Stat Farm Insurance

In the world of insurance, understanding the intricacies of coverage and the companies that offer it is essential. This comprehensive article delves into the depths of one such entity, State Farm Insurance, a name synonymous with insurance services across the United States. We will explore its history, services, unique features, and its impact on the insurance landscape, providing you with an in-depth understanding of this industry giant.

A Legacy of Service: The State Farm Story

State Farm Insurance, with its headquarters in Bloomington, Illinois, stands as a pillar in the insurance industry. Founded in 1922 by George J. Mecherle, a former farmer and insurance salesman, State Farm began as a small auto insurance agency with a singular goal: to provide affordable and reliable insurance to farmers and rural motorists, a demographic often overlooked by insurance providers of the time.

The company's initial success can be attributed to Mecherle's innovative business model. He recognized the potential of offering insurance policies directly to customers, a practice that was not common at the time. This direct-to-consumer approach allowed State Farm to cut out middlemen and provide more competitive rates. Mecherle's strategy proved successful, and State Farm's popularity grew rapidly, expanding its reach beyond rural areas and into urban markets.

Over the years, State Farm has evolved and expanded its offerings. Today, it is one of the largest providers of auto, home, life, and health insurance in the United States. The company's commitment to customer service and its extensive network of local agents have contributed significantly to its enduring success and popularity.

Comprehensive Services: What Does State Farm Offer?

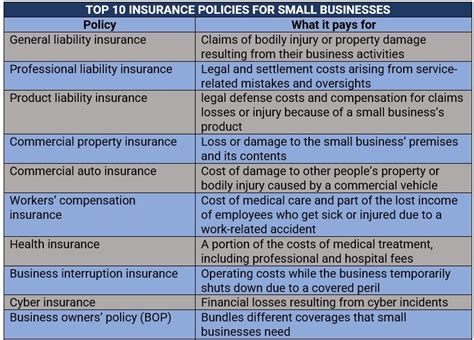

State Farm’s service portfolio is diverse and comprehensive, catering to a wide range of insurance needs. Here’s a breakdown of their key offerings:

Auto Insurance

State Farm’s roots lie in auto insurance, and it remains one of their flagship services. They offer a variety of auto insurance plans, including liability, collision, comprehensive, and personal injury protection (PIP) coverage. State Farm also provides discounts for safe driving, multiple vehicles, and bundled policies, making their auto insurance offerings highly competitive.

Home Insurance

State Farm’s home insurance policies are designed to protect homeowners and renters alike. Their coverage includes protection against damages caused by fire, theft, and natural disasters. State Farm also offers additional coverage for personal belongings and liability protection. With their extensive network of agents, State Farm can provide personalized home insurance solutions tailored to individual needs.

Life Insurance

State Farm offers a range of life insurance policies, including term life, whole life, and universal life insurance. These policies are designed to provide financial protection to beneficiaries in the event of the policyholder’s death. State Farm’s life insurance plans offer flexible terms and options, allowing policyholders to customize their coverage to suit their specific needs and budgets.

Health Insurance

State Farm’s health insurance offerings include medical, dental, and vision plans. Their medical plans cover a range of services, including doctor visits, hospital stays, and prescription medications. State Farm also provides supplemental health insurance policies, such as accident and critical illness coverage, to provide additional financial protection in case of unexpected health events.

Other Services

Beyond the traditional insurance offerings, State Farm provides a variety of other financial services. This includes banking services through their State Farm Bank subsidiary, which offers checking and savings accounts, mortgages, and loans. State Farm also offers retirement planning services, helping individuals prepare for their financial future.

Unique Features and Benefits

State Farm has several unique features and benefits that set it apart from other insurance providers. These include:

Local Agent Network

State Farm’s network of local agents is one of its most distinctive features. These agents serve as personal points of contact for customers, providing personalized advice and assistance. They can help customers navigate the complexities of insurance policies, answer questions, and offer guidance tailored to individual needs. This local presence and personal touch are highly valued by many State Farm customers.

Discounts and Rewards

State Farm is known for its extensive range of discounts and rewards programs. Customers can save on their insurance premiums through various discounts, such as safe driving discounts, multiple policy discounts, and loyalty rewards. State Farm also offers rewards for referring new customers, providing an additional incentive for customers to spread the word about their positive experiences with the company.

State Farm Bank

As mentioned earlier, State Farm Bank provides a range of banking services, offering customers the convenience of managing their insurance and banking needs under one roof. This integration of services can be particularly beneficial for customers, providing a streamlined and efficient financial management experience.

Digital Tools and Resources

State Farm recognizes the importance of digital technology in today’s world and has invested significantly in developing user-friendly digital tools and resources. Their website and mobile app offer customers easy access to their policies, billing information, and claims management. State Farm also provides a range of online resources, including educational materials and tools to help customers better understand their insurance options and make informed decisions.

Performance and Reputation

State Farm’s performance and reputation in the insurance industry are formidable. The company consistently ranks highly in customer satisfaction surveys, with its network of local agents and personalized service being a key differentiator. State Farm’s financial strength and stability are also well-regarded, with ratings agencies consistently assigning high ratings to the company.

In terms of financial performance, State Farm has demonstrated consistent growth and profitability over the years. The company's strong financial position allows it to invest in innovation and technology, ensuring it remains competitive in an ever-evolving insurance landscape. State Farm's commitment to customer service and its focus on providing value to its customers have been key factors in its long-term success.

Impact and Future Outlook

State Farm’s impact on the insurance industry is significant. The company’s pioneering spirit and focus on customer service have influenced the way insurance is delivered and perceived. State Farm’s direct-to-consumer approach and its emphasis on local agents have set a standard for personalized insurance services.

Looking to the future, State Farm is well-positioned to continue its legacy of success. The company's focus on innovation and technology, coupled with its commitment to customer service, will likely drive its continued growth and relevance in the insurance market. State Farm's ability to adapt to changing consumer needs and preferences, as demonstrated by its expansion into digital services and financial offerings, bodes well for its long-term sustainability.

In conclusion, State Farm Insurance is a true stalwart of the insurance industry, with a rich history and a bright future ahead. Its comprehensive services, unique features, and commitment to customer satisfaction have solidified its position as a trusted provider of insurance and financial services. As the insurance landscape continues to evolve, State Farm's ability to adapt and innovate will ensure its enduring success and relevance.

What makes State Farm Insurance unique compared to other insurance providers?

+State Farm’s unique features include its extensive network of local agents, personalized service, a wide range of insurance and financial services, and its focus on customer satisfaction. Their commitment to innovation and technology also sets them apart, as does their history of providing insurance to underserved markets, such as farmers and rural motorists.

How does State Farm’s financial strength and stability benefit customers?

+State Farm’s strong financial position ensures that the company can honor its insurance commitments, even in the event of large-scale claims or disasters. This stability provides customers with peace of mind, knowing that their insurance provider is financially secure and able to meet its obligations.

What digital tools does State Farm offer to enhance the customer experience?

+State Farm offers a range of digital tools, including a user-friendly website and mobile app. These platforms allow customers to access their policies, manage billing, and file claims online. State Farm also provides online resources and educational materials to help customers better understand their insurance options.