Healthcare Insurance Marketplace

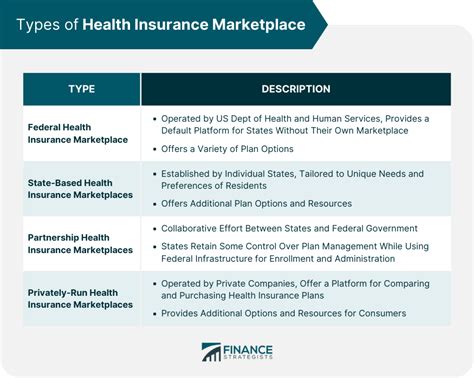

The Healthcare Insurance Marketplace, also known as the Health Insurance Exchange, is a critical component of the U.S. healthcare system, offering individuals and small businesses a platform to compare and purchase health insurance plans. With the implementation of the Affordable Care Act (ACA) in 2010, the Healthcare Insurance Marketplace has become an essential tool for ensuring access to affordable, quality healthcare for millions of Americans. In this comprehensive guide, we will delve into the intricacies of the Marketplace, exploring its history, functionality, benefits, and the impact it has had on healthcare accessibility and affordability.

The Evolution of the Healthcare Insurance Marketplace

The concept of a healthcare insurance marketplace emerged as a solution to the growing concerns over the lack of affordable healthcare options for many Americans. Prior to the ACA, individuals with pre-existing conditions often faced discrimination and were denied coverage or charged exorbitant premiums. The ACA aimed to address these issues by introducing a set of reforms and creating a centralized platform for health insurance shopping.

The Healthcare Insurance Marketplace officially launched in 2013, coinciding with the implementation of key provisions of the ACA. This marketplace serves as a one-stop shop where individuals and families can browse and compare health insurance plans from various providers, ensuring a transparent and competitive environment.

Key Features and Benefits of the Marketplace

The Healthcare Insurance Marketplace offers a range of features and benefits that empower individuals to make informed decisions about their healthcare coverage:

1. Plan Comparison and Selection

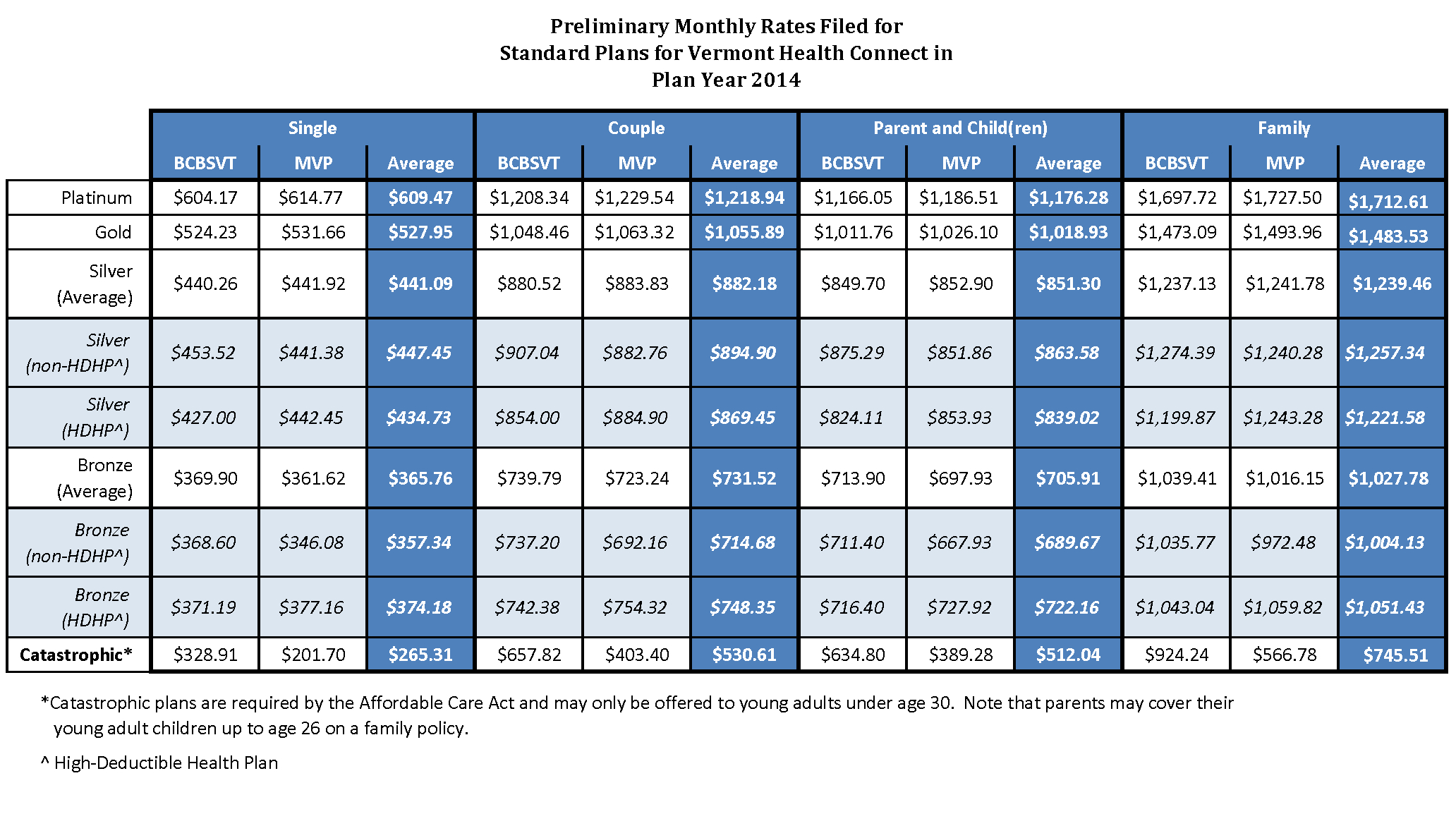

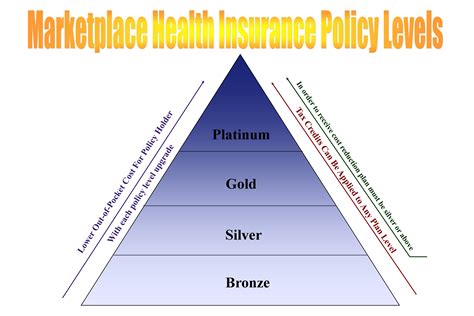

One of the primary advantages of the Marketplace is the ability to compare health insurance plans side by side. Users can evaluate factors such as monthly premiums, deductibles, copayments, and covered services, ensuring they find a plan that aligns with their healthcare needs and budget.

2. Income-Based Subsidies

A significant aspect of the Marketplace is the availability of income-based subsidies and tax credits. These financial aids make health insurance more affordable for individuals and families with limited incomes. The Marketplace calculates the subsidy amount based on income and family size, reducing the financial burden of healthcare coverage.

3. Pre-Existing Condition Coverage

One of the most impactful changes brought about by the ACA and the Marketplace is the prohibition of denying coverage or charging higher premiums based on pre-existing conditions. This ensures that individuals with health issues have equal access to affordable healthcare, promoting a more inclusive and equitable healthcare system.

4. Essential Health Benefits

The Marketplace mandates that all qualified health plans cover a set of essential health benefits, including ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, and more. This ensures that individuals receive comprehensive coverage, regardless of their chosen plan.

5. Special Enrollment Periods

In addition to the annual open enrollment period, the Marketplace offers special enrollment periods for individuals experiencing specific life events, such as losing job-based coverage, getting married, or having a baby. These special enrollment periods allow individuals to enroll outside of the regular timeframe, ensuring continuous coverage.

Navigating the Healthcare Insurance Marketplace

To make the most of the Healthcare Insurance Marketplace, individuals should follow a structured approach:

1. Determine Eligibility

The first step is to assess eligibility for Marketplace coverage. Individuals and families with incomes below a certain threshold may qualify for subsidies or Medicaid. The Marketplace website provides tools to determine eligibility and estimate potential savings.

2. Compare Plans

Once eligibility is confirmed, users can explore the available health insurance plans. The Marketplace website offers a user-friendly interface to compare plans based on cost, coverage, and provider networks. It’s essential to consider personal healthcare needs and budget when making a selection.

3. Enroll and Manage Coverage

After choosing a plan, individuals can complete the enrollment process online or with the assistance of a Marketplace navigator. The Marketplace provides a centralized platform for managing coverage, including updating personal information, changing plans during open enrollment, and accessing important documents.

Performance and Impact Analysis

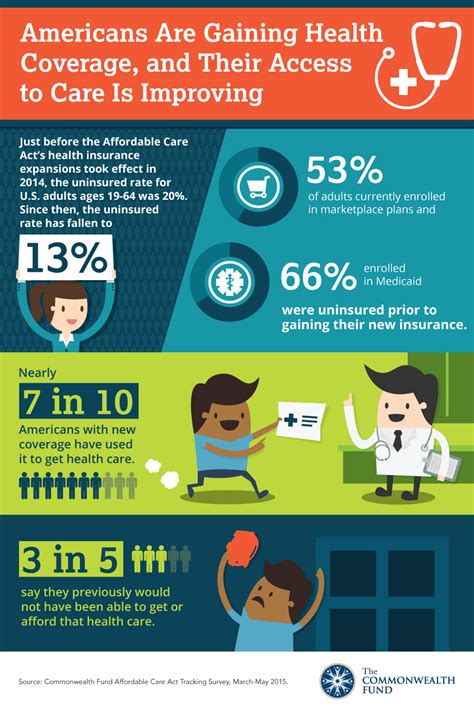

Since its inception, the Healthcare Insurance Marketplace has had a significant impact on healthcare accessibility and affordability. Studies and government reports highlight key findings:

Increased Healthcare Coverage

The Marketplace has played a pivotal role in increasing the number of insured Americans. According to the Centers for Medicare & Medicaid Services (CMS), over 13.8 million people have enrolled in Marketplace coverage as of 2022, with many more benefiting from expanded Medicaid coverage.

Lower Premium Costs

The competitive nature of the Marketplace has led to reduced premium costs for many individuals. A Commonwealth Fund study found that Marketplace plans offer lower premiums than comparable employer-sponsored plans, particularly for individuals with lower incomes.

Improved Access to Healthcare Services

With increased coverage and more affordable options, the Marketplace has improved access to essential healthcare services. A National Bureau of Economic Research working paper noted that Marketplace enrollment led to increased use of preventive care services and reduced financial barriers to accessing healthcare.

Positive Impact on Medicaid Enrollment

The Marketplace has also contributed to increased Medicaid enrollment, particularly in states that expanded Medicaid coverage under the ACA. This expansion has provided healthcare coverage to millions of low-income individuals who may not have otherwise qualified.

| Marketplace Enrollment by State (2022) | Number of Enrollees |

|---|---|

| California | 1.5 million |

| Texas | 1.2 million |

| Florida | 900,000 |

| New York | 800,000 |

| Pennsylvania | 700,000 |

Future Implications and Considerations

As the Healthcare Insurance Marketplace continues to shape the U.S. healthcare landscape, several key considerations and potential developments warrant attention:

1. Ongoing Policy Changes

The healthcare industry is subject to constant policy changes and reforms. Staying informed about these changes is crucial for individuals and families to understand how they may impact their healthcare coverage and options. Regularly checking reliable sources, such as government websites and healthcare advocacy organizations, can provide valuable insights.

2. Technological Advancements

The Healthcare Insurance Marketplace has embraced technology to enhance the user experience and streamline processes. Ongoing technological advancements, such as improved online platforms and mobile applications, can further simplify the enrollment and management of healthcare coverage. Staying updated on these technological innovations can ensure a smoother and more efficient experience.

3. Expanded Coverage Options

Efforts to expand healthcare coverage and improve accessibility are ongoing. Monitoring the development and implementation of new programs and initiatives, such as Medicaid expansion in additional states or the introduction of public option plans, can provide opportunities for individuals to access more affordable and comprehensive healthcare options.

4. Consumer Education and Support

Empowering consumers with knowledge and resources is essential for making informed healthcare decisions. Engaging with educational initiatives, utilizing available tools and resources, and seeking assistance from healthcare navigators or counselors can help individuals navigate the complexities of the Healthcare Insurance Marketplace and choose the most suitable coverage for their needs.

5. Collaborative Efforts for Healthcare Reform

The success of the Healthcare Insurance Marketplace and broader healthcare reforms relies on collaboration among various stakeholders, including policymakers, healthcare providers, insurers, and consumers. Encouraging open dialogue, sharing best practices, and fostering a culture of continuous improvement can contribute to a more efficient and equitable healthcare system.

6. Long-Term Sustainability

Ensuring the long-term sustainability of the Healthcare Insurance Marketplace is crucial for maintaining access to affordable healthcare. Advocating for policies that support the Marketplace’s infrastructure, funding, and continued innovation can help safeguard its effectiveness and ensure its ability to meet the evolving healthcare needs of the population.

7. Addressing Disparities

While the Marketplace has made significant strides in improving healthcare accessibility, disparities in coverage and access persist, particularly among certain demographics and communities. Addressing these disparities through targeted initiatives, cultural competency training, and tailored outreach efforts can help ensure that the benefits of the Marketplace are equitably distributed across the population.

8. Consumer Feedback and Satisfaction

Collecting and acting upon consumer feedback is essential for improving the Healthcare Insurance Marketplace experience. Encouraging individuals to share their experiences, both positive and negative, can provide valuable insights for identifying areas of improvement and implementing changes that enhance consumer satisfaction and overall satisfaction with the healthcare system.

How do I know if I’m eligible for Healthcare Insurance Marketplace coverage and subsidies?

+

Eligibility for Marketplace coverage and subsidies depends on your income, family size, and state of residence. You can use the Marketplace’s eligibility tool to determine if you qualify. Generally, individuals and families with incomes up to 400% of the federal poverty level may be eligible for subsidies, while those below 138% of the poverty level may qualify for Medicaid.

When is the annual open enrollment period for the Healthcare Insurance Marketplace?

+

The annual open enrollment period typically occurs in the fall and winter months, with specific dates varying by state. It’s important to stay informed about the enrollment period in your state to ensure you have time to review and select a plan.

Can I enroll in the Healthcare Insurance Marketplace outside of the open enrollment period?

+

Yes, you may be eligible for a special enrollment period if you experience certain qualifying life events, such as losing job-based coverage, getting married, or having a baby. These special enrollment periods allow you to enroll outside of the regular open enrollment timeframe.

How do I choose the right health insurance plan on the Marketplace?

+

When selecting a health insurance plan on the Marketplace, consider your healthcare needs and budget. Compare plans based on monthly premiums, deductibles, copayments, and covered services. Assess your anticipated healthcare expenses and choose a plan that provides adequate coverage without excessive costs.

What happens if I miss the open enrollment period and don’t have qualifying life events for a special enrollment period?

+

If you miss the open enrollment period and don’t qualify for a special enrollment period, you may be subject to a continuous coverage requirement. This means you’ll need to maintain minimum essential coverage throughout the year to avoid penalties. However, you may still have options for obtaining coverage through other means, such as employer-sponsored plans or Medicaid.