Insurance Motorbike Quote

Welcome to a comprehensive guide on understanding and navigating the world of motorbike insurance quotes, an essential aspect of motorcycle ownership. In this expert-led exploration, we will delve into the intricacies of acquiring suitable coverage for your two-wheeled ride, shedding light on the factors that influence quotes and offering valuable insights to ensure you make informed decisions. Whether you're a seasoned rider or a novice exploring the world of motorcycling, this article aims to empower you with the knowledge to secure the best insurance deal tailored to your needs.

The Fundamentals of Motorbike Insurance Quotes

Understanding motorbike insurance is crucial, as it provides financial protection in the event of accidents, theft, or other unforeseen circumstances. It’s not just a legal requirement in many regions but also a prudent measure to safeguard your investment and personal well-being.

Key Components of a Motorbike Insurance Policy

A typical motorbike insurance policy consists of several core components, each offering distinct benefits:

- Comprehensive Cover: Provides protection for a range of situations, including accidents, fire, theft, and natural disasters. It is often the most extensive form of insurance, offering peace of mind to riders.

- Third-Party Liability: Covers the policyholder for damages caused to others’ property or injuries sustained by others as a result of an accident involving the insured motorcycle.

- Collision Coverage: Specifically designed to cover repairs or replacements in the event of an accident, regardless of fault.

- Personal Injury Protection: Provides coverage for medical expenses and lost wages resulting from injuries sustained in a motorcycle accident.

- Uninsured/Underinsured Motorist Coverage: Protects the policyholder in the event of an accident with a driver who either lacks insurance or has insufficient coverage to compensate for the damages caused.

The inclusion of these components in your insurance policy can vary based on your specific needs and the laws in your region. It's important to carefully assess your requirements and understand the local regulations to ensure you're adequately covered.

Factors Influencing Motorbike Insurance Quotes

The process of obtaining a motorbike insurance quote is influenced by a multitude of factors, each playing a significant role in determining the overall cost and coverage options. Let’s explore some of these key influencers:

Rider’s Profile and History

Insurance providers thoroughly examine a rider’s profile and history to assess the level of risk associated with insuring them. This includes factors such as:

- Age: Younger riders, particularly those under 25, are often considered higher-risk due to their lack of experience, leading to higher insurance premiums.

- Riding Experience: Riders with extensive experience and a clean driving record may benefit from lower premiums, as they are seen as less risky.

- Claim History: Previous claims made against insurance policies can impact future quotes, with a history of frequent claims potentially leading to higher premiums.

Motorbike Specifications and Usage

The type of motorbike you own and how you use it are crucial factors in determining insurance quotes. Here’s a breakdown:

- Motorcycle Type: Sport bikes and high-performance motorcycles often attract higher insurance premiums due to their association with speed and potential for accidents.

- Engine Capacity: Larger engine capacities, typically above 600cc, may result in higher insurance costs, as they are often linked to higher speeds and performance.

- Usage: Motorbikes used for daily commuting or long-distance travel may be assessed differently from those primarily used for leisure or occasional rides. The frequency and purpose of usage can impact insurance quotes.

Geographical Location and Local Laws

The region where you live and ride plays a significant role in determining insurance rates. Factors such as:

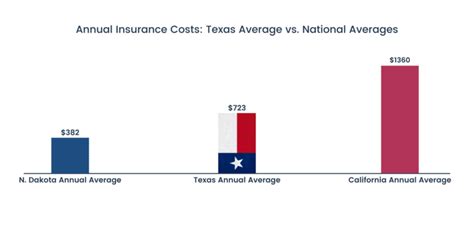

- Theft Rates: Areas with higher motorcycle theft rates may experience higher insurance premiums due to the increased risk.

- Accident Rates: Regions with a history of high accident rates for motorcyclists may also see elevated insurance costs.

- Local Laws: Variations in local laws and regulations, such as mandatory insurance coverage or specific requirements for certain types of motorcycles, can impact insurance quotes.

Comparing Motorbike Insurance Quotes

Obtaining multiple motorbike insurance quotes is a prudent step towards securing the best coverage at the most competitive price. Here’s a guide on how to effectively compare quotes:

Understand the Coverage Offered

When comparing quotes, it’s crucial to ensure you’re comparing apples to apples. Look beyond the premium prices and delve into the details of the coverage provided. Ensure that the policies you’re considering offer the same or similar levels of protection, especially in terms of the key components mentioned earlier.

Assess Additional Benefits and Discounts

Insurance providers often offer a range of additional benefits and discounts to attract customers. These can include loyalty discounts for long-term customers, multi-policy discounts if you have other insurance policies with the same provider, or even discounts for completing safe riding courses. Take note of these benefits and consider how they might impact your overall insurance experience.

Consider Customer Service and Claims Handling

While the price is an important factor, the quality of customer service and the efficiency of claims handling can be just as crucial. Research and read reviews from existing customers to gauge the provider’s reputation in these areas. A provider with excellent customer service and a streamlined claims process can provide added peace of mind.

Evaluate Financial Stability

When selecting an insurance provider, it’s important to consider their financial stability. A financially stable company is more likely to be able to pay out claims in the event of an accident or loss. Check ratings from independent agencies like AM Best or Standard & Poor’s to assess the provider’s financial strength and stability.

Maximizing Your Motorbike Insurance Savings

While obtaining multiple quotes is a great starting point, there are additional strategies you can employ to potentially reduce your motorbike insurance costs:

Choose the Right Coverage

Consider your specific needs and the risks you face as a rider. If you have an older motorcycle that may not be worth much, you might opt for liability-only coverage, which is typically more affordable than comprehensive coverage. On the other hand, if you have a high-value bike or ride frequently, comprehensive coverage might be the better choice.

Increase Your Deductible

Opting for a higher deductible can lower your insurance premium. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to pay a larger portion of the costs in the event of a claim, you can reduce your overall insurance costs.

Take Advantage of Discounts

Insurance providers often offer a variety of discounts to attract customers. These can include discounts for:

- Bundling multiple policies (e.g., motorbike and home insurance) with the same provider.

- Completing a safe riding course.

- Maintaining a clean driving record.

- Being a member of certain organizations or associations.

Be sure to ask your insurance provider about any available discounts and ensure you’re taking advantage of all applicable ones.

Maintain a Clean Riding Record

A clean driving record can significantly impact your insurance rates. Avoid traffic violations and accidents to keep your insurance costs down. Additionally, consider taking a defensive riding course, which can not only improve your riding skills but may also qualify you for insurance discounts.

The Future of Motorbike Insurance

The landscape of motorbike insurance is continually evolving, driven by advancements in technology and changing consumer needs. Here’s a glimpse into the potential future of motorcycle insurance:

Telematics and Usage-Based Insurance

Telematics technology, which collects and transmits data about a vehicle’s movement and usage, is already being used in some insurance policies. In the future, this technology could become more prevalent, offering riders the opportunity to lower their insurance costs by demonstrating safe and responsible riding habits. Usage-based insurance policies could reward riders for avoiding risky behaviors and adhering to safe practices.

Enhanced Digital Tools and Personalization

The insurance industry is increasingly adopting digital tools to enhance the customer experience. In the future, we can expect to see more sophisticated online platforms and mobile apps that allow riders to easily compare policies, manage their insurance, and even file claims. Additionally, these tools could leverage AI and machine learning to personalize insurance offerings based on individual rider profiles and preferences.

Sustainable and Electric Motorcycle Insurance

With the rise of electric motorcycles and a growing focus on sustainability, insurance providers may start offering specialized policies for these vehicles. Electric motorcycles present unique considerations, such as the cost and replacement of batteries, which could influence insurance rates. Additionally, insurance providers may explore incentives or discounts for riders who choose environmentally friendly motorcycles.

Conclusion

Navigating the world of motorbike insurance quotes is a crucial aspect of responsible motorcycle ownership. By understanding the key factors that influence insurance costs and the various coverage options available, you can make informed decisions to protect your bike and yourself. Remember, the best insurance policy is one that provides adequate coverage at a competitive price, and with the right knowledge and strategies, you can achieve this balance.

Stay tuned for more insights and updates on the ever-evolving world of motorcycle insurance, and ride safe!

How often should I review my motorbike insurance policy and quotes?

+It’s a good practice to review your insurance policy and quotes annually, or whenever your circumstances change significantly. This ensures that your coverage remains up-to-date and reflects your current needs.

Can I get a discount on my motorbike insurance if I have other types of insurance policies with the same provider?

+Yes, many insurance providers offer multi-policy discounts. If you have other insurance policies, such as home or auto insurance, with the same provider, you may be eligible for a discounted rate on your motorbike insurance.

What factors influence the cost of my motorbike insurance premium?

+Several factors influence the cost of your insurance premium, including your age, riding experience, claim history, the type and value of your motorcycle, your geographical location, and the coverage options you choose.

Can I customize my motorbike insurance policy to suit my specific needs?

+Absolutely! Motorbike insurance policies are often customizable, allowing you to choose the level of coverage and additional benefits that best fit your needs and budget. This flexibility ensures you’re not paying for coverage you don’t need.