What Is Long Term Insurance

Long-term insurance is a financial tool designed to provide individuals and businesses with protection and peace of mind over an extended period. This type of insurance offers coverage for various long-term risks and uncertainties, ensuring that policyholders can manage potential financial burdens and maintain stability during challenging times.

Understanding Long-Term Insurance

Long-term insurance is a broad term encompassing various policies that provide coverage for an extended duration, typically ranging from several years to an entire lifetime. These policies aim to safeguard individuals and their families from the financial consequences of unforeseen events, such as accidents, illnesses, or disabilities, which can significantly impact their ability to earn an income or maintain their standard of living.

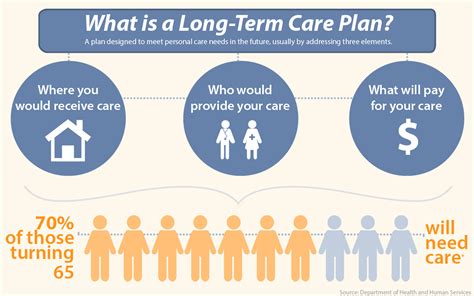

One of the key advantages of long-term insurance is its focus on providing coverage for longevity-related risks. As life expectancy increases, individuals face the prospect of living longer, which may result in extended periods of retirement or the need for long-term care. Long-term insurance policies are tailored to address these specific concerns, ensuring that policyholders can access the necessary financial support to maintain their quality of life.

Types of Long-Term Insurance

Long-term insurance encompasses a range of policies, each designed to address specific needs and risks. Here are some common types of long-term insurance:

- Life Insurance: This is perhaps the most well-known form of long-term insurance. Life insurance policies provide financial protection to beneficiaries in the event of the policyholder's death. They can offer peace of mind to families, ensuring they can manage funeral expenses and maintain their financial stability.

- Disability Insurance: Disability insurance, also known as income protection insurance, provides coverage for individuals who become unable to work due to a disability or injury. It replaces a portion of their income, ensuring they can meet their financial obligations and maintain their lifestyle.

- Critical Illness Insurance: This type of insurance provides a lump-sum payment to policyholders upon the diagnosis of a specified critical illness, such as cancer, heart disease, or stroke. It can help cover medical expenses, loss of income, and other financial burdens associated with the illness.

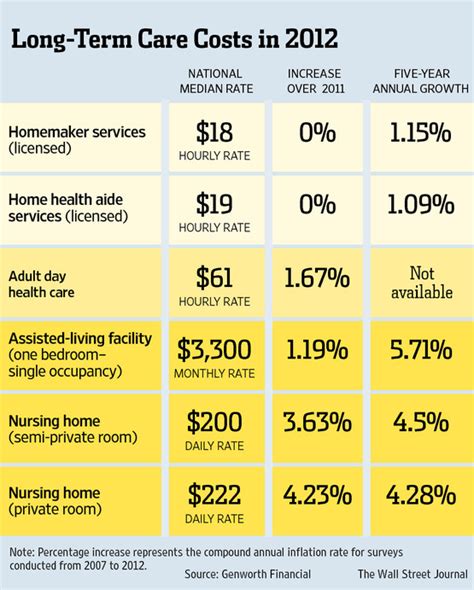

- Long-Term Care Insurance: As the name suggests, long-term care insurance is designed to cover the costs of extended care needed due to age, illness, or disability. This can include assistance with daily activities, nursing home care, or in-home care services.

- Annuities: Annuities are long-term investment contracts that provide a steady stream of income during retirement. They can be structured in various ways, offering guaranteed income for a specific period or for the policyholder's lifetime.

Key Considerations for Long-Term Insurance

When considering long-term insurance, it’s essential to evaluate your specific needs and circumstances. Here are some factors to keep in mind:

- Coverage Period: Determine the duration of coverage you require. Some policies offer coverage until a specific age, while others provide lifetime protection.

- Benefit Amount: Assess the amount of coverage you need to meet your financial goals and obligations. Consider your income, expenses, and the potential impact of unforeseen events.

- Premiums: Long-term insurance policies can vary significantly in cost. Evaluate your budget and choose a policy with premiums that align with your financial capabilities.

- Exclusions and Limitations: Carefully review the policy's terms and conditions to understand any exclusions or limitations. Ensure that the coverage aligns with your specific needs and risks.

- Provider Reputation: Choose a reputable insurance provider with a solid track record of claims handling and customer satisfaction. Research and compare different providers to find the best fit for your needs.

Additionally, it's beneficial to seek professional advice from financial advisors or insurance brokers who can guide you through the process of selecting the most suitable long-term insurance policy.

Real-World Benefits of Long-Term Insurance

Long-term insurance has proven to be a valuable tool for individuals and families, offering numerous benefits:

| Benefit | Description |

|---|---|

| Financial Security | Long-term insurance provides a safety net, ensuring that policyholders and their families can maintain their financial stability during challenging times. |

| Peace of Mind | Knowing that you have coverage for potential risks allows individuals to focus on their well-being and long-term goals without constant financial worries. |

| Income Replacement | Disability and income protection insurance policies replace a portion of an individual's income, ensuring they can continue to meet their financial obligations even if they become unable to work. |

| Coverage for Critical Illnesses | Critical illness insurance provides a much-needed financial cushion to cover medical expenses and other costs associated with serious illnesses. |

| Long-Term Care Support | Long-term care insurance ensures that individuals can access the necessary care and support they may require as they age or face health challenges. |

The real-world impact of long-term insurance is evident in the stories of policyholders who have relied on their coverage during difficult times. For instance, a family with a young child diagnosed with a critical illness was able to focus on their child's treatment and recovery without the added stress of financial burdens, thanks to their critical illness insurance policy.

Future Implications and Trends

The long-term insurance industry is continually evolving to meet the changing needs and risks of individuals and societies. As medical advancements and longevity increase, the demand for long-term care insurance and other longevity-focused policies is likely to rise.

Additionally, with the rise of remote work and the gig economy, the need for disability insurance and income protection is becoming increasingly crucial for individuals with non-traditional employment arrangements. Insurance providers are adapting their policies to cater to these evolving work dynamics.

Furthermore, technological advancements are shaping the long-term insurance landscape. Insurtech companies are leveraging data analytics and artificial intelligence to offer more personalized and efficient insurance solutions. This includes the use of wearable devices to monitor health and lifestyle factors, which can influence insurance premiums and coverage.

In conclusion, long-term insurance plays a vital role in safeguarding individuals and businesses from the financial uncertainties of the future. By providing coverage for a range of risks, these policies offer peace of mind and financial security, ensuring that policyholders can navigate life's challenges with confidence.

What is the difference between long-term and short-term insurance?

+Long-term insurance provides coverage for an extended period, often lasting several years or a lifetime. It focuses on addressing longevity-related risks and financial stability. Short-term insurance, on the other hand, offers coverage for a more immediate and shorter duration, typically for a year or less. It is often used to cover temporary risks or needs, such as travel insurance or event-specific coverage.

How does long-term insurance impact retirement planning?

+Long-term insurance plays a crucial role in retirement planning by providing a financial safety net. Policies like annuities offer guaranteed income streams during retirement, ensuring individuals can maintain their desired standard of living. Additionally, life insurance policies can be structured to provide inheritance tax planning benefits, allowing individuals to pass on their wealth more efficiently to their beneficiaries.

What factors should I consider when choosing a long-term insurance policy?

+When selecting a long-term insurance policy, consider your specific needs and financial circumstances. Assess the coverage period, benefit amount, and premium costs. Review the policy’s terms and conditions to understand any exclusions or limitations. Seek advice from financial advisors or insurance brokers to ensure you choose a policy that aligns with your goals and provides adequate protection.