Pre Existing Conditions Insurance

In the world of health insurance, one of the most critical considerations is the coverage of pre-existing conditions. These are medical conditions or health issues that an individual has prior to applying for insurance. The impact of pre-existing conditions on insurance policies is a complex and often confusing topic, but it's one that affects millions of people worldwide. This comprehensive guide aims to shed light on the intricacies of pre-existing conditions insurance, offering an in-depth analysis of its various aspects.

Understanding Pre-Existing Conditions

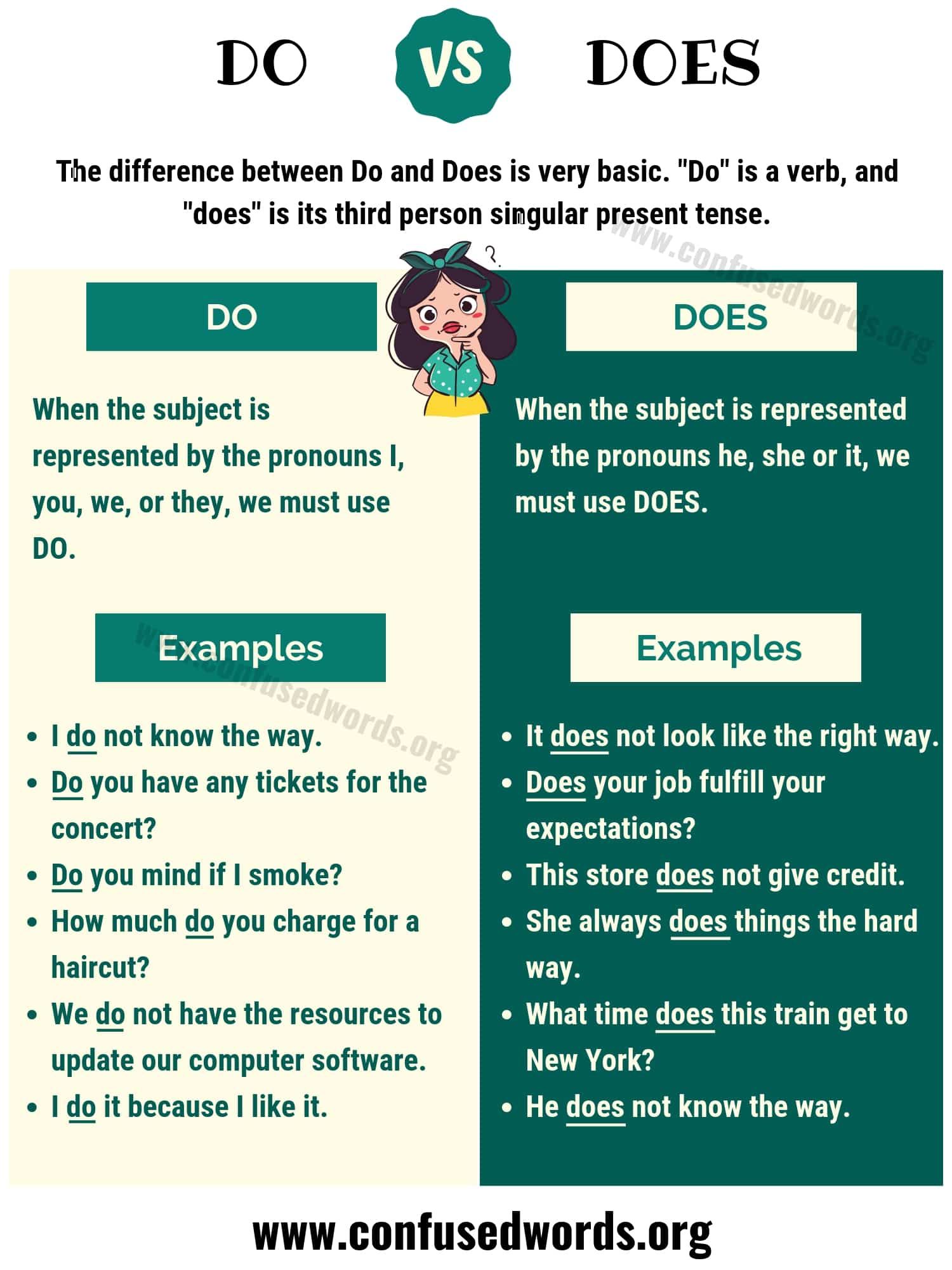

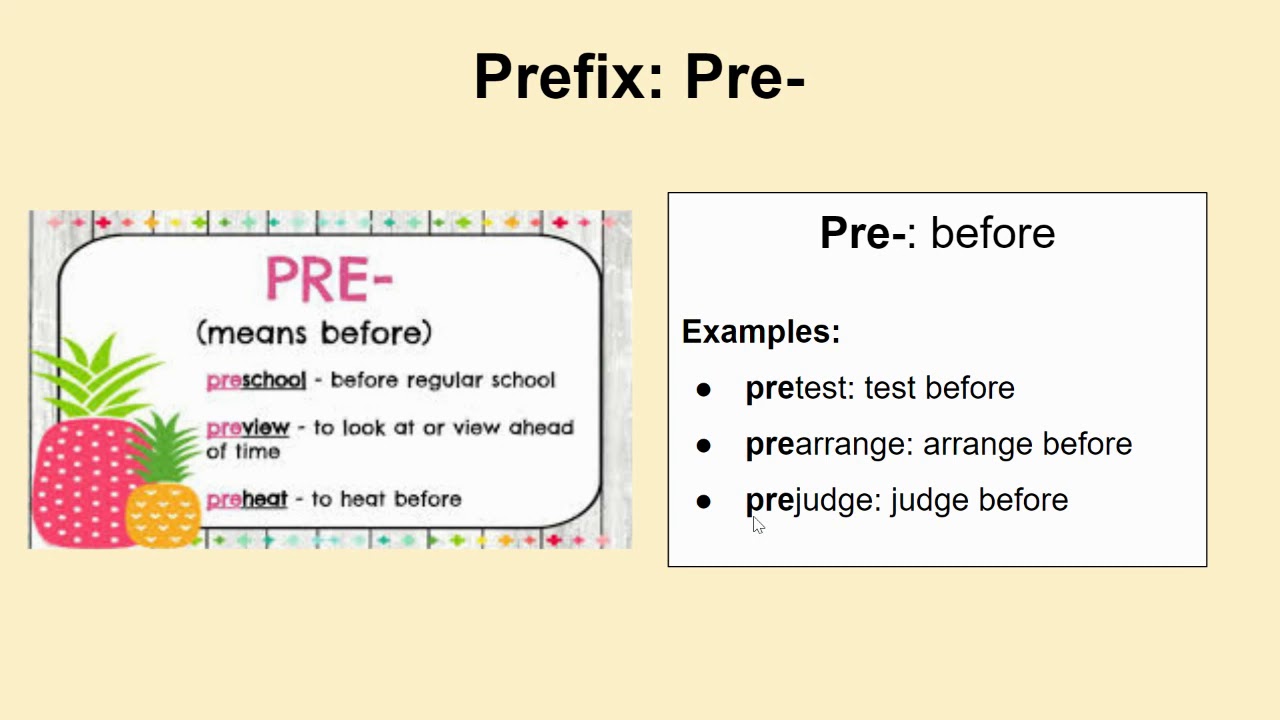

Pre-existing conditions are defined as any medical diagnosis, treatment, or symptom that occurred before an individual’s health insurance coverage began. This can include a wide range of health issues, from chronic diseases like diabetes or heart conditions to more common ailments such as asthma, arthritis, or even mental health disorders. The specific definition and scope of pre-existing conditions may vary depending on the insurance provider and the country’s healthcare regulations.

The management of pre-existing conditions is a delicate balance for both insurers and policyholders. On one hand, insurers must ensure the financial sustainability of their plans, often leading to careful consideration of applicants' health histories. On the other hand, individuals with pre-existing conditions require comprehensive coverage to manage their health effectively.

The Impact on Insurance Policies

The influence of pre-existing conditions on insurance policies is multi-faceted. Here’s a closer look at some of the key areas:

Coverage Options

Insurance providers approach pre-existing conditions in various ways. Some offer full coverage for all conditions, ensuring that policyholders can access the necessary treatments without discrimination. This inclusive approach is particularly beneficial for individuals with complex medical histories.

However, partial coverage is more common. In these cases, insurers may place certain conditions or limitations on the coverage of pre-existing conditions. This can include waiting periods, where the insurance policy doesn't cover the condition for a specified time after enrollment, or pre-authorization requirements, where certain treatments or procedures must be approved in advance.

Additionally, some insurers may exclude specific conditions from coverage altogether. This exclusion can be for a set period or even permanently, depending on the severity and nature of the condition.

Premium Calculations

The presence of pre-existing conditions can significantly impact the cost of insurance premiums. Insurers often use risk assessment models to determine the likelihood of an individual requiring medical care and the associated costs. For those with pre-existing conditions, this can result in higher premiums to offset the increased risk.

However, it's important to note that not all insurers follow this practice. In countries with stricter healthcare regulations, there may be laws in place to prevent insurers from charging higher premiums based solely on pre-existing conditions. These regulations aim to ensure that individuals with health issues can access affordable insurance.

Legal and Ethical Considerations

The management of pre-existing conditions in insurance is not just a financial matter but also a legal and ethical one. Many countries have implemented laws and regulations to protect individuals with pre-existing conditions, ensuring they have access to insurance without discrimination.

For instance, the Affordable Care Act (ACA) in the United States prohibits insurers from denying coverage or charging more for individuals with pre-existing conditions. This landmark legislation has significantly improved access to healthcare for millions of Americans.

Navigating Pre-Existing Conditions Insurance

For individuals with pre-existing conditions, navigating the insurance landscape can be challenging but not insurmountable. Here are some strategies to consider:

Research and Compare Policies

Not all insurance policies are created equal. It’s essential to research and compare different plans to find one that best suits your needs. Look for policies that offer comprehensive coverage for your specific condition, with minimal exclusions and limitations.

Consider working with an insurance broker or advisor who can provide expert guidance and help you understand the intricacies of different policies. They can also assist in negotiating better terms, especially if you have a complex medical history.

Utilize Government Programs

Many countries offer government-funded healthcare programs that provide coverage for pre-existing conditions. These programs often have specific eligibility criteria, so it’s crucial to understand if you qualify and what the benefits entail.

For instance, in the United States, Medicaid is a government-funded program that provides healthcare coverage to eligible low-income individuals and families, including those with pre-existing conditions. Similarly, Medicare covers individuals aged 65 and over, as well as those with certain disabilities, and often includes coverage for pre-existing conditions.

Consider Group Insurance

Group insurance plans, often offered through employers, can be a more affordable and accessible option for individuals with pre-existing conditions. These plans pool the risk across a large group, which can lead to more favorable terms and lower premiums.

Employers may also have specific provisions in place to protect employees with pre-existing conditions, ensuring they can access necessary healthcare without financial burden.

The Future of Pre-Existing Conditions Insurance

The landscape of pre-existing conditions insurance is continually evolving, influenced by changing healthcare regulations, advancements in medical technology, and shifts in societal attitudes. Here’s a glimpse into the potential future of this critical aspect of health insurance:

Technology-Driven Solutions

The integration of digital health technologies is poised to revolutionize the management of pre-existing conditions. Wearable devices, remote monitoring systems, and artificial intelligence-powered diagnostic tools can provide insurers with more accurate and real-time data on an individual’s health status.

This data-driven approach could lead to more precise risk assessments, potentially reducing the impact of pre-existing conditions on insurance premiums. Additionally, these technologies can empower individuals to better manage their health, leading to improved outcomes and reduced healthcare costs.

Shifting Regulatory Landscapes

Healthcare regulations play a pivotal role in shaping the insurance industry’s approach to pre-existing conditions. As societies evolve, so too do their healthcare systems, often leading to stricter regulations aimed at protecting individuals with pre-existing conditions.

In the coming years, we may see more countries adopting legislation similar to the ACA, ensuring that insurance providers cannot discriminate against individuals based on their health history. This shift towards more inclusive healthcare systems is a promising development for those with pre-existing conditions.

Focus on Preventive Care

A growing emphasis on preventive healthcare could significantly impact the management of pre-existing conditions. By investing in early detection and preventive measures, insurers and healthcare providers can potentially mitigate the severity of certain conditions, leading to better health outcomes and reduced healthcare costs.

This shift in focus could see insurance policies incentivizing healthy lifestyles and early intervention, which could, in turn, reduce the financial burden associated with pre-existing conditions.

Personalized Medicine

Advancements in genomics and personalized medicine are likely to play a significant role in the future of pre-existing conditions insurance. As our understanding of the human genome deepens, insurers may be able to offer more tailored coverage based on an individual’s genetic predispositions.

This personalized approach could lead to more accurate risk assessments and potentially more affordable insurance options for individuals with specific genetic profiles.

How do insurers determine if a condition is pre-existing?

+Insurers typically define a pre-existing condition as a medical diagnosis, treatment, or symptom that occurred before an individual’s insurance coverage began. This can be determined through medical records, physician referrals, or even self-reported health history during the application process.

Can I get insurance if I have a pre-existing condition?

+Yes, it is possible to obtain insurance with a pre-existing condition. Many insurers offer coverage for these conditions, although the terms and premiums may vary. It’s essential to research and compare policies to find the best fit for your needs.

Are there any countries where pre-existing conditions are not a concern for insurance coverage?

+Some countries, like the United Kingdom, have a national healthcare system where insurance is not required. In these systems, access to healthcare is often based on residency, not on an individual’s health history.