Inexpensive Dental Insurance

Unveiling the Best Inexpensive Dental Insurance Options for Your Smile's Well-Being

Maintaining a healthy smile is crucial, but finding affordable dental insurance can be a challenge. Fortunately, there are several options available that offer comprehensive coverage without breaking the bank. In this article, we will explore the world of inexpensive dental insurance, providing you with the knowledge to make informed decisions about your oral health and financial well-being.

With the rising costs of healthcare, many individuals and families are seeking ways to reduce expenses while still prioritizing their dental care. The good news is that affordable dental insurance plans exist, catering to a range of needs and budgets. By understanding the options available and the factors that influence pricing, you can secure the coverage you need without sacrificing your financial stability.

Understanding the Basics of Dental Insurance

Before diving into the specifics of inexpensive dental insurance, it's essential to grasp the fundamental concepts and terminology associated with dental coverage. Dental insurance plans typically cover a range of services, including preventive care, basic procedures, and more extensive treatments. Understanding the different types of coverage and the associated costs will help you make an informed choice.

Dental insurance plans often utilize a network of preferred providers, which are dentists and specialists who have agreed to offer their services at discounted rates. Out-of-network providers may charge higher fees, so it's important to consider this aspect when choosing a plan. Additionally, dental insurance usually has an annual maximum, which is the limit of coverage provided within a year. Understanding these basics will empower you to navigate the world of dental insurance with confidence.

Exploring Affordable Dental Insurance Plans

When it comes to inexpensive dental insurance, there are several options to consider. Here, we delve into the most popular and cost-effective plans available in the market.

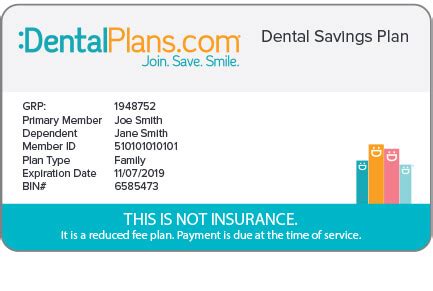

Discount Dental Plans

Discount dental plans, also known as dental savings plans, offer an affordable alternative to traditional insurance. These plans provide members with access to a network of participating dentists at significantly reduced rates. Instead of paying premiums, members pay an annual fee to enroll in the plan. The savings can range from 10% to 60% on various dental procedures, making it an attractive option for those seeking affordable dental care.

One of the key advantages of discount dental plans is their flexibility. Members are not bound by annual maximums or waiting periods, allowing them to seek treatment as needed. Additionally, these plans often cover a wide range of services, including preventive care, restorative procedures, and even specialty treatments like orthodontics. The simplicity and affordability of discount dental plans make them a popular choice for individuals and families on a budget.

Dental Insurance for Individuals and Families

If you're seeking dental insurance for yourself or your entire family, there are dedicated plans available to meet your needs. Individual dental insurance plans provide coverage tailored to your specific requirements, whether you prioritize preventive care or require more extensive treatment. These plans often offer customizable options, allowing you to choose the level of coverage that aligns with your budget and oral health needs.

For families, group dental insurance plans are an excellent option. These plans provide coverage for multiple family members, ensuring that everyone's dental needs are taken care of. Group plans often come with additional benefits, such as family discounts and simplified enrollment processes. By enrolling in a family dental insurance plan, you can secure peace of mind knowing that your loved ones have access to quality dental care without incurring excessive costs.

Dental Insurance for Seniors

Seniors often face unique dental challenges, and finding affordable insurance can be particularly crucial for maintaining their oral health. Fortunately, there are dental insurance plans specifically designed for seniors. These plans typically cover a range of services, including dentures, implants, and other procedures that may not be covered by standard dental insurance. By investing in a senior dental insurance plan, individuals can access the specialized care they need without straining their finances.

Factors Influencing Dental Insurance Costs

Understanding the factors that impact dental insurance costs is essential for making informed decisions. Several variables come into play when determining the price of a dental insurance plan. Here, we explore the key factors that influence pricing and provide tips on how to optimize your coverage while keeping costs affordable.

Age and Dental History

Age and dental history are significant factors in determining insurance costs. Generally, younger individuals tend to have lower premiums, as they are less likely to require extensive dental procedures. On the other hand, individuals with a history of dental issues or those who have undergone complex treatments may face higher premiums. It's important to consider your age and dental health when selecting a plan to ensure you receive the appropriate coverage at a reasonable cost.

Plan Type and Coverage

The type of plan and the level of coverage you choose will significantly impact the cost of your dental insurance. Basic plans with limited coverage tend to be more affordable, while comprehensive plans that cover a wide range of services may come with higher premiums. It's crucial to assess your oral health needs and financial situation to strike a balance between coverage and cost. Opting for a plan that covers your essential needs without unnecessary frills can help keep your insurance expenses manageable.

Network and Provider Choices

The network of dentists and specialists within your insurance plan plays a vital role in determining costs. In-network providers typically offer services at discounted rates, making them more affordable than out-of-network options. When choosing a dental insurance plan, consider the network's coverage in your area and the availability of preferred providers. By selecting a plan with a robust network, you can access quality dental care without incurring excessive out-of-pocket expenses.

Maximizing Your Dental Insurance Benefits

Now that you've chosen an affordable dental insurance plan, it's time to make the most of your benefits. By understanding how to utilize your coverage effectively, you can optimize your oral health and minimize out-of-pocket expenses. Here, we provide practical tips and strategies to help you maximize the value of your dental insurance.

Regular Preventive Care

Preventive care is the cornerstone of maintaining good oral health. Many dental insurance plans cover preventive services, such as dental cleanings, check-ups, and X-rays, at little to no cost. By taking advantage of these benefits and scheduling regular appointments, you can catch potential issues early on, reducing the need for more extensive and costly treatments down the line. Preventive care is an investment in your long-term oral health and can help you save money in the long run.

Understanding Your Plan's Coverage

Familiarizing yourself with the specifics of your dental insurance plan is crucial for maximizing your benefits. Take the time to review your policy documents and understand the covered services, exclusions, and any limitations. Knowing what procedures are covered and at what percentage will help you make informed decisions about your dental care. Additionally, reach out to your insurance provider or dental office if you have any questions or need clarification on specific coverage details.

Utilizing In-Network Providers

As mentioned earlier, utilizing in-network providers can significantly reduce your out-of-pocket expenses. When selecting a dentist or specialist, choose someone who is within your insurance network. By doing so, you'll benefit from the discounted rates offered by these providers. Remember to verify the network status of your chosen dentist periodically, as networks can change over time. Staying within the network ensures you receive the best value for your insurance coverage.

Addressing Common Concerns About Affordable Dental Insurance

While exploring inexpensive dental insurance options, you may encounter various concerns and questions. Here, we address some of the most common queries to provide clarity and reassurance.

Q: Can I still receive quality dental care with an affordable plan?

A: Absolutely! Affordable dental insurance plans prioritize providing quality care while keeping costs low. Whether it's a discount dental plan or a traditional insurance policy, you can access skilled dentists and specialists who are committed to delivering excellent oral healthcare. Rest assured that your smile's well-being is not compromised by choosing an affordable plan.

Q: Are there any hidden costs or fees associated with inexpensive dental insurance?

A: It's important to carefully review the terms and conditions of your chosen plan to identify any potential hidden costs or fees. Some plans may have additional charges for certain procedures or services, so it's essential to understand these upfront. Additionally, certain plans may require copayments or deductibles, which are typically outlined in the policy details. By being aware of these potential expenses, you can budget accordingly and avoid any surprises.

Q: How can I ensure I'm getting the best value for my money with inexpensive dental insurance?

A: To ensure you're getting the best value, consider the following factors: evaluate the plan's coverage to ensure it aligns with your oral health needs; compare prices and benefits offered by different providers; read reviews and seek recommendations from trusted sources; and, most importantly, understand the terms and conditions to avoid any unexpected costs. By conducting thorough research and making an informed choice, you can maximize the value of your inexpensive dental insurance plan.

Conclusion: Securing Your Smile's Future

Inexpensive dental insurance is within your reach, and with the right knowledge and resources, you can protect your smile without compromising your financial well-being. By understanding the basics of dental insurance, exploring affordable plan options, and maximizing your benefits, you can take control of your oral health and maintain a radiant smile. Remember, investing in your dental care today will pay dividends in the form of a healthier and happier you.

What are the benefits of having dental insurance?

+Dental insurance offers several benefits, including access to preventive care, reduced costs for dental procedures, and peace of mind knowing that you have coverage for unexpected dental emergencies or treatments. It encourages regular dental check-ups, which can help detect and prevent oral health issues early on.

How do I choose the right dental insurance plan for me?

+When selecting a dental insurance plan, consider your oral health needs, budget, and the network of dentists available. Assess the coverage offered, including preventive care, basic procedures, and any specialty treatments you may require. Compare plans from different providers to find the one that offers the best value for your specific circumstances.

Can I use my dental insurance outside of my network?

+Using your dental insurance outside of your network may result in higher out-of-pocket costs. While some plans may provide limited coverage for out-of-network providers, it’s generally more cost-effective to utilize in-network dentists. However, in certain situations or if you have an emergency, it may be necessary to seek treatment from an out-of-network provider. Check your plan’s terms and conditions to understand the coverage and potential expenses involved.