How To Compare Health Insurance Plans

Navigating the complex world of health insurance plans can be a daunting task, especially with the vast array of options available. Understanding the nuances of different policies and finding the best fit for your specific needs is crucial. This comprehensive guide aims to demystify the process, offering expert insights and practical tips to help you make informed decisions when comparing health insurance plans.

Understanding Health Insurance Basics

Health insurance is a contract between you and an insurance company, where you pay a premium in exchange for coverage of your medical expenses. These expenses can range from routine check-ups and prescriptions to more significant costs like hospital stays and surgeries. The specifics of what’s covered and the costs involved vary widely across plans.

Key terms to understand include:

- Premium: The amount you pay regularly (usually monthly) to maintain your health insurance coverage.

- Deductible: The amount you must pay out-of-pocket before your insurance coverage begins.

- Copayment (Copay): A fixed amount you pay for a covered medical service, usually at the time of service.

- Coinsurance: Your share of the costs of a covered health service, calculated as a percentage of the total cost of the service.

- Out-of-Pocket Maximum: The most you will pay for covered services in a year. Once you reach this amount, your insurance covers 100% of covered expenses for the rest of the year.

Evaluating Health Insurance Plans

When comparing health insurance plans, consider these critical factors:

Coverage and Benefits

Look closely at what each plan covers. Check for inclusions like doctor visits, specialist care, hospitalization, emergency services, prescription drugs, mental health services, and preventive care. Also, consider exclusions and any pre-existing condition limitations.

| Plan A | Plan B | Plan C |

|---|---|---|

| Covers all specialists | Limited to network specialists | Covers only select specialists |

| Includes prescription drugs | Requires additional prescription plan | Covers generic drugs only |

| Full coverage for preventive care | Basic preventive care included | Preventive care excluded |

Network and Provider Choices

Health insurance plans typically have a network of providers they work with. It’s important to ensure your preferred doctors, specialists, and hospitals are included in the plan’s network to avoid higher out-of-network costs.

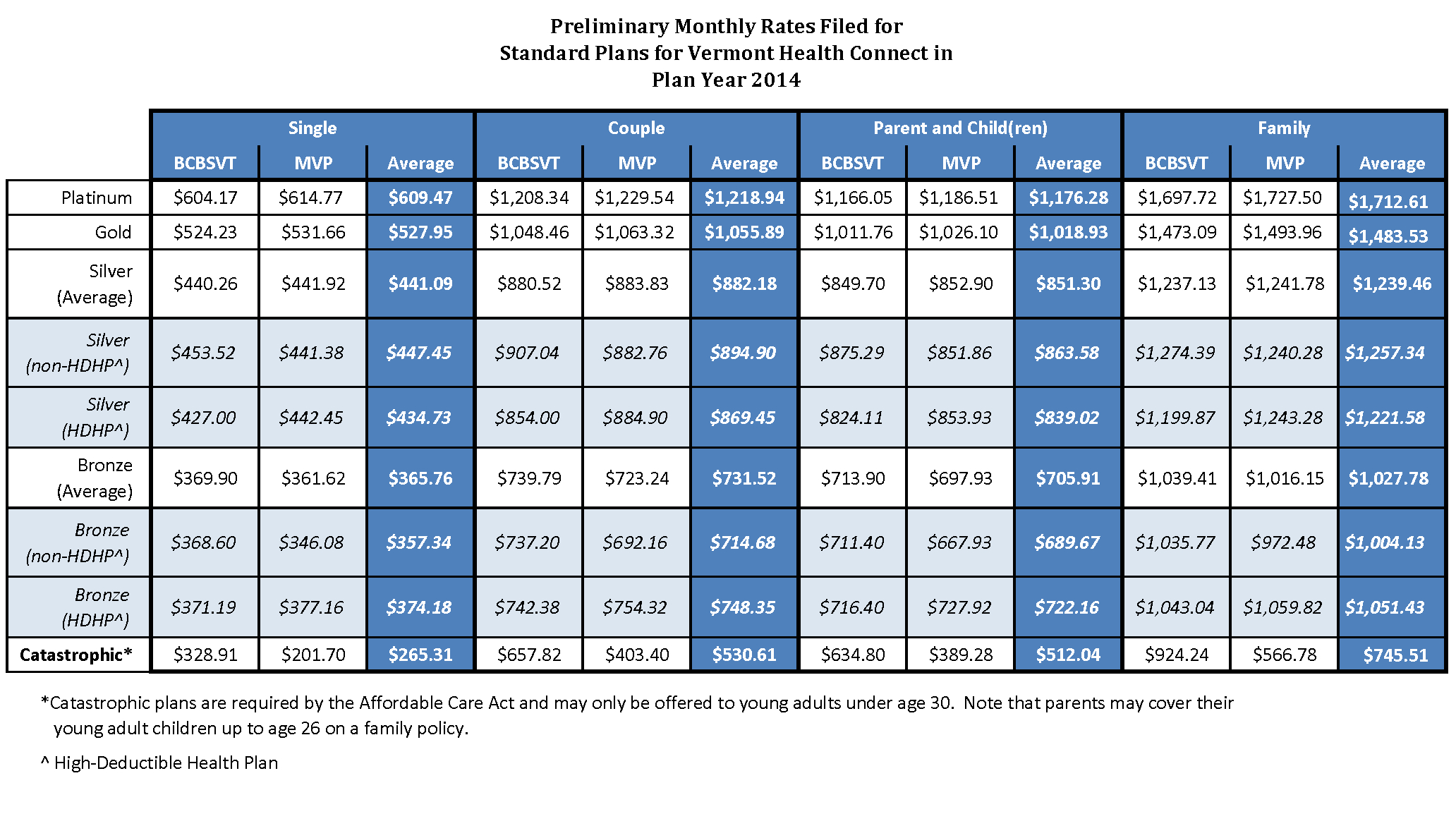

Costs and Out-of-Pocket Expenses

Evaluate the premiums, deductibles, copays, and coinsurance for each plan. Consider your anticipated medical needs and how these costs could impact your budget.

Flexibility and Customization

Some plans offer more flexibility in choosing your coverage options, allowing you to tailor the plan to your specific needs. This could include adding dental or vision coverage, choosing a higher or lower deductible, or selecting a plan with a health savings account (HSA) option.

Customer Service and Reviews

Research the insurer’s reputation for customer service and claims processing. Check online reviews and ratings to get an idea of how they handle claims and customer inquiries. Consider their accessibility and response times, especially during urgent situations.

Tips for Effective Comparison

To make the comparison process smoother, follow these expert tips:

- Use comparison tools or websites that provide detailed information on various plans.

- Read the plan's summary of benefits and coverage (SBC) to understand what's included.

- Review the plan's provider directory to ensure your preferred providers are in-network.

- Calculate your anticipated medical expenses and compare them against the plan's out-of-pocket costs.

- Consider short-term plans if you're between jobs or need temporary coverage.

- If you're self-employed, explore plans specifically designed for small businesses or entrepreneurs.

- For families, look for plans with family coverage options and consider the plan's maternity and pediatric benefits.

Conclusion: Making an Informed Decision

Comparing health insurance plans requires careful consideration of various factors. By understanding the basics, evaluating coverage and costs, and utilizing expert tips, you can navigate the process with confidence. Remember, the best plan for you is the one that provides the coverage you need at a cost you can afford.

Frequently Asked Questions

What happens if I have a pre-existing condition?

+Pre-existing conditions are typically covered under the Affordable Care Act (ACA). However, some plans may have limitations or waiting periods. It’s important to review the plan’s details and understand how they handle pre-existing conditions.

Are short-term health insurance plans a good option?

+Short-term plans can be a temporary solution, but they often have limited coverage and don’t provide the same protections as ACA-compliant plans. They may not cover pre-existing conditions and could have higher out-of-pocket costs.

How can I save money on health insurance premiums?

+Consider plans with higher deductibles, which usually have lower premiums. You can also explore plans with health savings accounts (HSAs), which allow you to save pre-tax dollars for medical expenses. Additionally, some employers offer wellness incentives that can lower your premium.

What’s the difference between HMO and PPO plans?

+HMO (Health Maintenance Organization) plans typically require you to choose a primary care physician (PCP) and get referrals for specialist care. They often have lower premiums but may have more limited provider networks. PPO (Preferred Provider Organization) plans offer more flexibility in choosing providers but usually have higher premiums.