Ins Car Insurance

When it comes to protecting our vehicles and ensuring peace of mind on the road, car insurance is an essential aspect that every driver should consider. With a wide range of options and policies available, it's crucial to understand the ins and outs of car insurance to make informed decisions. In this comprehensive guide, we will delve into the world of Ins Car Insurance, exploring its features, benefits, and how it can provide comprehensive coverage for your vehicle.

Understanding Ins Car Insurance: A Comprehensive Overview

Ins Car Insurance is a leading provider of automotive insurance solutions, offering a comprehensive range of policies tailored to meet the diverse needs of drivers. With a rich history spanning several decades, Ins has established itself as a trusted partner in the insurance industry, known for its innovative approaches and commitment to customer satisfaction.

The company's vision revolves around empowering drivers with the confidence to navigate the roads, knowing that their vehicles and well-being are protected. By offering a wide spectrum of coverage options, Ins aims to cater to the unique requirements of individuals, families, and businesses, ensuring that every policyholder receives the right level of protection.

Key Features of Ins Car Insurance

Ins Car Insurance boasts an extensive suite of features designed to provide comprehensive protection for your vehicle. Here’s an insight into some of its key offerings:

- Collision Coverage: Ins provides coverage for damages resulting from collisions with other vehicles or objects. This includes repairs or replacements, ensuring your vehicle is back on the road quickly.

- Comprehensive Coverage: This aspect of Ins's policy covers a wide range of non-collision incidents, such as theft, vandalism, natural disasters, and even damage caused by animals. It provides financial protection for unexpected events.

- Liability Insurance: Ins offers liability coverage to protect policyholders against claims arising from accidents they are at fault for. This includes bodily injury and property damage liability, ensuring you are financially safeguarded.

- Personal Injury Protection (PIP): Recognizing the importance of personal well-being, Ins includes PIP in its policies. This coverage provides compensation for medical expenses, lost wages, and other related costs in the event of an accident.

- Uninsured/Underinsured Motorist Coverage: Ins understands the risks posed by uninsured or underinsured drivers. Their policies include coverage to protect policyholders in such situations, providing financial assistance for medical bills and other damages.

In addition to these core features, Ins Car Insurance offers a range of optional add-ons and endorsements to further customize your policy. These include coverage for rental cars, roadside assistance, gap insurance, and more. By tailoring your policy to your specific needs, Ins ensures that you receive the right level of protection without unnecessary expenses.

Benefits of Choosing Ins Car Insurance

Ins Car Insurance provides numerous benefits that set it apart from other insurance providers. Here’s a glimpse into some of the advantages you can expect:

- Customizable Coverage: Ins understands that every driver has unique needs. Their policies are highly customizable, allowing you to choose the coverage that suits your driving habits, vehicle type, and budget.

- Competitive Pricing: Ins is committed to offering competitive rates without compromising on the quality of coverage. By providing a range of discounts and incentives, they ensure that policyholders receive excellent value for their money.

- Excellent Customer Service: Ins prides itself on its dedicated customer support team. With a focus on timely and efficient assistance, they are readily available to address any queries or concerns, providing peace of mind to policyholders.

- Digital Convenience: In today's fast-paced world, Ins recognizes the importance of digital accessibility. Their online platform offers a seamless experience, allowing policyholders to manage their policies, make payments, and file claims with ease.

- Claims Process Efficiency: Ins has streamlined its claims process to ensure prompt and fair settlements. With a dedicated claims team and a straightforward procedure, policyholders can expect efficient resolution of their claims, minimizing any disruptions.

The Ins and Outs of Car Insurance Policies

Car insurance policies can vary significantly, and understanding the intricacies is crucial for making informed choices. Here’s a closer look at some key aspects of Ins Car Insurance policies:

Policy Types and Coverage Levels

Ins Car Insurance offers a variety of policy types to cater to different driver profiles. These include:

- Standard Policy: This basic policy provides essential coverage, including liability, collision, and comprehensive insurance. It's ideal for drivers who want a balanced level of protection without excessive costs.

- Comprehensive Policy: For drivers seeking extensive coverage, Ins offers a comprehensive policy that includes all the core coverages plus additional benefits like rental car coverage, roadside assistance, and more. This policy is perfect for those who want maximum peace of mind.

- High-Risk Policy: Recognizing the unique needs of high-risk drivers, Ins provides specialized policies with tailored coverage. These policies offer increased liability limits and additional benefits to address the specific challenges faced by high-risk drivers.

Each policy type can be further customized with a range of coverage options, allowing policyholders to fine-tune their protection to match their specific needs and preferences.

Factors Influencing Policy Costs

The cost of your car insurance policy is influenced by several factors, including:

- Vehicle Type and Value: The make, model, and value of your vehicle play a significant role in determining policy costs. Higher-value vehicles generally require more extensive coverage, resulting in higher premiums.

- Driver Profile: Your driving history, age, and gender are key factors. Younger drivers, for instance, often pay higher premiums due to their perceived higher risk profile. Similarly, a clean driving record can lead to more favorable rates.

- Coverage Options: The level of coverage you choose directly impacts your policy costs. Higher coverage limits and additional benefits will increase your premiums, while basic coverage options will keep costs more affordable.

- Location: The area where you reside and drive also influences policy costs. Areas with higher crime rates or a history of frequent accidents may result in increased premiums.

Discounts and Incentives

Ins Car Insurance offers a range of discounts and incentives to help policyholders save on their premiums. These include:

- Multi-Policy Discount: By bundling your car insurance with other Ins policies, such as home or life insurance, you can enjoy significant discounts on your overall premiums.

- Safe Driver Discount: Ins rewards policyholders with a clean driving record and no accidents or violations. This discount recognizes responsible driving behavior and can lead to substantial savings.

- Loyalty Discount: As a token of appreciation for long-term customers, Ins offers loyalty discounts to policyholders who have maintained their policies without interruptions.

- Student Discount: Recognizing the financial constraints of students, Ins provides discounts to young drivers who maintain good academic records. This incentive encourages responsible behavior and makes insurance more affordable for students.

Real-World Performance and Customer Satisfaction

Ins Car Insurance’s reputation and success are built upon its real-world performance and the satisfaction of its policyholders. Here’s a closer look at how Ins delivers on its promises:

Claims Handling and Customer Support

Ins understands that efficient and empathetic claims handling is crucial for customer satisfaction. Their dedicated claims team is trained to provide prompt and personalized assistance, ensuring policyholders receive the support they need during challenging times.

From the moment a claim is filed, Ins's team works diligently to assess the situation, gather necessary information, and process the claim as quickly as possible. They strive to provide fair and accurate settlements, ensuring policyholders receive the compensation they are entitled to without unnecessary delays.

In addition to efficient claims handling, Ins's customer support team is readily available to address any queries or concerns. Whether it's clarifying policy details, providing guidance on coverage options, or assisting with policy changes, their team is committed to delivering exceptional service.

Customer Testimonials and Feedback

Ins Car Insurance takes customer feedback seriously and actively encourages policyholders to share their experiences. Here are some real-world testimonials from satisfied customers:

"Ins Car Insurance has been a lifesaver! I was involved in an accident, and their claims process was seamless. The team was incredibly supportive and helped me navigate through the entire process. I received a fair settlement, and my car was repaired promptly. I highly recommend Ins for their exceptional customer service and comprehensive coverage."

- John M., Satisfied Policyholder

"As a long-time customer of Ins, I've always been impressed by their commitment to customer satisfaction. Their policies are customizable, allowing me to tailor my coverage to my specific needs. The online platform is user-friendly, making it easy to manage my policy and file claims. Ins has consistently delivered on their promises, and I trust them to protect my vehicle and provide peace of mind."

- Sarah D., Loyal Customer

Future Trends and Innovations in Car Insurance

The car insurance industry is continuously evolving, and Ins Car Insurance is at the forefront of embracing new technologies and trends. Here’s a glimpse into the future of car insurance:

Telematics and Usage-Based Insurance

Ins is exploring the potential of telematics and usage-based insurance to offer more personalized and data-driven policies. By leveraging telematics devices and real-time driving data, Ins can provide more accurate premiums based on individual driving habits and risk profiles.

Artificial Intelligence and Machine Learning

Ins is investing in artificial intelligence and machine learning technologies to enhance its underwriting and claims processes. These advancements enable Ins to analyze vast amounts of data, identify patterns, and make more accurate predictions, ultimately leading to better risk assessment and improved customer experiences.

Connected Car Technology

With the rise of connected car technology, Ins is exploring opportunities to integrate with vehicle systems. This integration can provide valuable insights into driving behavior, vehicle performance, and potential risks. By leveraging connected car data, Ins can offer more targeted coverage options and provide real-time assistance to policyholders.

Sustainable and Electric Vehicle Coverage

As the automotive industry shifts towards sustainability, Ins is adapting its policies to accommodate the unique needs of electric and hybrid vehicle owners. This includes specialized coverage for charging infrastructure, battery replacement, and other aspects specific to electric vehicles.

Conclusion

Ins Car Insurance stands as a trusted partner in the automotive insurance industry, offering comprehensive coverage and exceptional customer service. With its rich history, innovative approaches, and commitment to customer satisfaction, Ins continues to lead the way in providing peace of mind to drivers across the globe.

Whether you're a first-time buyer or an experienced driver, Ins Car Insurance offers a range of policies and coverage options to meet your unique needs. By choosing Ins, you can rest assured that your vehicle and well-being are protected, allowing you to focus on the open road ahead.

How do I choose the right coverage level for my car insurance policy?

+Choosing the right coverage level depends on several factors, including your vehicle’s value, your financial situation, and your risk tolerance. It’s essential to assess your needs and preferences. Consider factors like the make and model of your vehicle, your driving habits, and any specific requirements, such as comprehensive coverage for a leased or financed vehicle. Consulting with an insurance agent can also provide valuable guidance in selecting the appropriate coverage level.

What are the key differences between liability-only and full coverage car insurance policies?

+Liability-only car insurance policies provide coverage for damages and injuries you cause to others in an accident. This includes bodily injury liability and property damage liability. Full coverage policies, on the other hand, include liability coverage but also extend protection to your own vehicle. This typically includes collision coverage, comprehensive coverage, and other optional add-ons like rental car reimbursement and roadside assistance.

Can I customize my car insurance policy to fit my specific needs and budget?

+Absolutely! Car insurance policies are highly customizable, allowing you to tailor your coverage to your unique requirements. You can choose the level of liability coverage, add or remove optional coverages like rental car reimbursement or gap insurance, and select deductibles that align with your budget. Consulting with an insurance agent can help you create a policy that provides the right balance of protection and affordability.

What should I do if I’m involved in a car accident?

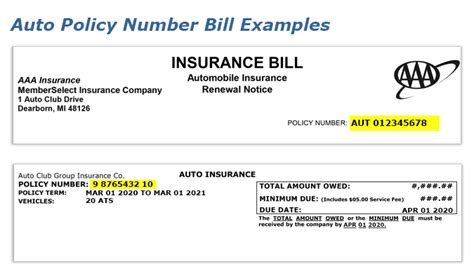

+If you’re involved in a car accident, the first step is to ensure your safety and the safety of others involved. Call emergency services if necessary. Collect information from the other driver(s), including their name, contact details, and insurance information. Take photos of the accident scene and any visible damage. Notify your insurance company as soon as possible to initiate the claims process. They will guide you through the next steps and provide assistance.