Who Has The Best Car Insurance

When it comes to choosing the best car insurance, there is no one-size-fits-all solution. The best insurance provider for you will depend on a variety of factors, including your specific needs, the coverage options available, and the cost of premiums. However, we can delve into the world of car insurance and provide an in-depth analysis to help you make an informed decision.

Understanding Car Insurance and Its Importance

Car insurance is a crucial aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. It ensures that you are covered for potential liabilities and can help cover the costs of repairs or replacements. Understanding the different types of car insurance and their coverage is essential to finding the best policy for your situation.

Types of Car Insurance Coverage

There are several key types of car insurance coverage to consider:

- Liability Coverage: This covers damages or injuries you cause to others in an accident. It is often required by law and protects you from significant financial losses.

- Comprehensive Coverage: Comprehensive insurance provides protection for non-collision incidents, such as theft, vandalism, natural disasters, or damage caused by animals.

- Collision Coverage: As the name suggests, this coverage pays for repairs or replacements needed after a collision, regardless of fault.

- Medical Payments Coverage: This type of insurance covers medical expenses for you and your passengers in the event of an accident, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in when the at-fault driver does not have sufficient insurance to cover the damages they caused.

- Additional Coverages: Some insurers offer specialized coverages like rental car reimbursement, gap insurance, or custom parts coverage, which can be beneficial depending on your needs.

Factors to Consider When Choosing an Insurance Provider

When evaluating car insurance providers, several key factors come into play:

- Coverage Options: Ensure the provider offers the specific types of coverage you require. Some insurers may specialize in certain areas, so it’s important to find one that aligns with your needs.

- Premium Costs: Compare quotes from multiple insurers to find the most competitive rates. Keep in mind that the cheapest option might not always provide the best value.

- Financial Stability: Look for insurers with a strong financial rating, ensuring they can meet their obligations in the event of a claim.

- Customer Service: Consider the insurer’s reputation for customer satisfaction and responsiveness. Efficient and friendly service can make a big difference when you need it most.

- Claims Process: Research the insurer’s claims process and history. A streamlined and efficient claims process can save you time and stress during a difficult situation.

- Discounts and Additional Benefits: Many insurers offer discounts for safe driving, multiple policies, or other factors. Additionally, some providers offer perks like roadside assistance or digital tools to enhance the customer experience.

Top Car Insurance Providers: A Comparative Analysis

Let’s explore some of the top car insurance providers and analyze their offerings to help you make an informed choice:

Provider 1: State Farm

State Farm is a well-established insurance provider known for its comprehensive coverage options and extensive network of local agents. Here’s a closer look at what they offer:

- Coverage Options: State Farm provides a wide range of coverage, including liability, collision, comprehensive, and medical payments coverage. They also offer specialized coverages like rental car reimbursement and roadside assistance.

- Premium Costs: State Farm’s premiums are generally competitive, and they offer various discounts to help reduce costs. These include discounts for safe driving, multiple policies, and even for students with good grades.

- Financial Stability: With an A++ rating from AM Best, State Farm is among the most financially stable insurers, ensuring they can handle large claims.

- Customer Service: State Farm is renowned for its excellent customer service, with a dedicated network of local agents who provide personalized assistance.

- Claims Process: The insurer’s claims process is efficient and straightforward, with a dedicated claims team and a mobile app for convenient claim management.

- Additional Benefits: State Farm offers a range of digital tools and resources, including a mobile app for policy management and a robust website with educational resources.

Provider 2: GEICO

GEICO, an acronym for Government Employees Insurance Company, is known for its competitive pricing and digital-first approach. Here’s an overview of their offerings:

- Coverage Options: GEICO provides standard coverage options, including liability, collision, and comprehensive coverage. They also offer specialized coverages like emergency roadside service and rental car reimbursement.

- Premium Costs: GEICO is renowned for its affordable premiums, making it a top choice for budget-conscious consumers. They offer various discounts, including multi-policy discounts and savings for safe driving.

- Financial Stability: With an A++ rating from AM Best, GEICO is financially secure, ensuring it can handle large claims.

- Customer Service: GEICO provides 24⁄7 customer service through its mobile app, website, and phone support. While they do not have local agents, their digital platform is user-friendly and efficient.

- Claims Process: GEICO’s claims process is streamlined, allowing for quick and efficient claim management. Policyholders can file claims online, via the mobile app, or over the phone.

- Additional Benefits: GEICO offers a range of digital tools, including a mobile app for policy management and claims filing. They also provide educational resources and a robust online community for customers.

Provider 3: Progressive

Progressive is a popular insurance provider known for its innovative products and customer-centric approach. Here’s what they bring to the table:

- Coverage Options: Progressive offers a comprehensive range of coverage options, including liability, collision, comprehensive, and medical payments coverage. They also provide specialized coverages like gap insurance and custom parts coverage.

- Premium Costs: Progressive’s premiums are competitive, and they offer various discounts to help reduce costs. These include discounts for safe driving, multiple policies, and even for completing a defensive driving course.

- Financial Stability: Progressive is financially stable, with an A+ rating from AM Best, ensuring it can handle large claims.

- Customer Service: Progressive provides excellent customer service, with a dedicated team of experts available 24⁄7 via phone, email, or live chat. They also offer a user-friendly mobile app for policy management.

- Claims Process: Progressive’s claims process is efficient and straightforward, with a dedicated claims team and a mobile app for convenient claim management. They even offer a photo estimate feature for quick assessments.

- Additional Benefits: Progressive offers a range of innovative products, including usage-based insurance (Snapshot) and a name-your-price tool, allowing customers to find the coverage that fits their budget.

Finding the Best Car Insurance for Your Needs

Choosing the best car insurance provider involves considering your specific needs, the coverage options available, and the cost of premiums. While the providers discussed above are among the top in the industry, it’s essential to compare quotes and assess which insurer aligns best with your requirements.

Remember, car insurance is a critical aspect of vehicle ownership, and it's worth taking the time to find the right coverage for your situation. By evaluating coverage options, financial stability, customer service, and additional benefits, you can make an informed decision and ensure you have the protection you need on the road.

Frequently Asked Questions

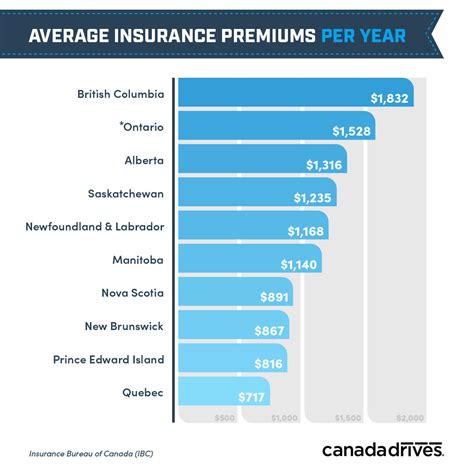

What is the average cost of car insurance in the United States?

+The average cost of car insurance varies across the United States, with factors like location, driving history, and vehicle type influencing premiums. As of 2023, the national average for car insurance is around 1,674 per year, or approximately 139 per month. However, rates can range significantly, from as low as 500 to over 3,000 annually, depending on individual circumstances.

How can I get cheaper car insurance rates?

+There are several strategies to obtain more affordable car insurance rates. These include shopping around for quotes from multiple insurers, maintaining a clean driving record, bundling policies (such as combining auto and home insurance), increasing your deductible, and taking advantage of discounts offered by insurers. Additionally, considering usage-based insurance programs, which base premiums on actual driving behavior, can lead to significant savings for safe drivers.

What factors influence car insurance premiums?

+Car insurance premiums are influenced by a variety of factors, including your age, gender, driving history, location, and the type of vehicle you drive. Insurers also consider the level of coverage you choose, with more comprehensive policies typically costing more. Other factors like credit score and marital status can also impact premiums, as these are seen as indicators of financial responsibility.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy at least once a year, or whenever your policy renews. This allows you to assess whether your coverage still meets your needs and whether you’re getting the best rates. It’s also a good opportunity to shop around for new quotes and potentially switch providers to save money or improve coverage.