Insurance Term Vs Whole Life

Unveiling the Differences: Insurance Term vs. Whole Life

In the complex world of financial planning and insurance, understanding the nuances between different policies is crucial. This in-depth exploration aims to shed light on the distinct features of Insurance Term and Whole Life policies, helping you make informed decisions for your financial future.

Insurance Term: The Essentials

Insurance Term, often referred to simply as Term Life Insurance, is a straightforward and cost-effective option designed to provide coverage for a specific period, typically 10, 20, or 30 years. This type of policy is particularly appealing to those seeking temporary financial protection for their loved ones during a defined period of their lives.

Key Characteristics of Insurance Term:

- Fixed Coverage Period: As the name suggests, term life insurance offers coverage for a predetermined term, ensuring financial support during critical life stages like raising a family or paying off a mortgage.

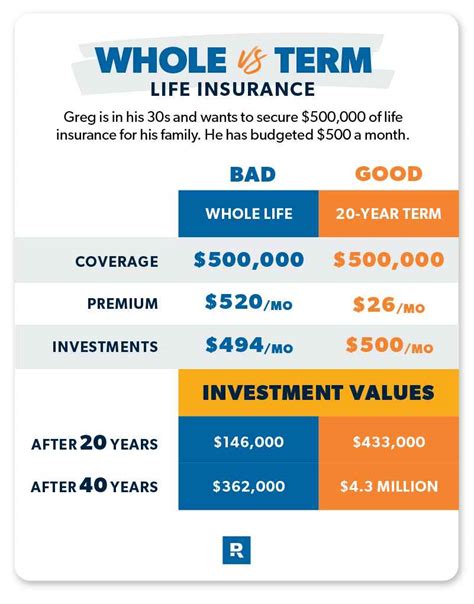

- Affordability: With lower premiums compared to whole life policies, term insurance is an attractive option for those on a budget, especially for young individuals or families.

- Flexibility: Many term policies offer the flexibility to convert to permanent coverage, providing an opportunity to switch to a whole life policy if your financial situation or needs change.

- Renewability: Policies often come with a renewable option, allowing you to extend the coverage period, although premiums may increase with age.

- Tax Benefits: Like whole life policies, term insurance offers tax benefits on the death benefit, ensuring your beneficiaries receive the full amount tax-free.

Real-World Example:

Consider John, a 30-year-old with a young family. He opts for a 20-year term life insurance policy with a $1 million coverage amount. During this term, John pays a monthly premium of $50. If an unfortunate event were to occur within the 20-year period, his family would receive the full $1 million, ensuring their financial stability. The policy provides peace of mind during a critical stage of John's life, knowing his family's future is secured.

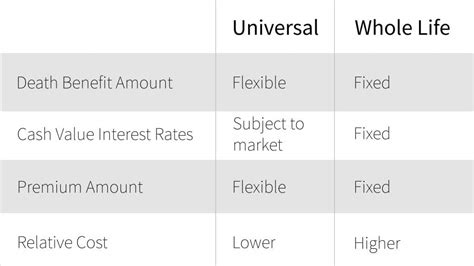

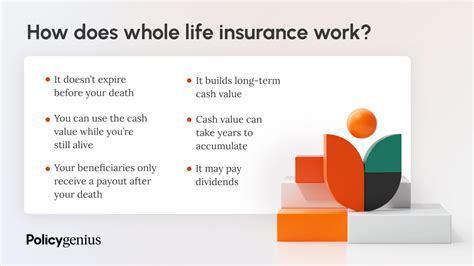

Whole Life: A Comprehensive Approach

Whole Life Insurance, as the name implies, is a type of permanent life insurance policy designed to provide coverage for the entirety of an individual's life. This policy offers more than just financial protection; it's an investment tool that accumulates cash value over time.

Key Features of Whole Life:

- Lifetime Coverage: As a permanent policy, whole life insurance ensures financial protection for the insured individual's entire life, regardless of age or health status.

- Cash Value Accumulation: Whole life policies build cash value over time, which can be borrowed against or withdrawn to meet financial needs, such as paying for college education or supplementing retirement income.

- Fixed Premiums: Unlike term insurance, whole life policies come with fixed premiums that remain the same throughout the policy's duration, providing long-term financial predictability.

- Guaranteed Death Benefit: The policy guarantees a specified death benefit, ensuring your beneficiaries receive a substantial sum upon your passing.

- Tax Advantages: Whole life insurance policies offer tax benefits, with the cash value accumulating tax-free.

Illustrative Example:

Sarah, a 40-year-old professional, decides to invest in a whole life insurance policy with a $500,000 coverage amount. She pays a fixed monthly premium of $200. Over time, the policy's cash value grows, providing her with a substantial financial asset. If Sarah were to pass away, her beneficiaries would receive the full $500,000, and the death benefit would be tax-free.

Comparative Analysis: Insurance Term vs. Whole Life

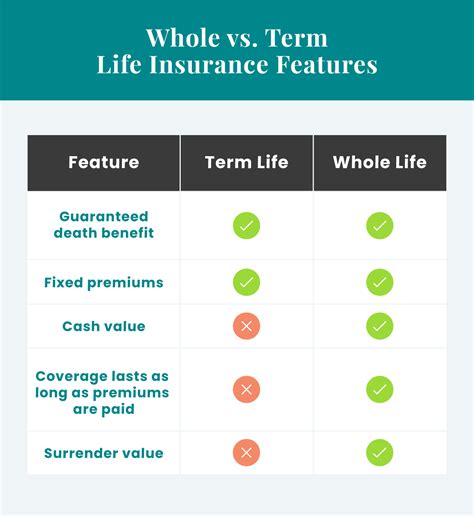

When deciding between Insurance Term and Whole Life policies, it's essential to consider your unique financial situation and long-term goals. Here's a table summarizing the key differences:

| Category | Insurance Term | Whole Life |

|---|---|---|

| Coverage Period | Fixed term (10, 20, or 30 years) | Lifetime coverage |

| Premium Cost | Lower initial premiums | Higher fixed premiums |

| Flexibility | Can be converted to permanent coverage | Offers guaranteed lifetime coverage |

| Cash Value | None | Builds cash value over time |

| Death Benefit | Tax-free benefit to beneficiaries | Tax-free guaranteed benefit |

The Bottom Line

Understanding the differences between Insurance Term and Whole Life policies is crucial for making informed decisions about your financial future. Whether you opt for the affordability and flexibility of term insurance or the comprehensive coverage and investment potential of whole life, both options provide essential financial protection for you and your loved ones.

Remember, when navigating the world of insurance, it's always beneficial to consult with financial advisors or insurance professionals to tailor a plan that aligns with your unique circumstances and aspirations.

Frequently Asked Questions

Can I convert my term life insurance policy to a whole life policy later on?

+

Yes, many term life insurance policies offer a conversion option, allowing you to switch to a permanent policy like whole life without having to undergo a new medical exam. However, it’s essential to review your policy’s specific terms and conditions to understand the conversion process and any potential limitations.

Are whole life insurance policies a good investment option?

+

Whole life insurance policies can be a valuable investment tool, especially for those seeking long-term financial protection and growth. The cash value accumulation can provide a reliable source of funds for various financial needs, from education to retirement. However, it’s crucial to weigh the benefits against the higher premiums and consider alternative investment options.

What happens if I outlive my term life insurance policy?

+

If you outlive your term life insurance policy, the coverage simply expires, and you no longer have insurance coverage. However, if your policy offers a renewable option, you may have the opportunity to extend the coverage period by paying higher premiums. It’s important to review your policy terms to understand your renewal options.