Insurance State Farm Quote

Insurance is an essential aspect of our lives, providing us with financial protection and peace of mind. When it comes to choosing the right insurance provider, many individuals and businesses turn to State Farm, a trusted name in the industry. State Farm offers a wide range of insurance products, catering to various needs. In this article, we will delve into the world of State Farm insurance, exploring its services, the quote process, and the benefits it brings to policyholders.

The Comprehensive Services of State Farm

State Farm is a renowned insurance company with a rich history and a strong presence in the United States. Founded in 1922, it has grown to become one of the largest insurance providers in the country. Over the decades, State Farm has expanded its offerings to meet the evolving needs of its customers.

One of the key strengths of State Farm is its comprehensive range of insurance products. Whether you're seeking auto insurance, homeowners insurance, life insurance, or even business insurance, State Farm has tailored solutions to meet your specific requirements. Here's a glimpse at some of the key insurance categories they cover:

- Auto Insurance: State Farm offers a wide array of auto insurance options, including coverage for liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist protection. They provide customizable policies to suit different driving needs and budgets.

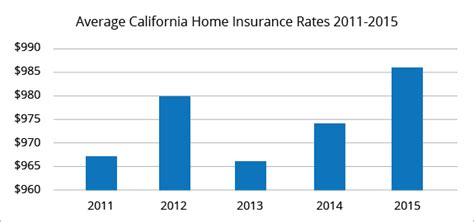

- Homeowners Insurance: Protecting your home and its contents is crucial. State Farm's homeowners insurance policies offer coverage for various perils, such as fire, theft, and natural disasters. Additionally, they provide liability protection and additional living expenses coverage in case of a covered loss.

- Life Insurance: State Farm understands the importance of financial security for your loved ones. Their life insurance policies provide death benefit protection, ensuring your family's financial well-being even in the event of an unexpected loss. They offer term life, whole life, and universal life insurance options.

- Business Insurance: For small business owners, State Farm offers comprehensive business insurance packages. These policies cover a range of risks, including property damage, liability claims, and business interruption. State Farm's business insurance solutions are designed to protect your business assets and help you recover from unexpected events.

In addition to these core insurance products, State Farm also provides specialized coverage for unique needs. This includes renters insurance, condo insurance, umbrella insurance, and even pet insurance. Their commitment to offering a diverse range of insurance options ensures that they can cater to a wide spectrum of customers.

The Seamless State Farm Quote Process

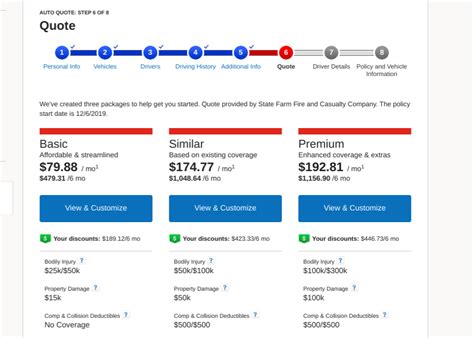

Obtaining a State Farm insurance quote is a straightforward and convenient process. State Farm has made it easy for potential customers to explore their insurance options and receive personalized quotes. Here’s a step-by-step guide to acquiring a State Farm insurance quote:

Step 1: Visit the State Farm Website

Begin by accessing the official State Farm website. The website is user-friendly and provides a wealth of information about their insurance products and services. You can navigate to the “Get a Quote” section, which is typically prominently displayed on the homepage.

Step 2: Select Your Insurance Type

On the quote page, you’ll be prompted to choose the type of insurance you’re interested in. State Farm offers quotes for auto, home, life, and business insurance, among others. Select the category that aligns with your insurance needs.

Step 3: Provide Basic Information

After selecting your insurance type, you’ll be guided through a series of questions to gather the necessary information. This typically includes personal details such as your name, date of birth, contact information, and the specifics of what you want to insure (e.g., vehicle details, home address, business location, etc.).

Step 4: Customize Your Coverage

State Farm allows you to tailor your insurance policy to fit your unique circumstances. During the quote process, you can choose the level of coverage you desire, add optional endorsements or riders, and adjust deductibles to suit your preferences and budget.

Step 5: Receive Your Quote

Once you’ve provided all the required information and customized your coverage, State Farm’s system will generate a personalized quote. This quote will outline the cost of your insurance policy, including any applicable discounts or surcharges. You’ll have the option to review the quote and make any necessary adjustments before proceeding.

It's important to note that State Farm's quote process is designed to be quick and efficient. They understand that obtaining insurance quotes can be time-consuming, so they've streamlined the process to provide you with a timely and accurate estimate.

Benefits of Choosing State Farm Insurance

State Farm insurance offers numerous advantages to policyholders. Beyond their comprehensive insurance products and seamless quote process, State Farm stands out for its exceptional customer service and additional perks.

Exceptional Customer Service

State Farm is renowned for its exceptional customer service. They have a vast network of local agents who are dedicated to providing personalized assistance. Whether you have questions about your policy, need to file a claim, or require guidance on insurance-related matters, State Farm agents are readily available to offer support.

State Farm's customer service extends beyond their agents. They also offer 24/7 assistance through their toll-free customer service hotline. This ensures that you can reach out for help whenever needed, even outside regular business hours.

Discounts and Savings

State Farm understands the importance of affordability when it comes to insurance. That’s why they offer a range of discounts to help policyholders save on their premiums. Some of the common discounts available include:

- Multi-Policy Discount: By bundling multiple insurance policies with State Farm, you can often qualify for significant discounts.

- Safe Driver Discount ": State Farm rewards safe driving habits. If you maintain a clean driving record, you may be eligible for reduced rates.

- Good Student Discount: Students who maintain a certain GPA or academic standing may qualify for lower insurance premiums.

- Homeownership Discount: Homeowners often receive discounts on their insurance policies, as owning a home can be a stabilizing factor.

Digital Convenience

State Farm embraces digital technology to enhance the customer experience. Their online and mobile platforms provide policyholders with convenient access to their insurance information. You can manage your policies, make payments, file claims, and even track the progress of your claims online or through their mobile app.

Financial Strength and Stability

State Farm is a financially strong and stable insurance company. They have consistently maintained high financial ratings, which provides policyholders with peace of mind. Knowing that State Farm has the financial resources to fulfill its obligations gives customers confidence in their long-term commitment.

Community Engagement

State Farm believes in giving back to the communities it serves. The company actively engages in various community initiatives, supporting education, safety programs, and local charities. By choosing State Farm, you’re not only investing in your insurance needs but also contributing to positive change in your community.

The Future of State Farm Insurance

As the insurance industry continues to evolve, State Farm remains at the forefront of innovation. They are continually enhancing their digital capabilities, making it easier for customers to interact with their insurance policies. State Farm is committed to staying ahead of the curve, adopting new technologies, and adapting to changing customer preferences.

In recent years, State Farm has expanded its focus on data analytics and artificial intelligence. By leveraging these technologies, they can offer more precise risk assessments and personalized insurance solutions. This ensures that policyholders receive tailored coverage that meets their specific needs.

Furthermore, State Farm is actively exploring opportunities in the emerging insurance market, such as usage-based insurance and telemedicine. These innovative approaches aim to provide customers with greater flexibility and cost-effectiveness in their insurance options.

Frequently Asked Questions

How does State Farm determine insurance rates?

+State Farm uses a combination of factors to determine insurance rates, including your personal information, driving record, claims history, and the specific coverage you choose. They also consider external factors like location and demographic data.

Can I bundle multiple insurance policies with State Farm to save money?

+Yes, State Farm encourages policyholders to bundle multiple insurance policies, such as auto and home insurance, to take advantage of significant discounts. Bundling can result in substantial savings on your overall insurance premiums.

What should I do if I need to file an insurance claim with State Farm?

+If you need to file a claim with State Farm, you can start the process by contacting your local State Farm agent or using their online or mobile claim reporting tools. They will guide you through the steps to ensure a smooth and efficient claims process.

Does State Farm offer insurance for unique situations, such as classic car owners or pet owners?

+Absolutely! State Farm recognizes the diverse needs of its customers. They offer specialized insurance coverage for classic car owners, pet owners, renters, condo owners, and more. Their goal is to provide tailored solutions for every customer’s unique circumstances.

How can I get in touch with a State Farm agent for personalized assistance?

+You can find your local State Farm agent by visiting their website and using the agent locator tool. Alternatively, you can contact their customer service hotline, and they will connect you with an agent who can address your specific insurance needs.

In conclusion, State Farm insurance is a trusted partner for individuals and businesses seeking comprehensive insurance coverage. With their wide range of insurance products, seamless quote process, exceptional customer service, and commitment to innovation, State Farm continues to be a leading choice for policyholders across the United States. Whether you’re looking for auto, home, life, or business insurance, State Farm has the expertise and resources to meet your insurance needs.