Auto Insurance Policy Lookup

In the vast landscape of insurance, the process of navigating auto insurance policies can be a complex journey. From understanding the intricacies of coverage to managing policy details, many drivers find themselves in need of a comprehensive guide to decipher the world of auto insurance. This article aims to demystify the process, providing a detailed insight into how one can effectively look up and manage their auto insurance policies.

The Fundamentals of Auto Insurance Policy Lookup

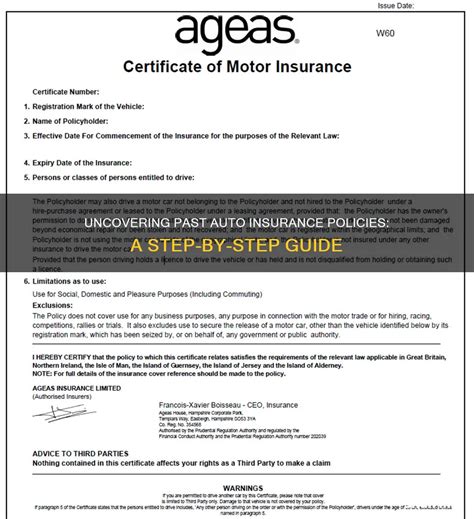

An auto insurance policy is a contract between the policyholder and the insurance company, outlining the terms and conditions of coverage. This policy serves as a legal document that defines the rights and responsibilities of both parties. To effectively manage and understand your auto insurance policy, it’s essential to grasp the basics of policy lookup.

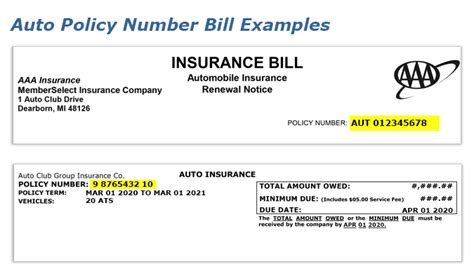

The process typically involves several steps. Firstly, one must locate their policy documents, which may be physical copies or digital files. These documents contain crucial information such as policy number, coverage details, and contact information for the insurance provider. Once these documents are in hand, the policyholder can proceed to the next step: understanding the policy's contents.

Auto insurance policies are often divided into sections, each covering different aspects of coverage. These sections may include liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. Understanding these sections is key to knowing what is covered under your policy.

For instance, liability coverage is a vital aspect of auto insurance, as it protects the policyholder against claims for bodily injury or property damage caused to others in an accident for which the insured is held responsible. On the other hand, collision coverage is an optional coverage that pays for damage to the insured vehicle caused by a collision with another vehicle or object.

Understanding Policy Documents

Policy documents are the primary source of information for understanding your auto insurance coverage. These documents are typically comprehensive, detailing everything from the types of coverage you have to the limits and deductibles associated with each.

For example, consider a policy that includes comprehensive coverage. This type of coverage protects against damage caused by events other than collisions, such as fire, theft, vandalism, or natural disasters. Understanding the limits and deductibles associated with this coverage is crucial, as it determines the financial responsibility of the policyholder in the event of a claim.

Furthermore, policy documents also outline the process for making a claim. This includes steps such as notifying the insurance company, providing proof of loss, and cooperating with any investigations. Understanding these procedures can streamline the claims process and ensure a smoother experience.

| Policy Section | Coverage Type | Description |

|---|---|---|

| Liability | Bodily Injury | Covers medical expenses and compensation for injuries sustained by others in an accident caused by the insured. |

| Collision | Vehicle Damage | Pays for repairs or replacement of the insured vehicle after a collision. |

| Comprehensive | Non-Collision Damage | Provides coverage for damage caused by events other than collisions, such as fire, theft, or natural disasters. |

| Medical Payments | Medical Expenses | Helps cover medical expenses for the insured and their passengers after an accident, regardless of fault. |

| Uninsured/Underinsured Motorist | Financial Protection | Offers protection in the event of an accident with a driver who does not have insurance or has insufficient coverage. |

Navigating the Online Policy Lookup Process

In today’s digital age, many insurance companies provide online platforms for policyholders to access and manage their policies. These platforms offer a convenient way to view policy details, make changes, and even file claims. However, navigating these platforms can be daunting for those unfamiliar with the process.

To begin, you'll need to access your insurance company's website and locate the login portal for policyholders. This portal is often secured, requiring a unique username and password for access. Once logged in, you'll be directed to your policy dashboard, which serves as the central hub for managing your policy.

Exploring the Policy Dashboard

The policy dashboard is a comprehensive overview of your auto insurance policy. It typically displays your policy number, coverage details, and any recent updates or changes. From here, you can access various sections of your policy, such as coverage limits, deductibles, and endorsements.

For instance, if you wish to review your liability coverage, you can navigate to the relevant section on your dashboard. Here, you'll find the limits of your bodily injury and property damage liability coverage, as well as any applicable deductibles. This information is crucial for understanding the financial protection your policy provides in the event of an accident.

Additionally, the dashboard often provides tools for policyholders to make changes to their coverage. This could include adding or removing vehicles from the policy, updating personal information, or even changing the level of coverage. These changes can impact your premium, so it's important to understand the implications before making any adjustments.

Online Claims Filing

One of the most significant advantages of online policy management is the ability to file claims digitally. This process simplifies the traditional claims procedure, allowing policyholders to report accidents and begin the claims process from the comfort of their homes.

To file a claim online, you'll typically need to provide details about the accident, such as the date, time, location, and a description of what occurred. You may also need to upload supporting documents, such as photos of the damage or police reports. Once the claim is submitted, you'll receive updates on its progress through your policy dashboard.

For example, let's say you've been involved in a minor fender bender. After assessing the damage and ensuring everyone involved is safe, you can log into your policy dashboard and initiate the claims process. You'll be guided through a series of steps to provide the necessary information and documentation. Once submitted, your insurance company will assign an adjuster to review the claim and determine the next steps.

Exploring Advanced Policy Features

Beyond the basics of policy lookup and management, auto insurance policies offer a range of advanced features that can enhance coverage and provide additional benefits. These features, often referred to as endorsements or riders, allow policyholders to customize their coverage to fit their specific needs.

Endorsements and Riders

Endorsements are amendments to an insurance policy that modify the terms and conditions of coverage. They can be used to add or remove coverage, increase or decrease limits, or change the policy’s deductibles. Riders, on the other hand, are specific types of endorsements that provide additional coverage for unique situations.

For example, imagine you own a classic car that you only drive on weekends. You could add a "limited use" endorsement to your policy, which would reduce your premium since you're driving the vehicle less frequently. This endorsement would adjust the coverage and premium to reflect the lower risk associated with limited driving.

Another common endorsement is the "gap coverage" rider. This rider covers the difference between the actual cash value of your vehicle and the amount you still owe on your loan or lease if your car is totaled or stolen. It's particularly useful for those who lease their vehicles or have a loan with a high loan-to-value ratio.

Umbrella Policies

An umbrella policy is a type of liability insurance that provides additional coverage above and beyond the limits of your auto, homeowners, or renters insurance policies. It kicks in when the limits of your underlying policies are exhausted, offering an extra layer of protection for catastrophic losses.

Consider a scenario where you're sued for a large sum due to an accident for which you're held responsible. Your auto insurance policy's liability limits may not be sufficient to cover the entire amount. In such a case, an umbrella policy would step in to provide additional coverage, protecting your assets and financial well-being.

Roadside Assistance and Towing Coverage

Many auto insurance policies offer optional roadside assistance and towing coverage. This coverage provides peace of mind by offering services such as battery jumps, flat tire changes, fuel delivery, and towing services in case of breakdowns or accidents.

For instance, if your car won't start due to a dead battery, you can call your insurance company's roadside assistance hotline. They'll dispatch a service provider to your location to jump-start your vehicle, ensuring you can continue your journey without delay.

The Future of Auto Insurance Policy Lookup

As technology continues to advance, the landscape of auto insurance policy lookup is evolving. Insurtech, a term coined to describe the fusion of insurance and technology, is bringing about significant changes in how policies are managed and accessed.

Insurtech Innovations

Insurtech companies are leveraging advanced technologies such as artificial intelligence, machine learning, and data analytics to revolutionize the insurance industry. These technologies are being used to enhance policy management, streamline claims processes, and provide personalized coverage options.

For instance, some insurance companies are using telematics devices to track driving behavior and offer usage-based insurance policies. These policies reward safe drivers with lower premiums, as the telematics data provides an accurate assessment of their risk profile.

Additionally, blockchain technology is being explored for its potential to secure and streamline insurance processes. Blockchain's distributed ledger system could improve the efficiency of claims processing, reduce fraud, and provide greater transparency for policyholders.

The Rise of Digital Insurance Platforms

Digital insurance platforms are becoming increasingly popular, offering a more convenient and user-friendly way to manage auto insurance policies. These platforms, often accessible via mobile apps or web browsers, provide a centralized hub for policyholders to view their policies, make changes, and file claims.

With a digital insurance platform, policyholders can have real-time access to their policy details, allowing them to quickly make informed decisions. These platforms often feature intuitive interfaces and interactive tools, making it easier for users to understand their coverage and make adjustments as needed.

For example, a policyholder might use their digital platform to compare different coverage options and see how changes in deductibles or coverage limits impact their premium. This level of transparency and control empowers policyholders to make more informed decisions about their auto insurance.

How often should I review my auto insurance policy?

+It’s recommended to review your auto insurance policy annually, or whenever your life circumstances change significantly. This ensures your coverage remains adequate and up-to-date with your needs.

Can I switch insurance companies without penalty?

+In most cases, you can switch insurance companies without penalty. However, it’s important to check your current policy for any cancellation fees or requirements. Typically, you can switch companies by providing a notice of cancellation and obtaining a new policy.

What should I do if I’m unsure about my policy coverage?

+If you have questions or concerns about your policy coverage, contact your insurance agent or company’s customer service. They can provide clarification and guidance to ensure you understand your coverage fully.