Cheap Online Insurance

In today's fast-paced world, having adequate insurance coverage is crucial to protect ourselves and our belongings. However, the cost of insurance policies can often be a significant burden, especially for those on a tight budget. The good news is that with the rise of digital platforms and a growing competitive market, cheap online insurance options have become more accessible than ever. In this comprehensive guide, we will delve into the world of affordable online insurance, exploring the various types, benefits, and strategies to help you secure the coverage you need without breaking the bank.

Understanding Cheap Online Insurance

Cheap online insurance refers to affordable insurance policies that can be easily purchased and managed through digital platforms. These policies offer coverage for a range of needs, including health, auto, home, life, and more, at competitive rates. The concept of cheap insurance has gained popularity as it provides an accessible and convenient way for individuals and families to secure the protection they require without sacrificing financial stability.

The Advantages of Cheap Online Insurance

Opting for cheap online insurance brings several advantages. Firstly, it provides a cost-effective solution for those with limited financial resources, ensuring that essential coverage is within reach. Secondly, the online nature of these policies offers unparalleled convenience, allowing individuals to compare quotes, purchase policies, and manage their insurance from the comfort of their homes. Additionally, cheap online insurance often comes with streamlined processes, making it quicker and easier to obtain the necessary coverage.

Another significant benefit is the potential for customization. Many online insurance providers offer a range of options and add-ons, allowing policyholders to tailor their coverage to their specific needs. This flexibility ensures that individuals only pay for the coverage they truly require, optimizing the value of their insurance investment.

Types of Cheap Online Insurance

The range of cheap online insurance options is vast, catering to various aspects of life. Here are some of the most common types of insurance available online at affordable rates:

Health Insurance

Health insurance is arguably one of the most crucial types of coverage, providing financial protection for medical expenses. Cheap online health insurance plans offer affordable options for individuals and families, covering a range of medical services, including doctor visits, hospital stays, prescription medications, and more. These policies often come with customizable features, allowing policyholders to choose the level of coverage that suits their needs and budget.

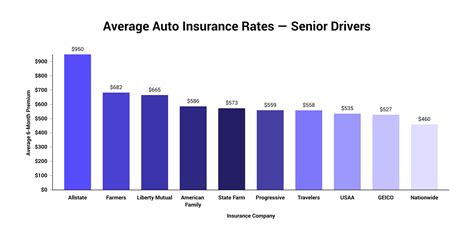

Auto Insurance

Auto insurance is mandatory in many regions and is essential for protecting your vehicle and covering potential liabilities. Cheap online auto insurance policies offer comprehensive coverage at competitive rates, providing financial security in the event of accidents, theft, or other vehicle-related incidents. These policies often include options for additional coverage, such as roadside assistance or rental car reimbursement, enhancing the overall value of the insurance.

Home Insurance

Home insurance is vital for safeguarding your residence and belongings. Cheap online home insurance policies provide coverage for a wide range of potential risks, including fire, theft, natural disasters, and liability claims. These policies often offer customizable options, allowing homeowners to choose the level of coverage for their specific needs, such as valuable possessions or additional living expenses.

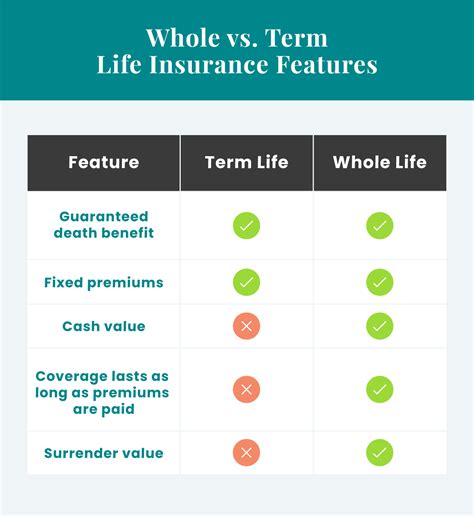

Life Insurance

Life insurance is an essential aspect of financial planning, providing peace of mind and financial security for your loved ones in the event of your untimely demise. Cheap online life insurance policies offer affordable options, ensuring that even those on a tight budget can secure this crucial coverage. These policies often come with flexible payment plans and customizable coverage amounts, allowing policyholders to tailor the policy to their specific circumstances.

Factors Influencing Cheap Online Insurance Rates

The cost of cheap online insurance policies can vary significantly based on several factors. Understanding these factors can help individuals make informed decisions when selecting the most suitable and affordable coverage.

Risk Assessment

Insurance providers assess the risk associated with insuring an individual or property. Factors such as age, health status, driving record, and location can influence the perceived risk and, consequently, the insurance premium. For instance, younger drivers or individuals with pre-existing health conditions may face higher premiums due to the increased likelihood of claims.

Coverage Limits and Deductibles

The level of coverage and the chosen deductibles significantly impact insurance rates. Higher coverage limits and lower deductibles generally result in more expensive policies. On the other hand, opting for lower coverage limits and higher deductibles can lead to more affordable insurance options. It’s essential to strike a balance between the desired level of protection and the available budget.

Discounts and Bundling

Many online insurance providers offer discounts to policyholders, helping to reduce the overall cost of coverage. These discounts may be available for various reasons, such as safe driving records, installing security systems, or bundling multiple policies with the same provider. Bundling, in particular, can be an effective strategy to save money on insurance, as it often leads to significant discounts on the overall premium.

Tips for Finding the Best Cheap Online Insurance

When searching for cheap online insurance, there are several strategies you can employ to ensure you find the most suitable and affordable coverage. Here are some valuable tips to guide you through the process:

Compare Multiple Quotes

Comparing quotes from different insurance providers is crucial to finding the best deal. Online insurance platforms often make this process convenient, allowing you to easily obtain multiple quotes within a short timeframe. By comparing these quotes, you can identify the providers offering the most competitive rates for your specific needs.

Understand Your Coverage Needs

Before purchasing insurance, it’s essential to understand your specific coverage needs. Take the time to assess your current situation and identify the types of risks you want to protect against. This assessment will help you choose the appropriate coverage limits and deductibles, ensuring that you don’t pay for unnecessary features while still maintaining adequate protection.

Consider Add-Ons and Optional Coverages

Many insurance providers offer add-ons and optional coverages that can enhance your policy. These additional features may provide valuable protection for specific situations or valuable possessions. However, it’s important to carefully evaluate these options to ensure they align with your needs and budget. Opting for unnecessary add-ons can drive up the cost of your insurance, so it’s crucial to strike a balance between coverage and affordability.

Read Reviews and Seek Recommendations

Before committing to an insurance provider, it’s beneficial to research their reputation and read reviews from existing customers. Online review platforms and social media groups can provide valuable insights into the experiences of others with the same provider. Additionally, seeking recommendations from friends, family, or financial advisors can help you make an informed decision, ensuring you choose a reputable and trustworthy insurance company.

The Future of Cheap Online Insurance

The insurance industry is continually evolving, and the future of cheap online insurance looks promising. With advancements in technology and a growing focus on digital transformation, insurance providers are investing in innovative solutions to enhance the customer experience and drive down costs. Here are some key trends shaping the future of affordable online insurance:

Artificial Intelligence and Automation

The integration of artificial intelligence (AI) and automation technologies is revolutionizing the insurance industry. These technologies enable insurance providers to streamline processes, improve accuracy, and reduce costs. For example, AI-powered chatbots can provide quick and efficient customer support, while automated claim processing systems can expedite the settlement process, leading to faster payouts and improved customer satisfaction.

Data Analytics and Personalized Pricing

Data analytics is playing a crucial role in shaping the future of insurance. By analyzing vast amounts of data, insurance providers can gain valuable insights into customer behavior, risk factors, and market trends. This data-driven approach enables them to offer more personalized pricing and coverage options, ensuring that customers only pay for the protection they truly need. Additionally, data analytics can help identify areas for cost optimization, further driving down insurance premiums.

Digital Partnerships and Integration

The insurance industry is witnessing an increasing number of partnerships and integrations with digital platforms and service providers. These collaborations aim to enhance the customer experience and provide additional value. For instance, insurance providers may partner with ride-sharing companies to offer specialized coverage for drivers, or collaborate with healthcare providers to offer integrated health insurance solutions. These partnerships can lead to more comprehensive and affordable insurance options for consumers.

| Insurance Type | Average Annual Cost |

|---|---|

| Health Insurance | $5,000 - $10,000 |

| Auto Insurance | $1,000 - $2,000 |

| Home Insurance | $500 - $1,500 |

| Life Insurance | $500 - $1,000 |

Frequently Asked Questions

Can I trust cheap online insurance providers?

+Yes, many reputable insurance providers offer affordable online insurance options. It’s essential to research their reputation, read reviews, and seek recommendations to ensure you choose a trustworthy company. Additionally, checking their financial stability and licensing status can provide further assurance.

How do I know if I’m getting a good deal on insurance?

+To determine if you’re getting a good deal, compare quotes from multiple providers and assess the coverage limits, deductibles, and additional features. Consider your specific needs and budget, and choose a policy that offers the right balance of coverage and affordability.

What happens if I need to file a claim with my cheap online insurance policy?

+If you need to file a claim, follow the instructions provided by your insurance provider. Typically, you’ll need to report the incident and provide relevant documentation. The claims process may vary depending on the type of insurance and the specific circumstances. It’s advisable to familiarize yourself with the claims process and any required steps before purchasing a policy.

Can I bundle multiple insurance policies to save money?

+Yes, bundling multiple insurance policies with the same provider can often lead to significant discounts. By combining policies such as auto, home, and life insurance, you may qualify for reduced rates. However, it’s important to compare the bundled rates with individual policies to ensure you’re getting the best value.