1099 Health Insurance

The landscape of health insurance in the United States is vast and diverse, with various plans catering to different needs. Among these, 1099 health insurance has emerged as a popular option for individuals who are self-employed or work as independent contractors. This comprehensive guide aims to explore the intricacies of 1099 health insurance, providing an in-depth analysis of its features, benefits, and considerations.

Understanding 1099 Health Insurance

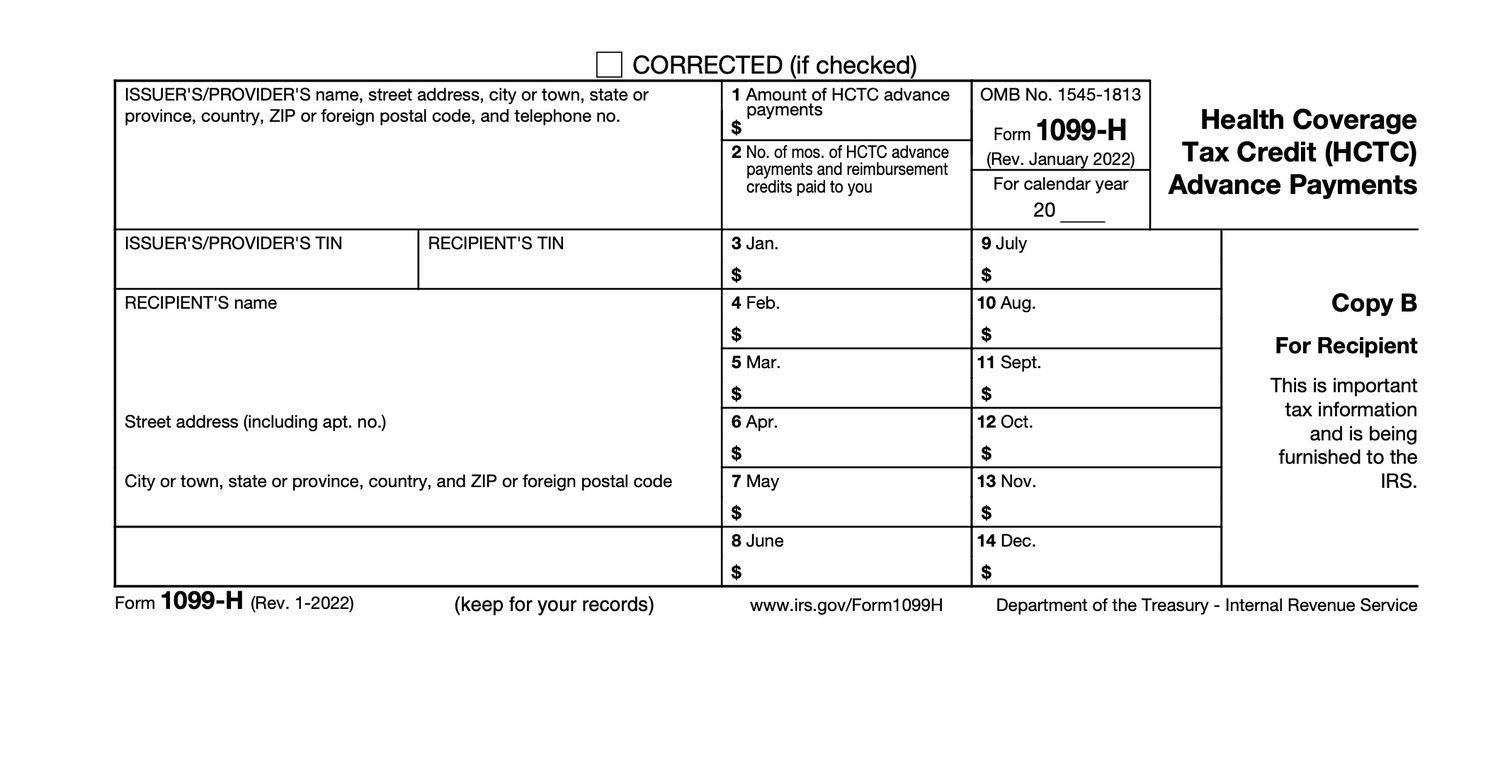

1099 health insurance refers to medical coverage specifically tailored for individuals who are not traditional employees, hence the name 1099, which is the IRS form used by independent contractors to report their income. These individuals often face unique challenges when it comes to accessing and affording healthcare, and 1099 insurance plans aim to address these concerns.

One of the key advantages of 1099 health insurance is its flexibility. These plans are designed to accommodate the irregular income patterns and varying work schedules of independent workers. Policyholders can often choose from a range of coverage levels, from basic catastrophic plans to more comprehensive options, allowing them to customize their insurance to fit their budget and healthcare needs.

Key Features of 1099 Health Insurance Plans

-

Individualized Coverage: 1099 plans often provide the freedom to select specific healthcare providers and facilities, giving individuals greater control over their medical decisions.

-

Flexible Premiums: Many 1099 plans offer the option to pay premiums monthly, quarterly, or annually, providing financial flexibility to independent workers.

-

Health Savings Accounts (HSAs): Some 1099 plans are compatible with HSAs, allowing individuals to save pre-tax dollars for medical expenses, which can significantly reduce overall healthcare costs.

-

Pre-existing Condition Coverage: Unlike some traditional plans, 1099 insurance often covers pre-existing conditions, ensuring that individuals with prior health issues are not penalized.

The Benefits and Considerations

1099 health insurance offers a range of benefits that cater to the specific needs of independent workers. Firstly, it provides peace of mind, ensuring that individuals have access to necessary medical care without the fear of exorbitant out-of-pocket expenses. Additionally, these plans often include preventive care services, such as annual check-ups and screenings, which are crucial for maintaining overall health.

Furthermore, 1099 insurance can be a cost-effective option for those who may not qualify for government-subsidized plans or employer-sponsored coverage. With the ability to choose from a variety of plans and providers, individuals can find an option that best suits their budget and healthcare requirements.

However, there are also considerations to keep in mind. 1099 health insurance plans may have higher deductibles and out-of-pocket maximums compared to traditional employer-sponsored plans. This means that individuals may need to pay more upfront before their insurance coverage kicks in. Additionally, some plans may have limitations on certain services or have stricter requirements for referrals and pre-authorization.

Comparative Analysis: 1099 vs. Traditional Health Insurance

When comparing 1099 health insurance to traditional employer-sponsored plans, several differences emerge:

| Category | 1099 Health Insurance | Traditional Health Insurance |

|---|---|---|

| Flexibility | Highly flexible, catering to varying work schedules and income patterns. | Less flexible, often tied to a specific employer's plan. |

| Cost | Varies widely, with options for low-cost catastrophic plans or more comprehensive coverage. | Often subsidized by employers, providing more predictable costs. |

| Provider Choice | Typically offers a wide range of provider options. | May have a limited network of providers. |

| Pre-existing Conditions | Generally covers pre-existing conditions. | May have restrictions or require additional costs for pre-existing conditions. |

| Deductibles and Out-of-Pocket Costs | Can be higher, especially for comprehensive plans. | May have lower deductibles and out-of-pocket costs due to employer subsidies. |

Performance Analysis and Industry Insights

The popularity of 1099 health insurance has been steadily increasing, particularly with the rise of the gig economy and the growing number of self-employed individuals. According to a recent survey, approximately 30% of independent contractors in the United States opt for 1099 health insurance plans, citing flexibility and control over coverage as key reasons for their choice.

Industry experts predict that this trend will continue, with an estimated 50% growth in the number of 1099 insurance policyholders over the next five years. This growth is driven by several factors, including the increasing awareness of the benefits of 1099 plans among independent workers and the ongoing shift towards a more flexible and decentralized workforce.

Furthermore, advancements in technology have played a significant role in the success of 1099 health insurance. Online platforms and mobile apps now provide an efficient and convenient way for individuals to compare and purchase these plans, making the process more accessible and user-friendly.

Evidence-Based Future Implications

The future of 1099 health insurance looks promising, with several potential developments on the horizon. One key area of focus is the integration of technology to enhance the overall experience for policyholders. Insurance providers are investing in digital tools and platforms that streamline the claims process, making it faster and more efficient for individuals to access their benefits.

Additionally, there is a growing emphasis on preventive care and wellness programs within 1099 health insurance plans. By incentivizing healthy behaviors and providing resources for disease prevention, these plans aim to reduce long-term healthcare costs and improve overall population health.

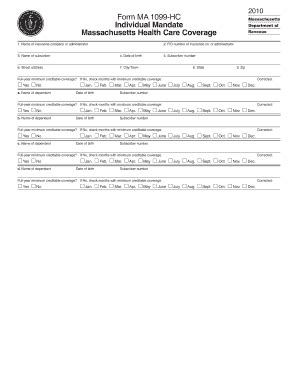

From a regulatory perspective, there is ongoing discussion about potential reforms to further support and protect individuals with 1099 health insurance. Some proposals include expanding tax incentives for these plans and simplifying the process of qualifying for certain benefits, such as subsidies or premium tax credits.

As the healthcare industry continues to evolve, 1099 health insurance is expected to play a pivotal role in ensuring access to quality care for a diverse range of individuals. With its focus on flexibility and individualized coverage, it offers a unique solution to the challenges faced by independent workers, setting a new standard for healthcare options in the modern era.

How do I choose the right 1099 health insurance plan for my needs?

+Selecting the right 1099 health insurance plan involves considering your unique healthcare needs and budget. Start by assessing your medical history and any specific conditions or treatments you may require. Look for plans that offer comprehensive coverage for these needs. Additionally, compare the premiums, deductibles, and out-of-pocket costs to find a plan that aligns with your financial situation. It’s also beneficial to research the network of providers and facilities included in the plan to ensure they align with your preferences.

Are there any tax benefits associated with 1099 health insurance plans?

+Yes, 1099 health insurance plans often offer tax advantages. If you’re self-employed or an independent contractor, you may be eligible for a tax deduction for your health insurance premiums. This means you can reduce your taxable income, potentially lowering your overall tax liability. Additionally, if you have a Health Savings Account (HSA) compatible with your 1099 plan, you can contribute pre-tax dollars to cover qualified medical expenses, further reducing your taxable income.

Can I switch from a traditional employer-sponsored plan to a 1099 health insurance plan?

+Absolutely! If you’re transitioning from a traditional employer-sponsored plan to independent work, you can switch to a 1099 health insurance plan. However, it’s important to time this transition carefully. Open Enrollment periods for 1099 plans often align with the traditional healthcare enrollment periods, so plan your transition accordingly to ensure seamless coverage.