Market Health Insurance

In today's world, where healthcare costs can be unpredictable and often astronomical, securing adequate health insurance coverage has become an essential financial safeguard for individuals and families. With the rising complexity of healthcare systems and the diverse range of insurance plans available, making informed decisions about health insurance is crucial. This comprehensive guide aims to provide an in-depth analysis of the health insurance market, offering valuable insights and strategies to navigate this critical aspect of personal finance.

Understanding the Health Insurance Market

The health insurance market is a dynamic and complex ecosystem, offering a multitude of plans, providers, and coverage options. From private insurers to government-sponsored programs, the choices can be overwhelming for consumers. To make informed decisions, it’s vital to grasp the fundamental concepts and nuances of this market.

Key Players in the Health Insurance Landscape

The health insurance industry is characterized by a diverse range of players, each offering unique plans and services. Major private insurers like Blue Cross Blue Shield, UnitedHealthcare, and Aetna dominate the market, providing comprehensive coverage options. Additionally, regional insurers often cater to specific demographics or geographic areas, offering tailored plans.

Government-sponsored programs, such as Medicare for seniors and Medicaid for low-income individuals, play a crucial role in providing healthcare coverage to vulnerable populations. Understanding the eligibility criteria and benefits of these programs is essential for those who qualify.

Types of Health Insurance Plans

Health insurance plans can be broadly categorized into several types, each with its own set of features and coverage limitations. The most common types include:

- Fee-for-Service (FFS): This traditional model allows policyholders to choose their healthcare providers and receive coverage for services rendered. FFS plans often require patients to pay a deductible and coinsurance, with the insurance company covering the remaining costs.

- Health Maintenance Organizations (HMOs): HMOs typically require policyholders to select a primary care physician who coordinates their healthcare needs. Referrals are often necessary for specialist care. HMOs may have a more limited network of providers but offer cost-effective coverage.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs, allowing policyholders to choose from a network of preferred providers without requiring referrals. While out-of-network care is covered, it often comes at a higher cost.

- Point-of-Service (POS) Plans: POS plans combine elements of HMOs and PPOs, offering a choice between in-network and out-of-network providers. Policyholders typically pay lower out-of-pocket costs when using in-network providers.

Evaluating Coverage and Benefits

When assessing health insurance plans, it’s crucial to carefully evaluate the coverage and benefits offered. Consider the following factors:

- Network of Providers: Check the insurance company's network to ensure your preferred healthcare providers are included. A robust network can provide more flexibility and ease of access to care.

- Covered Services: Review the plan's benefits to understand what is and isn't covered. This includes medical services, prescriptions, mental health coverage, and specialty care.

- Cost-Sharing: Understand the plan's cost-sharing structure, including deductibles, copayments, and coinsurance. Higher deductibles can result in lower monthly premiums but may require larger out-of-pocket expenses.

- Out-of-Pocket Maximum: The out-of-pocket maximum represents the limit of your financial responsibility for covered services in a given year. Plans with lower out-of-pocket maximums can provide greater financial protection.

| Plan Type | Network Flexibility | Cost-Sharing |

|---|---|---|

| Fee-for-Service | High | Deductibles, Coinsurance |

| HMO | Limited | Copayments |

| PPO | High | Deductibles, Copayments |

| POS | Flexible | Deductibles, Copayments |

Navigating the Health Insurance Market

With a solid understanding of the health insurance landscape, the next step is to navigate the market effectively to find the best plan for your needs. Here are some key strategies to consider:

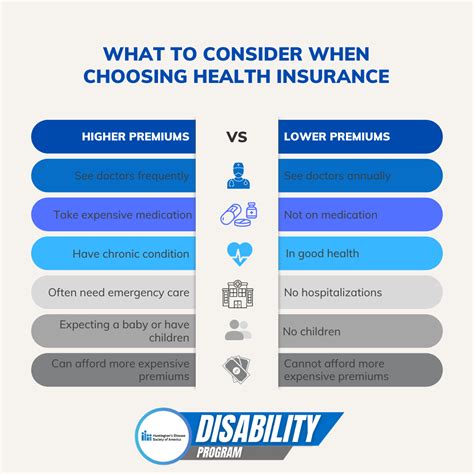

Assessing Your Healthcare Needs

Before selecting a health insurance plan, it’s crucial to assess your current and potential future healthcare needs. Consider factors such as:

- Chronic conditions or ongoing medical treatments.

- Prescription medication requirements.

- Mental health or behavioral health needs.

- Specialist care requirements.

- Potential for major medical events or surgeries.

By understanding your healthcare needs, you can choose a plan that provides adequate coverage and minimizes out-of-pocket expenses.

Comparing Plans and Costs

When comparing health insurance plans, consider both the monthly premiums and the overall cost of coverage. Plans with lower premiums may have higher deductibles or limited coverage, so it’s essential to evaluate the trade-offs.

Use online tools and resources to compare plans side by side. Look for plans that offer the coverage you need at a competitive price. Consider the cost of your preferred providers and the potential for out-of-network expenses.

Understanding Provider Networks

The network of healthcare providers associated with a plan can significantly impact your experience. Before enrolling, ensure that your preferred doctors, specialists, and hospitals are included in the plan’s network. Out-of-network care can be costly and may not be fully covered by your insurance.

If you have a particular healthcare provider you prefer, contact them directly to inquire about the insurance plans they accept. This can help narrow down your options and ensure you have access to the care you need.

Utilizing Government Resources

Government-sponsored programs and resources can provide valuable assistance when navigating the health insurance market. Here are some key resources to consider:

- Healthcare.gov: This official website provides information and resources for understanding health insurance options, including state-specific marketplaces for purchasing insurance.

- Medicare.gov: For seniors, Medicare offers comprehensive coverage with various plan options. This website provides detailed information on eligibility, benefits, and enrollment.

- Medicaid: Each state's Medicaid program has its own guidelines and eligibility criteria. Visit your state's Medicaid website to understand the application process and coverage details.

Seeking Professional Guidance

Navigating the complex world of health insurance can be challenging, especially when considering the numerous plans and options available. If you find the process overwhelming, consider seeking guidance from a professional:

- Insurance Brokers: Independent insurance brokers can provide unbiased advice and help you compare plans from multiple insurers. They can assist in finding the best coverage for your needs and budget.

- Financial Advisors: Financial advisors with expertise in health insurance can offer personalized guidance based on your financial situation and healthcare needs. They can help you understand the long-term implications of your insurance choices.

Maximizing Your Health Insurance Coverage

Once you’ve selected a health insurance plan, it’s essential to understand how to maximize your coverage and minimize costs. Here are some strategies to consider:

Understanding Your Plan’s Benefits

Take the time to thoroughly review your insurance plan’s benefits and coverage details. Familiarize yourself with the specific services and treatments covered, as well as any exclusions or limitations. This knowledge will help you make informed decisions about your healthcare.

Staying Informed about Plan Changes

Health insurance plans can change annually, with updates to provider networks, coverage benefits, and costs. Stay informed about these changes by regularly reviewing plan materials and communicating with your insurance provider. Being aware of plan changes can help you anticipate and prepare for any potential impacts on your healthcare access and costs.

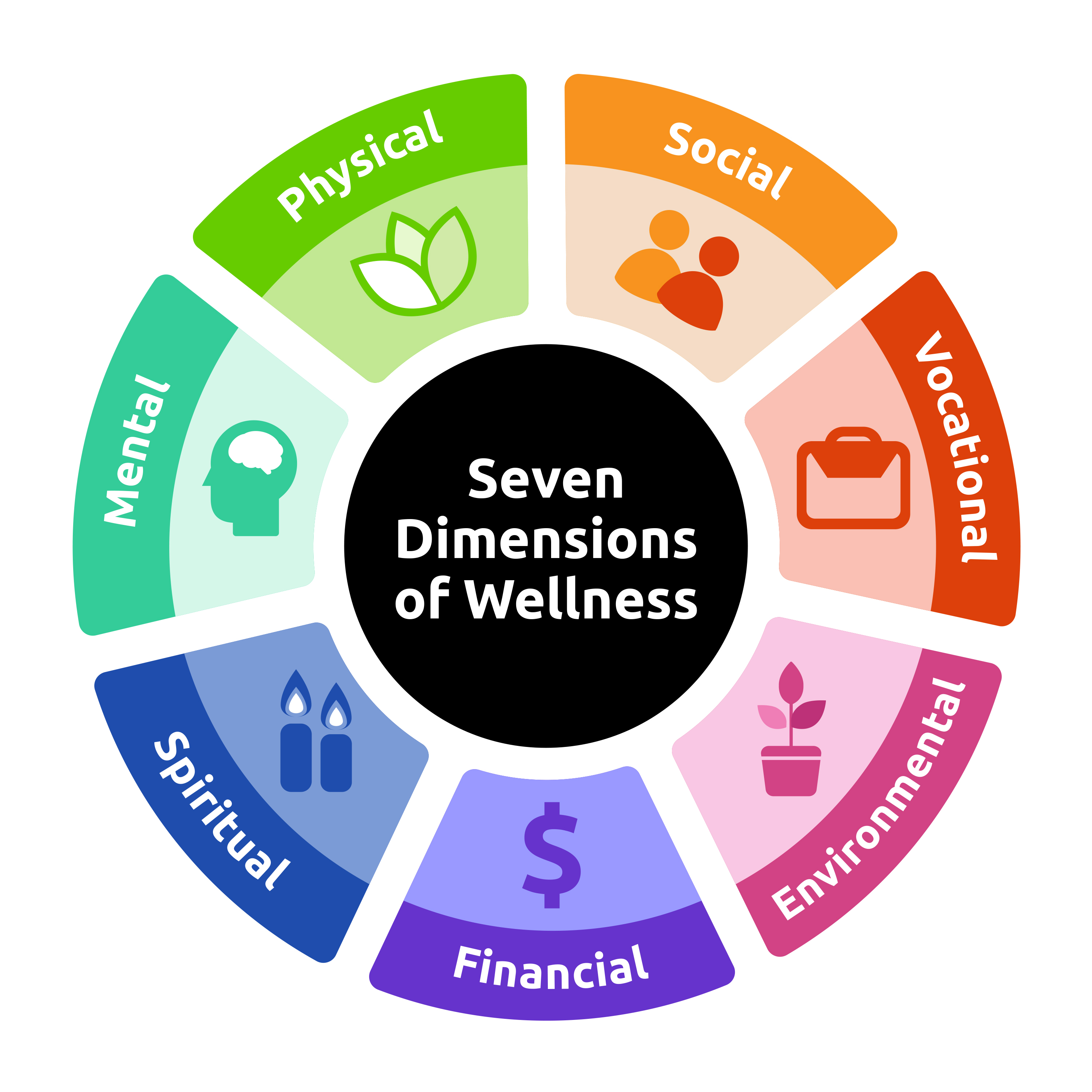

Utilizing Preventive Care Services

Many health insurance plans offer preventive care services at little to no cost. These services, such as annual physicals, immunizations, and screenings, can help identify potential health issues early on, allowing for more effective treatment and potentially reducing long-term healthcare costs.

Take advantage of these preventive care benefits to maintain your health and well-being. Regular check-ups and screenings can catch potential issues before they become more serious and costly to treat.

Managing Chronic Conditions

If you have a chronic condition, such as diabetes or heart disease, managing your condition effectively can help control healthcare costs. Work closely with your healthcare providers to develop a comprehensive treatment plan and stay on top of your health. This may include regular check-ins, medication management, and lifestyle modifications.

Many insurance plans offer disease management programs or resources specifically for chronic conditions. These programs can provide additional support, education, and tools to help you better manage your health.

Understanding Prescription Drug Coverage

Prescription medications can be a significant expense, so understanding your plan’s prescription drug coverage is crucial. Review your plan’s formulary, which lists the drugs covered and their associated costs. Look for generic drug options, as they are often more cost-effective than brand-name medications.

If you require a medication that is not covered by your plan or is only partially covered, consider discussing alternative options with your healthcare provider. Sometimes, there may be a similar medication available that is covered by your insurance.

Future Implications and Considerations

The health insurance market is subject to ongoing changes and developments, influenced by factors such as healthcare policy, technological advancements, and shifting consumer needs. Staying informed about these trends can help you make more strategic decisions about your coverage.

Healthcare Policy and Reform

Healthcare policy and reform efforts can significantly impact the health insurance market. Keep an eye on proposed legislation and policy changes that may affect your coverage options and costs. Understanding these changes can help you adapt and make informed choices about your healthcare.

Technological Advancements

Technology is revolutionizing the healthcare industry, and this extends to health insurance as well. Telehealth services, digital health platforms, and wearable health tracking devices are transforming the way healthcare is delivered and accessed. These innovations can improve access to care, enhance convenience, and potentially reduce costs.

Stay informed about these technological advancements and consider how they may impact your healthcare experience and insurance needs.

Shifting Consumer Preferences

Consumer preferences and expectations are evolving in the healthcare industry. There is a growing demand for more personalized, convenient, and affordable healthcare options. This shift is influencing the development of new insurance plans and benefits, such as wellness programs, telemedicine services, and flexible payment options.

Understanding these changing consumer preferences can help you choose a health insurance plan that aligns with your values and expectations.

Conclusion

Navigating the health insurance market can be a complex and daunting task, but with a solid understanding of the landscape and strategic decision-making, you can find the right coverage for your needs. By assessing your healthcare needs, comparing plans, and understanding the intricacies of coverage and benefits, you can make informed choices about your health insurance.

Remember, health insurance is a vital financial safeguard, and it's important to stay informed and engaged in your healthcare journey. By maximizing your coverage and staying abreast of market trends and developments, you can ensure you have the protection you need to maintain your health and well-being.

What is the Affordable Care Act (ACA) and how does it impact health insurance?

+The Affordable Care Act (ACA), also known as Obamacare, is a federal law that aims to increase the affordability and accessibility of health insurance. It introduced several reforms, including the establishment of state-based health insurance marketplaces, the expansion of Medicaid, and the implementation of essential health benefits that must be covered by insurance plans. The ACA has significantly impacted the health insurance market by increasing the number of insured individuals and introducing consumer protections.

How can I reduce my health insurance costs without compromising coverage?

+To reduce health insurance costs, consider the following strategies: (1) Shop around and compare plans from different insurers, as prices can vary significantly. (2) Evaluate high-deductible health plans (HDHPs) paired with health savings accounts (HSAs), which offer tax advantages and can lower premiums. (3) Assess your healthcare needs and choose a plan with coverage that aligns with those needs, avoiding unnecessary expenses. (4) Take advantage of employer-sponsored plans, as many employers offer subsidies or contribute to insurance costs.

What should I do if I have a pre-existing condition and need health insurance coverage?

+If you have a pre-existing condition, it’s important to know that under the ACA, insurance companies cannot deny coverage or charge higher premiums based on your health status. However, some grandfathered plans may still impose pre-existing condition exclusions. To find coverage, consider the following options: (1) Enroll in a marketplace plan during the open enrollment period. (2) Explore Medicaid or CHIP, as these programs often cover pre-existing conditions. (3) Check if your employer’s plan covers pre-existing conditions.

How can I find the best health insurance plan for my family’s needs?

+To find the best health insurance plan for your family, consider the following steps: (1) Assess your family’s healthcare needs, including any chronic conditions or prescription medication requirements. (2) Compare plans based on coverage, provider networks, and cost. (3) Evaluate additional benefits such as dental and vision coverage, mental health services, and wellness programs. (4) Consider the plan’s out-of-pocket costs and whether it aligns with your budget.