Cheapest Insurance For Car

When it comes to finding the cheapest insurance for your car, there are several factors to consider. The cost of car insurance can vary significantly depending on your location, the type of vehicle you own, your driving history, and various other personal circumstances. While saving money on insurance is important, it's crucial to ensure that you're still getting adequate coverage to protect yourself and your vehicle. In this comprehensive guide, we will delve into the world of car insurance, exploring the key factors that influence rates, providing valuable tips for finding the best deals, and offering insights into the cheapest insurance options available.

Understanding the Factors that Impact Car Insurance Rates

Car insurance rates are determined by a complex interplay of variables. Here are some of the primary factors that can influence the cost of your car insurance:

Location

Your geographic location plays a significant role in determining insurance rates. Insurance companies consider factors such as the rate of accidents, thefts, and claims in your area. Areas with a higher incidence of claims and accidents tend to have higher insurance premiums. Additionally, certain regions may have specific laws and regulations that impact insurance costs.

| State | Average Annual Premium |

|---|---|

| California | $1,742 |

| New York | $1,884 |

| Texas | $1,084 |

| Florida | $1,464 |

| Illinois | $1,012 |

Vehicle Type and Age

The make, model, and age of your vehicle are important considerations. Insurance companies assess the repair and replacement costs associated with different vehicles. Generally, newer and more expensive cars tend to have higher insurance premiums. Additionally, certain vehicle types, such as sports cars or SUVs, may be more prone to accidents or theft, leading to higher insurance costs.

Driving History and Record

Your driving record is a critical factor in determining insurance rates. Insurance companies examine your history of accidents, traffic violations, and claims. A clean driving record with no at-fault accidents or moving violations can result in lower insurance premiums. On the other hand, a history of accidents or traffic citations may lead to higher rates or even difficulty finding insurance coverage.

Personal Factors

Various personal circumstances can impact insurance rates. These may include your age, gender, marital status, and even your credit score. Insurance companies use statistical data to assess the risk associated with different demographics. Younger drivers, for instance, are often considered higher risk and may face higher insurance premiums.

Tips for Finding the Cheapest Car Insurance

Now that we understand the factors influencing car insurance rates, let’s explore some strategies to help you find the cheapest insurance options while still ensuring adequate coverage.

Shop Around and Compare Quotes

One of the most effective ways to find the best insurance deal is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, so it’s essential to shop around. Use online comparison tools or contact insurance agents to obtain quotes from various insurers. By comparing quotes, you can identify the most affordable options tailored to your specific circumstances.

Choose a Higher Deductible

The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can often reduce your insurance premiums. This strategy works best if you have the financial means to cover a higher deductible in the event of an accident or claim. However, be cautious not to choose a deductible that would strain your finances in the event of a claim.

Bundle Policies

Many insurance companies offer discounts when you bundle multiple policies together. For instance, you may be able to save money by combining your car insurance with homeowners or renters insurance. Bundling policies can provide significant savings, so it’s worth exploring this option with your insurance provider.

Maintain a Good Driving Record

A clean driving record is not only important for safety but also for keeping insurance costs low. Avoid accidents and traffic violations to maintain a positive driving history. Insurance companies reward safe drivers with lower premiums, so strive to be a responsible and cautious driver on the road.

Explore Discounts

Insurance companies offer a variety of discounts to attract customers. Some common discounts include safe driver discounts, multi-car discounts, student discounts, and loyalty discounts. Ask your insurance provider about the discounts they offer and ensure you’re taking advantage of all applicable discounts to reduce your insurance costs.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that allows insurance rates to be determined based on your actual driving behavior. With this type of insurance, your premium is calculated based on factors such as the number of miles driven, the time of day you drive, and your driving habits. This can be a cost-effective option for low-mileage drivers or those with a history of safe driving.

Exploring the Cheapest Insurance Options

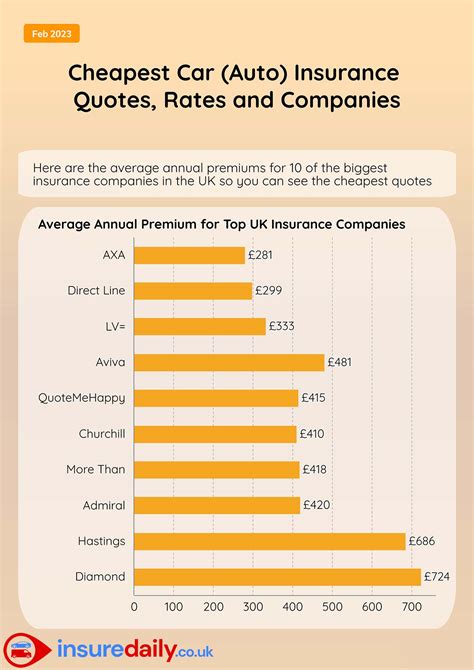

While finding the cheapest insurance requires a personalized approach based on your specific circumstances, there are some insurance providers that consistently offer competitive rates. Here’s a look at some of the top contenders for the cheapest car insurance:

State Farm

State Farm is one of the largest insurance providers in the United States and is known for its competitive rates. They offer a wide range of coverage options and provide discounts for safe driving, multiple policies, and more. State Farm’s comprehensive approach to insurance coverage makes it a popular choice for many drivers.

Geico

Geico, an acronym for Government Employees Insurance Company, is another well-known insurance provider known for its affordability. Geico offers a variety of insurance options and caters to a wide range of drivers. They provide discounts for safe driving, military personnel, and even for drivers who have completed defensive driving courses.

Progressive

Progressive is a leading insurance company that offers innovative insurance solutions. They are known for their competitive rates and provide various coverage options to suit different needs. Progressive offers discounts for safe driving, multi-policy bundles, and even for customers who switch from another insurance provider.

Esurance

Esurance is an online insurance provider that focuses on simplicity and convenience. They offer competitive rates and provide a user-friendly online platform for managing insurance policies. Esurance caters to tech-savvy drivers and offers discounts for safe driving, bundling policies, and maintaining a good credit score.

USAA

USAA is a unique insurance provider that exclusively serves active military personnel, veterans, and their families. They are known for their exceptional customer service and highly competitive rates. USAA offers a range of insurance products tailored to the needs of military families, making it an excellent choice for those who qualify.

The Importance of Adequate Coverage

While it’s essential to find the cheapest insurance option, it’s equally crucial to ensure you have adequate coverage. Car insurance is not just about saving money; it’s about protecting yourself, your vehicle, and others on the road. Here are some key considerations when evaluating insurance coverage:

- Liability Coverage: Ensure you have sufficient liability coverage to protect yourself financially in the event of an accident that results in injuries or property damage to others.

- Collision and Comprehensive Coverage: Consider adding collision and comprehensive coverage to protect your vehicle from damages caused by accidents, vandalism, theft, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage is essential to protect you in the event of an accident with a driver who has insufficient or no insurance.

- Personal Injury Protection (PIP): PIP coverage provides medical benefits to you and your passengers in the event of an accident, regardless of fault.

- Additional Coverages: Depending on your specific needs, you may want to explore additional coverages such as rental car reimbursement, roadside assistance, or gap insurance.

Future Trends in Car Insurance

The car insurance industry is evolving, and several trends are shaping the future of insurance coverage. Here’s a glimpse into some of the developments we can expect:

Telematics and Usage-Based Insurance

Usage-based insurance, powered by telematics technology, is expected to become more prevalent. Telematics devices installed in vehicles collect data on driving behavior, allowing insurance companies to offer personalized rates based on real-time driving habits. This trend is likely to encourage safer driving and provide more accurate insurance pricing.

Artificial Intelligence and Data Analytics

Insurance companies are increasingly leveraging artificial intelligence (AI) and data analytics to streamline processes and improve accuracy. AI-powered systems can analyze vast amounts of data to identify patterns and risks, enabling insurance providers to offer more tailored coverage options and potentially reduce costs.

Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is set to revolutionize the insurance industry. Electric vehicles may present unique challenges in terms of repair and replacement costs, while autonomous vehicles could significantly reduce the number of accidents. Insurance providers will need to adapt their coverage options to accommodate these emerging technologies.

Enhanced Customer Experience

Insurance companies are focusing on improving the customer experience by offering more convenient and personalized services. This includes digital platforms for policy management, real-time claim tracking, and enhanced customer support. The focus on customer satisfaction is expected to drive innovation and competition within the industry.

Conclusion

Finding the cheapest insurance for your car involves a careful balance between affordability and adequate coverage. By understanding the factors that influence insurance rates and implementing the tips outlined in this guide, you can navigate the insurance landscape more effectively. Remember to shop around, compare quotes, and explore the various discounts and coverage options available. Additionally, stay informed about the evolving trends in the insurance industry to make informed decisions about your coverage needs.

How can I get the cheapest car insurance rates?

+To get the cheapest car insurance rates, compare quotes from multiple providers, choose a higher deductible, bundle policies, maintain a good driving record, and explore available discounts. Additionally, consider usage-based insurance options if they are available in your area.

What are some common discounts offered by insurance providers?

+Common discounts offered by insurance providers include safe driver discounts, multi-policy discounts, student discounts, loyalty discounts, and discounts for completing defensive driving courses. Ask your insurance provider about the discounts they offer to take advantage of all applicable savings.

Is it worth sacrificing coverage to save money on insurance?

+While saving money is important, it’s crucial to maintain adequate coverage to protect yourself and your vehicle. Sacrificing coverage to save money may leave you vulnerable in the event of an accident or other unforeseen circumstances. Assess your specific needs and choose a coverage level that provides sufficient protection without breaking the bank.

How can I improve my driving record to lower insurance costs?

+To improve your driving record and lower insurance costs, practice safe and defensive driving techniques. Avoid accidents and traffic violations by following traffic laws, maintaining a safe distance from other vehicles, and being cautious in adverse weather conditions. Additionally, consider taking a defensive driving course to enhance your driving skills and potentially earn a discount on your insurance.