initiating a claim with Progressive is a straightforward process, designed to be accessible and efficient. Here’s a detailed breakdown of each step, along with specific examples and insights to guide you through:

Step 1: Contact Progressive

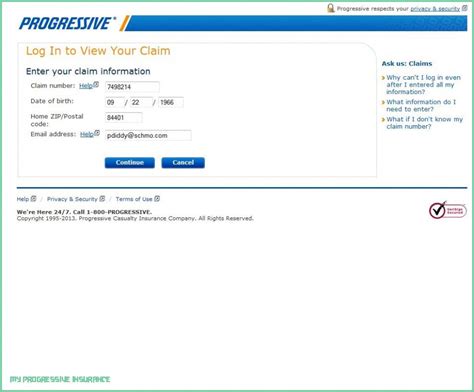

The first step in the claims process is to get in touch with Progressive. You can do this by calling their 24⁄7 claims hotline, which is a quick and convenient way to start the process. Alternatively, you can log in to your online account or use the Progressive app to begin your claim digitally. Let’s say you were involved in a fender-bender while driving to work. You can simply pull over, take some photos of the damage, and use the Progressive app to start your claim. The app will guide you through the process, making it easy and stress-free.

Step 2: Provide Details

Once you’ve initiated your claim, you’ll be asked to provide some key details about the incident. This includes the date, time, and location of the accident, as well as a description of what happened. You’ll also need to provide information about any other vehicles or parties involved. For instance, if you were rear-ended by a distracted driver, you would need to provide details about their vehicle and insurance information, if possible.

| Information Required | Example |

|---|---|

| Date and Time of Incident | July 15, 2023, at 9:00 AM |

| Location | Intersection of Main Street and Elm Avenue |

| Description of Incident | I was stopped at a red light when the vehicle behind me collided with my rear bumper. |

| Other Vehicle Information | Make: Toyota, Model: Camry, Color: Silver, License Plate: ABC-123 |

Step 3: Assess the Damage

Progressive will then assess the damage to your vehicle. This can be done in a few ways. You might be asked to take and submit photos of the damage, which Progressive’s claims adjusters can review. Alternatively, you may be asked to take your vehicle to a Progressive-approved repair shop for an in-person assessment. In some cases, a claims adjuster may even come to you to inspect the vehicle. Imagine your car has sustained significant damage to the front end. Progressive might ask you to take it to a nearby repair shop, where a professional can assess the damage and provide an estimate for repairs.

Step 4: Determine the Claim Value

Once the damage has been assessed, Progressive will determine the value of your claim. This is based on the cost of repairs, the value of your vehicle, and any other relevant factors. For instance, if your car is older and has high mileage, the claim value might be lower than if you had a newer model with low mileage. Progressive uses industry-standard valuation methods to ensure a fair and accurate assessment.

Step 5: Receive Payment

After the claim value has been determined, Progressive will process your payment. This can be done via check, direct deposit, or even a prepaid card, depending on your preference and the nature of your claim. For instance, if your car requires extensive repairs, Progressive might issue a check directly to the repair shop to cover the cost of the work.

Step 6: Resolve Additional Issues

In some cases, there might be additional issues that need to be resolved. This could include disputes over fault, further damage discovered during repairs, or issues with rental car coverage. Progressive has dedicated teams to handle these situations, ensuring a fair and timely resolution. For example, if the other driver disputes fault, Progressive’s claims adjusters will work with you and the other party to gather evidence and come to a resolution.

Step 7: Close the Claim

Once all issues have been resolved and you’ve received your payment, your claim will be officially closed. Progressive will keep you updated throughout the process, providing regular status updates and ensuring that you’re satisfied with the outcome. After your car has been repaired and all issues have been resolved, Progressive will send you a final claim closure notice, confirming that the process is complete.

Progressive Claims: Key Statistics and Insights

Progressive Insurance is renowned for its efficient and effective claims process, backed by a wealth of industry experience and resources. Here are some key statistics and insights that highlight Progressive’s commitment to its policyholders:

Timely Claims Resolution

Progressive prides itself on its quick claims resolution times. On average, simple claims are resolved within a matter of days, ensuring policyholders can get back on the road as soon as possible. In a recent survey, 92% of Progressive customers reported being satisfied with the speed of their claims resolution.

Comprehensive Claims Handling

Progressive offers a wide range of coverage options, ensuring that policyholders have the protection they need. This includes liability coverage, collision coverage, comprehensive coverage, personal injury protection, and more. With Progressive, you can rest assured that your claim will be handled comprehensively, addressing all aspects of the incident.

Expert Claims Adjusters

Progressive employs a team of highly skilled and experienced claims adjusters. These professionals are trained to handle a wide range of claims scenarios, from minor fender-benders to complex multi-vehicle accidents. Their expertise ensures that your claim is assessed fairly and accurately, with a focus on your best interests.

Customer Satisfaction

Progressive’s commitment to customer satisfaction is evident in its high customer satisfaction ratings. In independent surveys, Progressive consistently ranks among the top insurers for customer satisfaction. This is a testament to its efficient claims process, comprehensive coverage options, and dedicated customer support.

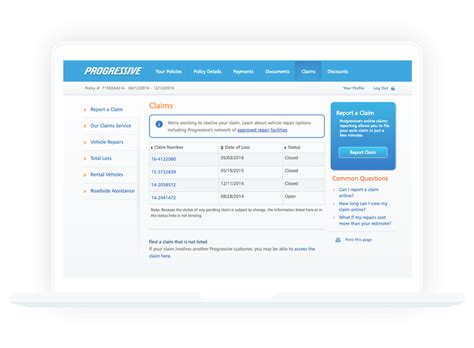

Advanced Technology

Progressive leverages advanced technology to enhance its claims process. This includes mobile apps for easy claim initiation and tracking, online resources for policyholders, and innovative tools for claims adjusters. These technological advancements ensure a seamless and efficient claims experience, keeping policyholders informed every step of the way.

Progressive Claims: A Real-World Example

To further illustrate the Progressive claims process, let’s consider a real-world scenario. Imagine you’re driving home from work when a sudden hailstorm hits. Your car, which is only a few months old, sustains significant hail damage. Here’s how Progressive might handle this claim:

- Initiating the Claim: You can use the Progressive app to start your claim, uploading photos of the damage and providing details about the incident.

- Assessing the Damage: Progressive might send a claims adjuster to your home or workplace to inspect the vehicle. Alternatively, you could take it to a Progressive-approved body shop for an assessment.

- Determining the Claim Value: Based on the extent of the damage and the value of your vehicle, Progressive will calculate the claim value. This might include costs for repairs, rental car coverage, and any other relevant expenses.

- Receiving Payment: Progressive could issue a check directly to the repair shop, or you might prefer to receive the payment via direct deposit. You can choose the method that works best for you.

- Resolving Additional Issues: In this case, there might be additional costs associated with a rental car while your vehicle is being repaired. Progressive would work with you to ensure these costs are covered, providing a seamless experience.

- Closing the Claim: Once your vehicle is repaired and all additional issues are resolved, Progressive will send you a claim closure notice. You can then rest easy, knowing that your claim has been handled efficiently and fairly.

The Future of Progressive Claims

Progressive Insurance is committed to continuously improving its claims process, leveraging technology and innovation to enhance the customer experience. Here are some insights into how Progressive might further evolve its claims process in the future:

AI and Machine Learning

Progressive is exploring the use of AI and machine learning to further streamline the claims process. This could involve automated damage assessment, intelligent claim routing, and enhanced fraud detection. By leveraging these technologies, Progressive can ensure an even faster and more efficient claims experience.

Expanded Digital Services

Progressive is committed to expanding its digital services, making it even easier for policyholders to manage their claims online or via mobile apps. This could include enhanced claim tracking, real-time status updates, and more intuitive interfaces. By embracing digital transformation, Progressive can offer a seamless and convenient claims experience.

Enhanced Customer Support

Progressive is dedicated to providing exceptional customer support, ensuring policyholders have the assistance they need throughout the claims process. This could involve expanded hours for its 24⁄7 claims hotline, more personalized support options, and additional resources to guide policyholders through the process.

Collaborative Claims Resolution

Progressive is exploring ways to enhance collaboration between policyholders, claims adjusters, and repair shops. This could involve shared platforms for real-time communication, digital estimate approvals, and streamlined payment processes. By fostering collaboration, Progressive can further streamline the claims resolution process.

Progressive Claims: Frequently Asked Questions

How long does it typically take for Progressive to resolve a claim?

+The time it takes to resolve a claim can vary based on the complexity of the incident and the nature of the damage. However, Progressive aims to resolve simple claims within a matter of days, while more complex claims may take a few weeks. Progressive keeps policyholders updated throughout the process, providing regular status updates.

Can I track the progress of my claim online or via the Progressive app?

+Absolutely! Progressive offers online and mobile app tracking for your claim. You can log in to your account or use the app to check the status of your claim, view updates, and even upload additional information if needed. This ensures you’re always informed and can actively participate in the claims process.

What if I disagree with Progressive’s assessment of my claim?

+If you have concerns or disagree with Progressive’s assessment, you can reach out to your claims adjuster to discuss your options. Progressive is committed to fairness and transparency, and its claims adjusters are trained to handle these situations professionally and respectfully. You can also refer to your policy documents for more information on the claims process and your rights as a policyholder.

Can I choose my own repair shop for vehicle repairs, or does Progressive have preferred shops?

+Progressive offers policyholders the flexibility to choose their own repair shop. However, they also have a network of preferred repair shops that have met their high standards for quality and customer service. You can choose to use one of these shops, or you can select your own trusted mechanic. Progressive will work with you to ensure your vehicle is repaired to the highest standards, regardless of the shop you choose.

What should I do if I’m involved in an accident while driving a rental car?

+If you’re involved in an accident while driving a rental car, you should follow the same steps as you would for any other accident. This includes contacting Progressive to initiate your claim, providing details about the incident, and allowing them to assess the damage. Progressive will work with you and the rental car company to ensure your claim is handled efficiently and fairly.

Progressive Insurance is dedicated to providing an exceptional claims experience, ensuring policyholders can navigate the process with ease and confidence. With its efficient claims process, comprehensive coverage options, and commitment to customer satisfaction, Progressive continues to set the standard for the insurance industry.