Christian Ministry Health Insurance

Christian ministry health insurance is a vital aspect for those dedicated to serving in faith-based organizations and churches. This specialized insurance type ensures that religious workers and volunteers receive comprehensive healthcare coverage tailored to their unique needs and circumstances. Understanding the nuances of Christian ministry health insurance is essential, as it empowers these individuals to focus on their spiritual calling without the burden of financial worries related to healthcare.

Understanding Christian Ministry Health Insurance

Christian ministry health insurance is designed to cater to the specific healthcare requirements of individuals involved in religious vocations. These plans recognize that those working in churches and faith-based organizations often face distinct challenges and needs compared to other professions. From covering routine check-ups and preventative care to providing financial protection for more significant health events, these insurance plans aim to offer peace of mind and support for the Christian community.

Key Features and Benefits

One of the primary advantages of Christian ministry health insurance is its focus on preventative care. Many plans offer comprehensive coverage for annual physicals, dental check-ups, and vision examinations, ensuring that individuals can maintain their health proactively. Additionally, these plans often include mental health services, recognizing the unique emotional and spiritual demands of religious work.

Furthermore, Christian ministry health insurance plans frequently provide coverage for a wide range of medical services, including hospitalization, surgery, and prescription medications. They may also offer specialized benefits such as coverage for alternative therapies, spiritual retreats, or even mission trips, acknowledging the diverse healthcare needs of those in Christian ministry.

| Plan Type | Coverage Highlights |

|---|---|

| Basic Plan | Routine check-ups, prescription medications, limited hospitalization |

| Enhanced Plan | All Basic Plan benefits, plus extended hospitalization coverage, vision and dental care |

| Comprehensive Plan | All Enhanced Plan benefits, plus alternative therapy coverage, mission trip support |

Eligibility and Enrollment

Eligibility for Christian ministry health insurance typically extends to pastors, missionaries, church staff, and other individuals directly involved in religious work. However, the exact criteria may vary depending on the insurance provider and the specific plan. Some plans may also offer coverage for family members of those in ministry, ensuring comprehensive healthcare protection for the entire household.

The enrollment process usually involves completing an application that captures essential information about the individual's health status, their role in the ministry, and their desired level of coverage. It's important to provide accurate and detailed information during this stage to ensure that the insurance plan meets the applicant's needs and expectations.

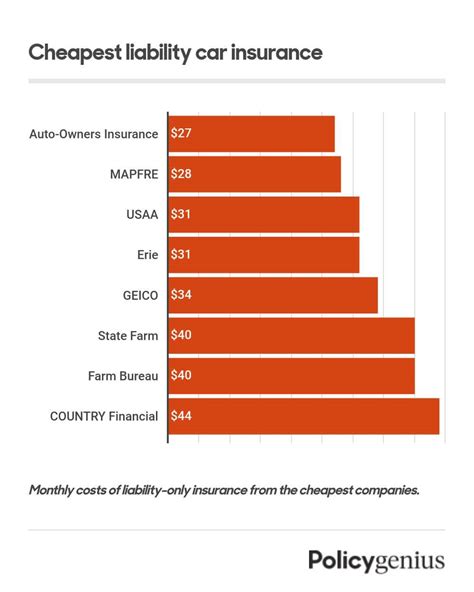

Financial Considerations

Christian ministry health insurance, like any other insurance type, comes with associated costs. These costs are typically structured as monthly premiums, which can vary based on the chosen plan, the applicant’s age and health status, and the level of coverage desired. Additionally, there may be out-of-pocket expenses such as deductibles, copayments, and coinsurance, which individuals should consider when selecting their insurance plan.

Many insurance providers offer flexible payment options, such as payroll deductions for those working full-time in the ministry, or installment plans to make the premiums more manageable. It's crucial to carefully review the financial details of any insurance plan to ensure that it aligns with your budget and financial capabilities.

Affordable Coverage Options

While Christian ministry health insurance is designed to be comprehensive, there are strategies to make it more affordable. One approach is to opt for a higher deductible, which can lower the monthly premium. However, this strategy requires careful consideration, as it means that the insured individual will need to pay more out-of-pocket before the insurance coverage kicks in.

Another option is to explore group plans, which are often offered by churches or faith-based organizations. These group plans can provide significant cost savings, as the insurance provider may offer discounted rates due to the larger pool of insured individuals. Additionally, some providers offer discounts for individuals who maintain a healthy lifestyle or who participate in certain wellness programs.

Navigating the Application Process

Applying for Christian ministry health insurance can be a straightforward process, especially with the right guidance and resources. Many insurance providers offer online application forms, making it convenient to apply from the comfort of your home or office. However, it’s essential to gather all the necessary documents and information before starting the application to ensure a smooth and efficient process.

Required Documentation

When applying for Christian ministry health insurance, you’ll typically need to provide documentation that verifies your role in the ministry and your eligibility for the plan. This may include a letter from your church or religious organization confirming your position, as well as any additional supporting documents, such as pay stubs or tax forms.

Additionally, you'll need to provide personal information, including your date of birth, social security number, and contact details. It's important to ensure that all the information provided is accurate and up-to-date to avoid delays or complications during the application process.

Common Challenges and Solutions

While the application process for Christian ministry health insurance is generally straightforward, there may be instances where applicants face challenges. One common issue is the requirement for medical underwriting, where the insurance provider assesses the applicant’s health status before offering coverage. This process can lead to delays or even denial of coverage for individuals with pre-existing health conditions.

To navigate this challenge, it's essential to be transparent and honest about your health status during the application process. Additionally, consider exploring guaranteed-issue plans, which do not require medical underwriting and provide coverage regardless of health conditions. These plans may have higher premiums, but they offer a reliable safety net for those with pre-existing health concerns.

Making the Most of Your Coverage

Once you’ve secured Christian ministry health insurance, it’s important to maximize the benefits and ensure you’re getting the most value from your coverage. This involves understanding the intricacies of your plan, from knowing which services are covered to familiarizing yourself with the network of healthcare providers associated with your insurance.

Utilizing Your Benefits

Christian ministry health insurance plans often offer a wide range of benefits, from routine check-ups to specialized treatments. To make the most of your coverage, it’s crucial to stay informed about the services and treatments that are included in your plan. Regularly review your insurance policy and reach out to your insurance provider if you have any questions or need clarification on specific benefits.

Additionally, take advantage of any wellness programs or incentives offered by your insurance provider. These programs can promote healthy lifestyles, prevent future health issues, and potentially reduce your insurance costs over time.

Choosing the Right Healthcare Providers

Most Christian ministry health insurance plans have a network of preferred healthcare providers, which are doctors, hospitals, and specialists that have negotiated rates with the insurance company. Utilizing these in-network providers can result in significant cost savings, as they agree to accept lower fees for their services.

When selecting healthcare providers, ensure they are in-network with your insurance plan. You can typically find a directory of in-network providers on your insurance provider's website or by contacting their customer service. By choosing in-network providers, you can avoid unexpected out-of-pocket expenses and ensure that your healthcare needs are covered according to your insurance plan.

Addressing Common Concerns

Despite the benefits of Christian ministry health insurance, there may be concerns or misconceptions surrounding this type of coverage. Addressing these concerns can help individuals make informed decisions about their healthcare needs and ensure they receive the support they deserve.

Misconceptions About Coverage Limits

One common misconception about Christian ministry health insurance is that it offers limited coverage compared to other insurance types. However, this is not necessarily true. While the specific coverage and limits may vary depending on the plan and provider, Christian ministry health insurance can offer comprehensive coverage that rivals or even surpasses traditional insurance plans.

It's essential to carefully review the details of any insurance plan you're considering, paying close attention to the coverage limits and exclusions. By doing so, you can make an informed decision and select a plan that aligns with your healthcare needs and budget.

Addressing Concerns About Pre-existing Conditions

Another concern that individuals may have about Christian ministry health insurance is the potential for discrimination based on pre-existing health conditions. While it’s true that some insurance plans may deny coverage or charge higher premiums for individuals with certain pre-existing conditions, this is not a universal practice.

Many Christian ministry health insurance plans are designed to be inclusive and offer coverage regardless of pre-existing conditions. These plans may have higher premiums to accommodate the additional risk, but they ensure that individuals with health concerns can still access the healthcare coverage they need. It's important to research and compare different insurance providers to find a plan that aligns with your health status and financial capabilities.

The Future of Christian Ministry Health Insurance

As the landscape of healthcare continues to evolve, so too does the world of Christian ministry health insurance. With advancements in technology and a growing emphasis on preventative care, the future of this insurance type looks promising.

Technology’s Impact

Technology is revolutionizing the healthcare industry, and Christian ministry health insurance is no exception. From online portals that provide easy access to insurance information and claims management to telemedicine services that offer remote consultations with healthcare professionals, technology is enhancing the efficiency and accessibility of healthcare coverage.

Additionally, technology is playing a crucial role in promoting preventative care. Wearable devices and health tracking apps can encourage individuals to adopt healthier lifestyles, while also providing valuable data that can inform insurance providers about their customers' health trends. This data-driven approach can lead to more personalized and effective healthcare plans.

Embracing Preventative Care

The future of Christian ministry health insurance lies in a continued emphasis on preventative care. By investing in regular check-ups, health screenings, and wellness programs, individuals can take a proactive approach to their health, potentially avoiding more serious health issues down the line.

Insurance providers are recognizing the value of preventative care and are offering incentives and discounts to encourage their customers to prioritize their health. This shift towards preventative care not only benefits individuals by improving their overall well-being but also reduces the financial burden on both the insured and the insurance provider in the long run.

FAQ Section

Can I get Christian ministry health insurance if I have a pre-existing condition?

+

Yes, many Christian ministry health insurance plans offer coverage regardless of pre-existing conditions. However, it’s important to carefully review the plan details and compare different providers to find the best option for your health status and budget.

How do I choose the right Christian ministry health insurance plan for me?

+

When selecting a Christian ministry health insurance plan, consider your healthcare needs, budget, and the specific benefits offered by each plan. It’s essential to review the coverage limits, out-of-pocket expenses, and any potential exclusions to ensure you’re getting the right coverage for your circumstances.

Are there any discounts or incentives available for Christian ministry health insurance?

+

Yes, many insurance providers offer discounts for Christian ministry health insurance. These discounts may be based on factors such as healthy lifestyle choices, group plans, or participation in wellness programs. It’s worth exploring these options to potentially reduce your insurance costs.

Can I include my family members on my Christian ministry health insurance plan?

+

Yes, many Christian ministry health insurance plans offer coverage for family members. Depending on the plan, this may include spouses, children, or even extended family members. It’s important to review the specific eligibility criteria and coverage details for family members when selecting your insurance plan.

What happens if I need to make a claim on my Christian ministry health insurance plan?

+

If you need to make a claim on your Christian ministry health insurance plan, you’ll typically need to provide documentation of the medical services received and their associated costs. This may include itemized bills, prescriptions, or other relevant paperwork. It’s important to carefully follow the claims process outlined by your insurance provider to ensure a smooth and timely reimbursement.