Auto Insurance Explained

Auto insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers around the world. With a multitude of coverage options and varying state regulations, understanding auto insurance can be a complex task. In this comprehensive guide, we delve into the intricacies of auto insurance, shedding light on key concepts, coverage types, and the factors that influence policy costs. Whether you're a seasoned driver or a first-time car owner, this article aims to demystify auto insurance and empower you to make informed decisions about your coverage.

Understanding Auto Insurance Policies

Auto insurance policies are contractual agreements between drivers and insurance companies. These contracts outline the terms and conditions of coverage, including the types of incidents covered, the financial limits of the policy, and any exclusions or limitations. The policy is designed to protect drivers from potential financial losses resulting from accidents, theft, or other covered events.

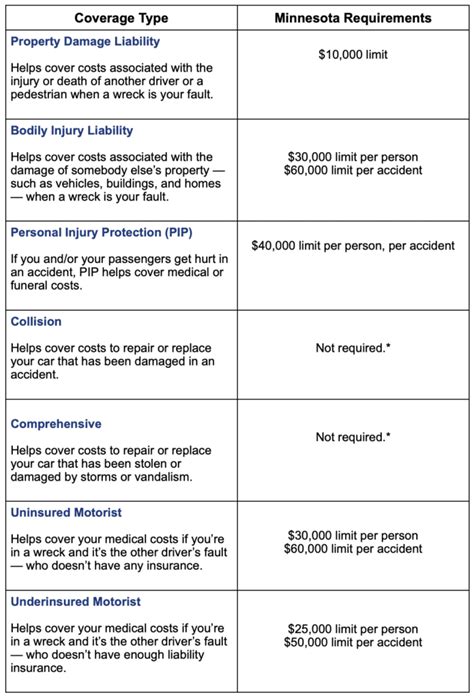

One of the fundamental aspects of auto insurance is liability coverage. This coverage type protects policyholders from financial responsibility in the event of an at-fault accident. It covers bodily injury and property damage claims made by others involved in the accident. Most states have minimum liability requirements, but drivers can opt for higher limits to provide greater protection.

Comprehensive and Collision Coverage

In addition to liability coverage, auto insurance policies often include comprehensive and collision coverage. Comprehensive coverage provides protection against non-collision incidents, such as theft, vandalism, natural disasters, or collisions with animals. Collision coverage, on the other hand, covers damage to the insured vehicle resulting from a collision with another vehicle or object.

These coverage types are optional, but they are highly recommended, especially for newer vehicles or those with outstanding loans. By including comprehensive and collision coverage, drivers can ensure they are protected against a wider range of potential incidents, providing greater financial security.

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal Injury Protection (PIP) and Medical Payments coverage are designed to cover the medical expenses of the policyholder and their passengers in the event of an accident, regardless of fault. PIP coverage is more comprehensive and often includes wage loss and other related benefits. Medical Payments coverage, on the other hand, provides a more limited scope of coverage, typically covering only medical expenses.

The availability and requirements of these coverages vary by state. Some states mandate PIP coverage, while others offer it as an optional add-on. Understanding the specific requirements and benefits of these coverages is crucial when selecting an auto insurance policy.

Uninsured and Underinsured Motorist Coverage

Uninsured and Underinsured Motorist coverage provides protection in the event of an accident with a driver who either has no insurance or insufficient insurance to cover the damages. This coverage is particularly important as it ensures that policyholders are not left with substantial financial burdens when involved in an accident with an uninsured or underinsured driver.

Many states require uninsured motorist coverage, but the limits and specific benefits may vary. It's essential to review the policy's details to understand the scope of this coverage and ensure it aligns with individual needs and state regulations.

Factors Influencing Auto Insurance Costs

The cost of auto insurance policies can vary significantly, influenced by a multitude of factors. Understanding these factors can help drivers make informed decisions when selecting coverage and potentially find ways to reduce their insurance premiums.

Driver’s Profile and History

One of the most significant factors in determining auto insurance costs is the driver’s profile and history. Insurance companies consider factors such as age, gender, driving record, and years of driving experience. Young, inexperienced drivers, for example, are often charged higher premiums due to their increased risk of accidents.

Additionally, a driver's history of accidents, traffic violations, and claims can impact their insurance rates. A clean driving record typically results in lower premiums, while a history of accidents or violations may lead to higher costs or even difficulty in obtaining coverage.

Vehicle Type and Usage

The type of vehicle and its intended usage also play a significant role in insurance costs. Sports cars, luxury vehicles, and SUVs often have higher insurance premiums due to their increased repair costs and higher likelihood of theft. Furthermore, the primary use of the vehicle, such as commuting, pleasure driving, or business purposes, can influence the cost of insurance.

Insurance companies also consider the vehicle's safety features, as vehicles equipped with advanced safety technologies may be eligible for discounts. Factors such as the vehicle's make, model, and year of manufacture are all taken into account when determining insurance costs.

Location and Driving Environment

The location where the vehicle is primarily driven and garaged can significantly impact insurance rates. Urban areas with higher population densities and increased traffic typically have higher insurance costs due to the higher likelihood of accidents and theft. Additionally, the specific neighborhood and its crime rate can also influence insurance premiums.

The driving environment, including weather conditions and road quality, is another factor considered by insurance companies. Areas with severe weather conditions or poor road maintenance may result in higher insurance costs due to the increased risk of accidents and vehicle damage.

| Factor | Impact on Insurance Costs |

|---|---|

| Driver's Profile and History | Age, gender, driving record, and experience influence premiums. |

| Vehicle Type and Usage | Vehicle make, model, safety features, and intended use impact costs. |

| Location and Driving Environment | Urban areas, crime rates, weather conditions, and road quality affect premiums. |

Shopping for Auto Insurance

When shopping for auto insurance, it’s essential to compare policies and quotes from multiple providers. Each insurance company has its own methodology for calculating premiums, and rates can vary significantly between carriers. By obtaining quotes from several companies, you can identify the best value and coverage options for your needs.

Understanding Coverage Options

Before selecting an auto insurance policy, it’s crucial to understand the different coverage options available and their specific benefits. Review the policy’s terms and conditions, including any exclusions or limitations, to ensure you have the desired level of protection. Consider your personal needs and the requirements of your state to determine the appropriate coverage limits and types.

Bundling Policies for Discounts

Bundling multiple insurance policies, such as auto and home insurance, can often result in significant discounts. Many insurance companies offer multi-policy discounts, rewarding customers who consolidate their coverage needs. By bundling policies, you not only save money but also simplify your insurance management by dealing with a single provider.

Using Online Tools and Resources

Online tools and resources can be invaluable when shopping for auto insurance. Insurance company websites often provide interactive tools that allow you to obtain personalized quotes based on your specific circumstances. These tools can help you compare policies, understand coverage options, and identify potential savings.

Additionally, online resources such as insurance comparison websites and forums can provide valuable insights and reviews from other policyholders. These platforms can offer a wealth of information, helping you make informed decisions about your auto insurance coverage.

Making Claims and Understanding Policy Limits

Understanding the claims process and policy limits is crucial when dealing with auto insurance. Knowing how to navigate the claims process efficiently can help ensure you receive the benefits you’re entitled to under your policy.

Filing a Claim

When an accident or covered incident occurs, it’s important to promptly report the incident to your insurance company. Most insurance providers offer multiple channels for reporting claims, including online forms, phone calls, and dedicated mobile apps. Providing accurate and detailed information about the incident can help expedite the claims process.

During the claims process, the insurance company will investigate the incident and assess the damages. They may request additional information, such as police reports, photos of the accident scene, and medical records, to determine the extent of the claim.

Policy Limits and Deductibles

Policy limits refer to the maximum amount of coverage provided by the insurance policy. These limits are typically set for each type of coverage, such as liability, comprehensive, and collision. It’s essential to understand these limits and ensure they align with your desired level of protection.

Deductibles are the amount you, as the policyholder, must pay out of pocket before the insurance coverage kicks in. Higher deductibles often result in lower premiums, as the policyholder assumes a larger portion of the financial responsibility. When selecting a policy, consider the balance between your desired deductible and the potential financial risks you may face.

Understanding Settlement Options

When a claim is approved, the insurance company will offer a settlement, which can take various forms. The settlement may be a cash payment, a repair or replacement of the damaged vehicle, or a combination of both. Understanding your settlement options and their implications is crucial to ensure you receive the appropriate compensation for your losses.

In some cases, you may have the option to choose between a cash settlement and having the insurance company handle the repairs directly. Evaluating your options and considering factors such as the extent of the damage and the value of your vehicle can help you make an informed decision about the settlement process.

Future Trends and Innovations in Auto Insurance

The auto insurance industry is continuously evolving, driven by technological advancements and changing consumer needs. Several trends and innovations are shaping the future of auto insurance, offering enhanced protection and personalized coverage options.

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and data collection devices, is revolutionizing the way auto insurance is priced and delivered. Usage-based insurance (UBI) programs utilize telematics to monitor driving behavior, such as speed, acceleration, and mileage. These programs offer policyholders the opportunity to lower their insurance premiums by demonstrating safe driving habits.

UBI programs provide real-time feedback and insights into driving behavior, allowing policyholders to make informed decisions about their driving habits. This technology is particularly beneficial for young drivers, as it encourages safer driving and provides an opportunity to lower insurance costs.

Artificial Intelligence and Data Analytics

Artificial Intelligence (AI) and data analytics are transforming the auto insurance industry by enabling more accurate risk assessment and personalized coverage. Insurance companies are leveraging AI to analyze vast amounts of data, including driving behavior, weather patterns, and accident statistics, to develop more precise risk models.

By utilizing AI and data analytics, insurance providers can offer more tailored coverage options, providing policyholders with a better understanding of their risks and potential savings. This technology also enhances the claims process, allowing for faster and more accurate assessments of damage and liability.

Connected Car Technology

The rise of connected car technology is reshaping the auto insurance landscape. Connected cars, equipped with advanced sensors and communication capabilities, provide valuable data to insurance companies. This data, including real-time driving behavior and vehicle diagnostics, allows insurers to offer more precise coverage and potentially lower premiums for policyholders.

Connected car technology also enhances the safety and security of vehicles, reducing the risk of accidents and theft. This, in turn, can lead to lower insurance costs for policyholders who opt for connected car technology in their vehicles.

Conclusion

Auto insurance is a critical component of responsible vehicle ownership, providing financial protection and peace of mind to drivers. By understanding the various coverage options, factors influencing insurance costs, and the claims process, you can make informed decisions about your auto insurance coverage.

As the auto insurance industry continues to evolve, embracing technological advancements and personalized coverage options, drivers can expect enhanced protection and greater control over their insurance costs. Staying informed about the latest trends and innovations can help you navigate the complex world of auto insurance and ensure you're always protected on the road.

What are the basic types of auto insurance coverage?

+

The basic types of auto insurance coverage include liability coverage, comprehensive coverage, collision coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Each type provides different levels of protection and covers specific aspects of vehicle ownership and potential incidents.

How do I choose the right auto insurance coverage for my needs?

+

When choosing auto insurance coverage, consider your specific needs and financial situation. Assess the risks you face on the road, such as accidents, theft, or weather-related incidents. Evaluate the coverage options available, including liability, comprehensive, and collision coverage, and choose limits that provide adequate protection without exceeding your budget.

Can I lower my auto insurance premiums?

+

Yes, there are several ways to potentially lower your auto insurance premiums. These include maintaining a clean driving record, taking advantage of multi-policy discounts by bundling your auto insurance with other types of insurance, and considering usage-based insurance programs that offer discounts for safe driving behavior.

What should I do if I’m involved in an accident?

+

If you’re involved in an accident, stay calm and ensure the safety of all involved parties. Exchange information with the other driver(s), including names, contact details, and insurance information. Take photos of the accident scene and any visible damage. Promptly report the accident to your insurance company and provide them with all the necessary details.

How does my driving record impact my auto insurance rates?

+

Your driving record plays a significant role in determining your auto insurance rates. A clean driving record with no accidents or traffic violations typically results in lower premiums. Conversely, a history of accidents or violations can lead to higher insurance costs or even difficulty in obtaining coverage. Insurance companies use your driving record to assess your level of risk and set your premiums accordingly.