Renters Personal Liability Insurance

Renters Personal Liability Insurance: Protecting Your Peace of Mind

In the world of renting, it's easy to feel like your belongings and personal liability are at the mercy of chance. From accidental damage to unexpected injuries, the risks are real and can have significant financial implications. This is where Renters Personal Liability Insurance steps in as a crucial safeguard, offering peace of mind and comprehensive coverage for renters.

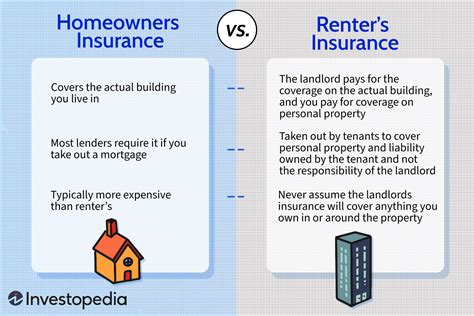

Unlike homeowners, renters often underestimate the importance of insurance, assuming that their landlord's policy will cover any mishaps. However, the reality is that standard landlord insurance typically covers the building and its structure, not the tenant's personal belongings or liability.

Renters Personal Liability Insurance is designed to fill this gap, providing essential protection for individuals and families living in rental properties. It's a vital tool in managing risk and ensuring that unexpected events don't lead to devastating financial consequences.

Understanding the Coverage

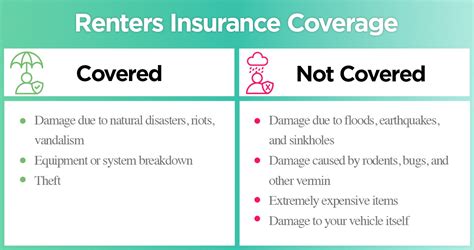

Renters Personal Liability Insurance is a type of insurance policy that protects individuals from financial loss due to unexpected events or accidents that occur within their rental property. It provides coverage for a wide range of incidents, ensuring that renters can focus on their daily lives without the worry of unforeseen expenses.

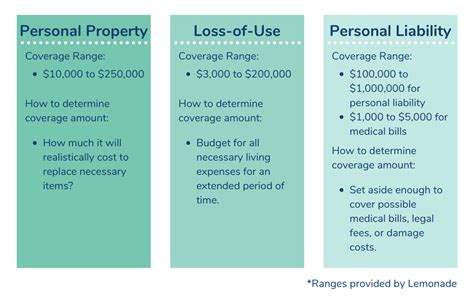

Property Damage

One of the primary concerns for renters is the potential for property damage. Whether it's a leaky pipe causing water damage or a cooking mishap leading to a fire, these incidents can result in costly repairs. Renters Personal Liability Insurance steps in to cover the costs of repairing or replacing damaged property, providing financial relief during difficult times.

For instance, imagine a scenario where a tenant accidentally leaves a candle unattended, leading to a small fire that damages the rental unit and neighboring properties. Without insurance, the tenant would be responsible for the full cost of repairs, which could run into thousands of dollars. With Renters Personal Liability Insurance, the policy would cover these expenses, ensuring the tenant isn't left financially devastated.

| Coverage | Amount |

|---|---|

| Property Damage Liability | $300,000 |

| Medical Payments to Others | $1,000 per person |

Personal Liability

Renters Personal Liability Insurance also covers personal liability, which is a critical aspect of protection. This coverage comes into play when a visitor or guest is injured on the rental property due to the tenant's negligence. It provides financial assistance to cover medical expenses and legal fees, ensuring the tenant isn't personally responsible for these costs.

Consider a scenario where a guest trips and falls on a slippery floor in the tenant's apartment, sustaining injuries. Without personal liability coverage, the tenant could be held responsible for the guest's medical bills and potentially face a lawsuit. Renters Personal Liability Insurance steps in to handle these expenses, offering a crucial safety net.

| Coverage | Amount |

|---|---|

| Personal Liability | $100,000 per occurrence |

| Legal Defense Costs | Up to $10,000 |

Additional Living Expenses

In the event of severe property damage that renders the rental unit uninhabitable, Renters Personal Liability Insurance also provides coverage for additional living expenses. This means that the policy will cover the cost of temporary accommodation and other necessary expenses until the rental unit is repaired or the tenant finds alternative housing.

For example, if a fire were to occur in the rental unit, causing extensive damage and requiring significant repairs, the tenant would need to find temporary housing. Renters Personal Liability Insurance would cover the cost of this temporary accommodation, ensuring the tenant isn't burdened with additional financial stress during an already challenging time.

| Coverage | Amount |

|---|---|

| Additional Living Expenses | Up to $20,000 |

The Benefits of Renters Personal Liability Insurance

Renters Personal Liability Insurance offers a multitude of benefits, ensuring that renters can live their lives with confidence and peace of mind. Here are some key advantages:

- Financial Protection: The primary benefit is financial protection. Renters can rest easy knowing that their insurance policy will cover a wide range of unexpected expenses, from property damage to personal liability claims.

- Peace of Mind: With insurance in place, renters can focus on their daily lives without the constant worry of potential financial disasters. It's a valuable asset for anyone looking to rent with confidence.

- Affordable Coverage: Renters Personal Liability Insurance is often surprisingly affordable, especially when compared to the potential costs of an uninsured incident. It's a small price to pay for the security it provides.

- Customizable Policies: Insurance policies can be tailored to the individual's needs, ensuring that renters receive the coverage that's right for them. This flexibility allows for a personalized approach to risk management.

- Legal Defense: In the event of a liability claim, the insurance policy can provide legal defense, ensuring that the tenant has expert representation to navigate the legal process.

Making an Informed Decision

When considering Renters Personal Liability Insurance, it's essential to shop around and compare different policies. Each insurance provider offers unique benefits and coverage limits, so it's crucial to find a policy that aligns with your specific needs and circumstances.

Start by researching reputable insurance companies and requesting quotes. Compare the coverage limits, deductibles, and any additional benefits or exclusions. Don't hesitate to ask questions and seek clarification to ensure you fully understand the policy terms.

Consider seeking professional advice from an insurance broker or financial advisor. They can provide expert guidance based on your individual situation, helping you make an informed decision. Remember, Renters Personal Liability Insurance is a vital investment in your financial security and peace of mind.

Frequently Asked Questions

What is the difference between Renters Personal Liability Insurance and standard landlord insurance?

+

Renters Personal Liability Insurance covers the tenant’s personal belongings and liability, while standard landlord insurance typically only covers the building’s structure and the landlord’s property. Landlord insurance does not provide coverage for the tenant’s personal items or liability.

Is Renters Personal Liability Insurance mandatory for all renters?

+

No, Renters Personal Liability Insurance is not mandatory, but it is highly recommended. While it is not a legal requirement, having insurance provides valuable financial protection and peace of mind in case of unexpected incidents.

What is covered under the property damage liability portion of the policy?

+

Property damage liability coverage typically includes costs associated with repairing or replacing damaged property caused by accidents or unforeseen events within the rental unit. This could include water damage, fire, or other types of property damage.

Does Renters Personal Liability Insurance cover legal expenses in the event of a liability claim?

+

Yes, many Renters Personal Liability Insurance policies include coverage for legal defense costs in the event of a liability claim. This means that the insurance company will provide legal representation and cover associated expenses up to the policy limit.

Can Renters Personal Liability Insurance be tailored to my specific needs and circumstances?

+

Absolutely! Renters Personal Liability Insurance policies can be customized to meet individual needs. You can choose coverage limits, deductibles, and even add optional coverage for specific concerns. Working with an insurance agent can help ensure you get the right coverage for your situation.