Auto Insurance Best Price

In the vast landscape of insurance providers, finding the best auto insurance rate can be a challenging task. With numerous companies offering diverse coverage options, it's crucial to navigate this market strategically to secure the most advantageous deal for your vehicle and driving needs. This article aims to provide an in-depth guide, offering practical tips and insights to help you navigate the complexities of auto insurance, ensuring you make an informed decision.

Understanding Auto Insurance Coverage

Auto insurance is a contractual agreement between you and an insurance provider, offering financial protection against potential risks and liabilities associated with owning and operating a vehicle. This coverage extends to various aspects, including liability for bodily injury and property damage, coverage for the cost of repairing or replacing your vehicle, and protection against theft or natural disasters.

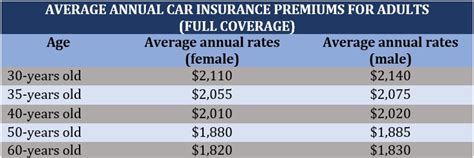

The cost of auto insurance can vary significantly based on several factors, including the make and model of your vehicle, your driving history, the coverage limits you choose, and the state in which you reside. Understanding these variables is essential to making an informed decision about your insurance coverage.

Factors Influencing Auto Insurance Rates

When shopping for auto insurance, it’s important to consider the following factors that can impact your premium:

- Vehicle Type and Usage: The make, model, and age of your vehicle, along with the primary purpose of its usage (e.g., commuting, business, pleasure) can affect your insurance rates.

- Driver’s Profile: Your age, gender, driving record, and credit score are key factors in determining your insurance premium. A clean driving record and a high credit score can often lead to lower rates.

- Coverage Options: The level of coverage you choose, such as liability-only or comprehensive coverage, will impact your premium. Comprehensive coverage offers more protection but comes at a higher cost.

- State Regulations: Each state has its own set of laws and regulations governing auto insurance, which can influence the cost and availability of certain coverage options.

Researching and Comparing Insurance Providers

With a wide array of insurance providers available, it’s essential to conduct thorough research to find the best fit for your needs. Consider the following steps:

- Online Quotes: Utilize online quote tools provided by insurance companies or comparison websites to get a quick overview of potential rates.

- Read Reviews: Check reputable review platforms to understand customer experiences and satisfaction levels with different insurance providers.

- Agent or Broker: Consider working with an independent insurance agent or broker who can provide personalized advice and compare rates from multiple providers.

- Bundling Policies: Explore the option of bundling your auto insurance with other policies, such as home or life insurance, which can often result in significant discounts.

Tips for Negotiating and Saving on Auto Insurance

Negotiating with insurance providers and adopting cost-saving measures can help you secure a better rate. Here are some strategies to consider:

- Discounts: Ask about available discounts, such as safe driver discounts, multi-policy discounts, or discounts for safety features in your vehicle.

- Higher Deductibles: Opting for a higher deductible can lower your premium, but ensure it’s an amount you can comfortably afford if you need to make a claim.

- Policy Adjustments: Review your policy annually and adjust it to reflect changes in your life or driving habits. For instance, if you’ve moved to a less congested area, your premium might be reduced.

- Usage-Based Insurance: Some insurance providers offer usage-based insurance plans that track your driving habits and reward safe driving with lower rates.

Analyzing Coverage Options and Customizing Your Policy

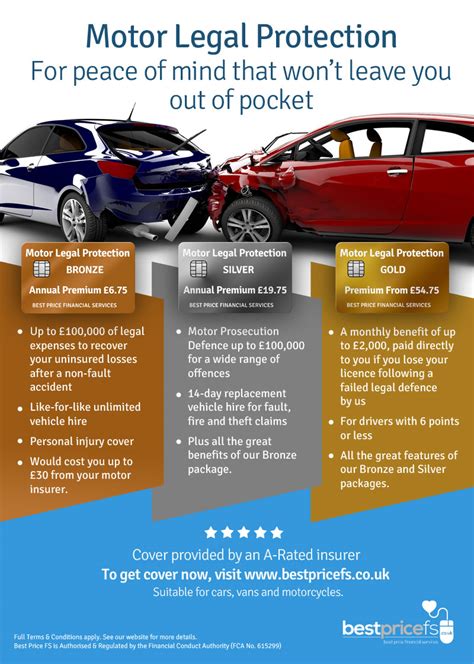

Auto insurance policies offer a range of coverage options, and understanding these options is crucial to tailoring a policy that suits your specific needs and budget. Here’s a breakdown of common coverage types and how they work:

Liability Coverage

Liability coverage is a fundamental component of auto insurance, protecting you from financial loss if you’re found at fault in an accident that causes bodily injury or property damage to others. This coverage typically includes:

- Bodily Injury Liability: Covers medical expenses and lost wages for individuals injured in an accident caused by you.

- Property Damage Liability: Pays for repairs or replacement of property damaged in an accident for which you’re responsible.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical costs and lost wages for injured individuals |

| Property Damage Liability | Pays for repairs or replacement of damaged property |

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional but provide essential protection for your vehicle. Here’s a closer look at these coverage types:

- Collision Coverage: Pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: Covers damages to your vehicle caused by events other than accidents, such as theft, vandalism, natural disasters, or collisions with animals.

Personal Injury Protection (PIP) and Medical Payments Coverage

These coverage types provide medical expense coverage for you and your passengers, regardless of fault in an accident. They differ in terms of coverage limits and availability by state:

- Personal Injury Protection (PIP): Covers a wide range of medical expenses, lost wages, and other related costs.

- Medical Payments Coverage: Offers more limited coverage for medical expenses only.

Uninsured/Underinsured Motorist Coverage

This coverage is designed to protect you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have sufficient insurance to cover the damages. It includes:

- Uninsured Motorist Coverage: Pays for your injuries and property damage if the at-fault driver is uninsured.

- Underinsured Motorist Coverage: Covers additional expenses if the at-fault driver’s insurance limits are insufficient to cover your damages.

Understanding Claims and Deductibles

When an accident occurs, understanding the claims process and your deductible responsibilities is crucial. Here’s a guide to help you navigate this aspect of auto insurance:

Filing a Claim

If you’re involved in an accident, the first step is to contact your insurance provider to report the incident. Here’s a general process for filing a claim:

- Gather Information: Collect details about the accident, including the other driver’s information, contact details of witnesses, and photographs of the accident scene and vehicle damage.

- Contact Your Insurer: Reach out to your insurance provider as soon as possible to initiate the claims process. They will guide you through the necessary steps.

- Provide Documentation: Submit all relevant documentation, including police reports, medical records (if applicable), and estimates for vehicle repairs.

- Assessment and Settlement: Your insurer will assess the damages and determine the value of your claim. They will then offer a settlement, which you can accept or negotiate further if you believe it’s inadequate.

Understanding Deductibles

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. It’s an important consideration when choosing your policy and can significantly impact your premium. Here are some key points to understand:

- Choosing a Deductible: When selecting your policy, you can opt for a higher deductible to lower your premium or a lower deductible for more financial protection.

- Paying Your Deductible: If you make a claim, you’re responsible for paying your deductible before your insurance provider covers the remaining costs.

- Waiving Deductibles: In certain situations, your insurance provider might waive your deductible, such as if you’re involved in a not-at-fault accident or if you have certain types of coverage (e.g., comprehensive coverage for theft or vandalism).

The Future of Auto Insurance: Trends and Innovations

The auto insurance industry is evolving, with new technologies and trends shaping the way policies are designed and priced. Here’s a glimpse into the future of auto insurance:

Telematics and Usage-Based Insurance

Telematics technology is revolutionizing auto insurance by allowing providers to track driving behavior in real-time. This data is used to offer more accurate and personalized insurance rates, often resulting in lower premiums for safe drivers. Usage-based insurance plans are becoming increasingly popular, providing an incentive for drivers to adopt safer driving habits.

Artificial Intelligence and Data Analytics

Insurance providers are leveraging AI and data analytics to improve risk assessment and pricing models. By analyzing vast amounts of data, these technologies can identify patterns and trends, leading to more precise risk evaluation and tailored insurance offerings.

Connected Car Technology

The integration of connected car technology is transforming the way insurance providers interact with their customers. This technology allows for real-time vehicle diagnostics, proactive maintenance, and remote assistance, enhancing the overall driving experience and providing valuable data for insurance providers.

InsureTech Innovations

InsureTech startups are disrupting the traditional insurance model by offering innovative solutions. These include peer-to-peer insurance platforms, blockchain-based insurance contracts, and AI-powered claim processing systems, all aimed at providing more efficient, transparent, and customer-centric insurance services.

Conclusion

Navigating the complex world of auto insurance requires a strategic approach. By understanding the factors that influence rates, researching and comparing providers, and customizing your coverage to fit your needs, you can secure the best price for your auto insurance. Stay informed about emerging trends and technologies, as they have the potential to revolutionize the industry and offer new opportunities for cost savings and improved coverage.

How can I lower my auto insurance premium?

+There are several strategies to reduce your auto insurance premium. These include choosing a higher deductible, maintaining a clean driving record, exploring discounts (such as safe driver or multi-policy discounts), and considering usage-based insurance plans that reward safe driving habits.

What factors determine my auto insurance rate?

+Auto insurance rates are influenced by various factors, including your driving history, the type of vehicle you drive, the level of coverage you choose, your age and gender, and the state you reside in. Each of these factors can impact your premium differently.

How do I choose the right coverage for my needs?

+Choosing the right coverage involves assessing your specific needs and budget. Consider factors like the value of your vehicle, your daily driving habits, and potential risks. Discuss your options with an insurance agent or broker to find the coverage that provides adequate protection at an affordable price.

What is the process for filing an auto insurance claim?

+Filing an auto insurance claim typically involves reporting the incident to your insurance provider, providing detailed information about the accident, and submitting relevant documentation. Your insurer will then assess the claim and offer a settlement, which you can either accept or negotiate.