Best No Exam Life Insurance

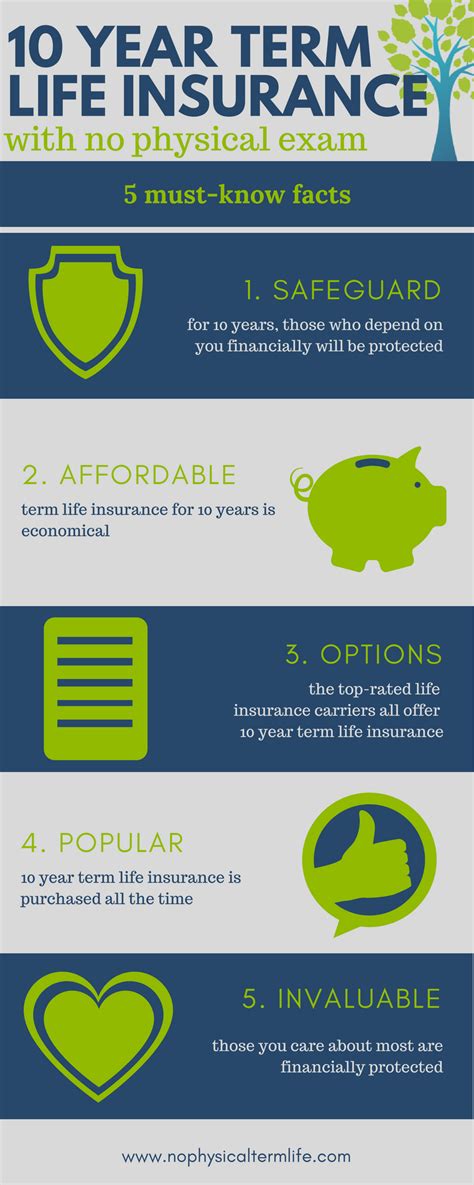

In today's fast-paced world, finding adequate life insurance coverage without the hassle of medical exams is a top priority for many individuals. No exam life insurance policies offer a convenient and efficient way to secure financial protection for your loved ones, making them an attractive option for those seeking quick and straightforward coverage.

Understanding No Exam Life Insurance

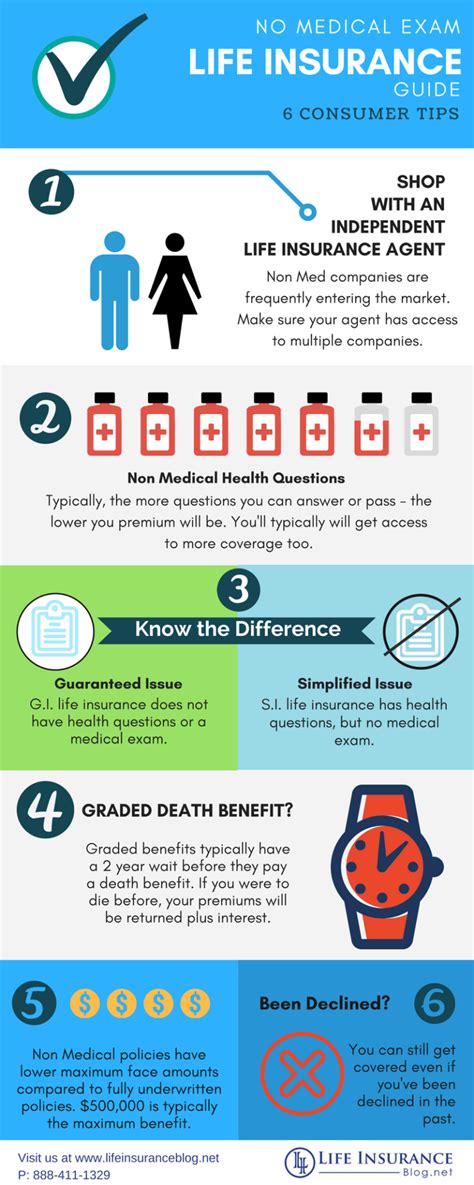

No exam life insurance, also known as simplified issue life insurance, is a type of policy that does not require the policyholder to undergo a medical examination. Instead, these policies are based on a few simple health questions and, in some cases, a review of your medical history. This streamlined process makes it an ideal choice for individuals who want immediate coverage or have health conditions that might make traditional life insurance difficult to obtain.

The primary benefit of no exam life insurance is the speed and ease of application. You can often complete the application process online or over the phone, without the need for an in-person meeting or a physical exam. This can be particularly appealing to those who are short on time or prefer a more private and discreet insurance experience.

Top No Exam Life Insurance Providers

When it comes to choosing the best no exam life insurance, several reputable providers offer a range of options to suit different needs and budgets. Here’s an overview of some of the top players in this market:

Prudential

Prudential, a well-established name in the insurance industry, offers Prudential Simplified Term and Prudential Simplified Whole Life policies. These policies provide coverage amounts up to 500,000 and 250,000 respectively, with terms ranging from 10 to 30 years. The application process is straightforward, and you can often receive a decision within minutes.

| Policy | Coverage Amount | Term Length |

|---|---|---|

| Prudential Simplified Term | $500,000 | 10-30 years |

| Prudential Simplified Whole Life | $250,000 | N/A (whole life coverage) |

AIG

AIG, a global leader in insurance, provides the AIG Direct Express Term policy. This policy offers coverage amounts of up to $500,000 for terms of 10, 20, or 30 years. AIG’s no exam life insurance is known for its simplicity and competitive rates.

| Policy | Coverage Amount | Term Length |

|---|---|---|

| AIG Direct Express Term | $500,000 | 10, 20, or 30 years |

Banner Life (Legal & General)

Banner Life, a subsidiary of Legal & General, offers the Legal & General Express Term policy. This policy provides coverage amounts of up to $500,000 for terms of 10, 20, or 30 years. Banner Life is known for its efficient application process and excellent customer service.

| Policy | Coverage Amount | Term Length |

|---|---|---|

| Legal & General Express Term | $500,000 | 10, 20, or 30 years |

Mutual of Omaha

Mutual of Omaha’s Whole Life Express policy offers permanent life insurance coverage without a medical exam. This policy provides up to $250,000 in coverage and is ideal for those seeking long-term protection. Mutual of Omaha is known for its financial stability and customer-centric approach.

| Policy | Coverage Amount | Term Length |

|---|---|---|

| Whole Life Express | $250,000 | N/A (whole life coverage) |

Haven Life

Haven Life, a subsidiary of MassMutual, provides the Haven Term policy. This policy offers coverage amounts of up to $3 million for terms of 10, 15, 20, or 30 years. Haven Life’s application process is entirely online, and decisions are typically made within minutes. They also offer a unique digital experience and excellent customer support.

| Policy | Coverage Amount | Term Length |

|---|---|---|

| Haven Term | $3,000,000 | 10, 15, 20, or 30 years |

Factors to Consider

When choosing the best no exam life insurance policy, several factors should be taken into consideration:

- Coverage Amount: Ensure the policy provides adequate coverage to meet your needs. Consider your financial obligations, such as mortgage payments, outstanding debts, and your family's future financial requirements.

- Term Length: Determine how long you need coverage. Term life insurance policies typically offer coverage for a specific period, while whole life policies provide coverage for your entire life.

- Premiums: Compare the premiums offered by different providers. While no exam life insurance tends to be more expensive than traditional policies, there can still be significant variations in cost.

- Policy Features: Look for additional benefits or riders that may be included with the policy, such as accelerated death benefits or waiver of premium in case of disability.

- Reputation and Financial Strength: Choose a reputable insurer with a strong financial rating. This ensures the insurer is likely to be around to pay out claims in the future.

The Application Process

The application process for no exam life insurance is designed to be straightforward and efficient. Here’s a general overview of what you can expect:

- Choose a Provider: Select a reputable insurer offering no exam life insurance policies that fit your needs.

- Complete an Application: This typically involves providing basic personal information, such as your name, date of birth, and contact details. You'll also be asked a few simple health questions.

- Medical History Review: The insurer may conduct a review of your medical history. This process is often automated and takes into account factors like your age, gender, and smoking status.

- Receive a Decision: Based on the information provided, the insurer will make a decision on your application. This process is usually quick, with some providers offering instant decisions.

- Policy Delivery: Once approved, you'll receive your policy documents. Review these carefully to ensure all the details are correct.

Future Implications

The demand for no exam life insurance is expected to grow as more individuals seek convenient and accessible financial protection. As the industry evolves, we can anticipate the following trends and developments:

- Digital Transformation: Insurers will continue to enhance their digital platforms, making the application process even more streamlined and user-friendly.

- Enhanced Underwriting: Advances in technology may lead to more sophisticated underwriting processes, allowing for more accurate risk assessment without the need for invasive medical exams.

- Expanded Coverage Options: As the market grows, we can expect a wider range of coverage options, including higher coverage limits and more flexible terms, to cater to a diverse range of needs.

- Increased Competition: With more insurers entering the no exam life insurance market, competition will likely drive down premiums and improve policy features, benefiting consumers.

Conclusion

No exam life insurance provides a convenient and accessible way to secure financial protection for your loved ones. With a range of reputable providers offering competitive policies, individuals can quickly and easily obtain the coverage they need without the hassle of medical exams. As the industry continues to innovate, we can look forward to even more efficient and comprehensive no exam life insurance options in the future.

What is the typical coverage limit for no exam life insurance policies?

+Coverage limits for no exam life insurance policies can vary, but they typically range from 250,000 to 500,000. However, some providers, like Haven Life, offer coverage amounts up to $3 million.

Are no exam life insurance policies more expensive than traditional policies?

+Yes, no exam life insurance policies often have higher premiums compared to traditional policies that require medical exams. This is because the insurer assumes a higher level of risk when issuing coverage without a thorough medical evaluation.

Can I get no exam life insurance if I have a pre-existing medical condition?

+Yes, no exam life insurance policies are designed to be more inclusive and can often accommodate individuals with pre-existing medical conditions. However, the coverage amount and premiums may be affected based on the nature and severity of the condition.

How long does it take to receive a decision on my no exam life insurance application?

+The application process for no exam life insurance is designed to be quick and efficient. Most providers offer instant decisions or promise a response within a few business days. Some even provide immediate coverage upon application approval.