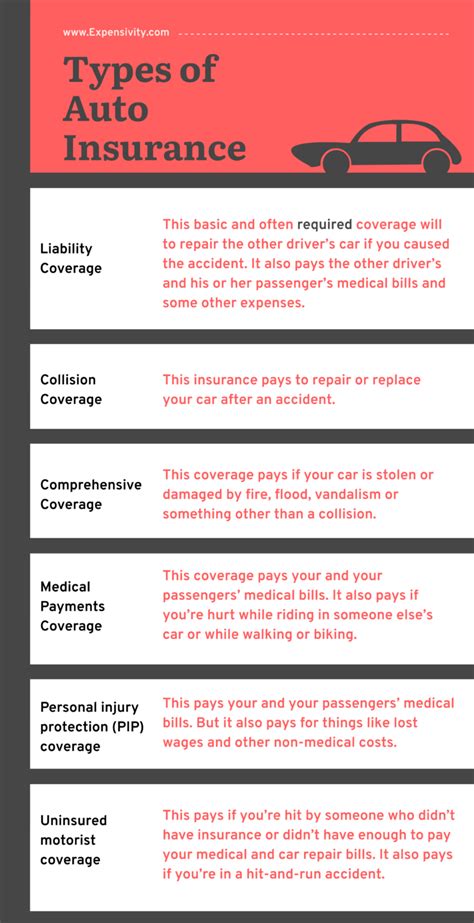

Types Of Car Insurance Coverage

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers. With a wide range of coverage options available, it's crucial to understand the different types of car insurance policies and their specific benefits. In this comprehensive guide, we will delve into the various car insurance coverages, their key features, and how they can safeguard your automotive journey.

Understanding Car Insurance Coverage Types

Car insurance coverage is designed to protect policyholders from financial losses arising from unexpected events, such as accidents, theft, or natural disasters. Each type of coverage serves a unique purpose, offering different levels of protection and addressing specific risks associated with owning and operating a vehicle. By familiarizing yourself with these coverage options, you can make informed decisions to tailor your insurance policy to your individual needs.

Liability Coverage

Liability coverage is a fundamental component of car insurance and is often mandatory in many regions. This coverage type safeguards you against financial liabilities arising from accidents where you are at fault. It covers the costs associated with bodily injuries, property damage, and legal expenses incurred by the other party involved in the accident.

Bodily Injury Liability

Bodily injury liability coverage pays for the medical expenses and lost wages of the injured party. It also covers legal fees if a lawsuit is filed against you. This coverage is crucial as it protects you from potentially devastating financial consequences in the event of a serious accident.

Property Damage Liability

Property damage liability coverage compensates for the repair or replacement costs of the other driver’s vehicle or any other property damaged in the accident. This includes damage to fences, buildings, or even other people’s belongings. Having adequate property damage liability coverage ensures that you are not left financially burdened by these unexpected expenses.

Examples and Real-World Scenarios

Imagine you’re driving on a busy road and accidentally rear-end another vehicle, causing significant damage. Without liability coverage, you would be solely responsible for covering the costs of repairing the other driver’s car, as well as any medical bills if they sustain injuries. This could result in a substantial financial burden.

| Coverage Type | Example Scenario |

|---|---|

| Bodily Injury Liability | You cause an accident resulting in serious injuries to the other driver. This coverage pays for their medical treatment and lost income. |

| Property Damage Liability | Your car collides with a parked vehicle, causing extensive damage. Property damage liability coverage helps cover the repair costs for the parked car. |

Collision Coverage

Collision coverage is an optional type of car insurance that provides protection for your own vehicle in the event of a collision. It covers the costs of repairing or replacing your car if it is damaged in an accident, regardless of who is at fault.

Key Features

Collision coverage offers several advantages. Firstly, it ensures that you are not left paying for expensive repairs out of pocket. Secondly, it can be especially beneficial if you have a newer or more valuable vehicle, as the costs associated with repairs or replacements can be significant.

Deductibles and Coverage Limits

When opting for collision coverage, you typically choose a deductible, which is the amount you agree to pay out of pocket before the insurance coverage kicks in. Deductibles can vary, and selecting a higher deductible can lower your insurance premiums. Additionally, collision coverage often has a coverage limit, which is the maximum amount the insurance company will pay for a claim.

Real-Life Collision Scenarios

Consider a scenario where you are driving on a rainy night and skid on a patch of black ice, resulting in a collision with a guardrail. Without collision coverage, you would be responsible for the full cost of repairing the extensive damage to your vehicle’s front end.

| Scenario | Collision Coverage Benefit |

|---|---|

| You collide with a deer while driving at night. | Collision coverage covers the repairs needed to fix the damage caused by the impact. |

| A careless driver rear-ends your car at a stoplight. | With collision coverage, you can have your car repaired without worrying about the costs. |

Comprehensive Coverage

Comprehensive coverage, often referred to as “comp” coverage, is another essential aspect of car insurance. It provides protection for your vehicle against damages caused by non-collision events, such as theft, vandalism, natural disasters, and other unforeseen circumstances.

Protection Against Unforeseen Risks

Comprehensive coverage is particularly valuable as it covers a wide range of unexpected situations that could result in costly repairs or even the total loss of your vehicle. Here are some common scenarios where comprehensive coverage comes into play:

- Your car is stolen from a parking lot.

- Vandals key your vehicle, causing significant damage.

- A fallen tree branch dents your car's roof during a storm.

- Your car is damaged by hail during a severe weather event.

How Comprehensive Coverage Works

When you file a claim under comprehensive coverage, the insurance company will typically cover the cost of repairs or provide you with the actual cash value of your vehicle if it is deemed a total loss. However, similar to collision coverage, you will be responsible for paying the deductible before the insurance benefits kick in.

Comprehensive Coverage Example

Imagine you park your car in a busy city center, and when you return, you find that the side mirror has been smashed and the window is shattered. Without comprehensive coverage, you would have to pay for the repairs or replacement out of your own pocket. With comprehensive coverage, your insurance provider would cover these costs, ensuring your vehicle is back in shape.

Personal Injury Protection (PIP)

Personal Injury Protection, commonly known as PIP, is a coverage type that provides additional protection for the policyholder and their passengers in the event of an accident. It focuses on covering medical expenses and lost wages, regardless of who is at fault in the accident.

Benefits of PIP

PIP coverage is especially beneficial as it ensures that you and your passengers receive prompt medical attention without worrying about immediate financial constraints. It covers a wide range of medical expenses, including:

- Doctor and hospital visits.

- Prescription medications.

- Physical therapy and rehabilitation.

- Lost wages due to time taken off work for recovery.

PIP Coverage Example

In a scenario where you are involved in a rear-end collision, and you sustain minor injuries, PIP coverage would kick in to cover your medical bills and any lost wages during your recovery period. This ensures that you can focus on healing without the added stress of financial concerns.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage provides protection in situations where you are involved in an accident with a driver who either lacks insurance or has inadequate coverage to fully compensate for the damages caused.

Protection Against Uninsured Drivers

Uninsured motorist coverage steps in to cover your medical expenses, property damage, and lost wages if the at-fault driver does not have insurance. This coverage ensures that you are not left financially burdened due to the actions of an uninsured driver.

Underinsured Motorist Coverage

Underinsured motorist coverage comes into play when the at-fault driver’s insurance coverage is insufficient to cover all the damages caused. In such cases, your insurance provider will step in to cover the remaining expenses, ensuring that you receive fair compensation.

Real-Life Scenarios

Consider a situation where you are involved in an accident with a driver who is at fault but has no insurance. Without uninsured motorist coverage, you would be responsible for covering your own medical bills and vehicle repairs. With this coverage, your insurance provider would handle these expenses, providing you with the necessary financial support.

Medical Payments Coverage (MedPay)

Medical Payments Coverage, or MedPay, is an optional car insurance coverage that provides quick and convenient medical expense coverage for you and your passengers after an accident, regardless of fault.

Benefits of MedPay

MedPay offers several advantages. Firstly, it provides prompt coverage for medical expenses, ensuring that you can receive the necessary treatment without delays. Secondly, it has a separate limit from your liability coverage, meaning it does not reduce your liability limits.

How MedPay Works

When you opt for MedPay coverage, you select a specific limit, such as 5,000 or 10,000, which represents the maximum amount your insurance provider will pay for medical expenses per person. This coverage is particularly beneficial for minor accidents where the injuries are not severe enough to warrant a lawsuit but still require medical attention.

MedPay Example

In a low-speed fender bender, you sustain minor neck and back injuries. With MedPay coverage, you can receive immediate medical treatment, and your insurance provider will cover the costs up to the chosen limit, providing you with quick relief from medical bills.

Conclusion: Tailoring Your Car Insurance Coverage

Understanding the various types of car insurance coverage is crucial for making informed decisions about your policy. Whether it’s protecting yourself from financial liabilities, covering the costs of repairing your vehicle, or providing additional medical coverage, each type of insurance serves a unique purpose.

By carefully considering your individual needs, the value of your vehicle, and the risks you face on the road, you can tailor your car insurance coverage to ensure comprehensive protection. Remember, the right insurance policy provides not only financial security but also peace of mind, allowing you to enjoy your automotive journey with confidence.

How do I choose the right car insurance coverage for my needs?

+Choosing the right car insurance coverage involves assessing your individual circumstances and priorities. Consider factors such as the value of your vehicle, the risks you face in your area, and your financial ability to cover potential expenses. Additionally, consult with insurance professionals to understand the specific coverage options available in your region.

Are there any mandatory car insurance coverages I should be aware of?

+Yes, many regions have mandatory car insurance coverages, such as liability insurance. These requirements vary by location, so it’s essential to familiarize yourself with the specific laws and regulations in your area to ensure you meet the minimum insurance standards.

Can I customize my car insurance policy with additional coverages?

+Absolutely! Car insurance policies can be customized to suit your specific needs. You can opt for additional coverages like collision, comprehensive, or personal injury protection to enhance your protection and provide peace of mind. Discuss your options with your insurance provider to create a tailored policy.